Key Takeaways

- Creating and living on a budget helps you stay in control and fight back against the pressure of inflation.

- Paying off debt and watching your online spending frees up your income and keeps your goals in focus.

- A fully funded emergency fund and steady investing provide long-term stability even in uncertain times.

- If you’re financially ready, don’t wait on market trends—buy a home with confidence and a clear plan.

Money’s tight. Prices are high. And maybe your goals feel farther away than ever. But here’s the truth: You can still take control of your money in 2026—you just need a new game plan.

These 10 simple, proven steps will help you break the cycle, build real momentum, and make this the year you finally move forward with confidence.

1. Create a budget and stick to it.

It all begins with a budget—a plan for your money. Budgeting can get a bad rap because people think it takes away your freedom. But budgeting is seriously so empowering. And that’s because when you budget, you’re telling your money where to go instead of wondering where it went.

If you haven’t made a plan for your money in the past, make a budget. Pronto. It’s the first step to taking control and being intentional with your money. And once you’ve got that budget in place, stick with it—day in and day out. That consistency is what turns a plan into progress.

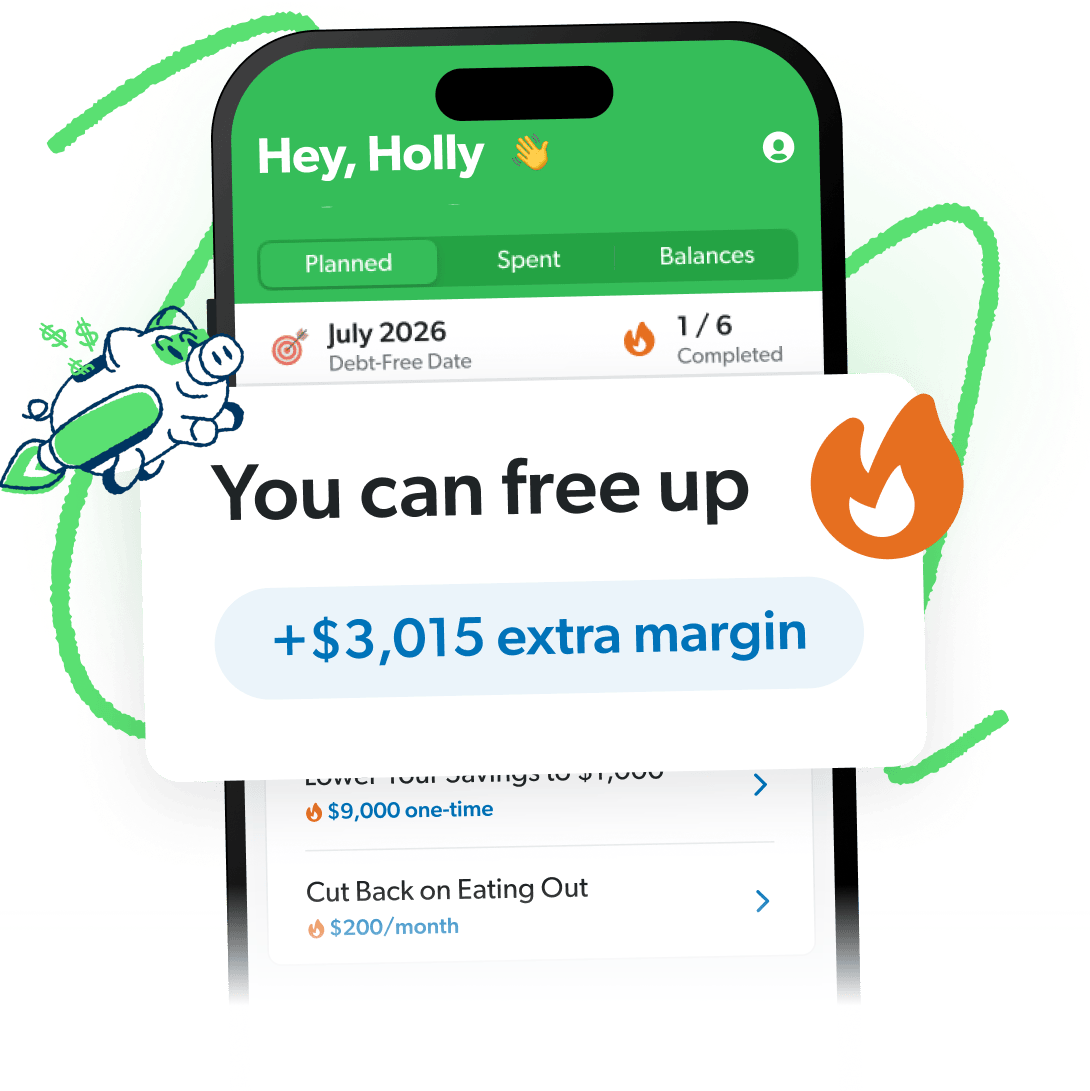

Find Margin You Didn’t Know You Had With EveryDollar

The EveryDollar budgeting app helps you find extra money every month so you can beat debt, build wealth, and make progress. Every. Day.

2. Adjust your budget to handle inflation.

When people budget, they say they feel like they got a raise. And with inflation, that “raise” is something we could all use, right?

Budgeting is how you create margin with your money. Because when you plan out where your money’s going, you’ll easily see the spots to cut or trim back. And if you decide you need to get a side hustle to help balance the rising costs, budgeting is how you’ll make sure you use that extra income for what you need—instead of accidentally spending it on checkout-line candy bars or one-click impulse buys.

