EntreLeadership: What Are the 5 Stages of Business?

14 Min Read | Apr 15, 2025

Key Takeaways

- Every business goes through growing pains that look different depending on the stage of business you’re in.

- You need a way to identify your stage of business so you know what to expect and what to focus on to carve a path through each challenge.

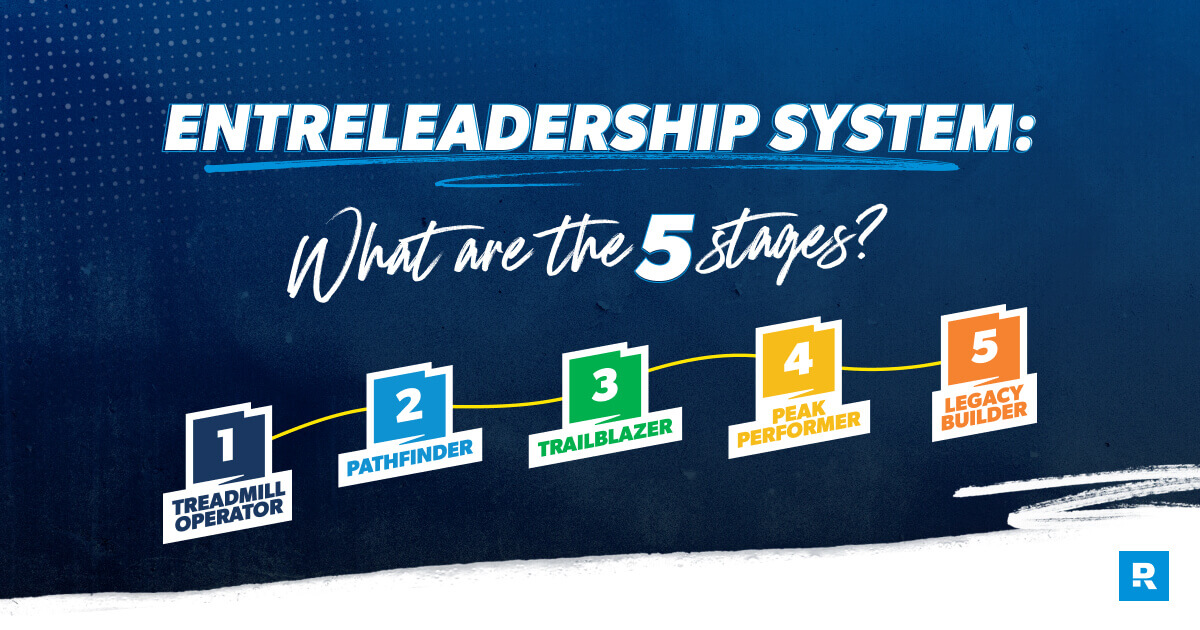

- The EntreLeadership System includes the 5 Stages of Business small-business leader Dave Ramsey went through as he grew his business into a national brand.

- Each stage has a unique set of challenges and requires you to master a new set of skills. Working through them will help you build a business that means something to you.

Ready to Level Up Your Business?

Find out your Stage of Business with our free assessment and get free resources to help you level up by focusing on the right things at the right time.

Ever heard of an ultramarathon? It’s a race that’s anywhere from 30 to more than 200 miles long. So to go from couch potato to distance runner, you’d have to commit to loads of blood, sweat and tears. Could you do it? Absolutely! But only with a great plan and the guts to keep going.

You probably thought running a business sounded fun—until you realized it would actually run you. Discover the EntreLeadership System—the small-business road map that takes the guesswork out of growth.

The same is true of growing a successful business. A load of hard work stands between the dream that got you started and the impact you want to make. Pushing through the challenges can be exciting and exhausting. Some days you feel on fire. Others you’re completely burned out and even disconnected from your dream. No wonder roughly one business shuts down for every business that opens.1 Hello, Debbie Downer.

So, how do you beat odds like that? First, understand that every business goes through growing pains. And those pains look different depending on the stage of business you’re in. The secret is to have a plan—a way to identify your stage of business so you know what to expect and what to focus on to carve a path through each challenge.

