10 Common Types of Fraud (and How to Protect Yourself)

21 Min Read | Jul 1, 2025

Key Takeaways

- Common types of fraud include impostor scams, debit and credit card fraud, check fraud, internet fraud, job scams, bank account takeover fraud, mail fraud, tax refund fraud, investment fraud and elder fraud.

- Fraud can include scams, but if you willingly hand over your information or money to a scammer, banks and identity theft protection won’t reimburse you.

- Your best protection is being alert to the signs of fake websites and email addresses, researching companies and people, learning to recognize emotional manipulation, installing and updating antivirus software, and getting an identity theft protection plan.

- Stay aware of AI-enabled scams like voice cloning, deepfakes and fake social media profiles that can impersonate loved ones, influencers or companies.

Fraud is a broad term that comes in all shapes and sizes—from slick talking “investment advisors” to fake FBI agents calling Grandma and convincing her to wire away her life savings. But whether it’s done through charm, hostility or outright lies, it all has one thing in common: someone deceiving someone else and taking what isn’t theirs.

The best way to protect yourself from fraud, scams and identity theft is to get educated—learn to spot the red flags and warning signs before the scammers get too close. Because when you know what to look for, you’re way less likely to let a bad guy (or girl, to be fair) slip through your defense—you’ll sniff out a fishy situation from miles away. So, let’s sharpen those instincts and break down some of the most common types of fraud out there today.

10 Common Types of Fraud

Sadly, fraud is all too common in our world today. From internet fraud to bank account fraud, Americans’ personal information is more vulnerable than ever. Let’s dive into some fraud numbers:

At the end of 2024, people ages 30–39 reported the most instances of fraud losses, with more than 178 loss reports per 100,000 people and a median loss of $450. But here’s the thing—the other age groups? Not that far behind at all. And the older you get? The cost of those losses rises dramatically. Folks over 80 years old report a median loss of $1,650!1

So, as you can see, fraud is a big, expensive issue. Here are the 10 types of fraud you need to watch out for:

Knowing the different types of fraud—and following a few smart tips—can go a long way in protecting your money, your identity and your peace of mind.

Scams vs. Fraud Explained

Before we move on—I want to clear something up. When talking about fraud, types of scams inevitably come up. But they’re not exactly the same thing.

The government tends to lump scams and fraud together. Under fraud’s broadest definition (someone deceiving you for personal gain), scams are a type of fraud. But banks don’t see it that way, and that’s usually who you have to deal with in these situations.

Banks generally separate the two into these definitions:

- Fraud: the use of your personal sensitive info without permission

- Scam: a scheme to manipulate you into giving away your money or sensitive info

Scams (like fake sweepstakes entries) are used to gather your sensitive info, and then that info is used to do things like open a new account (fraud) or take what’s in your account (theft).

If you fall for a scam and mail $50,000 in a shoe box to a Walgreens in another state, your bank won’t help you. And neither will identity theft (IDT) protection plans. If you mail someone your Social Security number on the other hand, a good IDT plan will help you sort that mess out.

My list of common types of fraud includes both scams and the stricter definition of fraud.

What's your risk of identity theft?

Take this quiz to assess your risk.

Impostor Scams

These are the scam stories that make headlines. You’ve heard it before—something like, “Retired Woman Hands Over Life Savings to FBI Impostor.”

Stories like this are all too common today. In fact, by the end of 2024, losses from impostor scams neared a staggering $3 billion in the U.S.—with over 847,000 reported cases.2

Often, impostors will pose as government agents. This means you could get an unpleasant (sometimes threatening) call from someone claiming to be the FBI, CIA or the IRS, citing big consequences for not handing over your information. Other impostors include Nigerian princes, vehicle warranty department professionals, aid workers, tech support guys, package delivery companies and even romantic partners that never existed.

Sometimes, they’ll even spend months grooming you to believe their fake identity before they actually ask you to give them something.

And here’s the extra scary part—a lot of folks think they’d never fall for these types of scams, but it doesn’t always take an Oscar-worthy performance to win you over. With the rise of AI voice cloning, you could get a frantic call from your “son” telling you he’s in big trouble and needs you to wire him $10,000 ASAP—and you might actually do it.

Look, these scammers aren’t sloppy. They’re strategic, they’re relentless, and clearly, they’re good at what they do. You don’t rake in billions being bad at it. Don’t underestimate the lengths they’ll go to steal from you or a loved one.

How to Protect Yourself From Impostor Scams

It’s important you’re vigilant about these because if you get duped and hand over money, not a lot can be done for you—the banks won’t help you, and IDT protection won’t help you. You’re on your own.

