Becoming a homeowner is super exciting, you guys! There are so many fun decisions to make. City or country? Ranch house or townhome? Fixer-upper or move-in ready?

But no matter how you answer those questions, the most important thing is buying a house you can actually afford—and making a good home budget is the biggest key to making that happen.

Plus, budgeting for a house doesn’t require some kind of fancy degree in economics or finance. Nope, no expertise required. You just need to follow five simple steps.

Let’s dive in!

How Do I Budget for a House?

We’re about to walk through the five key steps to make a home budget. But first, I need to warn you—you should only buy a house when you’re debt-free with a full emergency fund. Otherwise, owning a home and covering the expenses that go along with it will be super stressful.

Find expert agents to help you buy your home.

Without that kind of margin in your budget, anything that goes wrong or needs repair (like a broken fridge or leaky roof) can turn an inconvenient expense into a full-blown money crisis. So before you start making your house budget, pay off all your debt and save up an emergency fund worth 3–6 months of your typical expenses.

Once you do that, these five steps will set you up with a great plan for buying a home on a budget.

Step 1: Set Your Savings Goal

The first step to budgeting for a house is figuring out your savings goal by asking yourself these three simple questions.

- How much house can you afford? Divide your monthly take-home pay by four. Ta-da! That’s how much of a monthly payment (including principal, interest, homeowners insurance and HOA fees) you can afford on a house with a 15-year fixed-rate mortgage. (Anything more than 25%, and you run the risk of being house poor!) Our free Mortgage Calculator will give you a good look at the monthly payment you can expect for different home prices.

- How much of a down payment do you want to make? If you’re a first-time home buyer, you’ll want to save up a down payment of at least 5–10%. But if you can swing a 20% down payment, that’s even better—it’ll keep you from having to pay for private mortgage insurance (PMI), which can be pricey. Plus, a bigger down payment means smaller monthly payments on your mortgage. Who doesn’t love that? And don’t forget about extra money for closing costs and any other expenses that could pop up during the home-buying process.

- When do you want to buy a house? The way you set up your budget for buying a house will depend on when you’re planning to buy. For example, if you’re on the fast track to buy a house in 10 months, you’ll need to save more aggressively to reach your down payment. But if you don’t want to buy for a few years, you don't have to be quite as intense.

Next, it’s time to do some math (hooray!) to figure out how much money you’ll need to save each month to reach your goal. Divide the amount you plan to put down by the number of months you want to save.

Let’s look at an example to see how this works. We’ll say a married couple that makes a $130,000 combined salary wants to get super aggressive and save up a huge 33% down payment over the next two years so they can afford the monthly payments on a $300,000 house (with a 5.5% interest rate).

Here’s what their savings goal would look like:

Now, you may be thinking $200,000 isn’t a whole lot to spend on a house. But here’s the deal: You may have to adjust your expectations when you’re buying your first home. House prices have gone up a ton in the last few years, so you’re probably not going to wind up with your dream home right out of the gate.

Don’t feel bad about buying a smaller, more affordable starter home if that’s what you can afford. And if you have to compromise on location, that’s okay too. Trust me: You’ll be so thankful you didn’t overspend on a house just because you wanted it to look and feel a certain way. Plus, you can always upgrade down the road when you can afford to!

Now, you may be thinking that saving $100,000 is way too big of a goal for this couple. But once you see how all the numbers work out as we walk through this example, I think you’ll be surprised by how achievable this can be for them—and you!

