Key Takeaways

- The best way to get out of debt is by using the debt snowball method.

- Debt reduction strategies like debt consolidation, debt settlement and credit card balance transfers don’t actually help you get out of debt.

- Making a budget, increasing your income, and lowering your expenses are some ways you can get out of debt faster.

If you’re struggling with student loans, car payments or credit card debt, we know how overwhelming it can feel.

Pay off debt fast and save more money with Financial Peace University.

And with so many “debt relief” options out there, it’s hard to know which ones you should trust and which ones are just a waste of time. But there is a way out.

Let’s talk about how to get out debt—and stay out of debt. Plus, keep reading for tips to help you speed up your debt payoff even more!

Ways to Get Out of Debt

The internet has a lot of ideas for how to get out of debt. Some work and some straight up suck (just being honest).

Here’s a quick rundown of some of the most popular debt repayment strategies—and whether or not they’ll actually help you get rid of your debt.

The Debt Snowball: The Best Way to Get Out of Debt

What’s the debt snowball method? It’s the best (and fastest) way to pay off your debt—especially if you’re juggling multiple debts. Here’s how it works:

1. List all your debts from smallest to largest, ignoring the interest rates.

2. Make minimum payments on all your debts, except the smallest—that’s the one you’ll attack. Throw as much extra money at that smallest debt as possible! (More on that in a bit.)

3. Once you pay off your smallest debt, take that payment and apply it to your next-smallest debt.

4. Repeat this process until all your debts are gone!

By knocking out your smaller debts first, you free up more money faster. Like a snowball rolling down a hill, you gain more momentum to tackle the rest of your debt. And each quick win gives you the motivation to keep going!

We’ve been teaching the debt snowball method for over 30 years—and it’s helped so many people pay off massive amounts of debt! You see, the reason the debt snowball is the best payoff method is because it works. Plain and simple.

The Debt Avalanche

The debt avalanche (aka debt stacking) is when you pay off your debts in order from the highest interest rate to the lowest interest rate, no matter the balance. The math makes sense on paper—but paying off debt isn’t just about math. It’s about behavior.

Here’s the deal: With the debt avalanche, you’ll be working on that first debt payoff for-freaking-ever. That’ll cause your motivation to die out quicker than a campfire in the rain.

Motivation inspires behavior change. Behavior change keeps you going, debt after debt after debt. If you listen to a debt-free scream, you’ll probably hear some of those exact words—and they’re talking about the debt snowball.

Find More Margin. Beat Debt Faster.

