From budgeting to building wealth, every feature is here to help you know how you’re doing with money—and how to do better.

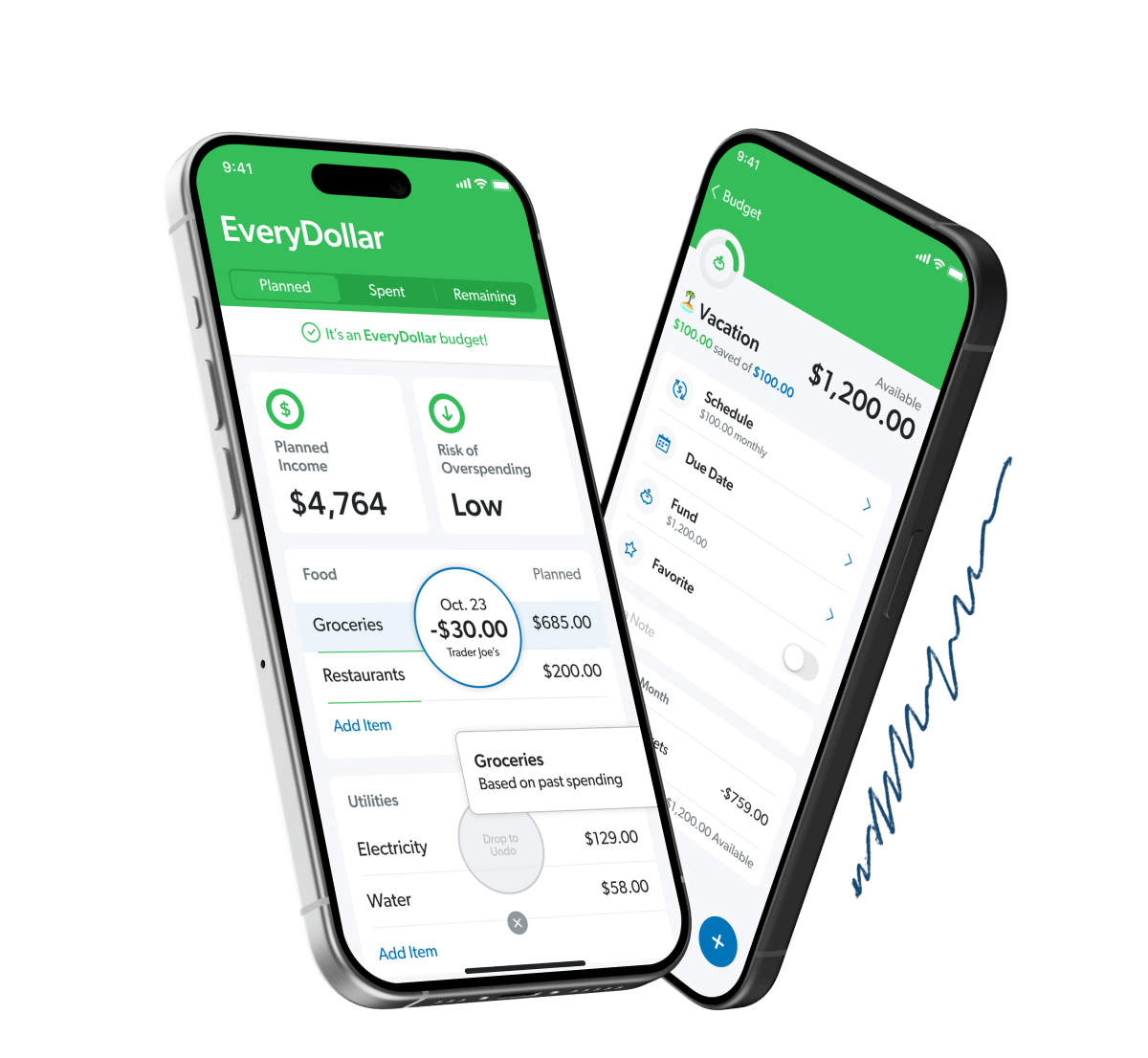

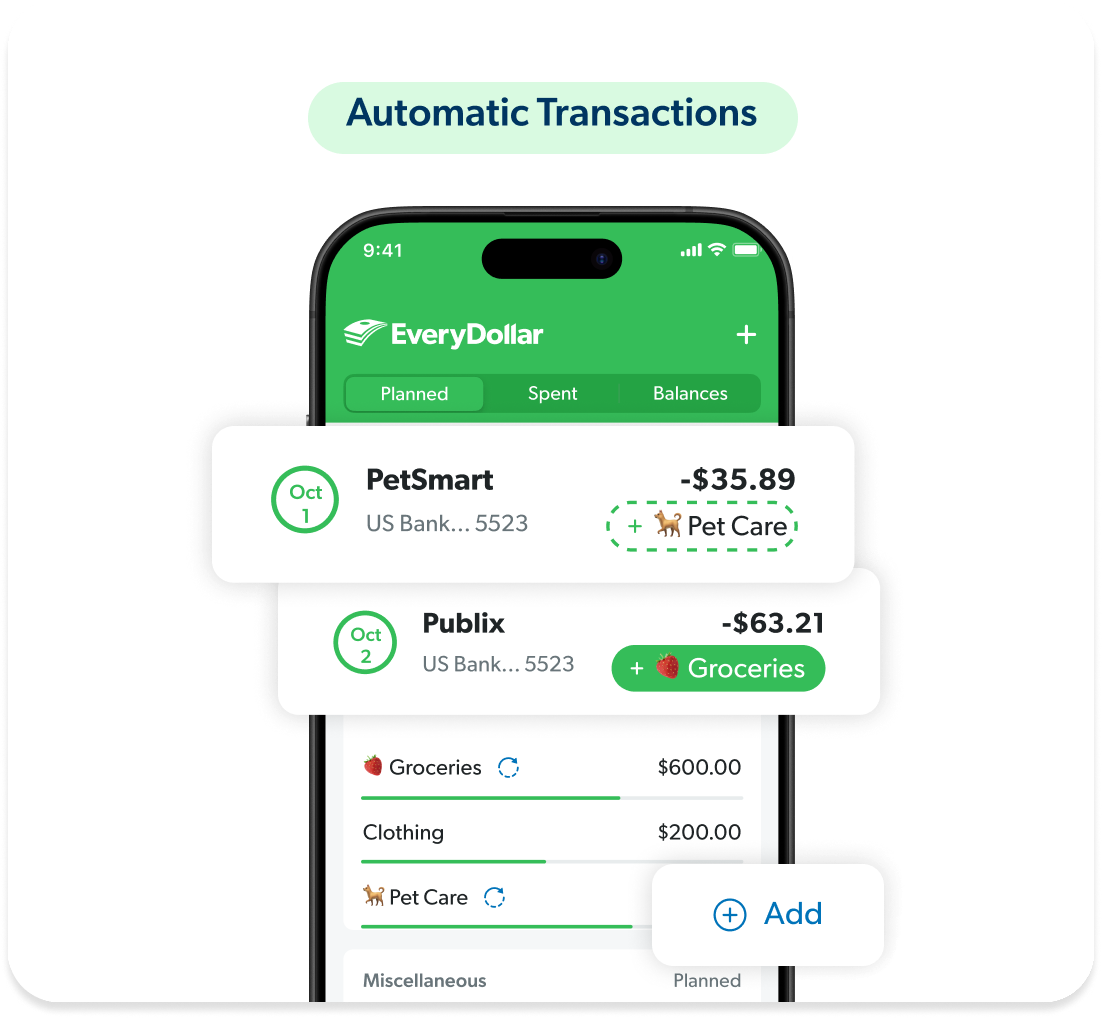

Give every dollar a job and know where your money’s going.