First off, be really skeptical. If someone on the phone, in an email, or in a text is claiming to be someone and you’re not 100% sure about them, double- or even triple-check. The government will never contact you out of the blue with wild requests. You can always look up the actual person or agent and call them with a number that you found from the official site.

It’s important to note that legit phone numbers can be spoofed, meaning the incoming call may look like the accurate number. So when in doubt, ask if you can call back, and use the legit phone number you find online. If they refuse to let you call back or get flustered, that’s a classic sign of a scam.

Also, talk to someone else! Run the request by a person you trust. Sometimes, two noses are better than one. Ask your bank—they’re experts at recognizing fishy transactions. Any legitimate request will never come with requirements to not tell anyone. But scammers often try to isolate you in the deception by telling you it’s vitally important you don’t tell anyone about it.

If someone you know is contacting you but something feels off, call them with a number you know to be theirs. Don’t give them anything until you’ve absolutely made sure it’s them and not a scammer. (And even then, you’re allowed to say no if you want. Boundaries are brave.)

Debit and Credit Card Fraud

When a thief gets access to your debit or credit card number, you don’t have to second-guess it—that’s fraudulent activity. And the banks will agree. This can happen when the card number or the physical card itself is stolen.

Sometimes, fraudsters don’t take the direct route. There’s a new scheme out there called refund phishing. A criminal steals your card number, but instead of going right for the money they can get off your card, they purposely make a purchase from a fraudulent website they’ve set up.

When you notice there’s a purchase you didn’t make, they hope you contact the fake company to dispute the purchase so they can trick you into sharing sensitive account details—which gives them more ways to steal from you than just the card.

How to Protect Yourself From Debt and Credit Card Fraud

I recommend monitoring your bank account on a weekly basis. That way, you’ll catch any unauthorized charges on your bank or credit card statements and can contact the card issuer right away so they can cancel the card and send you a new one. (If it’s a credit card, I’d recommend cancelling it and telling them they can shove the new one into a woodchipper. If you know, you know.)

Guard your cards carefully to make sure no one steals your numbers. Chip cards are more secure than those with only the magnetic strip.

You should also be cautious about using ATMs anywhere other than your bank. Hackers can sometimes tamper with these third-party ATMs with devices called skimmers that steal your information.

And remember: Never store your card numbers online. Instead, consider using a service like PayPal or Privacy.com to avoid putting in your actual debit card number when paying for things online.

Interested in learning more about identity theft?

Sign up to receive helpful guidance and tools.

Check Fraud

Think checks are safe? Think again. Even in our digital-first world, check fraud is still a huge issue. In fact, a recent 2025 public service announcement from the FBI and U.S. Postal Inspection Service (USPIS) warns that mail theft-related (more on that in a minute) check fraud is on the rise—with reported incidents doubling between 2021 and 2023.3 Yikes!

Basically, check fraud is when someone shady uses a check to steal money from individuals or businesses. Here are just a few examples of check fraud:

- Check washing: A thief uses chemicals to erase the ink on stolen checks, leaving blank slips they can resell or rewrite for themselves.

- Paperhanger: This scam involves writing checks from an account with no funds—often set up just for the con, like a junk email address. By the time the check bounces, the scammer’s long gone with the goods.

- Check kiting: Fraudsters exploit the time it takes for checks to clear by writing between two accounts, creating the illusion of available funds.

The good news? There are smart, simple ways to guard against check fraud.

How to Protect Yourself From Check Fraud

First, only mail checks when absolutely necessary. Safer alternatives include making secure digital payments when you can (via a trusted platform, of course) or having your bank send a check directly on your behalf.

If you do need to mail a check, do it carefully. Hand it directly to your mail person or hop in the car and take it to the post office yourself (don’t worry, you can stop for ice cream after). If you do have to drop it in your mailbox, make sure it won’t sit there for hours or overnight. Here’s a pro tip—be sure to use permanent ink when writing a check. This makes it much harder for thieves to chemically alter your information if they do get ahold of your check.

Also, accepting a personal check from someone you don’t know or trust is always a gamble. If you’re selling something small, it’s perfectly reasonable to ask for cash or a digital payment. For bigger ticket items—where cash might not be practical—you can opt for a money order or a bank-issued check, like a cashier’s check or a certified check, which are much safer alternatives.

And no matter the amount, if you do accept a personal check, it’s a good idea to wait a few business days to make sure it fully clears before handing over your item—just because it hits your account doesn’t mean it’s legit. And hey, since you’re obviously not the paperhanger here, there’s no harm in playing it safe. If the buyer tries to rush or pressure you to skip that waiting period, consider it a big ol’ red flag.