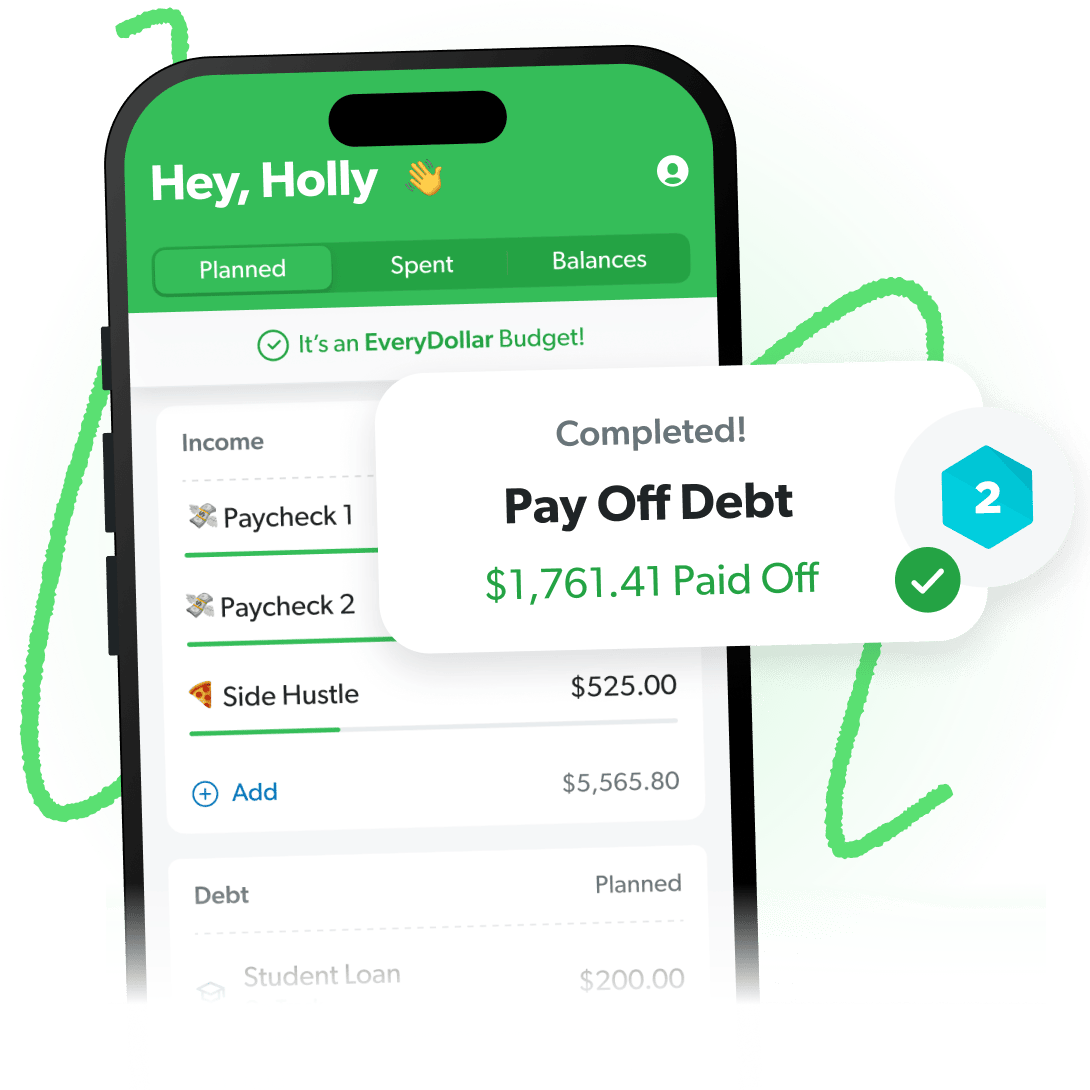

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

Debt Consolidation

You’ve probably heard of it. And maybe you’ve been sucked into the idea it’ll help you get out of debt sooner. But debt consolidation is a bad idea.

Combining your debts to get a lower interest rate might make you feel like you’ve done something to help your situation. But really, it’s only going to keep you in debt longer—because debt consolidation often means a longer repayment term. Oof.

The only form of debt consolidation we can get behind is student loan consolidation. And even then, you should use it to boost your debt payoff, not slow it down.

Debt Settlement

Debt settlement is when a third party tries to settle your debts on your behalf (keyword: tries). Companies will charge you a fee and then promise to negotiate with your creditors to reduce what you owe. But they usually take your money and leave you responsible for your debt. Run from this option.

Also, some companies advertise credit card debt forgiveness. But this is really just debt settlement in disguise—so don’t be fooled!

Credit Card Balance Transfers

Just like debt consolidation, credit card balance transfers will only offer you a temporary solution. You might think you’re taking control of your debt—when you’re really just moving it around. Plus, you have to pay a balance transfer fee. Listen, the only way to get out of debt is to pay it off yourself.

Retirement Withdrawals

Nope. Not good. Never withdraw from your retirement to pay off debt, unless you’re trying to avoid bankruptcy or foreclosure. You’ll get hit with penalties, fees and taxes on your withdrawal. By the time you add all that up, it’s simply not worth it. Oh, and the same goes for 401(k) loans—borrowing from your retirement is even worse!

Remember: You want to keep that money invested for your future. Don’t use it to pay for the mistakes of the past.

Personal Loans

Taking out a personal loan to pay off your credit card debt won’t solve your problem. Even if you manage to get a better interest rate, you’re only digging yourself into a deeper hole. So, steer clear of borrowing money to pay off debt (that includes sneaky schemes like HELOCs).

