Key Takeaways

- Afterpay is a buy now, pay later lender.

- Afterpay customers can divide a purchase into four payments over six weeks (interest-free) or pay monthly for up to a year on more expensive purchases (with up to 35.99% interest).

- If you don’t make payments, Afterpay can charge late fees up to 25% of the purchase and eventually turn you over to debt collections.

- Their website says customers who use Afterpay spend more money and shop more often than those who don’t.

Afterpay is a buy now, pay later lender, similar to Klarna or Affirm. Customers can divide a purchase into four payments over six weeks (interest-free) or pay monthly for up to a year on more expensive purchases (with up to 35.99% interest).

Pay off debt fast and save more money with Financial Peace University.

Afterpay started out in Australia in 2014 and came over to the U.S. in 2018. The company grew over the years, buying up other buy now, pay later services—including one in Spain for $82 million. (Hmm. I wonder if they paid for that in four installments.) And in 2021, Square bought Afterpay for $29 billion.

Now, before we go any further, I have to say that I don’t like buy now, pay later schemes (because that’s exactly what they are: schemes). And Afterpay is no exception. For starters, Afterpay really pushes the agenda of instant gratification—which doesn’t last! And Afterpay says they want to help you find “financial wellness” . . . in purchases . . . in buying stuff you can’t afford right now. But that is not where true financial wellness is found. Ever.

Here’s what I uncovered in my deep dive on Afterpay.

