Money Hub

lives positively impacted

years of providing hope

national bestselling books

Find out how these areas work together and why it matters for the life you’re building.

Money

Your finances touch everything, from your daily choices to your biggest dreams. When you take control of your money, it can transform your life, career and peace of mind.

Personal Growth

When the hard parts of your life change for the better, your health is affected too. Leaning into good choices—like getting rid of debt stress or finding a job you love—helps you thrive with purpose.

Relationships

When you build trust, voice your needs, and set boundaries, your whole life benefits. It’s the foundation you can count on to carry you into every area of life.

Career

Work isn’t just a paycheck—it’s a calling. Finding your purpose in what you do and how you do it brings meaning to your days and leads to serving others with excellence.

The legacy you leave starts with the choices you make today.

Take the next step toward a life built on purpose.

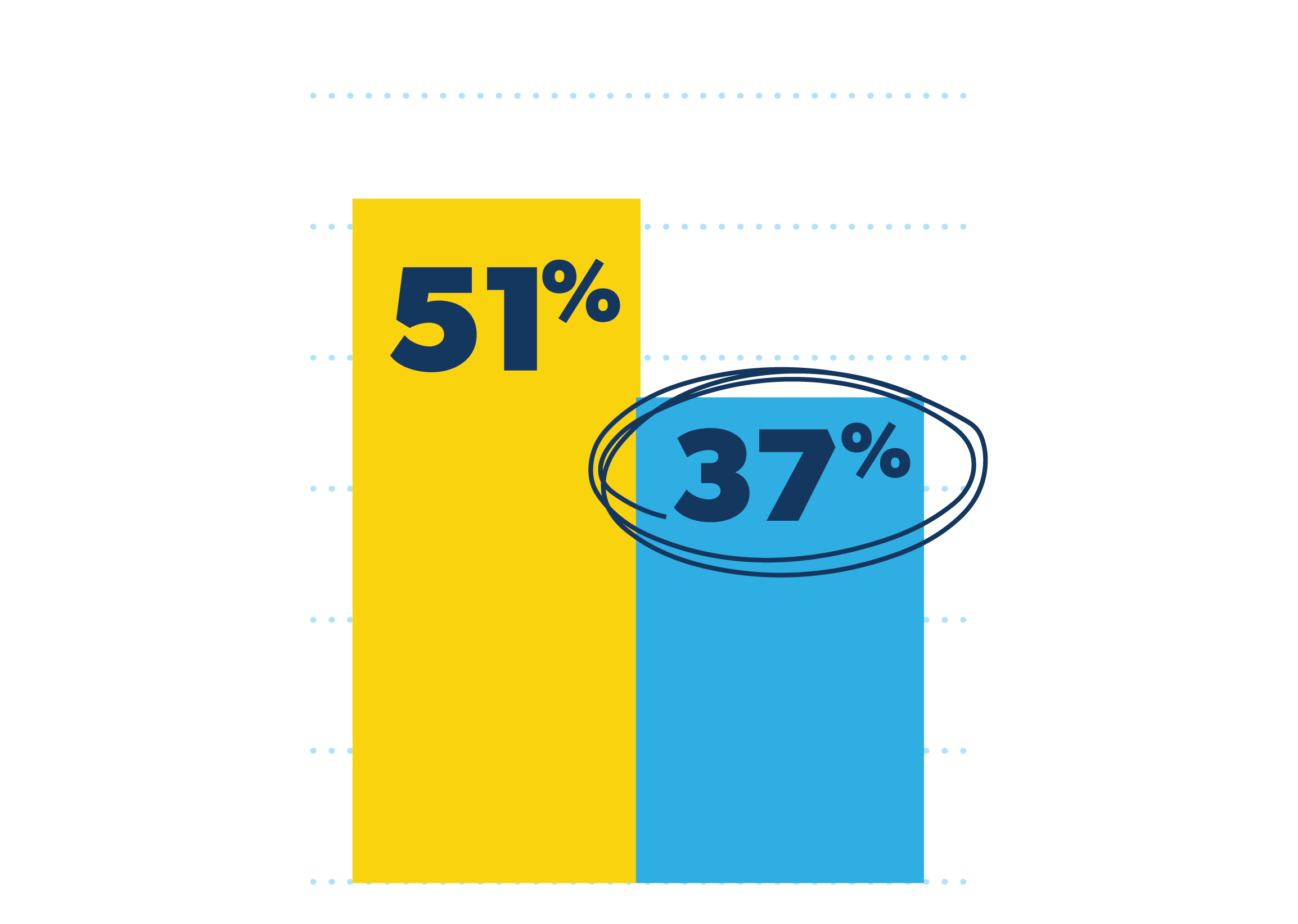

We dug into how people think, feel and act when it comes to money. Check out the difference between those who follow the 7 Baby Steps and those who don’t.

Over half of Americans stress about money daily. But among those following the Baby Steps, it’s just 37%.

Worry fades step by step—45% feel it in Baby Step 1 and only 7% in Baby Step 7.