Student Loan Forgiveness

If you’re feeling the burden of student loans, you may think your best option is to apply for student loan forgiveness. First off, watch out for student loan forgiveness scams (yeah, that’s a real thing)! And secondly, the odds of actually having your student loans forgiven are very low. In fact, the approval rate for borrowers who apply for Public Service Loan Forgiveness (PSLF) is about 2%.1 That’s depressing.

And if you’re hoping the president will bail you out by forgiving everyone’s student loans at once, don’t hold your breath. He already tried that and failed. The truth is, putting your faith in a politician or the government is not how you get rid of debt—you have to do it yourself.

Bankruptcy

When you have so much debt you can’t breathe and the debt collectors won’t stop calling, you might think bankruptcy is the answer. But the truth is, it’s rarely your only option.

Bankruptcy is a long and messy process, and it won’t erase every debt (like student loans). So, before you go down that route, you should do everything you can to avoid bankruptcy. Start by talking with a Ramsey Preferred Coach who can walk you through all your options.

Tips for How to Get Out of Debt Fast

Okay, so now you know the debt snowball method is the best way to get out of debt. But let’s talk about how to get rid of debt faster!

Make a Budget

This one is at the top of the list because it’s that important. If you don’t intentionally tell your money where to go, you’ll have a real hard time paying off your debt.

A budget is simply a plan for your money that you make before the month begins. By giving every dollar a job, you can confidently cover all the essentials (bills, food, gas), cut out unnecessary extras, and add more money to your debt snowball.

And our EveryDollar budgeting app can help. EveryDollar shows you how to find thousands of dollars of hidden margin (no, really) and builds you a personalized, step-by-step plan to beat debt way faster!

Lower your expenses.

Once you’ve made your budget, go through it line by line and see where you can cut back on your spending.

Do you actually need a new outfit this month? Can you hold off on buying expensive sports tickets or movie tickets? What if you stopped going out to eat? (Calm down, it’s just while you’re getting out of debt!) We know saying no to yourself is hard. But getting out of debt takes some sacrifice—there’s no way around it.

Also, get creative and look for ways to save money on the essentials. Meal planning, shopping around for insurance, or even doing your own yard work can help you save some big bucks every month. Remember, every extra cent gets you one step closer to debt freedom!

Increase your income.

Think of your income as a shovel. The bigger your shovel, the faster you can dig yourself out of debt.

You can increase your income (get a bigger shovel) by working extra hours, snagging a side hustle, or selling your stuff. Will it be easy? Nope. Will it be worth it? Absolutely! So, find ways to make extra money so you can boost your debt snowball payments.

Cut up your credit cards.

You’ll never get out of debt if you keep creating more debt each month! That’s like continuing to buy cigarettes when you want to quit smoking.Okay, we know the credit card industry has tried for decades to convince us that we can’t survive without a credit card. But they’re wrong.

Your credit card may feel like a safety net, but it’s really just keeping you stuck in the cycle of debt. It’s time to handle your money on your own terms, instead of the credit card company’s terms.

You can’t get out of debt until you break up with debt. For good. So, cut those cards up (every last one) and never look back!

Know your why.

Why do you want to get out debt? No, seriously. What could you do if you had zero payments holding you back?

Whether your goal is to take a big trip, change careers, start a family, or buy a house, knowing and prioritizing your why is a key part of the debt payoff process. Because when things get hard and you’re tempted to give up, you need something that’ll push you to keep going.

So, nail down your why. And then make it visual (like a picture of the house you want or a Pinterest board of your dream vacation) to help you remember the reason you’re doing this.

Take Financial Peace University.

Choosing the right debt payoff strategy is half the battle. But if you’re serious about ditching debt, you need to change how you handle your money.

Financial Peace University (FPU) is a nine-week class that teaches you how to pay off debt using the debt snowball, save for emergencies, and build wealth that lasts. You’ll learn how to take control of your money and set you (and your family) up for financial success!

Plus, when you take an FPU class in person, you get the support and encouragement you need from people who are on the same journey as you! In fact, the average household who takes FPU pays off $5,300 of debt in the first 90 days. Talk about an awesome kick-start to your debt-free goal.

Sign up for an FPU class and ditch your debt faster!