Over the past three decades, Ramsey Solutions has taught millions of Americans how to get out of debt, save for emergencies, and build wealth through the Baby Steps.

On top of that, there are thousands of folks out there who have become millionaires after years and years of hard work and applying our investing principles into their financial plan.

We call this special group of people Baby Steps Millionaires—and they are living, breathing proof that this stuff works! And if it worked for them, it can work for you too.

What Is Ramsey Solutions’ Investing Philosophy?

A lot of people have questions about when and how to invest their money, and that’s totally okay! Plain and simple, here’s the Ramsey Solutions investing philosophy:

- Get out of debt and save up a fully funded emergency fund first.

- Invest 15% of your income in tax-advantaged retirement accounts.

- Invest in good growth stock mutual funds.

- Keep a long-term perspective and invest consistently.

- Work with a financial advisor.

We’re going to take a closer look at Ramsey’s approach to investing and break each of those principles down one by one. By the end, you’ll see how these principles will help you build wealth, retire with dignity, and become outrageously generous. That’s what it’s all about!

Investing Principle 1: Get out of debt and save up a fully funded emergency fund first.

Any successful investment strategy needs a firm financial foundation, so it’s really important to lay the groundwork for financial success by working through the Baby Steps we were just talking about in order.

That means getting out of debt (everything except the house) and building a fully funded emergency fund of 3–6 months of expenses before you start investing.

Getting out of debt in order to invest is the quickest right way to build wealth. So if you haven’t paid off all your debt or saved up 3–6 months of expenses, stop investing—for now. Here’s why.

First, your income is your most important wealth-building tool. As long as your money is tied up in monthly debt payments, you can’t build wealth. That’s like trying to run a marathon with your legs tied together!

And second, if you start investing before you’ve built up your emergency fund, you could end up tapping into your retirement investments when an emergency does come along, totally ruining your financial future in the process.

Think of it this way: Paying off debt and dodging a money crisis with a fully funded emergency fund are fantastic investments that pay off for you in the long run! And you need to take care of all of that before you start investing.

Investing Principle 2: Invest 15% of your income in tax-advantaged retirement accounts.

Once you’ve completed the first three Baby Steps, you’re ready for Baby Step 4—investing 15% of your household income in retirement. This is where things get really exciting!

You’ll get the most bang for your buck by using tax-advantaged investment accounts. For example, pretax investment accounts give you a tax break on your contributions now (but you’ll pay taxes on your withdrawals in retirement), while after-tax investment accounts let you enjoy tax-free growth and tax-free withdrawals in retirement!

Pretax Investment Accounts

- 401(k)

- Traditional IRA

- 403(b)

- Thrift Savings Plan (TSP)

After-Tax Investment Accounts

- Roth 401(k)

- Roth IRA

When you’re trying to figure out where to invest for retirement first, just remember: Match beats Roth beats Traditional. Here’s how you can reach your 15% goal by following that formula:

- First, if your employer matches contributions to your 401(k), 403(b) or TSP, invest up to the match. That’s free money—and nothing beats that!

- Second, take advantage of all the Roth you can at work or as an individual. If you have a Roth 401(k) at work, great! You can invest your entire 15% there. If not, then max out a Roth IRA for yourself (and your spouse if you’re married).

- If you still haven’t reached your 15% goal after maxing out your Roth IRA, keep bumping up your contribution to your 401(k), 403(b) or TSP until you hit that 15%.

Fun fact: Did you know that 8 out of 10 millionaires invested in their company’s 401(k)?1 That means their boring old workplace retirement account was a huge piece of their financial success! On top of that, 3 out of 4 millionaires invested outside of their company plans too.2

Want to learn even more about how these millionaires built their wealth? Dave Ramsey’s bestselling book, Baby Steps Millionaires, will show you the proven path that millions of Americans have taken to get out of debt and build wealth—and how you can too!

Invest Like No One Else

From investing advice to wealth management, find a SmartVestor Pro who speaks your language.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Investing Principle 3: Invest in good growth stock mutual funds.

