Key Takeaways

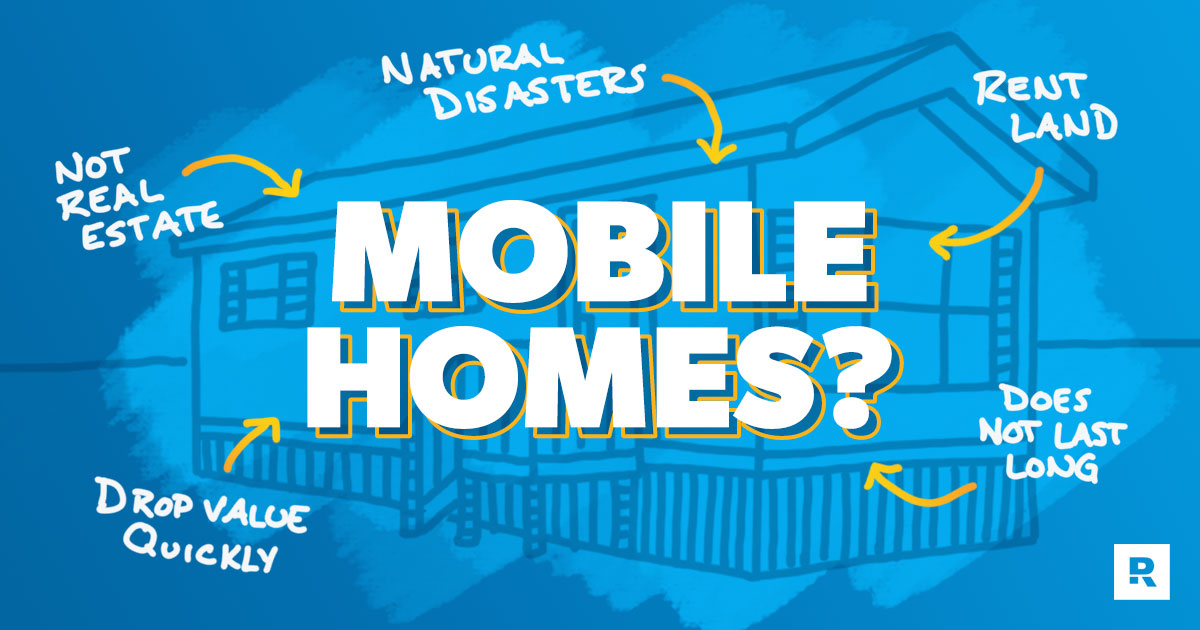

- Mobile homes may look better these days, but they still lose value fast—just like a car—which makes them a bad long-term investment.

- Manufactured homes meet federal standards but are still movable, while modular homes are built to local codes on permanent foundations.

- A new mobile home costs around $124,800, but that doesn’t include the price of land, insurance or other extras—and those can add up quick.1

- Mobile homes usually last 30–55 years but don’t appreciate like traditional houses and are more vulnerable to natural disasters.2

Mobile homes have come a long way since your grandparents’ time. Today’s models often look more like traditional houses—with cleaner lines, more space and way better curb appeal. And thanks to lower price tags, they’re making quite a comeback—just like baggy jeans (no thanks), cash stuffing (yes please), and Nickelback (no comment).

But here’s the thing: Just because mobile homes are becoming more popular doesn’t mean they’re a smart move—especially if you’re thinking long-term. Mobile homes lose value fast. It’s less like buying real estate and more like buying a new car, which loses value the second you drive it off the lot.

Look, I’m not saying mobile homes aren’t nice or a good living option. Heck, some of the more modern manufactured homes might even be engineered better than some older “regular” homes. But that doesn’t make them good long-term investments.

Mobile vs. Manufactured vs. Modular Homes

First, let’s break down three key terms: mobile homes, manufactured homes and modular homes. While these types of homes are all part of the same big, slightly dysfunctional housing family, there are a few differences we need to talk about.

Mobile Homes

Mobile homes are the grandpa of the family. When most people hear the term mobile home, they usually think of those classic, self-contained, shoebox-shaped houses typically seen in trailer parks—made popular in the mid-20th century alongside Elvis and I Love Lucy.

