Key Takeaways

- Starting in January and saving a little each month is ideal, but it’s not too late to begin now and still make a difference.

- Using cash instead of cards can help you spend less and stay on budget while Christmas shopping.

- Cutting expenses like cable, unused subscriptions and gym memberships can free up hundreds of dollars in just a few months.

- Planning early, hunting for deals, and even going DIY with gifts or potluck parties can help you stay festive without overspending.

- Being intentional—like setting aside “under budget” money or opening a separate Christmas savings account—helps ensure those savings don’t get accidentally spent.

We get it—Christmas carols may not be on your playlist right now. But here’s the thing: While it might not be time to hang the stockings just yet, it’s never too early to start saving for Christmas. Trust us, your future self will thank you when the holidays roll around—and your bank account will be a lot happier too!

When to Start Saving Money for Christmas

Now . . . yeah, like right now. The sooner you start saving up for Christmas, the better (and less brutal) it will be. Too many people wait until December to buy gifts. With no money saved up, they turn to credit cards in a panic and end up paying for Christmas until April of the next year. Not good.

There’s no reason to put yourself through that kind of stress. Just take some time to think ahead and you can avoid that mess. The best way to do it? Start saving in January, put aside a little money each month, and you’ll be golden come December! But if you’re just now starting to save money for Christmas, don’t worry. You still have plenty of time to save up a stash of cash between now and then.

17 Easy Ways to Save Money for Christmas

The chaos of the holidays might make for great Christmas movie moments—but in real life, it’s not so funny. That’s why we’re here to help you plan ahead, stay on budget, and avoid the stress. The best part? These tips can be used all year long! Just remember, the numbers are estimates. Depending on your specific situation, you could save a little less or a lot more.

So start playing your favorite Bing Crosby Christmas tune and curl up with a good cup of peppermint hot cocoa—we’re about to show you 17 easy ways to save money for Christmas.

1. Use cash only.

Save $150 (or way more)

Budgeting and paying with cash is a game changer—and that’s why it’s first on the list. People who shop with cash almost always spend less than those who swipe a card. Why? Because there’s just something about physically handing over your hard-earned money that makes you think twice before spending it on things you could live without.

Let’s say you usually spend around $1,500 on everyday purchases over two months. If switching to cash helps you cut just 10% of those spur-of-the-moment, didn’t-really-need-it kind of buys, that’s $150 in your pocket. Not bad for such a simple shift!

Now, when we say “pay in cash,” we also mean “pay in full.” Don’t fall for the buy now, pay later traps that only lead to regret (and debt). Instead, try the envelope system—use a labeled envelope just for Christmas spending. Set the amount ahead of time and fill the envelope. Once it’s empty, you’re done. No overspending. No stress.

2. Cut out cable.

Save $400

Okay, it might sound a little extreme, but if you’ve already been thinking about cutting the cable cord, now’s the time to do it. TV packages can run anywhere from $50 to over $200 a month—so If you cancel now, you could potentially pocket more than $400 in just two months. Wow!

And in case you haven’t noticed, it’s 2025! That means you don’t need cable to watch television anyway. Between Disney+, Netflix, Hulu, Amazon Prime, Roku, Apple TV and skinny cable bundles, there are plenty of ways (almost too many) to watch your favorite shows without that crazy cable bill.

3. Buy generic brands.

Save $50

Even if you’re an avid fan of a certain cereal, snack or yogurt brand, see if you can give the generic brand a try for a little while. Small tweaks like this can really make a difference when it comes to hitting your Christmas savings goal.

If you go completely generic for just 10 meals over two months, you could cut more than $50 from your grocery bill! Not ready to make the full switch? No problem. Just start with generic staple items like milk, spices, flour, sugar and produce. Even small shifts in your shopping cart can lead to big savings over time.

