Key Takeaways

- Paying off your car loan early is a smart financial decision because it saves you money on interest and gets you out of debt faster.

- Selling your car is often the best option if it will take you longer than two years to pay it off.

- You can pay off your car loan faster by getting on a budget, increasing your monthly payment, and reviewing your car insurance.

If you’ve got a car loan, you could be stuck making payments for years and paying a ton of money in interest. But it doesn’t have to be that way!

Pay off debt fast and save more money with Financial Peace University.

Paying off your car loan sooner rather than later saves you time and money. Plus, you’ll be free to go after your other financial goals when you don’t have a car payment holding you back.

I’m going to walk you through why you should pay off your car loan early and how to actually do it. Let’s get into it!

Should I Pay Off My Car Loan Early?

Yes, you absolutely should! Paying off a car loan early is always a smart financial decision.

Not only do car payments take a toll on your wallet, but they also take a toll on your mind. And with more and more people falling behind on their car loans, you might be only one layoff or big emergency away from an unpleasant visit from the repo man. That’s not something you want to mess around with.

When you pay off your car early, you’re trading in that massive payment (and the stress that comes with it) for freedom and peace. I know it might be easier to just pay the minimum each month and wait until your loan term is up. But you can pay off your car faster than you think!

First, though, you need to decide if paying off your car is actually your best option, or if you should sell your car instead. Here are a couple questions to ask yourself:

- Is the total value of all your vehicles more than half your annual income? If yes, sorry, but you’re what’s known as “car poor.” In that case, you need to sell your car and find a car you can afford. Otherwise, move on to the next question.

- Can you pay off your car in two years or less? If yes, keep the car but pay it off as soon as you can. If not, you’re better off selling your car and buying a cheaper car with cash while you save up.

Ultimately, your goal should be to get out of your car loan. Whatever helps you get there faster, do that!

Advantages of Paying Off a Car Loan Early

1. You’ll save money on interest.

When you take out a car loan, you’re not just paying for the price of the car itself, you’re also paying interest to the lender. And right now, the average interest rate is 6.73% for a new car loan and 11.87% for a used car loan.1

A $20,000 used car loan at a 11.87% interest rate would cost you $6,615 in interest over five years. Not to mention, cars depreciate (or lose their value) over time. So that $20,000 car will only be worth about $8,000 by the time you pay it off. And paying interest on something that’s worth less and less every month is a terrible idea—no matter how much money you have.

But if you attacked your car debt like crazy for the next year and increased your payment (more on that later), you could save several thousand dollars in interest! Now, that sounds nice.

2. You’ll be out of debt sooner.

Paying off your car early will not only save you money, but it’ll also get you out of debt faster! If you decide to be different and throw as much money as you can at your car, you could cut years off the life of your loan.

Imagine not having to worry about how you’re going to make your car payment. You’ll own your car, instead of it owning you. And just think of what you can do with that extra $500+ a month in your budget! You could throw that cash at your other debts, pad your savings account, or invest for the future. Cha-ching!