Step 2: Write Down Your Income

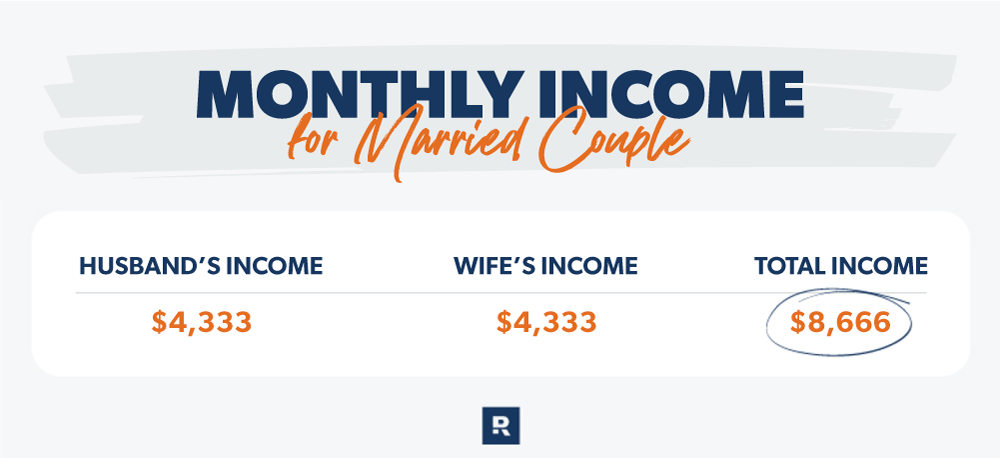

Once you’ve set your savings goal, the next step in budgeting for a house is writing down your income (after taxes). After all, you can’t make a budget if you don’t know how much money you’ll have to spend!

So, sit down and add up every source of income you get each month. That includes your salary, any side hustles you have, and any other money you plan to make during the month. You want to account for every dollar you’ve got to work with.

Here’s what this step will look like for our example couple:

Super easy, right?