Internet Fraud

Internet fraud is a blanket term—a blanket the size of Texas! It basically covers any criminal activity happening online. And like other types of fraud and scams, it usually involves deception to trick people into giving up sensitive information or money. We’re talking stuff like:

- Phishing: A scammer creates a fake email or website to trick folks into revealing sensitive info like login credentials or bank account details.

- Smishing: Like phishing, but through SMS text messages—fraudsters send texts to lure you into clicking links or giving up personal data.

- Malware: Malicious (bad) software is used to steal data, hijack devices, or launch cyberattacks and data breaches.

- Online consumer fraud: Scam websites take your money for products that don’t exist.

- Social media scams: This type of online consumer fraud uses fake influencers or giveaways to capture data.

These are just a few of the tactics scammers use to steal personal information or launch data breaches—sometimes on a massive scale. The FBI reported that online fraud likely led to losses of over $16 billion in 2024 (a 33% increase in losses from the year before).4

And with the rapid rise of generative artificial intelligence, these fraudsters can now supercharge their schemes using AI-generated text, images, deepfakes and even voice cloning. In fact, Deloitte’s Center for Financial Services predicts that generative AI could contribute to as much as $40 billion in fraud-related losses in the U.S. by 2027.5

How to Protect Yourself From Internet Fraud

You can keep malware and other identity-stealing threats at bay by keeping your antivirus software up-to-date on both your computer and your phone.

Thankfully, a lot of today’s tech handles the heavy lifting for you. You know those update pop-ups you keep hitting “Remind me later” on? Yeah, they’re annoying—but they’re also essential for keeping your devices protected.

To stay alert for phishing or smishing attempts, keep an eye out for any unexpected emails or texts asking for personal information. This should always raise a red flag. And always double-check links to make sure you’re landing on a legit website, not a scam look-alike.

And when it comes to AI, the FBI has some tips to follow. You can:6

- Set up a secret word or phrase with friends and family to confirm it’s really them.

- Watch for odd details in videos—think glitchy hands, strange eyes or anything that just feels off.

- Don’t share sensitive info with anyone you’ve only met online or over the phone (stranger danger still applies!).

Also, never send money, gift cards, crypto—anything, really—unless you’re completely sure it’s legit. And remember, if someone’s pressuring you to act fast, there’s a good chance their intentions aren’t exactly honest.

Job Scams

One of the most common deceptions out there is fake job ads. When scammers post these, they’re often hoping to get your personal info so they can steal your identity. Or they take your money by requiring you to purchase equipment or training that doesn’t exist. Sometimes it’s worse, like they’re running a human trafficking ring.

Here are some common job scams:

- Pyramid scheme: Nobody’s making any money except a few people at the top.

- Online data entry: If someone promises you six figures for typing on your couch, go ahead and hit that back button—fast.

- Personal assistant scams: After you’re hired, you get a check from your boss to cover some expenses—except the check is too big and you have to reimburse them for the extra . . . and the check bounces.

- Reshipping scams: How do criminals move their stolen goods? Convincing people to repackage and ship them from their homes. Payment never materializes.

How to Protect Yourself From Job Fraud

These types of scams usually come with some telltale signs:

- Too good to be true

- Poor grammar and spelling

- Too urgent

- No request for work verification

- Generic email address

Respect your sixth sense when it comes to job offers. If something smells like sardines, it’s probably rottener than a cracked tin of tuna. You can always ask for more information, and if they don’t get any more concrete than vague promises of Prince Ali-level wealth, run.

Finally, do your own research. AI is making it easier for criminals to create convincing websites, so this part is really important. If the email address looks off, check it out. Research the company online extensively. Scam companies usually don’t hold up under a magnifying glass.

Bank Account Takeover Fraud

One of the worst types of fraud to clean up is when a thief gets access to your bank account. This can happen pretty easily just by someone stealing a check out of your mailbox, getting ahold of your account info through an email scam, or (if you’re really unlucky) using malware to gain access to all of your personal information.

This type of fraud can completely drain your bank account if you don’t act quickly—and you might never get that money back. Be sure to monitor your account statements on a regular basis and keep an eye out for any transfers you didn’t authorize.

How to Protect Yourself From Bank Account Takeover Fraud

It should go without saying—but never log in to your bank account from unsecured Wi-Fi (checking your account balances while hanging out on JFK Airport’s Boingo Wi-Fi is a big no-no). And always check to make sure it’s actually your bank’s website you’re logging in to instead of a scam site built to look like the real thing.