- Create unlimited monthly budgets

- Customize your budget how you want

- Automatically stream transactions from your bank

- Stay on top of your spending in seconds

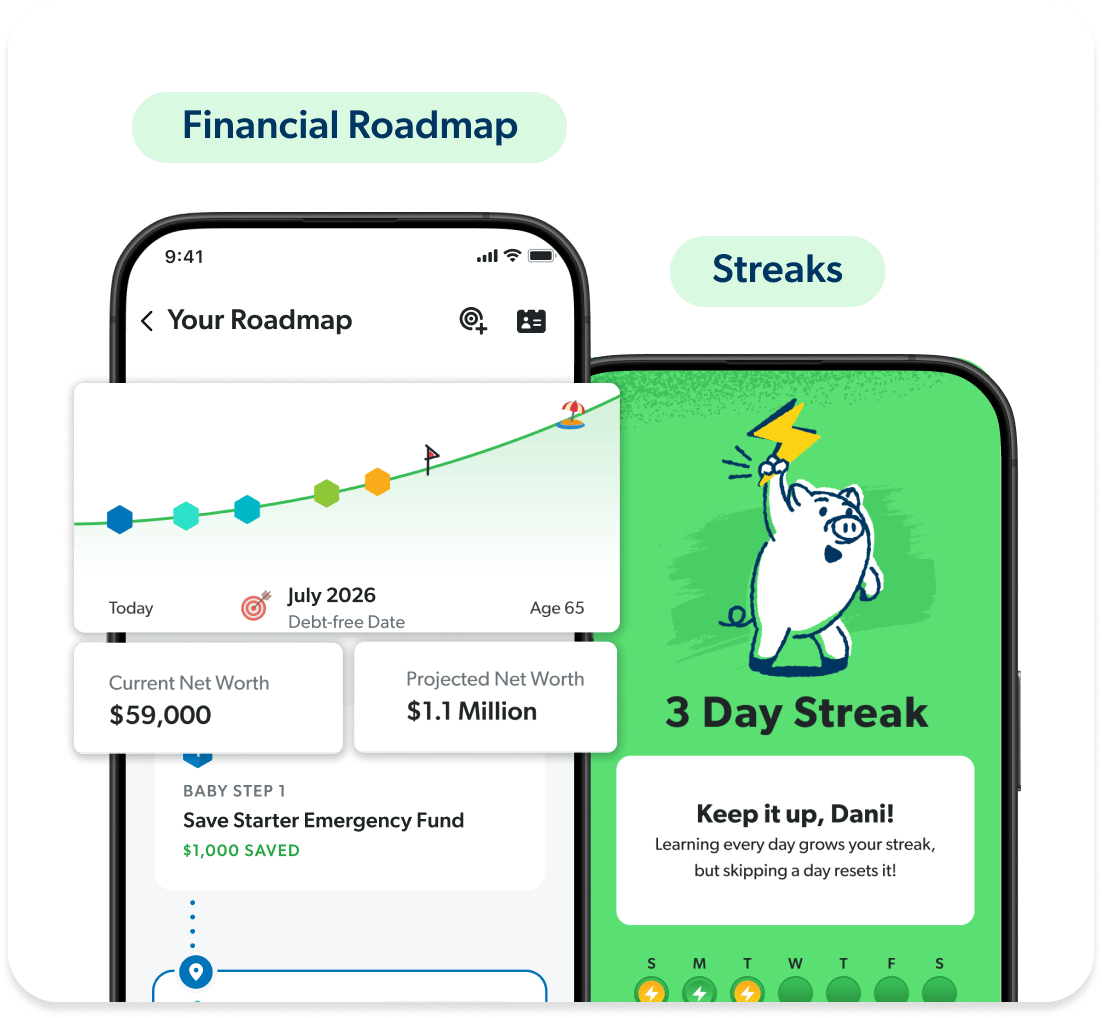

Track where you’re at with money and see how you’re winning!

