Will vs. Trust: What’s the Difference?

11 Min Read | Apr 10, 2025

Link copied!

Unable to copy link. Please try again.

Key Takeaways

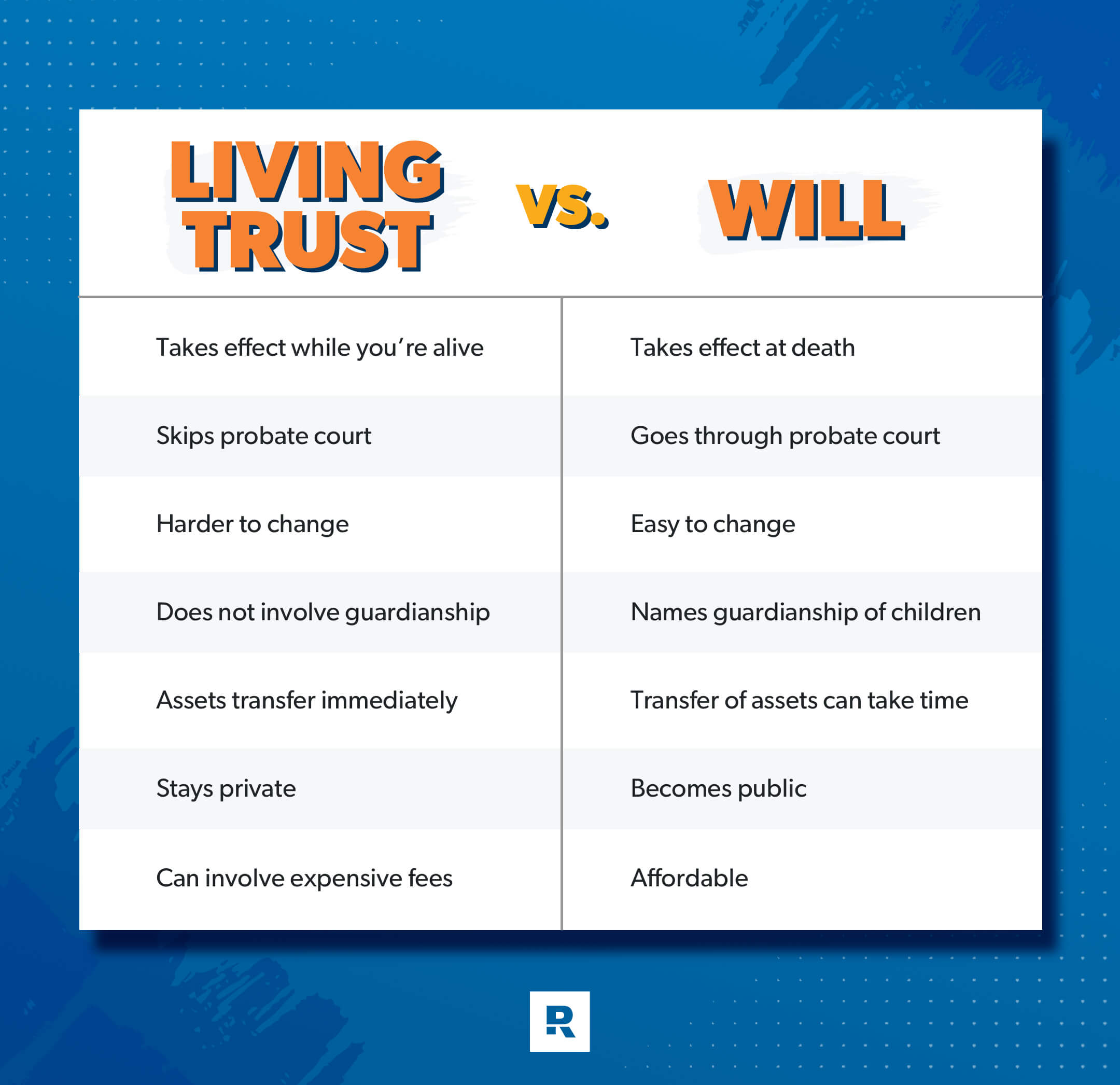

- A will is simpler and cheaper and kicks in after you die, while a living trust is more complex and expensive and starts working while you’re still alive.