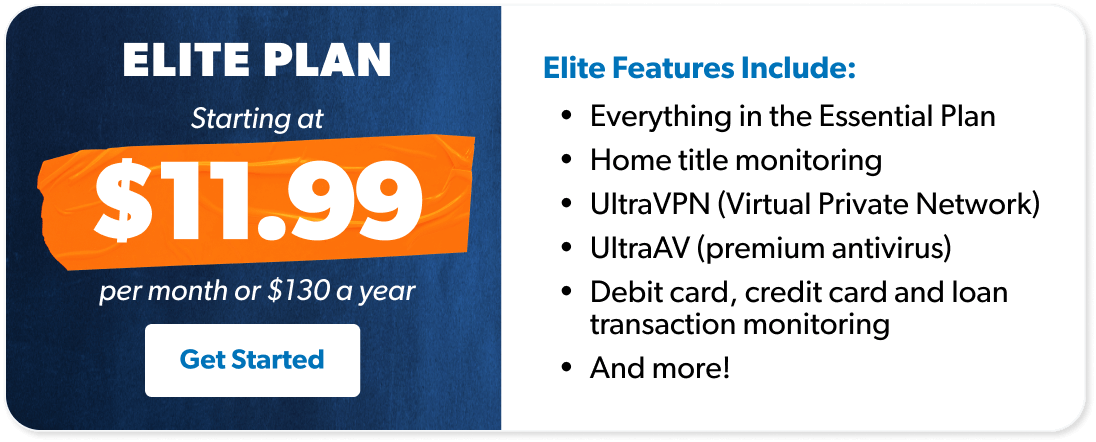

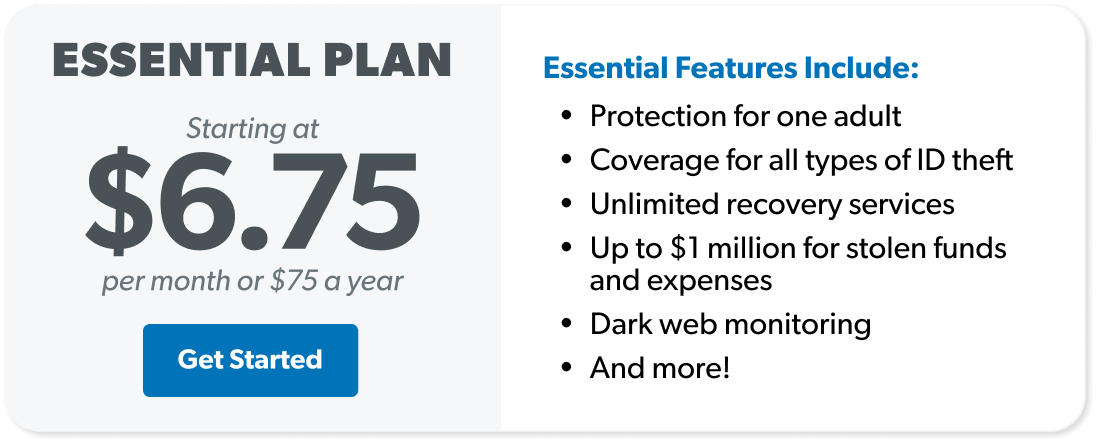

Thankfully, this kind of fraud is covered by some IDT protection, like the one we recommend below. And if you go with the Elite plan, they also monitor your account for takeovers so you don’t have to.

Tax Refund Fraud

It might be hard to believe anyone would voluntarily go near taxes—but criminals do! They steal your Social Security number and then file for a giant tax refund on your behalf. You better believe it won’t be accurate, so not only will you not get your tax refund, but it’ll also look like you were the one committing fraud! You’ll catch it when you send in your real return and it’s rejected by the IRS because you’ve “already filed.”

During tax season, you’ll hear a lot about the importance of filing your taxes early. Why? Part of the reason is to avoid tax fraud! It sounds crazy, but this kind of identity theft happens more often than you’d think—in the 2024 tax season, the IRS identified over 3.5 million tax returns as potentially fraudulent.7

How to Protect Yourself From Tax Refund Fraud

So, what’s a law-abiding taxpayer to do? Be vigilant about who and where you give your personal information. Play it safe and use security software on your computer. And don’t ever carry around your Social Security card or anything with your Social Security number on it—including your W-2! Keep it all in a safe place.

Investment Fraud

After months of texts back and forth, the man of your dreams (who you haven’t actually met in person) suggests you invest in this stock. He wants to help you, after all.

Ding ding ding! Alarm bells. (Really, they should’ve gone off a long time ago when he refused to meet up.)

This is just one of many types of investment scams that are all based on someone trying to get you to invest in something that’s worthless—whether it’s stocks, a business, currency, real estate or even training on how to invest.