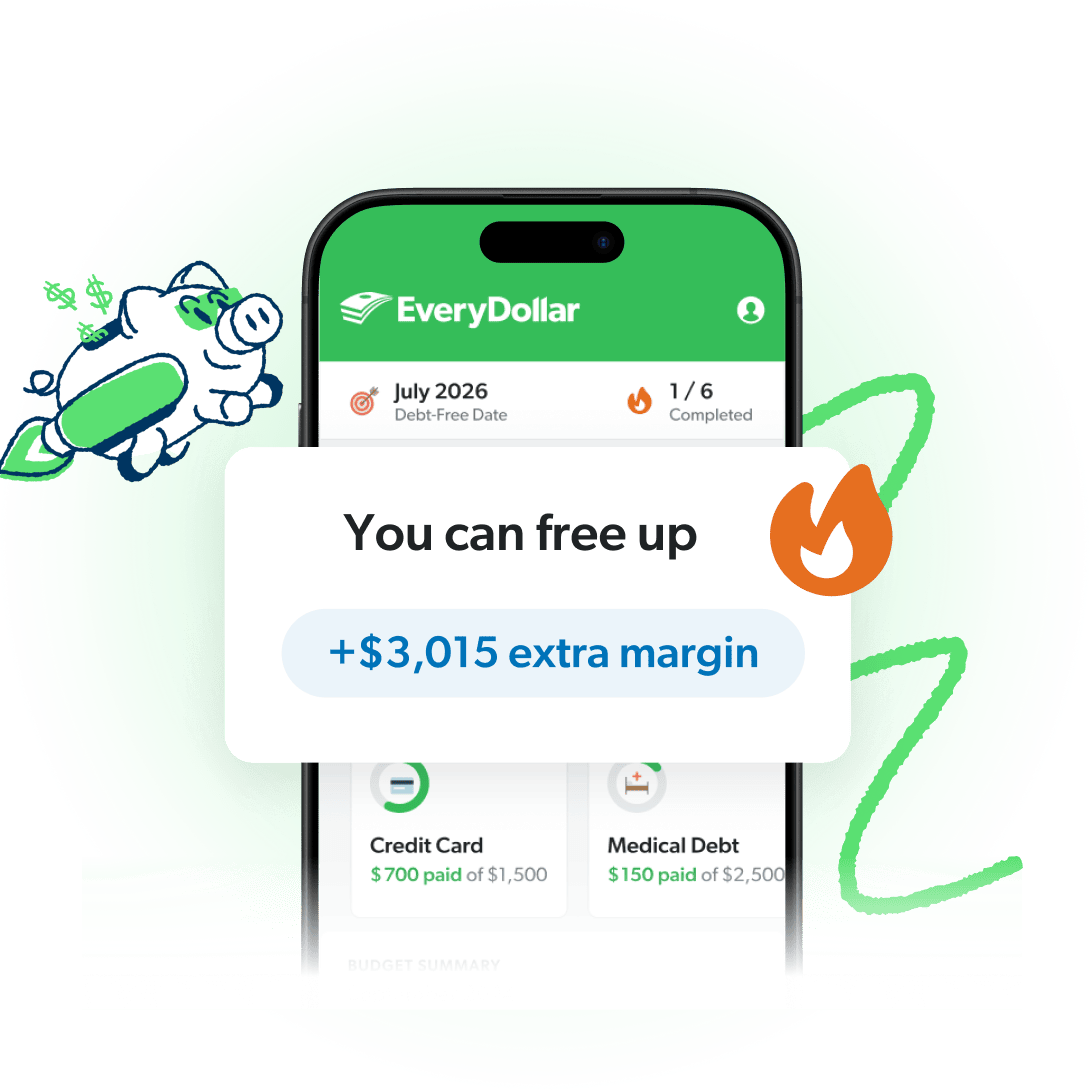

Find More Margin. Beat Debt Faster.

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

3. You won’t get stuck with an upside-down car loan.

If you owe more on your car than your car is worth, you’ve got what’s known as an upside-down car loan. This happens when your car depreciates (loses value) faster than you can pay off the loan—usually because you didn’t have a big enough down payment or you got stuck with a bad deal.

Upside-down car loans are a mess to clean up, for sure. And one of the best ways to avoid even getting to that point is by paying off your car faster.

4. You’ll never have to take out a car loan again.

Once you pay off your car loan early, you won’t want to go back into debt for a car payment again. You probably won’t even mind driving your now paid-for car a little longer while you save cash for your next car.

The thing about saving is . . . it’s addicting. And if you keep saving what you would’ve spent on a car payment, you’ll be able to get a decent upgrade sooner than you think. For example, $500 saved every month for one year is $6,000. Add that to the $8,000+ you could get for your current ride and you’ll have over $14,000 to pay for your next car—with cash. And that’s just after one year!

Drive that car for five years while continuing to save, and you’ll have even more money for your next ride. If you keep following that same formula over and over for the rest of your life, you’ll never have a car payment again. See, totally possible!

Disadvantages of Paying Off a Car Loan Early

While the pros of paying off your car early definitely outweigh the cons, there are some things to keep in mind about the process. These aren’t so much disadvantages as they are inconveniences. Because trust me, paying off your car early is always worth it!

1. You may have to pay a prepayment penalty.

Some lenders will charge a penalty if you pay off your car loan before the loan term ends. It’s their way of trying to make up for the extra interest you’re not paying them. You can check to see if your loan contract has a prepayment penalty clause and how much it is.