What is EntreLeadership?

That’s what the EntreLeadership system helps you do. The term “EntreLeadership” (pronounced ON-tray-leadership) represents both the passion of an entrepreneur and the character of a leader. And the EntreLeadership system is the proven way for business owners to lead a team, grow a business, and build a legacy.

This system includes the Stages of Business. These are the same five stages small-business leader Dave Ramsey scratched and clawed his way through as he grew his business into a national brand—Ramsey Solutions. Working with and coaching leaders and business owners for more than three decades has also helped us recognize the universal challenges and opportunities that define the Stages of Business (or what some call the business life cycle) and how to move from one stage to the next.

As you learn and apply the real-life principles and processes Dave learned through the school of hard knocks, you can grow your business from the one-person daily grind of the Treadmill Operator (stage one) and build a life-changing legacy (stage five). Even better, you’ll be equipped not just to build any ol’ business but to scale a business with soul.

What to Expect in Your Business Life Cycle

Before we take a deep dive into the Stages of Business, there’s one more fact every serious business owner must face: There’s no easy button or shortcut for running and growing a thriving business. You have to push through the five unavoidable stages of business. And each stage has a unique set of challenges and requires you to master a new set of skills.

Yep, that’s right—once you overcome one hurdle, your reward is a new hurdle to clear. So if you’re looking for a get-rich-quick scheme or a way to just sit back and coast through running your business, you’ve come to the wrong place.

Related article: What Is Work Ethic (and How to Build a Strong One in Your Team)?

Now, are you ready for some good news? Here it is: Applying the five Stages of Business will help you avoid the headaches and hassles of trying other systems that don’t work. (And there are a lot of bad business theories and systems out there that’ll get you nowhere.)

Even better than that, working through these five Stages of Business will help you build a business that means something to you—something that changes lives, families and even communities. Heck, you can even change the world. To advance through the stages, you also have to focus on six drivers. We won't hit on the 6 Drivers of Business here, but get familiar with them so you're clear on how to propel forward faster.

Ready to get a little dirt under your fingernails? Let’s go!

The Five Stages of Business are:

Your Road Map to Grow Your Business

Dave Ramsey’s new book Build a Business You Love is now available for purchase! This book will walk you through the same proven system Dave Ramsey used to build Ramsey Solutions from a card table in his living room to a $300 million company.

Stage 1: Treadmill Operator

Congratulations! This is the first stage of business, and if you’re here, you’re no longer a wantraprenuer. You’ve worked your tail off and beaten the odds. You’re in business. But the thing is, you’re also stuck in the role of chief everything officer.

Unless you inherited or bought a company, most leaders start in the Treadmill Operator stage. This can be a super exciting place for a season, but that’s exactly what it should be—a season. This isn’t a stage you want to camp out in forever. If you do, it’ll wear you out and take you down.

You might be a Treadmill Operator if:

- You work all day doing the thing that makes the money. Then at night, you do the paperwork, pay vendors, take care of emails, and try to collect payment.

- There’s more to-do list than there is day, so important things like going to your kid’s soccer games or taking your spouse on a date feel nearly impossible.

- Your success—being good at lots of things and afraid to pass off responsibilities—has trapped you in your business.

- You’re burned out.

What’s the primary Treadmill Operator business problem?

Too much of the business relies on you. Your core revenue comes from you doing the thing your business is built on.

What can you look forward to when you overcome the problem?

Most of the business results are generated without you.

Key things to learn:

If earning all the revenue falls on you, you really don’t own a business—you own a job. If you want to lead a business that thrives, you have to stop letting your business run you and start running your business. Then, and only then, most of your business results can be generated without you. You probably already know that, so the question is: “How do I get off this flipping treadmill?” These are the critical skills you have to learn to move past this stage:

You’ve got to do plenty of other things to stay in business, like pay the light bill and provide good customer service. But not developing these four skills will hold you back more than anything else. Once you generate margin with your time and money, hire reliable help, and get nonessentials off your plate, you can squeeze in time for marketing and strategic planning that will help you increase your impact.