Yes, inflation is tough. But you (and your budget) are tougher! So, adjust that budget for inflation and stand up to those rising costs.

3. Use the debt snowball to pay off debt fast.

While you’re at it, pay off all your debt! Debt keeps you stuck in the past and robs you of so many opportunities, right now and in the future.

Don’t know where to start? Use the debt snowball method to knock those payments out of your life. One. By. One. You’ll start with the smallest and work your way to the largest, building momentum and motivation with each stamp of “paid in full.”

The freedom that comes from being debt-free is like nothing else. Is it weird? Yeah. Is it worth it? Heck yeah.

4. Pay attention to your online spending habits.

Here’s another important thing to do differently with your money: Pay attention to your online spending habits. Because the ability to buy something quickly and have it at your door the same day is like having a genie in a bottle . . . who drains your bank account with every click of that Buy Now button.

How can you keep yourself in check? Try one (or all) of these:

- Delete shopping apps from your phone.

- Think about a purchase overnight before buying.

- Clear your cookies on your browser so you get fewer targeted ads.

- Check in with your budgeting accountability partner.

We aren’t against online shopping. It can save you time and money when you do it well! But it’s so easy to not do it well. So, pull out the budget, review your online spending habits, and make it as difficult as possible to overspend online.

And hey, if you need a place to track all this, EveryDollar makes it easy to see where your money’s going and where you need to tighten things up.

5. Build (or rebuild) your emergency fund.

This one depends on what Baby Step you’re on. What’s that? The 7 Baby Steps are the proven, guided path to save money, pay off debt, and build wealth. And getting your emergency fund set up is part of that path!

If you’ve got debt, you need just $1,000 in savings as a starter emergency fund (Baby Step 1). Then attack that debt with the debt snowball method we mentioned earlier (that’s Baby Step 2). Then build up a fully funded emergency fund (aka Baby Step 3).

How much money should you save up? For a fully funded emergency fund, save 3–6 months of expenses. This safety net in life gives you a ton of peace and comfort knowing you’ve got cash in the bank to pay for the emergencies that are bound to happen.

So, if you’re ready to finish up Baby Step 3, get at it! And if you had to dip into your emergency fund last year, rebuild it.

6. Keep investing—even when the market’s down.

Speaking of Baby Steps, if you’ve already built up that fully funded emergency fund, it’s time to save for retirement (Baby Step 4). Keep in mind, retirement investing is a long game, so don’t stop investing just because the market is down. Investing in retirement is a lot like riding a roller coaster. And you know what happens when people jump off a roller coaster in the middle of the ride? They get hurt.

Ride the ups and the downs. Keep investing.

7. Don’t sit on the sidelines if you’re ready to buy a home.

If you’re ready to buy a home, buy a home. Don’t wait on rates or prices to drop. But how do you know if you’re ready? You’re ready if . . .

- You’re debt-free with a fully funded emergency fund.

- You’ve got a proper down payment. Ideally, you should put down 20% or more to avoid PMI. But if you’re a first-time home buyer, 5–10% is okay too.

- You qualify for a 15-year fixed-rate conventional loan (no VA or FHA loans).

- You can stick to spending 25% or less of your monthly take-home pay on house payments (including mortgage, HOA, taxes, insurance and PMI).

- You can pay the closing costs and moving expenses without stealing from your down payment.

- You plan to live in the home more than a year or two.

8. If you’re married, combine your money and goals.

When you get married, the two become one. And that includes your finances! This means living with an ours attitude, not dividing income and bills and payments. All that division with your money can create division in your marriage. But when you work as a team, you’ll win faster financially.

Communicate. Combine dreams. Go toward the same main goals. Together!

If you’ve been dragging your feet to combine your checking accounts, this is the time to do it.

9. Find your why to stay motivated with money.

What’s your why for doing things differently with your money this year? If you haven’t thought of that yet, think it through now. Write it down. Do you want to budget so that you can take control and have confidence with your money? Do you want to be debt-free so that the weight of your monthly payments doesn’t keep you up at night anymore?

One ultimate, big-picture why of managing your money well is to build wealth so that you can be outrageously generous. And it’s so important, we have a whole lesson on it in Financial Peace University (our course on how to walk those Baby Steps).

Right now, that moment might seem so far away that it isn’t even imaginable. But take a second to imagine it! The bills might have you feeling like a tightrope walker with 50-ton weights on your ankles.

But you will survive. And you will thrive. Write down your why for now—and dream big about your why for the future as well.

Want More Money Tips—And Tons of Hope?

Learn how to walk the Baby Steps, spend wisely, buy a home that’s a blessing (not a burden), and more in Financial Peace University (FPU). Plus, there’s a solid dose of hope in every lesson.

Start FPU10. Choose hope and believe you can win with money.

Speaking of thriving, take heart. Have hope. If you’re discouraged right now, you aren’t alone. But you also aren’t stuck.

It’s so easy to get discouraged when you feel like your money isn’t getting you as far as it used to, or like you aren’t reaching your goals as quickly as you planned.

Have hope.

One characteristic we see all the time in the people who win with their money? They believe they can. So hear this: You can!

Work through these 10 things to do differently with your money, and you can make a true difference with your finances—and your future.

Next Steps

- Figure out which Baby Step you’re on and identify the action items from the list that match your current season.

- Take one clear step this week—whether it’s cutting spending, making a debt payment, building savings, or setting a home-buying goal.

- Start budgeting with EveryDollar to track your progress, plan ahead, and stay in control of your money.