But don’t let the idea of a penalty scare you into not paying off your car loan early. Usually, the penalty is way less than the amount you’ll save in interest anyway. You’ll still come out ahead!

2. It may temporarily lower your credit score.

If you pay off your car loan early, you might see your credit score take a dip. Again, this is the credit industry “punishing” you for not playing by their rules. It’s usually not a huge change and, depending on what other debts you have, it won’t take long for your credit to bounce back.

But credit scores really aren’t as important as everyone makes them out to be. You can survive (and thrive) without a FICO score. In fact, the only reason people say you need good credit is so you can borrow more money. But you’re getting out of debt by paying off your car, remember? Forget a credit score—your personal score is freedom!

How to Pay Off Your Car Loan Faster

1. Pay a lump sum if you can.

If you’ve got the cash to pay off your car loan today (or at least make a sizeable dent in it), do it—like right now!

I know it can be scary to use your savings to pay off debt. But you’ll be able to rebuild your savings faster without a car payment stealing your paycheck. Just make sure you keep an emergency fund of $1,000 so you can cover any minor car repairs while you save up for a new one.

2. Don’t refinance your car loan.

Many people will tell you to refinance your car loan, but that doesn’t help you pay off your car faster. In fact, refinancing usually extends your loan for even longer, which means you’ll pay even more in interest.

And getting a lower monthly payment or interest rate will tempt you to slow down—which is not the goal here! Plus, you could get charged refinancing fees on top of everything else. Not worth it.

3. Increase your monthly payments.

If you want to pay off your car early, minimum payments aren’t going to cut it. You’re going to have to increase the amount you’re paying each month. But be sure to tell your lender that you want to apply the extra amount to the loan principal—otherwise, they’ll just use it as an advance payment for future months (again, they don’t want you paying off your car early).

So, see where you can lower your spending. Are there any expenses you can cut completely? Or maybe you need to increase your income by snagging a side hustle (or two). Yes, it’s extra work, but the temporary sacrifices will help you get out of debt faster.

4. Pay off smaller debts first.

This may sound backward, but hear me out. If you’ve got multiple debts, pay them off in order from smallest to largest balance. By knocking out your smallest debts first, you free up money faster than if you tried to tackle them in order of interest rate.

So, if you’ve got $3,000 of credit card debt and a $15,000 car loan, pay off the credit card first—then use what you were paying on it to knock out the car loan.

5. Review your car insurance.

One way to boost your car payment is to save money on other car expenses—specifically car insurance. You might be overpaying for your insurance or paying for coverage you don’t even need (like gap insurance).

Shop around (preferably with an independent insurance agent) and see if you can get better coverage for less. And don’t forget to ask if you qualify for any discounts! Then put those savings straight toward your car payment.

The Best Way to Pay Off Your Car Loan Early: A Budget

Whether you’re paying off your car or saving for a new one, the best way to take control of your money is with a budget.

By making a plan for your money every month, you can make sure you’re covering your monthly expenses, including that car payment. Plus, a budget helps you see where the rest of your money’s going—so you can redirect more of it toward your car loan!

And our EveryDollar budgeting app can help. EveryDollar shows you how to find thousands of dollars of hidden margin (no, really) and builds you a personalized, step-by-step plan to beat debt way faster! Plus, you’ll track your progress right in the app until every dollar of debt is history!

So, what are you waiting for? Start EveryDollar for free today!

And listen, paying off your car early is one of the best financial decisions you can possibly make. There’s no better feeling than trading in your car payment for the freedom of a paid-for ride! Then, just keep saving up and pay cash for your next one. You won’t regret it!

Frequently Asked Questions

-

How Long Does It Take to Pay Off a Car?

-

Most car loans take about 67 months (or five and a half years) to pay off. But that’s if you’re just paying the minimum each month. You can pay off your car loan faster by increasing your monthly car payment.

-

What Happens When You Pay Off Your Car?

-

When you pay off your car, your lender should send you a letter stating your car loan has been paid in full, as well as your car’s title (if you don’t already have it).

-

Does Paying Off a Car Loan Early Hurt Your Credit?

-

If you pay off your car loan before your loan term is up, your credit score might temporarily dip. But it won’t take long for your credit to bounce back. However, paying off debt is way more important than chasing after a good credit score.