Depending on how they’re built, mobile homes can be transported either with a tow hitch and a truck (like a camping trailer) or on the back of a flatbed.

Manufactured Homes

A manufactured home is basically a mobile home with a master’s degree. In 1974, the federal government passed the National Mobile Home Construction and Safety Act. Then, two years later, the Department of Housing and Urban Development (HUD) rolled out the Manufactured Home Construction and Safety Standards.

From that point on, all mobile homes had to be built to meet universal standards—and just like Prince, they got a name change: manufactured homes. But even with all the fancy, sophisticated additions and certificates, these homes are still built on a movable foundation.

Today’s manufactured housing comes in three sizes: single-, double- and triple-wide. (A single is usually a little over 1,000 square feet.)3 For simplicity, I’ll keep using the term mobile home throughout this article to refer to these homes also. The only type I’m not lumping in? Modular homes.

Modular Homes

A modular home is like the sophisticated city-slicker cousin of the mobile home family—it’s reading The Wall Street Journal every morning while other mobile homes are watching reruns of The Price Is Right. It’s the only manufactured home that technically isn’t mobile.

The pieces of a modular house are built off-site in a factory, like the parts of its relatives. But then the pieces are attached to a permanent foundation at the homesite and built to local building codes, just like traditional homes. That’s why they’re often referred to as prefabricated (prefab for short).

When the assembly is all done and it’s ready to be moved into, you can barely tell the difference between it and a conventionally built home. And honestly, that’s the goal: You don’t want your “investment property” to scream, I came in pieces on a truck last week.

Buy or Sell Your Home With an Agent Who Puts You First

Finding a reliable agent who actually cares can be a headache. But RamseyTrusted® makes it easy—connecting you with local market experts who’ll fight for you to get the best deal.

How Much Do Mobile Homes Cost?

According to the U.S. Census Bureau, the average price of a new mobile home was nearly $124,800 in April 2025.4 Of course, the price varies with the size and look of the home:

|

Type |

Average Cost |

Average Living Space |

|

Single-Wide |

$88,500 |

1,084 square feet |

|

Double-Wide |

$152,9005 |

1,753 square feet6 |

Note: The Census Bureau doesn’t break out stats for triple-wide homes—they’re lumped into the overall total.

Buyers should know that costs and size regulations vary by state because these homes have to be transported.

The final price depends on personal customizations—like fancy granite countertops—and add-ons, like a large front porch. Beyond the home itself, you’ll have to factor in other expenses, like insurance, which can vary based on where your mobile home sits.

And don’t forget—you’ll need land. That means either buying or renting land for your home. It’s difficult to pin down an average mobile home lot cost because they’re not tracked the same way as traditional real estate. But the price will always reflect your local state and city’s real estate market. For example, a lot in California will cost way more than one in Indiana (no shock to anyone).

Lot costs also depend on what’s included—like electricity, water access, trash pickup or even an on-site pool. (And no, a pool still doesn’t turn it into a great investment.)

How Quickly Do Mobile Homes Lose Value?

Here’s where the real trouble starts. Mobile homes don’t appreciate like traditional houses. In fact, they typically lose value year after year. How fast they depreciate depends on a few factors—like location, condition, market trends and whether the home is permanently attached to land.

While it’s hard to track down exact depreciation rates, many believe mobile homes lose about 5% of their value the moment you buy them—like a car that drops in value as soon as it leaves the dealership. By the end of year one, that loss could double. After that, you could see a dip of around 5% each year.

Based on those percentages, here’s an example of how a mobile home’s value might decline in the first 10 years:

|

Year |

Estimated Value |

% Depreciation From Purchase |

|

0 |

$150,000 |

— |

|

1 |

$135,000 |

-10% |

|

3 |

$120,000 |

-20% |

|

5 |

$105,000 |

-30% |

|

10 |

$67,500 |

-55% |

Estimated mobile home value decline rate over time.

Looking at those numbers, it’s clear that a $150,000 double-wide mobile home could lose almost a third of its original value in just five years! That’s not a long-term investment—that’s a money pit full of regret.

So, do mobile homes gain equity? In most cases, no. Equity is the difference between what your home is worth and what you owe on it, and mobile homes usually don’t appreciate—even with good upkeep—unless they’re permanently attached to land and titled as real property.