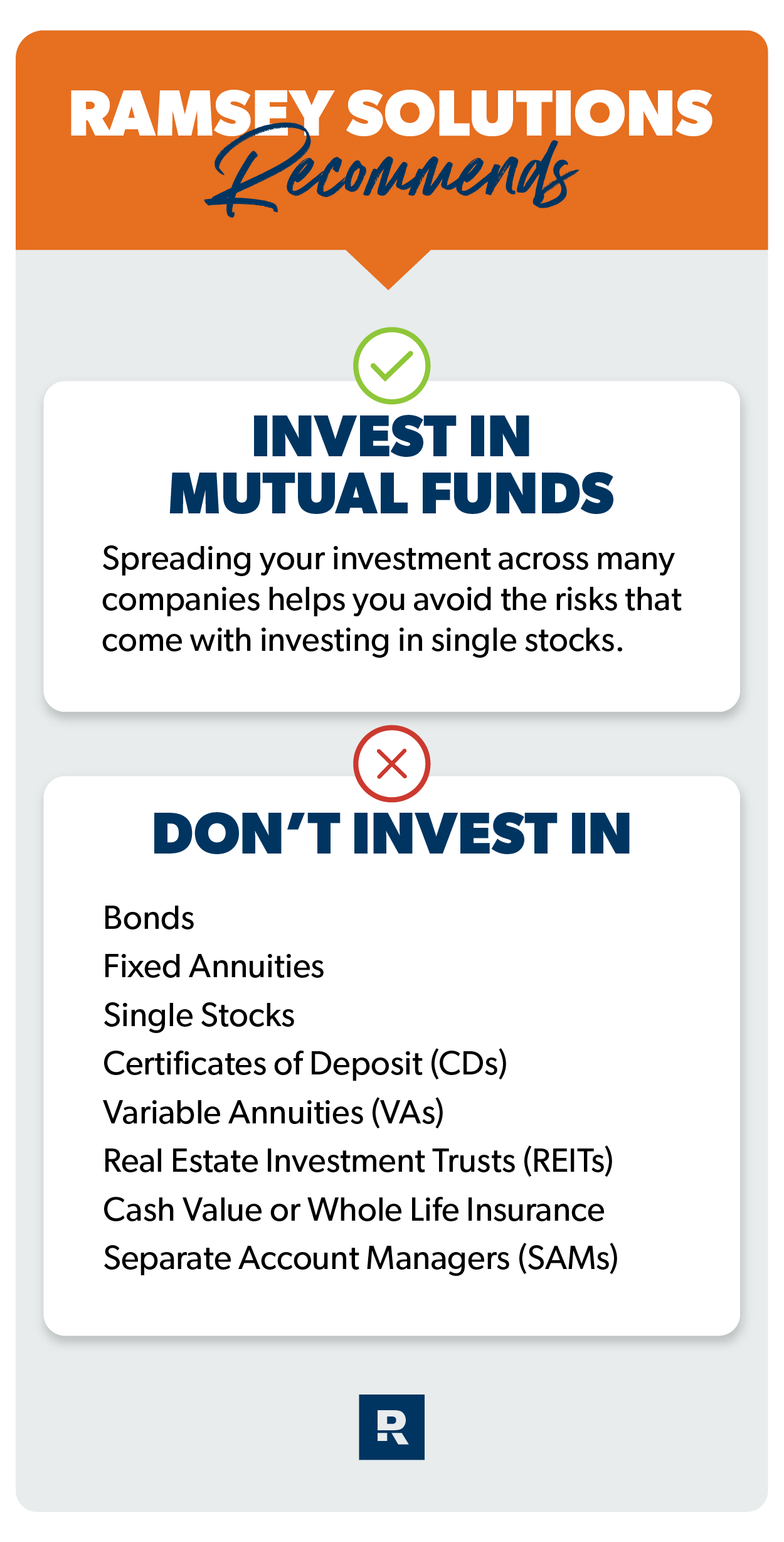

What should you invest in inside your 401(k) and Roth IRA? There are many different types of investments to choose from, but Ramsey says mutual funds are the way to go!

Mutual funds let you invest in a lot of companies at once, from the largest and most stable to the newest and fastest growing. These funds have teams of managers who do tons of research on the company stocks they choose for the fund to invest in, making mutual funds a great option for long-term investing.

Why are mutual funds the only investment option Ramsey Solutions recommends? Well, we like mutual funds because they spread your investment across many companies, and that helps you avoid the risks that come with investing in single stocks and other “trendy” investments (we’re looking at you, Dogecoin).

And to go one step further, we recommend dividing your mutual fund investments equally between four types of funds: growth and income, growth, aggressive growth, and international. This lowers your investment risk because now you’re invested in hundreds of different companies all over the world in a whole bunch of different industries. In other words, you’re not putting all your eggs in one basket!

Here’s a closer look at those four types of funds and what they bring to your investment portfolio:

Growth and Income

These funds create a stable foundation for your portfolio by investing in big, boring American companies that have been around for decades. They might also be called large-cap or blue-chip funds.