- Earn streaks for good money habits

- Track your net worth and your millionaire date

- See your full financial picture

- Know when you’ll hit your big money milestones

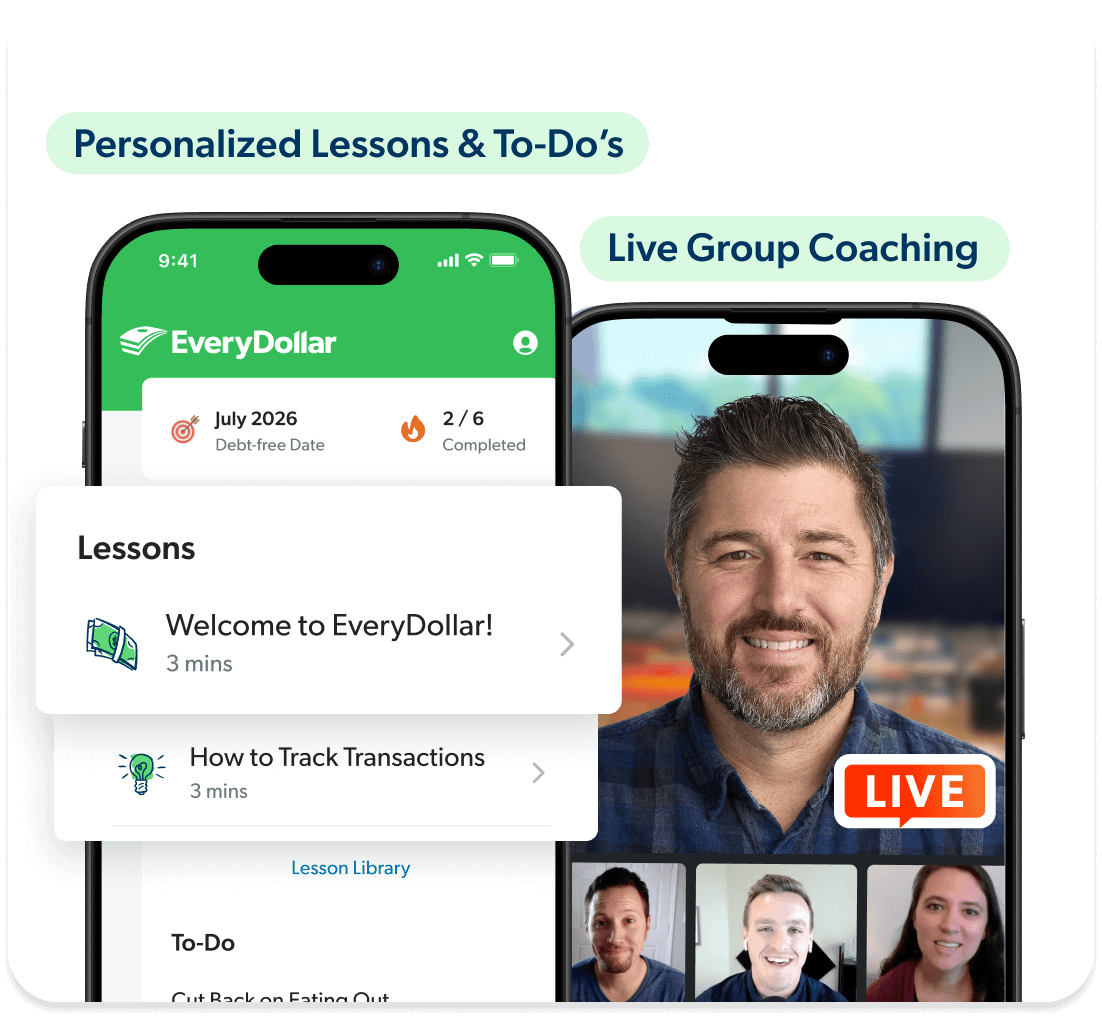

Find margin, stay on track, and know your next right step.

- Get personalized action steps to free up margin

- Do bite-sized lessons to build better money habits

- Join live workshops on budgeting and other topics

- Get support from expert coaches (aka, real humans)