Sometimes people will point to stats that show mobile home appreciation. But here’s the catch: Those stats are usually based on the value of mobile homes that include the land. In those cases, it’s the land that’s going up in value—not the structure.

Why Mobile Homes Are a Bad Investment

All that talk about depreciation leads to the obvious question: Are mobile homes ever a good investment? Not really. Even though they look more like traditional houses these days, they still lose value fast and don’t build wealth the way real estate should. That means when it’s time to sell, the resale value of most mobile homes is usually much lower than what you paid.

Remember, your home should be a blessing, not a burden. If it feels like a financial ankle weight, that’s a problem. Here’s a closer look at some pros and cons of manufactured homes as an investment:

|

Pros |

Cons |

|

Lower price: They’re cheaper up front than traditional homes. |

Fast depreciation: They lose value quickly—especially if not attached to land. |

|

Quick setup: Factory-built homes are faster to move into. |

Hidden costs: Land, setup and utility hookups can cost thousands more. |

|

Modern features: Newer models can look nice and be energy-efficient. |

Bad financing choice: Most buyers use loans with high interest—and debt on something that loses value is never a smart move. |

|

Weaker construction: Even under HUD standards, they’re less durable in storms and natural disasters. |

|

|

No long-term growth: They don’t build equity or appreciate. The only thing that might increase in value is the land—if you even own it. |

How Long Do Mobile Homes Last?

The typical life expectancy of a modern mobile home is around 30–55 years.7

Of course, just like a car, mobile homes can last longer if they’re well maintained. If you keep up general maintenance, choose your plot location wisely, and have your home inspected every so often, it could outlast that 55-year mark.

Natural disasters can also cut down on a mobile home’s life-span. Like standard homes, mobile homes are made out of wood and metal. But unlike standard homes, most aren’t set on a permanent foundation with framing built to last. So, people who live in mobile homes are more vulnerable to natural disasters like hurricanes, tornadoes, flooding and fires.

And I hate to be the bearer of bad news, but the National Weather Service says your risk of being killed during a tornado is 15–20 times higher in a mobile home than in a traditional one.8 Yeesh. That’s not just a money problem—that’s a safety problem.

Needless to say, a mobile home isn’t something you’re going to pass down through your family for generations. Nobody’s fighting over Grandma’s double-wide in the will.

Want More Expert Real Estate Advice?

Sign up for our newsletter! It’s packed with practical tips to help you tackle the housing market and buy or sell your home with confidence—delivered straight to your inbox twice a month!

Better Investment Options

If you’re looking at investing in real estate, there are much better opportunities out there than mobile homes, and that’s because of one magical word: appreciation.

Even with the ups and downs of the real estate market, most properties increase in value over time. In fact, traditional home values have been rising pretty much nonstop for over a decade now. Meanwhile, mobile homes follow a different curve—called depreciation.

Instead of investing in a mobile home, put your money toward a better investment. Here are my two favorites:

Buy a traditional house.

If you’re debt-free with a full emergency fund, saving up a strong down payment to buy a traditional house is a great investment. When our team at Ramsey talked to over 10,000 millionaires for The National Study of Millionaires, most of them had a paid-for house as part of their portfolio. Translation: Boring, paid-off homes help people become millionaires. I’m Team Boring all day.

Invest in mutual funds.

The best way to do this is to put money in a tax-advantaged retirement account, like a 401(k) or Roth IRA, and invest that money in mutual funds with a long track record of solid growth. I recommend investing 15% of your income here once you’re debt-free of all non-mortgage debt with an emergency fund of 3–6 months of expenses.

Work With an Agent You Can Trust

If you do choose to invest in real estate, you shouldn’t do it alone. It’s one of the biggest investments you’ll ever make—and though it can be a big moneymaker, it can also be really overwhelming, confusing and risky to navigate if you don’t have someone in your corner.

That’s why I recommend working with a real estate professional who’s the best in their field. Connect with a RamseyTrusted® agent who can help you find what you’re looking for. Through the RamseyTrusted program, you’ll get instant access to the right real estate professional for your family.

Next Steps

- Decide if you want to waste money on a mobile home.

- Realize that traditional housing is a better investment.

- Work with a RamseyTrusted agent to help you find a deal.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.