- Only a will lets you name guardians for your kids, but only a trust can bypass probate.

- For most people, a simple will is all they need. Trusts are better for those with over $1 million in assets or with complex situations.

- Some people use both a will and a living trust to cover all their bases—avoiding probate while also making sure their kids and assets are taken care of.

In the world of estate planning, wills and trusts often take center stage. They’re kind of like siblings (without all the fighting). Both are legal tools that transfer your stuff to those you love. One big difference, though, is that the most common type of trust (a living trust) takes over while you’re still alive but a will goes into effect after you die.

Save 10% on your will with the RAMSEY10 promo code.

Living trusts can help your heirs avoid probate, while wills are the only tool you can use to name a guardian, but both are often used together. Living trusts are also more complicated than wills and usually more useful to those with Beverly Hillbilly-level wealth.

Let’s look at each of these wealth-transfer tools more closely so you can get a better idea of what’s right for you.

Living Trust vs. Will: Main Differences

What Is a Will?

A will is a legal document that explains what you want to happen with your estate when you die. It outlines things like who you want to get your stuff, your money and guardianship of your kids or pets.

There are many different types of wills. But for most people, a simple will is enough. It can be made online or with a lawyer, and it’s simply a basic will for a straightforward estate. It’s all you need to establish a rock-solid estate plan—one that protects your family if something happens to you (and it will, eventually at least).

If you have less than $1 million in assets, you can probably just stop right here and get yourself a will—or go get your questions about wills answered and then buy a will. (Unless you really want to learn about trusts as a kind of hobby. If so, more power to you!)

But if you think you might be in that small percentage of people who need more than a will, keep reading.

Here’s a Tip: When it comes to deciding between a will or a trust, probate is a big consideration. What is probate? It’s the legal process that takes place after someone dies and includes overseeing the distribution of assets. It’s supervised by a court, which means if an estate goes through probate, everything that happens is public.

Will an online will work for you?

Find out if an online will works for you in less than 5 minutes.

What Is a Trust?

Trusts are a complex way to transfer property to someone else. They come with a few advantages like helping you avoid probate and (sometimes) estate taxes. To set one up, you create a trust document, list your assets, and sign over ownership of your stuff to the trust (lots of paperwork). Similar to a will, you name beneficiaries. Then you hand over control to a trustee (a person you appoint to oversee the whole thing—more paperwork). This is called funding the trust.

Trusts come in lots of different forms—close to a dozen actually. So let’s focus on the most common ones and what they do.

First, there are two categories of trusts.

Trusts

| Living Trust | Testamentary Trust |

| Revocable or Irrevocable | Irrevocable |

Optional specifications: charitable trust, spendthrift trust, special needs trust, domestic asset protection trust, etc.

Living Trust

A living trust gets its name because it’s in effect while you’re alive, as opposed to a will, which only kicks in after you’re gone. Once it’s set up, a living trust transfers your assets to loved ones quickly and easily (no probate!). You can put things like bank or savings accounts, cars, real estate, art, jewelry and even intellectual property (like your novel manuscript) in a living trust. But even though those assets are named inside your trust, other people can’t access them until after your death.

Testamentary Trust

A testamentary trust is one you create using a will, and it’s formed when you die. So, in your will, you basically say, “When I die, this and that will be placed into a trust for this person.” The kind of trust you create (like charitable or special needs) is up to you. It can also simply be an irrevocable testamentary trust (more on the whole irrevocable thing below).

Testamentary trusts are essential for parents of young children. This is the legal tool you use to make sure the property you leave behind for them is stewarded well and handed over to them at the proper age. The online will maker we recommend, Mama Bear Legal Forms, provides a simple will with the option to make a testamentary trust.

Here's A Tip

You can’t create a testamentary trust without a will. If you’re the parent of young kids, you need a will that creates a testamentary trust.