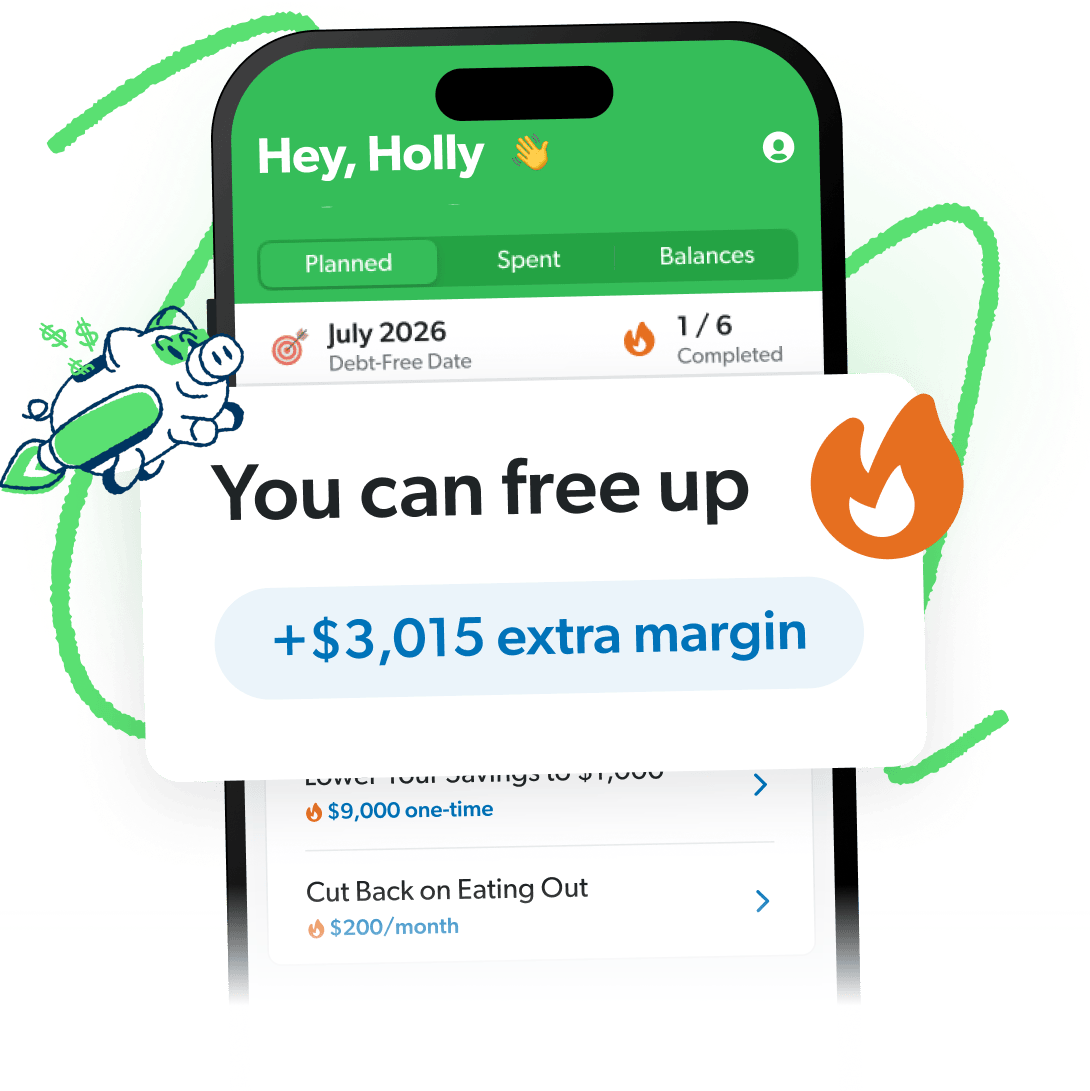

Put More Breathing Room in Your Budget

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

4. Pack your own lunch.

Save $400

It’s time to embrace the office microwave and say hello to the leftover life! If your go-to lunch plan is hitting up the drive-thru for a $10 meal, you’re wasting $50 a week right there. And while it might not seem like a big wad of cash for just one week, that adds up to $200 a month (and $400 over two months)! Take the cheaper route and bring leftovers from home—your wallet is sure to thank you.

5. Use cold water (and less of it).

Save $100

Here’s a secret: You can wash your clothes in cold water and they’ll still get clean. Shocking, we know. Two of the best ways to cut back on the energy your home eats up is by using a cooler water temperature and less water. Just changing the temperature setting on your washer could cut each load’s energy use in half!1

You can also save big by cutting back on water. Let’s say your monthly water bill runs about $100. If you go hardcore for just two months and cut your water usage in half, you could save around $100—and that’s not as tough to do as it sounds. Cut everyone’s shower time in half and turn off the faucet while you’re brushing your teeth.

6. Unplug electronics.

Save $30

Did you know that just having a power cord plugged into the wall uses up energy? Yep. It’s called phantom energy, and Americans can waste up to a quarter of your monthly bill each year on it.2 That’s like being charged for nothing! No thanks. Instead, go on an unplugging spree to make sure you’re not surging through precious dollars.

Make a habit to unplug things like your laptop charger, phone charger, toaster and even coffee maker when they aren’t in use. When it comes to big things like your TV, DVD/Blu-Ray player, or sound system, it can get annoying to unplug every single device. And who can even reach those tucked-away plugs anyway? The solution: Plug it all into a power strip so you can easily unplug everything in one fell swoop.