Step 3: List Your Expenses

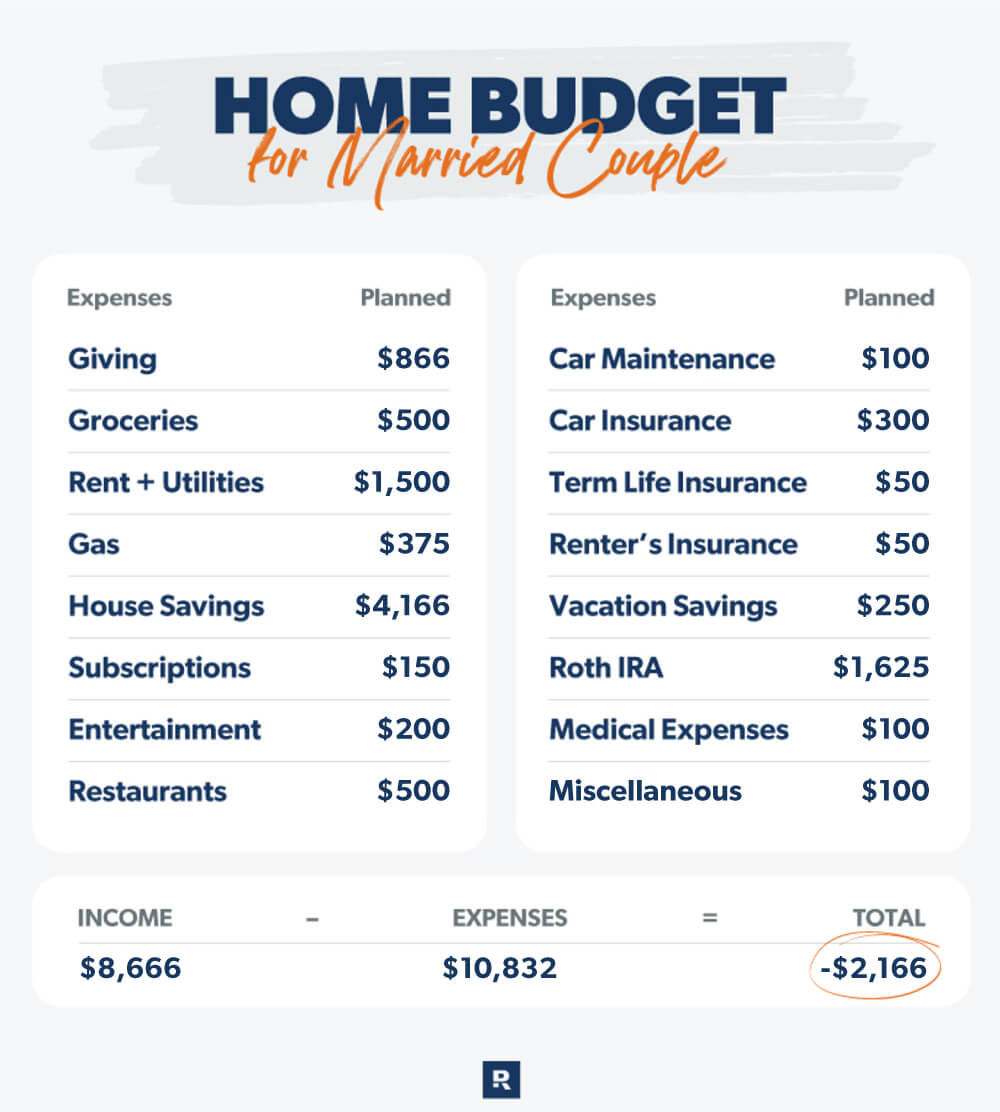

Now that you know how much money you’ve got coming in, it’s time to figure out where it’s all going to go by listing your typical monthly expenses. If you’re already living on a budget, then you’ve already completed this step! But if this is your first time making a budget, I promise it’s not as difficult as you think.

Start by covering food, transportation, housing and utilities—aka, the stuff we all have to pay for. Then, think about any other major categories you spend money on each month—subscriptions, clothing, entertainment, routine car maintenance, eating out and (most importantly) generosity. And since you’re saving for a house, one of the categories on your budget will need to be “house savings.”

Once you finish listing out the categories, you’ll need to figure out how much you’re going to spend on each of them. If you’re not sure how much money you should put toward a particular category, look at recent bank statements and receipts to get a good idea of how much money you’ve been spending in each area. And don’t forget to plug the number you got from step one into your “house savings” category!

Let’s go back to our example of the married couple who each makes $65,000. Here’s what their home budget might look like after completing this step of the process.

As you probably noticed, they’re currently planning to spend more money than they actually make. We don’t want that! Luckily, the next step will help them (and you) get back on track.