Types of Trusts

Revocable and Irrevocable Trusts

We can divide trusts into two more types: revocable and irrevocable. A revocable trust just means you can revoke (or change) the terms of the trust. How about an irrevocable trust? Yep, you guessed it. You can’t change the terms. For example, in an irrevocable trust, once you name the beneficiaries of your property, the names of those beneficiaries are set in stone and can’t be changed.

Living trusts can be revocable or irrevocable, but testamentary trusts are always irrevocable because they’re created after you’re dead and messages passed through the Ghost Whisperer aren’t legally valid.

Revocable trusts are the most common, but even making changes to a revocable trust takes a lot of paperwork. Fun fact: Revocable trusts magically transform into irrevocable trusts after your death. (Well, it isn’t magical, but it is a fact.)

With irrevocable trusts, the trade-off you get for not being able to touch your stuff is tax advantages. Since the trust owns your stuff, your estate (which is no longer considered yours) isn’t subject to estate taxes. (Keep in mind, your estate would have to be worth more than $13,990,000 before it would be taxed.[1])

So, who does control your stuff in a trust? A trustee that you select. This means if you want to make any changes, you have to convince the trustee to do it—and they can say no.

|

|

Revocable Trust |

Irrevocable Trust |

|

Pros |

|

|

|

Cons |

|

|

Charitable Trust

As the name suggests, a charitable trust is used to give away part of your estate to a charity. You can create a charitable lead trust (CLT) or a charitable remainder trust (CRT). The CLT is simple: You designate assets to go to your favorite charity (like Agatha’s Donkey Shelter, for example). With a CRT, you put certain assets into the trust that you or your beneficiaries will get income from, and whatever’s left of your assets after that go to one or more charities.

Spendthrift Trust

Some people just don’t know how to handle money. If you’re looking at your loved ones and thinking, Yep—that’s them, a spendthrift trust might be a good option for you. This kind of trust allows you to control when and how your beneficiaries get your stuff.

Special Needs Trust

Using this trust, you can make sure any dependents with special needs will be supported and cared for after you’re gone.

Domestic Asset Protection Trust (DAPT)

A common way these trusts are used is to protect assets for your kids in case of a divorce. If you put assets in a DAPT, your spouse is no longer entitled to them.

In some states, a DAPT can be used to protect your assets from creditors in the future (no, it’s not a time machine). This might be particularly useful if you have a valuable asset that’s also a family heirloom or that also has high sentimental value. A DAPT would ensure that your family can keep it even if you get into debt later.

What’s Covered in a Will vs. a Trust?

Now that we’ve gone over what wills and trusts are, what sets them apart?

One of the most important differences between wills and trusts is the ability to name a guardian for your minor children. You can name a legal guardian in your will, but you can’t in a trust. So even if you have a trust, you still need a will to make sure your kids are taken care of after you die.

Here's A Tip

Wills are the only legal tool you can use to name a guardian for your kids.

Another important distinction between the two is that, unlike a will, a living trust can let you skip probate court. Probate court cases can be expensive and drag on forever. So skipping them is a big deal. If your estate gets mixed up in probate court because a loved one challenges the will, it could mean your family has to spend the next year involved in a court case while grieving. Not fun.

But remember, if your will is clear and you don’t have a huge estate, probate won’t be a huge hassle. And you probably don’t need a living trust.

While we’re on the subject of probate court, let’s talk about some family stuff.

There’s a little crazy in every family. You know who they are in your family (and if you don’t, it might be you). But some families deal with more than their fair share.

Wills can be good for families who struggle with tension and trust issues (not the kind you’re thinking of) because probate court can resolve those issues. On the other hand, families who have a lot of confidence in each other and can handle healthy conflict would be fine with a trust since they don’t need a probate court to babysit them.

If you’re wondering whether you can have both a trust and a will, the answer is yes. In fact, most people who have a trust have a will too. And anyone who wants to set up a testamentary trust has a will.

How Much Does It Cost to Set Up a Living Trust vs. a Will?

