Index Funds vs. Mutual Funds: What's the Difference?

10 Min Read | May 21, 2024

When was the last time you got excited about something being “average”? Did you rave to your friends about that restaurant with “okay” service? Or that by-the-numbers movie that was just “fine”? Probably not.

In the investing world, index funds are the very definition of the “average” investment. Sure, they’ll get the job done most of the time . . . but if you could find an investment with better than average returns, wouldn’t that be something worth shouting from the rooftops? Mutual funds attempt to provide just that.

The index fund vs. mutual fund debate is nothing new. From the hallowed pages of the Wall Street Journal to the watery depths of TikTok, every financial “expert” has an opinion on the issue.

And while it’s true that both mutual funds and index funds have their merits, there is a clear winner when it comes to which investment is better for your retirement savings.

What Is a Mutual Fund?

Simply put, mutual funds are investments that allow investors to pool their money together to invest in something—usually stocks or bonds.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Most mutual funds are actively managed, which means they have a team of professionals working behind the scenes picking and choosing the stocks, bonds or other investment options to include inside the fund. The goal is to put together a collection of stocks that outperform the average stock market index. Which brings us to . . .

Mutual Funds

|

PROS |

CONS |

|

|

What Is an Index Fund?

An index fund is a type of mutual fund designed to mirror the performance of the stock market or a particular area of the stock market. Index funds are passively managed—which means the fund simply buys shares of stocks that are included on the index it’s based on instead of relying on a team of experts to pick the stocks.

Are you wondering what an index is? It’s just a measuring stick for the stock market or a sector of the stock market. For example, the S&P 500 Index and the Dow Jones Industrial Index are used to measure the performance of the stock market as a whole.

Index Mutual

|

PROS |

CONS |

|

|

How Are Mutual Funds and Index Funds Similar? And How Are They Different?

Mutual funds and index funds do have a lot in common. After all, index funds are a type of mutual fund. Some of the similarities include:

- Mutual funds and index funds help investors diversify their investments. Diversification is when you spread your investments among stocks from dozens or hundreds of different companies, lowering your investment risk at the same time.

- Mutual funds and index funds are easy to set up and invest in. There are thousands of mutual funds and index funds to choose from, and you can automate your investments to help you save for retirement consistently over time.

- Mutual funds and index funds are cheaper than other investments. Unlike buying and selling single stocks, which usually comes with transaction fees for every purchase and capital gains taxes when you sell, mutual funds and index funds keep your costs relatively low.

Those are all great traits that both mutual funds and index funds have in common. But there are some key differences that set them apart. Here are some of the main ones you need to know about:

1. Mutual funds are actively managed, index funds are passively managed.

Mutual funds have active management, meaning they have a team of financial experts looking for the right stocks to include in their fund.

Index funds, on the other hand, have passive management—they don’t need a whole team of experts to pick stocks. All they do is copy whatever index the fund is supposed to mirror. Copy, paste, repeat!

2. Mutual funds try to beat the stock market, index funds try to mirror it.

Mutual funds and index funds have different goals. Mutual funds are trying to pick a mix of stocks that will beat the average returns of the stock market or a particular benchmark index.

Index funds? They don’t even want to try. They’re more than happy to settle for whatever returns the index they’re copying can muster.

3. Mutual funds have higher fees than index funds.

Because mutual funds have more operating costs and a team of investing nerds running the show, they have higher fees than index funds.1 But the idea is that you’re paying a little extra for better service and a better product that will ultimately make you more money over the long haul.

Mutual Funds vs. Index Funds: Which One Is Better for Investing?

The truth is that mutual funds and index funds can both play a part in your investing strategy. But does one have an edge over the other? And which one should you prioritize when you’re saving for retirement?

For retirement, mutual funds are the way to go. We recommend investing 15% of your gross income evenly between four types of good growth stock mutual funds: growth and income, growth, aggressive growth, and international. That mix of funds will give you plenty of diversification to lower your investment risk while still allowing you to use the power of the stock market to build wealth over time.

But don’t just add the first mutual fund you see to your retirement portfolio. You really need to do your homework and research first. Why? Because even though mutual funds try to outperform index funds, many of them fall short. But don’t worry, there are still plenty of actively managed mutual funds out there that beat out the average returns you get from index funds.2,3

The good news is that mutual funds that outperform the market aren’t that hard to find! All you have to do is look at a mutual fund’s prospectus and scroll over to the fund’s performance, and then compare it to a market index like the S&P 500 or another similar benchmark.

The key is to look for funds that are at least 10 years old and have a strong track record of returns that consistently beat the market over time. If you see that a fund doesn’t regularly beat the benchmark index, then just keep looking until you find a fund that does. It’s that simple!

And the good news is you don’t have to do all this research on your own. You can work with a financial advisor or investment professional to help you identify and choose which funds to include in your Roth IRA and 401(k).