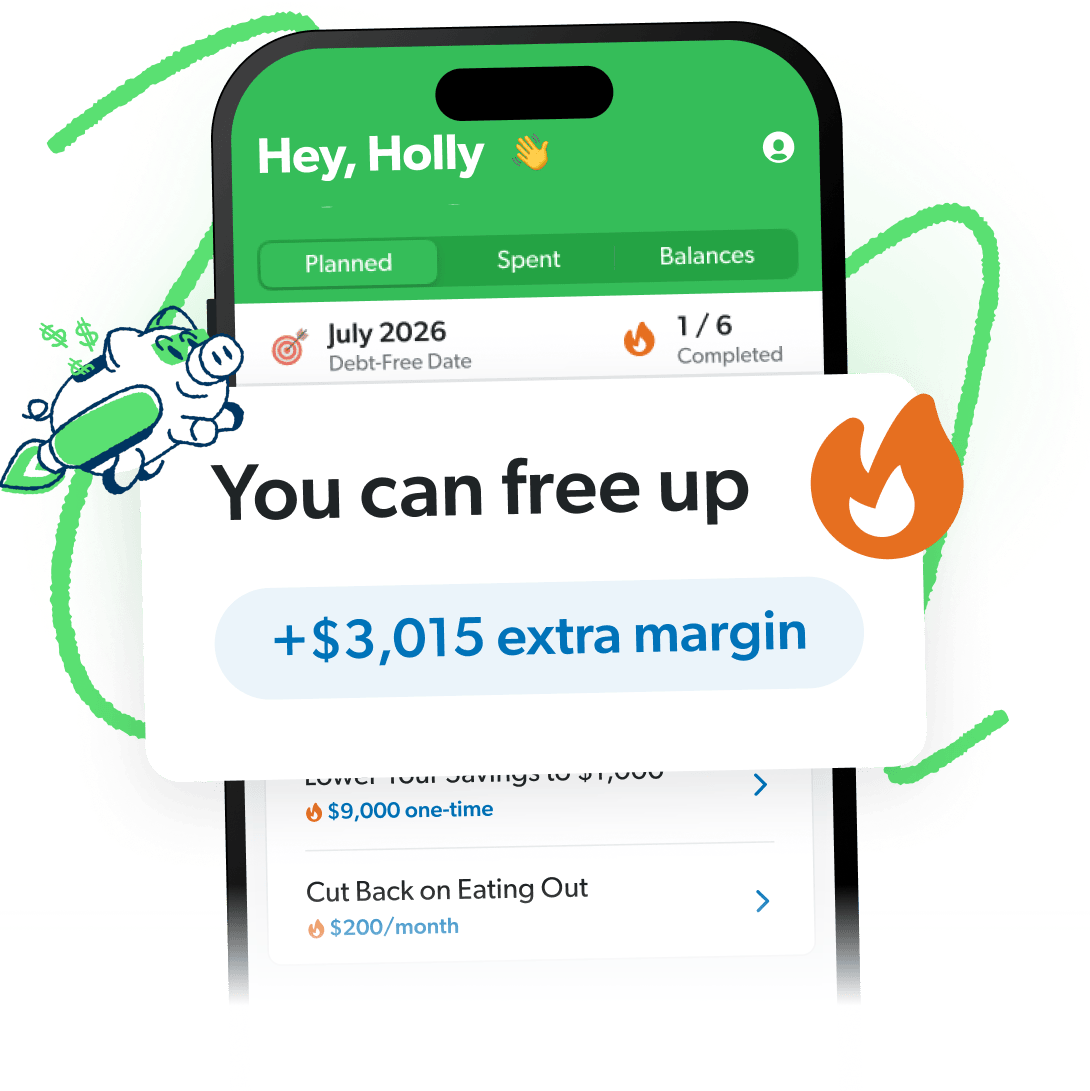

The Budgeting App That Finds Hidden Margin

You’ve got more margin than you think. EveryDollar helps you find it in minutes so you can start making real money progress, really fast.

How Does Afterpay Work?

Here’s how Afterpay works:

- A customer downloads the app and creates an account.

- They set up the digital Afterpay Card and connect it to their Apple Wallet or Google Wallet.

- They shop at any store found in Afterpay’s Shop Directory. (This can be online, in a physical store, or on Afterpay’s app.)

- The customer sees something they want—but can’t afford right now.

- They tap to make the first payment (25% of the cost).

- Then they pay another payment every two weeks for six weeks, until the item is paid off.

- The customer will lather, rinse, repeat with as many purchases as they want, racking up as many of those payment plans as they want (as long as they keep making payments).

- The customer can use the app to manage all these payments (which Afterpay says is “staying in control” of your money—when it’s really letting retail therapy control your money).1

- If the customer misses a payment, it’s fee time, and they can’t make another purchase. (More details on that coming in a second.)

- The customer can fall deeper into the lie that buying everything they want when they want it (even though they can’t afford it) is the key to happiness.

Quick note: All those steps apply to the more traditional payment method. Afterpay now has a monthly payments option that is interest-based. (And that interest is high!) I’ll dive into that in the next section.

Okay, you can tell how I’m feeling about this “service.” But let’s keep going.

Can You Use Afterpay to Pay Bills?

I went down a few weird, unhelpful rabbit holes online that claimed you can pay your bills with Afterpay. But the truth is, you can’t. The company’s own website clearly says you can use Afterpay online or in store with any of their partnering retailers.2 There’s zero mention of spreading out your electricity, rent or water bill payments here.

So, if you’re having trouble paying your bills, Afterpay definitely won’t help you. Set up a free call with one of our trained financial coaches and get some real money help.

How Does Afterpay Make Money?

Since Afterpay doesn’t charge crazy amounts of interest on every purchase, how do they make money? Great question.

Afterpay Monthly Payments

First, let’s cover the fact that Afterpay does have an installment plan that charges interest on purchases of $400 or more.

In the very fine print on their website, they explain that their APR (annual percentage rate) on this plan can range from 6.99% to 35.99%.3 You guys, the average interest rate right now on credit cards is at an all-time high of 22.63%.4 And Afterpay can jump up to 35.99%? No, thank you.

Retail Partnerships

Another way Afterpay makes money is through their retail partnerships. Currently, they work with thousands of brands (like Apple, Best Buy, lululemon, Sephora, Target) and have “helped” 19 million customers use their service to “get everything you need now.”5,6

These companies give Afterpay a portion of every sale. And they get a lot of sales from Afterpay. A lot. (More on that in the section “Is Afterpay Safe?”)