In general, trusts are more complicated and expensive to set up and maintain than wills. The exact cost depends on the type of trust, your location and how complex the document is.

But keep in mind, even though trusts might be more expensive up front, they could wind up saving your family money in the long run by avoiding probate court.

Wills, on the other hand, are generally easier to create and cost less to carry out. So they’re cheaper up front than a trust. Again, though, the ultimate cost of a will depends on how simple or complicated it is. An online will with no personal lawyer consultation is the cheapest option by far.

|

Option |

Cost |

|

Simple Will (Online) |

$100–300 |

|

Will Drawn Up by an Attorney |

$300–1,000+ |

|

Living Trust |

$1,000–2,000+ |

Living Trust vs. Will: Which Is Best?

Now comes the big question: Should you get a trust, a will or (drumroll, please) . . . both? It really boils down to personal choice.

First, take a big-picture look at your needs and your overall life circumstances.

- Just a will: A will is the best option if you’re the average person with a couple of kids and a house. You won’t need a lawyer unless there’s something really complicated about your situation. You can set up a will yourself in just a few minutes online (but if you have young kids, make sure the document includes an option for a testamentary trust to be created if you die).

- Just a trust: A trust might be better if you’re older, your kids are grown, and your estate is worth at least $1 million. The trust can handle a more complex estate and give you privacy. This is also a good option if you have unusual circumstances like a special needs dependent or complicated family situation.

- Both a will and a living trust: You might need both if you have a large estate and dependents. (Remember, the will fills in that guardianship gap.) And if you do get both, don’t worry about them bumping into each other. They’re separate legal instruments, and there usually aren’t any conflicts between them (unlike siblings). If there is a legitimate conflict, the trust overrides the will.

So, let’s wrap it all up. Almost everyone needs a will, but most people don’t need a living trust. A will is a great way for you to leave a simple estate to your loved ones. A living trust might be more than you need for your situation, but it can be a great tool if you have a larger or more complex estate.

If you’re in the 95% of people who don’t need a living trust, just get yourself a will. Don’t put it off—you’ll feel so much better knowing your stuff will go to the right people and your family will be looked after for many years to come.

Next Steps

- If you need a will, take some time to figure out what to include in your will. You also need to decide who gets what and who will be responsible for making sure your wishes are carried out, among other things.

- Grab The Complete Guide to Estate Planning, which will help you understand everything you need to know about estate planning in a simple, straightforward way.

- RamseyTrusted provider Mama Bear Legal Forms makes it super easy to get your will done in a matter of minutes. You can see their packages and pricing options below.

Complete Last Will Package for Married Couples

Complete Last Will Package for Individuals

Interested in learning more about estate planning?

Sign up to receive helpful guidance and tools.

Frequently Asked Questions

-

Which is better: a trust or a will?

-

It depends on the size of your estate. If your estate is large and complex, a trust could be your best bet. But if your estate is smaller and fairly simple, a will is likely the best option. If you have dependents, you definitely want a will—even if you get a trust too.

-

Are trust assets left to a beneficiary part of your taxable estate?

-

It hinges on how the beneficiary receives distributions (payouts). If the money your beneficiary gets is from the principal (the money or assets you put in originally), then it won’t be taxed. But if your beneficiary is getting payouts from interest earned on the principal, then they’ll owe taxes on that.

-

Does transferring property to a trust protect it from creditors?

-

Probably not. There are a few trusts called asset protection trusts that aim to do that, but they don’t have a 100% success rate. Most trusts aren’t a good bet for protecting property from people you owe money to.

A revocable trust offers no protection because you still own the property, while an irrevocable trust can offer some shelter because technically you no longer own what’s inside. But your best option is paying off your debt. Then you can know for sure your loved ones will get what you want them to have.

-

What assets cannot be placed in a trust?

-

There are a couple things you can’t put in a trust:

- Foreign assets or property

- Retirement accounts and Health Savings Accounts (You can name the trust as the beneficiary on these accounts to fix this problem, though.)

- Cash (But you can put cash in a bank account and name your trust as the beneficiary.)