How Do Fees Impact Mutual Fund and Index Fund Performance?

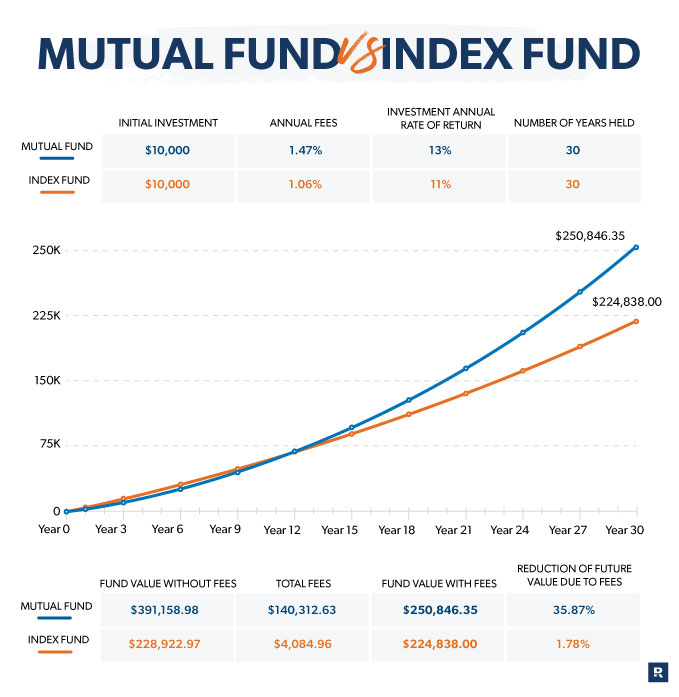

And what about fees? Everyone makes a big deal about fees, but how much do they really impact your investments? Let’s run the numbers to see how an actively managed mutual fund can outperform a typical S&P 500 index fund—even with fees.

Let’s say you’re making a one-time $10,000 investment in a mutual fund or an index fund, and your plan is to let the money sit and grow for 30 years. With help from a financial advisor, you find a mutual fund using an advisor and paying a 1% annual fee, an ongoing 0.47% expense ratio, and a 13% average annual rate of return (yes, they exist!).

Your other option is go the do-it-yourself route and invest in an index fund with an 11% average annual rate of return (the historic annual rate of return of the stock market over time is between 10–12%) and a 0.06% expense ratio (with no sales charge or commission, since you’re not working with an advisor).4

Which fund wins after 30 years? Surprise—it’s the actively managed fund!

After you factor in all the fees, the better-performing mutual fund still outperforms the index fund by about $26,000—and that’s assuming you don’t add a single penny! The gap widens even more if you invest consistently month after month, year after year.

Here’s the moral of the story: Don’t get so caught up in the fees that you end up stepping over dimes to pick up nickels.

The Keys to Becoming a Successful Investor

And at the end of the day, the most important factor to successfully invest for retirement isn’t fees or even how the investment performs (although they are still important to consider). Nope, the people who actually wind up with enough money to retire comfortably are those who invest consistently over time.5 It’s not rocket science, people!

And if you’re wondering whether it’s worth getting help from a financial advisor or investment professional, here are some things to keep in mind. A recent study from Vanguard shows that working with an advisor—someone who can help you with investing options, tax strategy, estate planning and more—could potentially add up to 3% in net returns to your investment portfolio. Maybe that’s why 68% of millionaires in The National Study of Millionaires said they worked with a financial advisor to help them reach their net worth.

That’s why once you’re debt-free (everything except your mortgage) with a fully funded emergency fund (enough to cover 3–6 months of expenses), you should invest 15% of your gross income into good growth stock mutual funds invested in tax-advantaged retirement accounts like your 401(k) and Roth IRA.

That’s it. That’s the path that has helped millions of Americans become Baby Steps Millionaires—and it can get you there too.

When Does It Make Sense to Invest in Index Funds?

While mutual funds are the better choice for your retirement investments, that’s not to say index funds never have a place in your investing strategy.

Once you’re ready to invest beyond 15% of your income or you’ve maxed out your tax-advantaged retirement accounts, one of your options is to invest in low-turnover mutual funds—which includes index funds—inside of a taxable brokerage account.

Index funds can also help you save for a down payment on a house or for other long-term financial goals only if you won’t need the money for five years or longer and your index funds are in a taxable brokerage account separate from your retirement investments. But if your saving time frame is shorter than that, a regular online savings account or money market account will do the trick.

Work With an Investment Pro

The good news is you don’t have to walk that path alone. An investment professional who can teach you about the differences between mutual funds and index funds and help you pick and choose funds to include in your portfolio? That’s priceless.

If you’re ready to get started, check out the SmartVestor program. We can connect you with up to five investment professionals to choose from.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.