Step 4: Make Adjustments

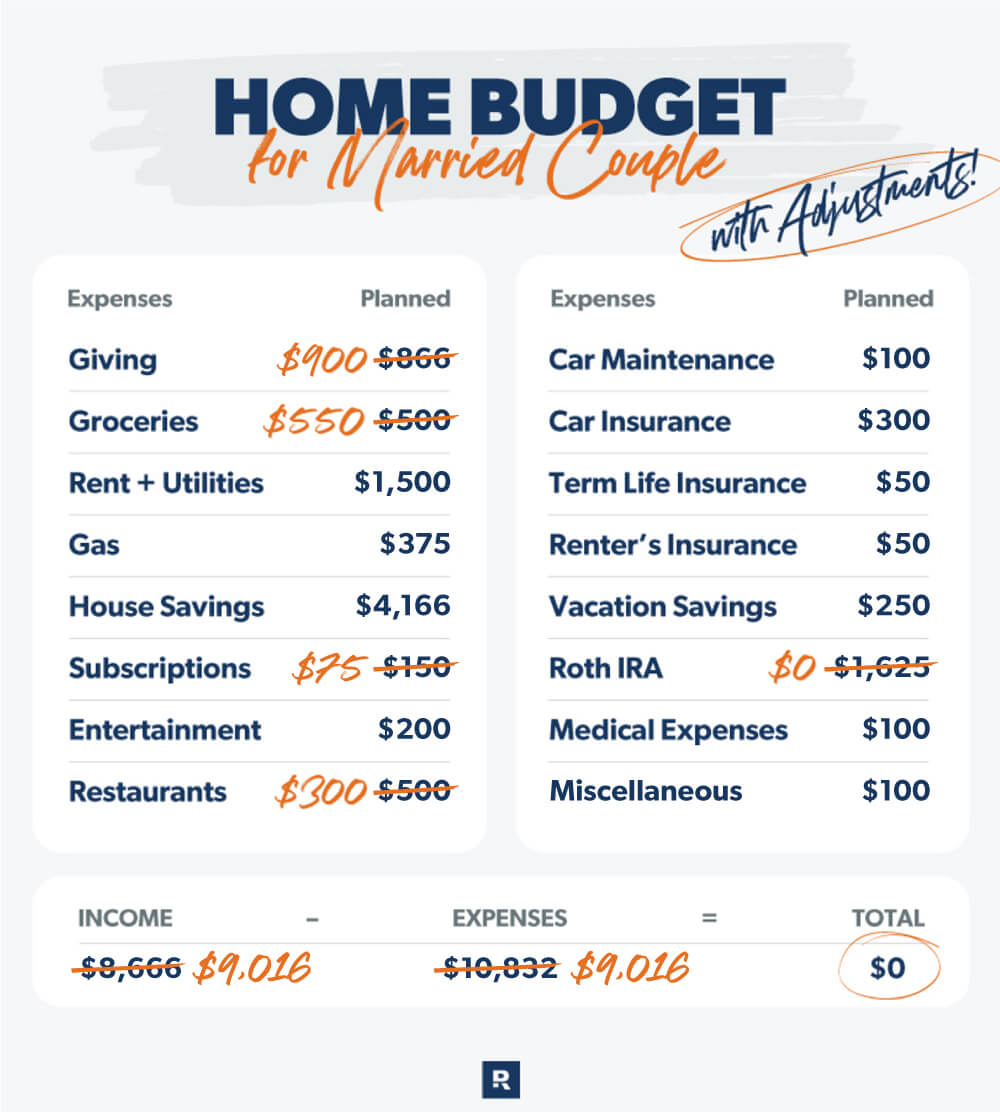

If this is your first budget, there’s a good chance you’ll wind up with more money going out than coming in when you list your expenses—just like the couple in our example. That means you need to do one of two things: Increase your income or decrease your expenses.

To start, you can increase your income by getting a side hustle, working overtime, selling items you don’t need, or plenty of other ways.

When it comes to lowering your expenses, here are three of my favorite ways to spend less while saving for a house:

- Temporarily stop investing. Consistently saving for retirement over time is a major key to a good financial game plan. However, if you want to pause investing while you focus on saving for a house, that’s A-OK. Just make sure you pause your investing for no more than three years (and go right back to investing 15% of your income every month as soon as you buy a house).

- Eat at home more often. There’s nothing wrong with eating out, but taking fewer trips to restaurants is a great way to save a whole lot of money (just make sure you add a little extra to your grocery budget).

- Limit your paid subscriptions. It feels like there are a million different streaming services to choose from these days—and the costs can add up quickly. So, if you’re looking for an easy way to cut down on expenses, canceling some subscriptions is a great way to do that. Not only are there lots of great free streaming services available, but chances are you don’t need Netflix, Hulu, Max and Disney+.

Small changes like these can really add up, you guys. Don’t believe me? Let’s go back to our example couple.

Say the couple takes all three of those steps to cut back on expenses, and they each start a side hustle that lets them bring home an extra $175 a month. Here’s what their updated budget would look like:

Pretty big difference, huh? With just a few small tweaks, this couple went from being over $2,000 underwater on their budget to having a zero-based budget that will let them make a 33% down payment on a new home in just two years.

Step 5: Track Your Progress

Once you’ve made your home budget, you can’t stop there! For this whole thing to work, you’ve also got to stick to the budget and track your progress. That means you’ll need to review your transactions throughout each month to make sure you’re staying in line with the amounts you’ve set for each category of expenses.

My favorite way to do that is using the EveryDollar app. When you buy the premium version, you can link your bank account so the app will automatically download all of your transactions. It makes keeping up with everything super easy—no need to worry about old bank statements and receipts!

You’ve Got This!

If you’re sticking to your budget every month, you’ll stay on track to hit the saving goals you set in step one. That means it won’t be long before you’re ready to buy a house. That’s so exciting!

Next Steps

1. Figure out how much house you can afford using our free calculator.

2. Set your home savings goal.

3. Make your home budget on the free EveryDollar app.

Frequently Asked Questions

-

Where should I keep my down payment?

-

You can stash your down payment in a simple money market account or high-yield savings account. You won’t make tons on interest, but you won’t lose money either. As long as you keep your savings liquid and in a place that’s easy to access, you’ll be good to go.

-

When should I start saving for a house?

-

As soon as you’re debt-free with a full emergency fund of 3–6 months of your typical expenses, you’re ready to start saving for a house!

-

How much money should you save before buying a house?

-

You should save enough money to make a down payment of at least 5–10% in addition to paying for closing costs and any other expenses that may pop up during the home-buying process. If you can put 20% down, that’s even better—it’ll keep you from having to pay for private mortgage insurance (PMI).

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.