How to Make a Will Without a Lawyer

9 Min Read | Apr 16, 2025

Listen to this article

Writing a will is one of the kindest things you can do for your family, but people come up with all sorts of reasons to put it off.

I‘m going to live a long time.

I’ll die if I write a will.

I’m not writing a will—I’d have to pay a lawyer!

Now, thanks to the power of the internet, that last excuse is toast. It’s possible to make a legal will without a lawyer. And it’s actually really easy and inexpensive! As for the other cop-outs, well, we have some good news and some bad news. Bad news: You are still going to die. Good news: It won’t be because you wrote a will.

Let’s walk through exactly how to do your own will.

Will an online will work for you?

Find out if an online will works for you in less than 5 minutes.

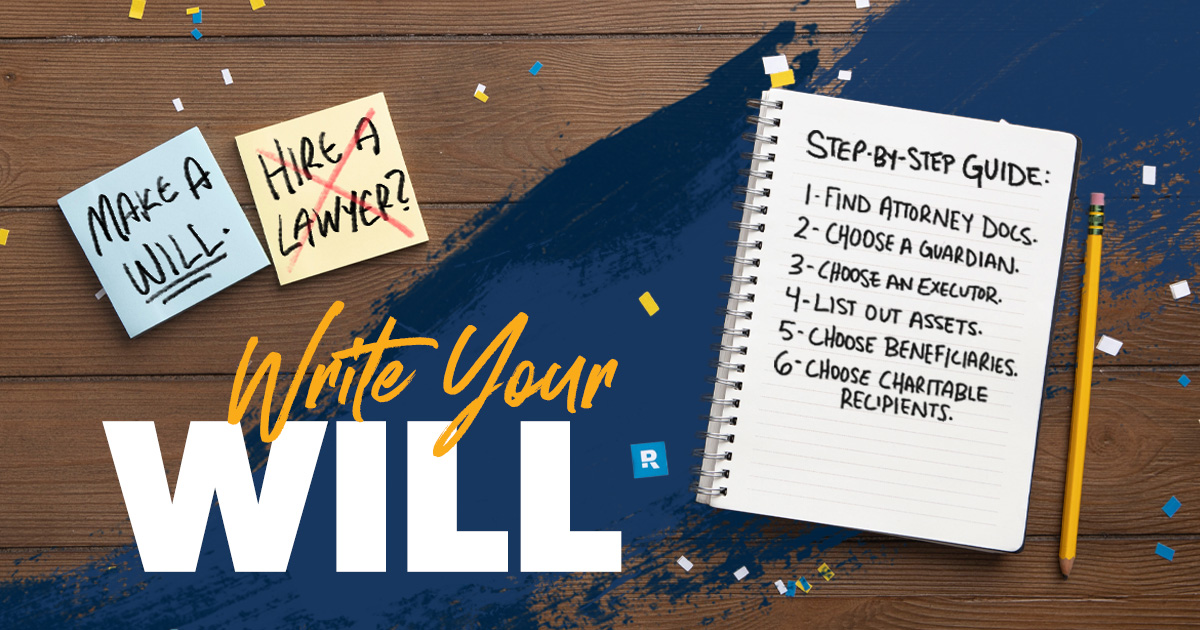

1. Find an online service with state-specific, attorney-designed documents.

The first thing to do is to find a reputable online will service. When you’re researching these services, we suggest you find one that offers legal forms that follow your state laws. But how can you tell if it does?

Save 10% on your will with the RAMSEY10 promo code.

If an online will service doesn’t offer the option to select your state before you write your will, it’s a red flag that they’re not legit. Why? Because laws around wills are different depending on whether you’re in California or Florida or some other state. It’s up to the online will service to make sure their attorney-designed forms comply with the most recent laws in each state.

Before we go to step two, let’s pause and explain why it’s so important to make your will now. If you wait until the last minute, you’ll miss the chance to make good decisions about your legacy.

And if you die without a will, you’ll miss the chance to make any decisions about what happens to your stuff at all. Plus, you’d be leaving your family with a huge mess and a ton of legal hurdles to jump through. Don’t do that to them. Make your will now!

Okay, back to explaining how to make a will without a lawyer.

2. Decide on a guardian for your children (if you have them).

If you have children younger than the age of 18 (also known as minors), you should name a guardian for them in your will. A guardian would have legal custody of your kids and your kids’ property if you’re not around.

Kind of hard to think about, isn’t it? But hey, this is a big (and necessary) decision. Make sure you decide on someone you trust and someone you believe can take on that kind of responsibility. Then remember to talk it over with that person before naming them in your will.

Warning! If you don’t name a guardian for your children in your will, a probate court will decide that for you—and that’s just not right! No one wants a court to decide something as important as guardianship for children.

Tip: Don’t forget to name an alternate guardian in case your first choice doesn’t work out. It’s also a good idea to check in with your primary guardian every year or so to make sure nothing has changed that would keep them from taking care of your kiddos.

Don't Know Where to Start With a Will?

Download our will worksheet to get started.

3. Choose an executor.

Your will’s executor (aka personal representative) is the person who will carry out your directions in your will when you’re gone. Your executor will also manage the probate process, make sure your beneficiaries get what you want them to have, and oversee other duties that require honesty and integrity.

Be sure to pick the right person for the job, someone who can follow your will carefully and responsibly—without getting a lawyer involved. That’s the goal!