Here are some common types:

- High-yield investment programs: Fraudsters sell investors on stocks with promises of crazy high returns. If it sounds too good to be true, it is.

- Ponzi schemes: Scammers take money from one guy’s “investment” to pay out another—until they run out of new investors.

- Pump and dump: A scammer convinces a group of people to buy a worthless stock at a high price (because it’s going to be such a great investment, of course). Then, the scammer turns around and sells all their own stock for the inflated price. As soon as the scammer dumps all the stock, its value drops, and you’re left with worthless stock. This is a common trend in the crypto world lately.

- Unsuitable financial products: A financial advisor might actually sell you a legitimate investment—but it’s also legitimately sucky. It could be something that earns them more money than it does you, or maybe they earn tons from fees, while your investment isn’t even growing fast enough to keep up with inflation. I actually group any kind of permanent life insurance in with this type of scam.

How to Protect Yourself From Investment Fraud

This is another one that banks and IDT protection won’t help you with. If you get snookered by one of these scheming scammers, your money is gone, and there’s pretty much nothing you can do to get it back. So, what can you do?

Avoid anything that sounds too good to be true. This “investment” is guaranteed to consistently earn you big money? Walk away.

This person magically knows your retirement and investing needs? Run away.

Someone says they’re the only ones who have access to this amazing investment opportunity, but you have to sign right freakin’ now? Slam the door in their face.

If you have any questions about the legitimacy of an investment, you can check up on the salesperson’s licensing. Scammers are often not registered to sell securities, or they’re trying to sell unregistered securities.

Mail Fraud

This is another one of those blanket terms. Mail fraud is any fraudulent activity that involves the use of postage mail. This could mean stealing and opening someone else’s mail, using chain letters to collect money or items, or sending a fake donation request letter for Bruce’s Abused Baboons Fund to try to scam money or personal info. Basically, if snail mail is used at any point in the fraud process, it’s considered mail fraud.

How to Protect Yourself From Mail Fraud

The best way to guard against mail fraud is to make sure a letter is legitimate before responding to it. If there’s a phone number printed on what looks like a piece of official communication, verify it’s actually the phone number of the company involved and not a fake one.

A good rule of thumb when mailing a letter that includes personal information (such as your bank account number or Social Security number) is to take it directly to the post office so it can’t be stolen out of your mailbox.

And make sure you don’t leave mail out in your mailbox for too long! If you know you’ll be away for a while, try temporarily stopping your mail service or asking a neighbor to get it for you until you’re back in town.

Elder Fraud

While anyone can fall prey to any of the fraud types we’ve talked about, elderly people are targets for even more fraudulent activity specific to their age group. They’re generally known for being more trusting, good-natured and kindhearted people. And if they’re anything like my grandma, they jump at any opportunity for social interaction. (Also, friendly reminder—call your grandma.)

But in general, this leaves them more exposed to types of fraud like phone scams or wire transfer fraud. Many scammers offer lottery winnings, sweepstakes prizes or even health care services. These false promises help them gain access to financial and personal information.

Unfortunately, the problem is getting worse by the year. The FBI reports that elder fraud cases rose 14% in 2023, with financial losses climbing 11%.8

And elderly folks are especially vulnerable to impostor scams via AI voice tools that can mimic a loved one in distress, begging for an urgent payment for a lifesaving medical treatment or something of similar importance.

How to Protect Yourself From Elder Fraud

Elderly people can also be less likely to keep an eye on their bank account information. So by the time they discover what happened to all their money, it’s too late. If you’re seeking peace of mind for the older loved ones in your life, consider getting them to sign up for an identity theft monitoring service like the one Zander Insurance offers. Zander will help them stay alert of any suspicious activity on their accounts.

Also, talk to your loved one about the new ways scammers can trick them using AI voice imitation (but you should probably cover this in person . . . so they know it’s not AI).

Don’t Be a Victim of Fraud!

Are you feeling a little world-weary now? I get it—there’s a lot of bad out there trying to get you. I’ve been gotten before, so it’s definitely a real threat. But you don’t have to rely only on your wits to protect your accounts. You can rest easier if you know a good identity theft protection plan has your back.

Set up a plan now to protect yourself from many common types of fraud through our RamseyTrusted® provider, Zander Insurance! They offer two plans, Essential and Elite, to give you peace of mind knowing your accounts and sensitive info are being monitored 24/7. Plus, if thieves manage to break into your account and take your cash, Zander will reimburse you up to $1 million.

Next Steps

- Learn how data breaches put you at risk (and what you can do about it).

- Read up on the best identity theft protection for you.

- Don’t leave your financial and identity safety to chance. Get in touch with Zander to put a protection plan in place.