But don’t worry about unplugging major appliances like your washing machine. They tend to pack a heavy punch of high voltage. We want you to save a bundle without electrocuting yourself.

7. Sell stuff with apps.

Save $50

Believe it or not, selling all that extra stuff you have laying around can really add up. You probably won’t get a ton of money for Christmas this way, but you might be pleasantly surprised by how much cash you’ll rake in just for getting rid of things you don’t need.

Gone are the days of taking your gear to a consignment shop or praying your garage sale is a hit. Now you can snap a picture of the item, post it in an app, and sit back and wait for someone to make an offer. It’s as easy as that! Sell your used treasures on sites like eBay, Facebook Marketplace, OfferUp, Poshmark, decluttr or Mercari.

8. Pause your gym membership.

Save $100

Think back to last year . . . you had every intention of going to the gym. But once the holiday madness started to kick in, how many times did you really go? Let’s say your gym membership costs $50 a month. If you can pause your membership for eight weeks, that’s an extra $100 toward your Christmas savings!

That doesn’t mean you have to forgo your fitness though. While the weather is still nice, take advantage of walking or jogging outdoors in the evenings after work, or team up with a coworker to walk during your lunch break. If your kids are playing sports, use their practice time to take a walk around the building or field.

Is staying indoors more your thing? YouTube workouts make it easy to stay fit for free. If you’re an avid yogi but can’t bear the high price of going to a yoga studio, check out Yoga With Adriene. Or for high intensity interval training (HIIT) you can do at home, try channels like FitnessBlender and Madfit. Your bulked-up Christmas savings will thank you!

9. Drop the subscriptions.

Save up to $430

Subscription services are everywhere. If you aren’t careful, those things will $12.95 you into a hole. If you drop some of the more expensive subscriptions like your meal kit delivery service, you could save some serious cash right there!

Meal kits usually cost around $10 per serving, which is about the same as eating out. Let’s say you’re getting five meals a week through a subscription. If you put it on hold for the next two months and buy basic staples to make multiple meals (hello, beans and rice), you could save around $400! It’s time to get your cheap meal ideas from Pinterest or your favorite blogger.

Maybe you’re a book nerd and opted in to Audible to listen to your books on the go. It’s handy, sure—but if you pause your membership for two months and stick to podcasts in the car instead, you’ll have $30 to add to your Christmas budget. In the meantime, you can download Libby and get free e-books that you can read right from your tablet or phone.

10. Use cash back apps.

Save $20

Disclaimer: Don’t expect to make 1,000 bucks using these apps. But after two months, cash back reward apps like Ibotta, Rakuten and Receipt Hog can start to add up.

So, how does it all work? It’s simple. Apps like these offer you rewards or points for doing certain things. Sometimes that’s buying bananas and almond milk or spending $20 at a popular store. The amount of points (aka cash) you get from each transaction depends on what you’re doing. But you can usually expect to earn anywhere from 25 cents to $3 in reward points for things you do.

Keep in mind, most of these apps make you hit a $5 or $10 minimum before you can cash out your rewards. And make sure you aren’t buying things you don’t need just to collect the points (talk about not helpful). But if you can get cash for things you buy or do every day, you’ll have $20 more to your name in no time!

11. Don’t run the air conditioning or heat (when you can).

Save $50

On nice days, see if you can get by without running the air conditioning or heat. If you have a programmable thermostat, adjust it so the AC or heat only runs when you’re actually there. Your house doesn’t have to be the perfect temperature when no one is home to enjoy it!

While you’re at it, keep the blinds closed during the day. Sure, you might feel like a vampire blocking out any shred of light creeping in—but the payoff could be worth it. About 76% of sunlight that hits standard double-pane windows enters to become heat.3 If you still want some natural light (and we don’t blame you), open the curtains or blinds that don’t let direct sunlight in.

12. Change your cell phone plan.

Save $40

You didn’t hear this from us, but there are more cell phone providers out there than just the top three you’ve always known about. You can get coverage that’s just as good for far less money too. If you want a quick way to save money for Christmas, it’s worth looking into other cell providers. Research which carriers offer coverage in your area and start comparing their plans to the one you have. If you aren’t ready to switch providers just yet, try cutting back on the minutes or data package you already have.

And here’s a bonus tip: Turn off the cellular service for some of your apps, especially the ones that constantly run in the background (they drain your data without you even knowing it). This eats up your data package for no reason and could land you in hot water with costly data overages.

13. Make coffee at home.

Save $40

Do you treat yourself to a fancy latte every Friday morning? That might not seem like much, but it still sets you back about $5 each week. Just think: If you could cut the coffee habit and stash away $5 a week for eight weeks, you’d end up with $40 right there!