4. Make a list of your property.

Simply put, property is anything you own, and it’s grouped into two categories:

- Personal Property:

- Physical (vehicles, boats, family heirlooms, clothing, home furnishings, etc.)

- Financial (checking and savings accounts, investments, life insurance, retirement accounts, etc.)1

- Digital (videos, images, PDFs, spreadsheets, etc.)

- Real Property:

- Land and homes, including investment real estate

When listing your property, be as specific as possible. So, instead of just saying you want to leave your condo (the one you bought before your current marriage) to your first wife, specify the exact street address of the condo and your first wife’s full legal name.

Tip: For personal property like vehicles and boats (anything with a title), it’s a good idea to include a copy of the title with the will. (That way, if the title gets lost, it’ll be easy to get a duplicate to sell the vehicle or transfer it to the beneficiary).

Here’s another thing to keep in mind. When you do your own will, the more details you provide, the less chance there is for confusion about your final wishes after you’re gone. Don’t be afraid of being too detailed.

5. Decide on beneficiaries.

Once you’ve listed your property, it’s time to choose who you want to give each asset to. These people are called beneficiaries. You can pick one or several beneficiaries—it’s completely up to you. And remember if you don’t list beneficiaries in your will, a probate court judge decides who gets your stuff. Not good!

Bonus tip: Make sure you pick a residuary beneficiary (aka remainder beneficiary). What the heck is a residuary beneficiary? Well, officially, it’s the person who receives the “residue” of your estate. But in English, it’s whoever gets the leftover assets after everything else has been passed out. Sounds like a raw deal, right?

Not necessarily! Here’s an example: Let’s say Jay’s assets include an antique car collection, a sizable savings account, and a four-bedroom house in Palm Springs. In his will, Jay names his friend David as the beneficiary of his antique car collection. He also names his friend Stan as the residual beneficiary, so Stan gets the bulk of Jay’s estate in this case. Lucky guy!

Something to keep in mind at this point is the difference between an heir and a beneficiary. An heir is someone legally entitled to inherit (as in a spouse or close family member) even if there’s no will. A beneficiary is someone named in a legal document like a will or designated in account documents (like bank or retirement accounts) to receive that asset if the original owner dies.

Knowing this comes in handy because a beneficiary named on an account will override an heir or even a beneficiary named in a will. So if you think your wife will get the money in your old bank account you opened when you were single even though you named your brother as the beneficiary on the account, you’re going to be in for a surprise. Or rather she will, because you’ll be. . . well, you know. So do everybody a favor and make sure the people you name on accounts match the people you name in your will.

6. Decide on charitable giving.

Did you know that instead of naming a person as a beneficiary in your will, you can leave your things to a charity? If you decide to do this (and we hope you consider it!), research the charity you have in mind to make sure their goals match your beliefs.

You can also mix it up if you want by assigning people as beneficiaries to some property and assigning charities as beneficiaries to other property.

Like we mentioned, it’s totally up to you how you distribute your stuff in your will. Just be sure to include percentages or dollar amounts so your personal representative knows exactly how much each beneficiary is entitled to.

Also, if one or more of your beneficiaries is a nonprofit (most charities are nonprofit), include their employer identification number (EIN) so they’re easy to identify as a 501(c).

7. Sign and notarize the document.

This last part is easy but super important. For your will to be valid, you need to sign it. And in some states, get it notarized. Different states have different requirements about signing your will, notarizing it, and having a certain number of witnesses.

Once you’re prompted to select your state by your online will service (remember, we mentioned earlier that this is the best way to tell if the service is legitimate), you should be automatically directed to the signature, witness and notary requirements for your area.

Last tip, we promise! Most states don’t require you to get your will notarized. But we highly recommend it anyway in case anyone challenges the validity of your will. The notary will sign off on an affidavit that will be attached to your will, making it a self-proving will. (Seriously, it’s a quick and easy step to take that could save some trouble down the road.) When family and emotions are involved—like they usually are with wills—disagreements are common. So, get your will notarized to add an extra layer of protection.

Here again, the goal is to set up as many safeguards as possible so your family can avoid hiring an attorney.

Finally, if you’re still unsure about whether you can use an online will service instead of paying a lawyer, take our Online Will vs. Lawyer quiz.

Do the Right Thing—Write Your Will

Writing your will matters because of the people you love. They’re the ones who give your will meaning while you're writing it. Before you put this off, think about how much good you can do them by getting your will done.

Next Steps

- Still not convinced you need a will? Learn more about wills and why you definitely need one.

- Use these six steps to get started estate planning.

- Take our quiz below to figure out whether an online will works for you.

- Start your online will with RamseyTrusted provider Mama Bear Legal Forms.

Complete Last Will Package for Married Couples

Complete Last Will Package for Individuals

1Reviewer Kim Christopherson:

“You can keep property, like checking and savings accounts, investments, life insurance, and retirement accounts, out of probate by naming a payable-on-death beneficiary or transfer-on-death beneficiary on the policy or account. It’s a good idea for people to name beneficiaries on anything they can to avoid probate. (However, some people will name their estate as the beneficiary of their financial accounts, and some will name a trust as the beneficiary. In the latter case, they might be funding a special needs trust for a child or family member needing long-term care and financial assistance.)”

Interested in learning more about estate planning?

Sign up to receive helpful guidance and tools.