You’ll also grow your business enough to afford to bring on more team members. Remember, the less you need to be the doer, the more you can be the leader. In short, you’ll work your way off the treadmill and into leading a team. And that will land you right in the Pathfinder stage.

Stage 2: Pathfinder

The biggest blessings in business are the people. And the biggest burdens? Also the people. In the Pathfinder stage, you are now 100% in the people business, which comes with a special set of challenges to overcome.

You might be a Pathfinder if:

- Running your business feels like a game of whack-a-mole. You’re herding cats and putting out fires all day, and your results are all over the place.

- You struggle with some team members who don’t do things the way they need to or don’t care about the business like you do.

- The mission you’re on, the values you live by, and the vision you have for your business are second nature to you but not to your team. That keeps you from moving in a shared direction.

What’s the primary Pathfinder business problem?

You lack clear direction.

What can you look forward to when you overcome the problem?

Your team is engaged in a shared direction.

Key things to learn:

Playwright and Nobel Prize winner George Bernard Shaw said the biggest misconception about communication is that it has happened. That’s the risk you run at the Pathfinder stage. To keep you and your team aligned, you need to define and master these critical areas for your business:

It’s not enough to have mission, vision and values statements in a binder somewhere or even on a poster in the hall. At the Pathfinder stage, you have to work to plant all of that into the hearts and minds of every team member so it shapes their actions and decision-making. That means you get to become the chief reminding officer. And if you get sick of reminding your team of your mission, vision and values—good! That means you’re just starting to repeat them enough.

What’s another leadership task you now get to take on? Getting work done and achieving goals with and through a group of people. You’ll start to see better communication and people influence happen as you master the Pathfinder stage. And as you and your team all pull together in the same direction, you’ll build momentum that leads you to the Trailblazer stage of business.

Related article: Mastermind Groups: What Are They, and How Can They Help You Grow Your Business?

Stage 3: Trailblazer

One thing you’ll notice as you hit the Trailblazer stage in your business is speed—as in work’s coming at you almost faster than you can keep up with. You and your team have the tiger by the tail, but it could turn around and bite you if you’re all stretched too thin to manage it.

You might be a Trailblazer if:

- You’re moving fast and making gains, but you don’t have a clear plan of where you’re going (let alone how to get there). You’re more reactionary than intentional.

- You’re ready to develop leaders who are so in sync with you that they can finish your sentences.

- You get glimpses of ways you could scale your business but are thrilled and terrified because you lack repeatable processes.

- You know company culture matters but don’t have time to build it.

What’s the primary Trailblazer business problem?

You lack the leaders and plan to scale your business.

What can you look forward to when you overcome the problem?

You have a leadership team who’s executing a plan that’s scaling your business.

Key things to learn:

In this stage, your number one aim is to create a strategic, scalable plan along with a solid leadership team to get ’er done. To help you manage the speed and scope of your business, you need bulletproof processes and systems that get repeatable results at scale. In the early days, getting stuff done by brute force was fine, but it’s time to work smarter, not just harder. (If someone told you blazing new trails so you can grow your business isn’t hard work, they lied to you). Your most important objectives now become:

- Planning

- Process improvement

- Leadership development

- Intentional culture

- Organizational maturity

Once you build a leadership team that functions as one team with one dream, you’re on your way to making your desired future a reality. And when you level up your leadership, your systems and your company culture, you’ll naturally blaze on to the next stage, which is the peak of your potential

Related article: Leadership Development: What It Is and 7 Signs You Need to Invest in Leadership Team Development

Stage 4: Peak Performer

At this stage of the business life cycle, you’re no longer a one-person show. You’re part of an entire company that’s thinking about how to serve people, grow profits, and take performance to the next level. You’ve got the wind to your back, and you’re sailing. Well done! But there’s a tricky new challenge just waiting to take that wind right out of your sails. It’s called complacency.

You might be a Peak Performer if:

- Business is doing great, but you risk relying more on what you’ve already done well than what you need to do next to stay competitive.