Late Fees

If you’re late on one of those payments, Afterpay charges late fees up to 25% of the order’s value.7

I know what you’re thinking. But I’ll make all my payments on time. Everyone thinks that at first, but our research shows that three in four people who used a buy now, pay later plan missed a payment! And that fee might seem small at first, but anything extra you’re paying on something, especially so you can “have it right now,” is too much.

Also, huge fees or not, Afterpay is in the debt business. Debt is owing money to anyone for any reason. Buy now, pay later companies fit that definition. And you can’t get ahead with your money when you’re always paying for the past.

Does Afterpay Have a Credit Limit?

Afterpay has credit limits (or “spend limits”) for customers, and that number is based on a few things:8

- How long you’ve had an Afterpay account

- How often you use Afterpay

- Your payment source

- If you make payments on time

- How often you’re declined for a purchase because you didn’t have the 25% to put down

Basically, customers who've been with Afterpay longer, and shown they pay on time, are allowed to borrow more.

How Does Afterpay Affect Your Credit Score?

When you sign up for Afterpay, you agree to allow them to perform at least a soft credit check, meaning they can peek in on your credit report. And any time you use the Pay Monthly option while checking out, Afterpay will run a credit check.9

Okay, but does Afterpay affect your credit? First, you need to know I’m not a fan of the credit score. It’s a made-up number that shows how you juggle debt—not how responsible you are with money. But if you’ve got debt, you’ve got a credit score, and I want you to know how Afterpay relates to that.

Purchases with this company won’t lower your score—but hear this: If you don’t make payments, that will affect your score. And it gets worse. Afterpay can turn you over to debt collections.

Yep. It’s one of the reasons a retailer likes having this middleman in place: “Afterpay takes on the risk of payment default while conducting the debt collection process, if necessary.”10 If you’re in debt collections, it will totally show up on your credit report and can send your credit score into a nose dive.

And yes, if you aren’t making a payment you said you would make, that’s no good. But this is all no good. Think about it: Afterpay might claim they weren’t technically the bad guy in this debt collections situation. But they sold you to the bad guy, washed their hands, and moved on.

Is Afterpay Safe?

This depends on how you define “safe.” Do you mean are they going to take your Apple Wallet, Google Wallet or bank info and deposit loads of your money into an offshore account as their CEOs sip Mai Tais and laugh at your loss? Not likely.

Now, any time you’re putting your personal and financial info into an app or on the internet, there’s some sort of risk. But it doesn’t look like that particular threat is worse with Afterpay specifically.

When it comes to gaining true financial security, though, Afterpay isn’t the way to go. If you’re a shopper at heart like I am, or you ever impulse buy—having Afterpay at your fingertips isn’t safe for your money goals, your budget or your contentment. You. Will. Overspend.

They literally claim on their website (when encouraging retailers to partner with them), that “shoppers who use Afterpay spend +40% more than those who do not” and “shoppers who use Afterpay shop +50% more frequently than those who do not.”11

You guys, Afterpay knows you will spend more money and shop more often when you use their services. They want you shopping again and again and again—staying stuck in the payment juggle.

You’re better than a payment juggler. You have a future to think about! Don’t let any company tell you instant gratification is the key to financial wellness or peace. That’s a lie.

The Best Alternative to Afterpay

Listen, you know this by now: I enjoy spending money. I can out-shop just about anyone.

But I don’t need Afterpay to do it, and guess what—neither do you! You can break the cost of anything into four parts on your own: Put that money away in the budget yourself with zero risk of late fees and absolutely no debt involved. Then pay cash! Don’t Afterpay for it. Actually pay for it. Patience is important in all areas of life. Have patience with your money too!

I don’t want you stuck juggling payments. I don’t want you caught paying over 35% interest on anything. And I don’t want you believing the lie that you can’t wait for what you want.

I want you to know the real freedom that comes when you own instead of owe. I want you to feel real contentment! It starts by taking control of your money with a budget. Make it easier on yourself and download our EveryDollar budgeting app.

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.