Growth

Sometimes called mid-cap or equity funds, growth funds are filled with stocks from U.S. companies that are still on the up-and-up, but their performance tends to ebb and flow with the stock market as a whole.

Aggressive Growth

Meet the wild child of your investing portfolio. These funds invest in smaller companies that have tons of potential. When they’re up, they’re up. But when they’re down, buckle up—because you’re in for a bumpy ride.

International

These funds are great because they help spread your risk beyond American soil by investing in large companies that aren’t based in the U.S. Just don’t get them confused with global funds, which bundle U.S. and foreign stocks together.

How Do You Choose the Right Mutual Funds?

Great question! Your employer-sponsored retirement plan will most likely offer a pretty good selection of mutual funds, and there are thousands of mutual funds to choose from as you pick investments for your IRAs.

When looking for mutual funds to invest in, keep an eye out for funds with a long track record (at least 10 years) of strong returns that consistently outperform the S&P 500. They’re out there!

Choosing the right mutual funds can go a long way in helping you reach your retirement goals and stay away from risk. That’s why it’s important to compare all your options before making your final picks.

And let’s talk about mutual fund fees and costs for a second. While it’s important to pick funds that don’t have outrageously high costs, fees won’t keep you from being wealthy. We don’t have a problem paying a commission for mutual funds. Why? Because it helps to have a financial advisor in your life to help you pick your investments and keep you on track with investing. Don’t get so fixated on fees that you start stepping over nickels to pick up pennies.

Here are a few other questions to think about as you figure out which mutual funds are the right fit for you:

- How much experience does the fund manager have?

- Does this fund cover multiple business sectors, like financial services, technology and health care?

- Has the fund outperformed other funds in its category over the past 10 years or more?

- What costs come along with the fund?

- How often are investments bought and sold within the fund?

If you can’t find answers to these questions on your own, reach out to your financial advisor for help. It’s worth the extra time if it means you can make a better and more thought-out decision about your investments. They’re kind of a big deal, after all.

Investing Principle 4: Keep a long-term perspective and invest consistently.

We recommend a buy-and-hold strategy when it comes to investing. The stock market is like a roller coaster. There are going to be ups and there are going to be downs—the only people who get hurt are the ones who try to jump off before the ride is over.

Historically, the average annual rate of return for the stock market ranges from 10–12%.3 Remember that’s an average—some years you’ll see massive returns, and in other years you might see negative returns. But over time, you should see your money grow if you keep it invested for the long haul!

The folks who became Baby Steps Millionaires knew that and kept a long-term perspective throughout their financial journey. They didn’t freak out over what happened in one particular year. They didn’t pull their money out at the first sign of trouble. They stayed focused, and they kept investing in their 401(k)s and IRAs every month, no matter what was happening in the stock market.

And research proves over and over again that the top indicator of investment success is your savings rate.4 Your savings rate is how much you save and how often you do it. Figuring out rates of return, asset allocation and expense ratios is all fine and dandy, but they won’t mean a thing if you don’t actually put any money in your 401(k)!

Whatever you do, don’t go around chasing returns. Folks who do that can’t see more than a few feet in front of them. They get all excited and greedy when their investments are up, and then go into full-on panic mode and sell at the wrong time when things are down. That’s how you wake up one day with an empty nest egg and a ton of regret.

What’s the bottom line here? Investing your money month after month, year after year, and decade after decade is way more important than any other investment analysis out there. So stop sitting around arguing with your broke family members and just freaking do it!

Investing Principle 5: Work with a financial advisor.

No matter where you are on your financial journey, it still helps to team up with a financial advisor. It’s a pro’s job to stay on top of investing news and trends, but their most valuable role is helping you meet your retirement goals.

A good financial advisor or investment professional should give insight and direction based on their years of experience, but at the end of the day, they know you’re the decision-making boss.

And remember: You should never invest in anything until you understand how it works. Look for a pro who takes time to answer your questions and gives you all the information you need to make good investing choices. You should leave a meeting with your financial advisor feeling smarter and more empowered than when you went in!

Ready to find an investment pro who’s committed to helping you make informed decisions with your money? Then try SmartVestor. It’s a free and easy way to find investing advisors in your area.

Next Steps

- Check out the free resources available on the Ramsey Investing Hub. You’ll find Ramsey’s Complete Guide to Investing, interactive calculators and other tools you can use to tap into your investing potential.

- Dave Ramsey’s bestselling book Baby Steps Millionaires will show you how millions of folks around the country have used this investment philosophy to reach millionaire status.

- The SmartVestor program can connect you with investment pros in your area who can help you make informed investing choices.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.