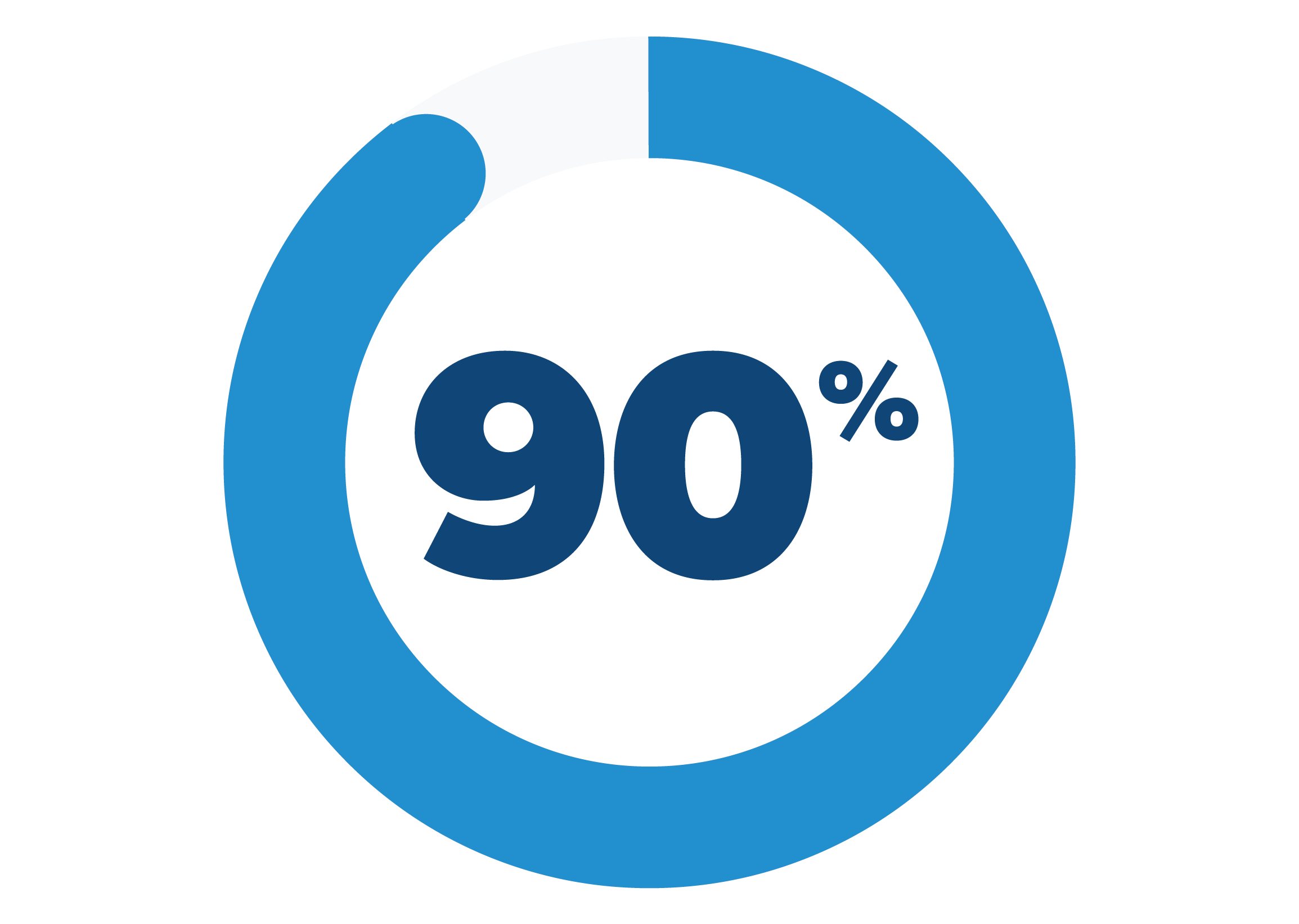

90% of those following the Baby Steps said they believe they can overcome their money challenges.

Through shows, podcasts, articles and bestselling books, our experts break down life’s hard topics and help you take the right next steps.

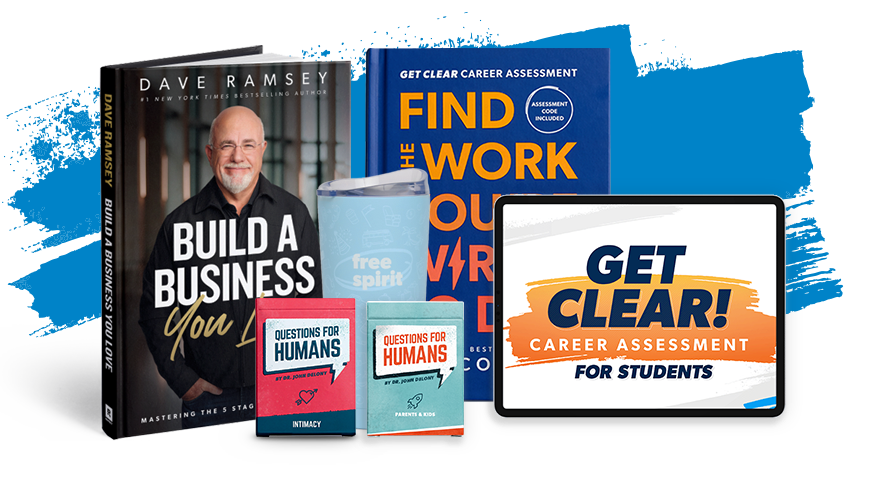

Dave Ramsey

Personal Finance and Retirement Expert

Jade Warshaw

Personal Finance and Debt Elimination Expert

Dr. John Delony

Mental Health and Wellness Expert

George Kamel

Personal Finance Expert

Rachel Cruze

Personal Finance and Budgeting Expert

Ken Coleman

Professional Growth Expert

Laugh, learn and get expert advice for your relationships, finances and personal wellness.

Practical advice for life’s tough money questions.

Real talk on life, relationships and mental health.

Unfiltered talk about culture and how to afford a life you love.

Get better. Move up. Lead well.

Filter what shows and topics you want to hear using the Ramsey Network app.

Get practical tips that help you build stronger money habits, deeper relationships and a life built on purpose.

If you don’t teach your kids about money, someone else will! Here are 15 ways to teach your kids about money so they’ll get a head start and be set up to win with money at any age.

If it’s your first time getting your kids started with chores or it’s time for them to get back in the swing of helping out at home, here are chore lists for kids that are also age appropriate.

I’m all for teaching your kids about money at a young age, including how to earn it. But is an allowance for kids the right way to teach them? Keep reading to find out!

It's crucial to teach your kids how to save from a young age. But let’s be real: It can be intimidating to know how to teach big financial concepts to little ones in a way that will stick with them.

Learn the behaviors that define a toxic relationship, the key signs to watch out for, and what to do next to protect your emotional and physical well-being.

Does starting a conversation feel awkward or even terrifying? You’re not alone. Most of us choose withdrawal or distraction over connection. Here are 11 ways to start a conversation naturally.

From money and marriage to mindset and career, we’ll help you build balance, joy and peace in your life.

Get weekly emails you’ll actually love—with practical advice, real stories and tips that’ll make you laugh, learn and take action.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.