We’re not asking you to cut out coffee completely—we’re not heartless. But guess what? You can make your favorite drink at home. Look up copycat recipes to follow (they’re all over the internet). A lot of them surprisingly taste better than the “real deal” at the coffee shop. Enjoy your morning coffee while smiling at that extra $5 bill still hanging out in your wallet!

If you can’t bring yourself to stop your coffee trips completely but still want to pay less, here are a few Starbucks hacks you can try.

14. Look for deals early.

Save $100

The early bird gets the worm—and the discount. Late summer and fall are packed with sales: end-of-season clothes, back-to-school supplies and even big-ticket items like electronics (especially during Black Friday). So keep your eyes peeled. You never know what you might find after a little digging.

Another good reason to get your shopping done earlier this year? Shipping time. With more people shopping online, it takes longer for packages to arrive. So don’t wait till the last minute to tackle your Christmas shopping—you don’t want to pay for expedited shipping. And with more deliveries showing up at your door this time of year, it’s also smart to stay alert and follow a few holiday home security tips to keep your packages—and your peace of mind—safe.

15. Have a DIY Christmas.

Save $100

Hop onto Pinterest or Instagram to get some ideas for crafts that you can give as DIY Christmas gifts. Searching for them now gives you plenty of time to buy the materials and put the effort into creating something that has just the right touch. Even better, you have time to start over in case your first attempt looks more like a Halloween decoration than a Christmas gift—it happens to the best of us.

And hey, if December sneaks up on you and crafting goes out the window, we’ve got your back with a list of last-minute Christmas gifts on a budget. No glue gun required.

16. Make your Christmas party a potluck.

Save $90

Most people have a go-to family recipe they love to share—so let them! Turning your Christmas dinner into a potluck is a smart way to save money and let everyone pitch in. It also gives you the chance to tweak a few old traditions without losing the fun of gathering together. Ask each guest to bring their favorite side dish or dessert, and assign a few to bring essentials like drinks, ice or disposable serveware. Most folks are happy to help—they just need a little direction.

You can also delegate tasks like stocking the cooler, setting out chairs, or keeping the trash from piling up. With everyone lending a hand, you’ll cut costs and gain something even better: more time to relax and enjoy the party.

17. Use your “under budget” money.

Save $75 (or way more)

An easy (and sneaky) way to save money for Christmas is to use your “under budget” cash. Any time you spend less than you planned—on groceries, clothing, gas or whatever—take the leftover and stash it away in your Christmas savings. That $10 here and $15 there can add up in a flash.

Plus, it gives you one more reason to look for bargains and cut back on everyday expenses. Take insurance, for example. If you haven’t shopped your rates in a while, you might be paying way too much. Have one of our RamseyTrusted® pros check your insurance rates to make sure you’re getting the best deal! The money you save could cover plenty of Christmas shopping.

Make Sure You’re Actually Saving Your Savings

It’s super easy to say you’re going to save money for Christmas and then not actually put aside what you’ve saved. Whoops. Instead of letting your money get lost in your bank account (and then spent), be intentional about cashing it out or transferring it over to a separate Christmas savings account. It’s a great way to be extra disciplined about putting aside that money and not touching it. Check with your bank about opening a side savings account for all your Christmas needs.

How to Budget for Christmas

Take a look at how much you spent on Christmas last year to get an idea of where you might want to land this year. Where can you cut back? Once you’ve given it some thought, come up with a Christmas budget grand total for this year. Now divide it by the number of months or weeks left until Christmas (ugh, nothing bums out the Christmas spirit like math—we know). The number you end up with is how much you need to set aside each month or week for Christmas. In December, your Christmas savings will be set and you can enjoy the season instead of feeling pinched for extra money.

Let’s say your budget for Christmas is $700. If you started saving in January, then you’d only have to put away about $58 each month to hit that goal. But if you haven’t saved anything and you’ve only got two months until December, that means you need to save $350 each month (or $87.50 a week). It might sound tough, but you can do it. And if your job gives out a Christmas bonus, even better! You’ll hit your savings goal faster and maybe have a little extra to knock out debt or invest.

Save Money for Christmas Now

Remember, Christmas will be here before you know it, so don’t let it sneak up on you. Start saving for Christmas now.

Our zero-based budgeting app, EveryDollar, makes it easy to keep track of your savings so you can pay cash for Christmas.

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.

Start EveryDollar for free right now!

Then, all you have to do is set up your Christmas budget line and you’re good to go. Bring on the holiday cheer!

Next Steps

- Download the EveryDollar budgeting app and create a dedicated Christmas savings line item.

- Set a clear savings goal based on your budget and choose which of the 17 money-saving tips you’ll start applying today.

- Begin saving consistently toward your Christmas goal!