- You can afford to be more hands off in the daily operations of delivering your product or service.

- You’re investing most of your time in developing leaders.

- Your team is all in with fulfilling your mission.

What’s the primary Peak Performer business problem?

Your business has become too comfortable.

What can you look forward to when you overcome the problem?

You and your team have a relentless culture of getting better.

Key things to learn:

As your business continues to grow, Peak Performers empower a deep bench of leaders to carry out the mission, vision and strategy of the business. But no matter how successful you are, you have to keep fighting for your business and its culture. Running on autopilot slowly weakens the culture that got you this far.

Maybe you’ve heard this saying from author and humorist Mark Twain, “I’m in favor of progress; it’s change I don’t like.” Peak Performers can never afford to shy away from change. So how do you stay on top of your game? You learn how to sustain success through change by digging deep into your business so you can:

- Reconnect to your mission

- Inspire your team

- Reflect and respond

- Disrupt the marketplace

You’re a freaking Peak Performer. Now’s definitely not the time to get too comfortable, or we guarantee your team will too. Lean into why you got into business in the first place, and share your why with your team. That’ll get them more fired up to do work that matters!

You’ll also want to stir some things up at this stage—maybe even break some old habits so you can see your business through fresh eyes. As you reinvent your business (yes, again) and hopefully even generate some market disruption, you’ll create a wave of change instead of being crushed by it. That will lead you to the final stage of the business cycle: Legacy Builder.

Stage 5: Legacy Builder

If you’re a Legacy Builder, you’ve got a lot to be proud of! You’ve built a solid business through a never-quit, servant-leadership attitude, and you’re preparing for the day you’ll hand your company over to a new leader. You want to keep your business in good hands when you step down, but here’s a hard truth: For many business owners, there’s a big difference between what they want and what they’re set up to get.

You might be a Legacy Builder if:

- You spend a lot of energy wondering who should take over your business and how to ready the team for when you step down.

- You’re concerned with how to equip a key leader (and your team) to carry on the work you started with drive, passion and energy.

- You’re looking at your financials and wondering how to value your business.

What’s the primary Legacy Builder business problem?

You don’t have a succession plan—or you have one but haven’t started rolling it out.

What can you look forward to when you overcome the problem?

The business is successfully running without needing you there.

Key things to learn:

The Legacy Builder stage can be the most rewarding stage as you reflect on what you’ve built and its impact on others. But to truly be a giant whose shoulders a new generation can stand on, you need a solid succession plan that covers these key areas:

- Reputation transfer

- Financial transfer

- Legal transfer

- Leadership transfer

Those are some big mountains to conquer. We get it. Handing over your business and leadership is a mind game. This is your baby. You’ve spent more than your fair share of sleepless nights and trials by fire growing it into something you’re proud of. And you don’t want anything or anyone to screw that up.

That’s all the more reason to invest a ton of energy into a smooth transfer of trust, power and client care—and to ensure your finances are in order. The last thing you want is to feel like you have to sell your business to your kids to fund your retirement.

When you knock this stage out of the park, you’ll see a new generation of strong, smart, integrity-driven leaders ready to take what you built even further. And you’ll be free to pursue your next big adventure.

A Final Word

The stuff you just learned isn’t a far-fetched theory from someone who’s never made payroll. It’s been proven by thousands of business leaders steadily climbing from Treadmill Operator to Legacy Builder. On top of that, it’s the best way to lead your team, grow your business, and create a world-class culture.

What's Next: Go the Distance

When you have a clear understanding of the stage of business you’re in, you’ll more clearly see how your business is winning, where it’s stuck, and what to do to level up. That’s where EntreLeadership can help.

- Subscribe to The EntreLeadership Podcast for advice that can boost your business no matter what stage it's in.

- If you already know your stage of business and you’re ready for more support, join EntreLeadership Elite to accelerate your progress toward the next stage.

- Not sure which stage you’re in? Take our free Stages of Business Assessment. It’ll help you find out where your business stands and give you a plan to overcome what’s holding you back.