How to Pay Off Credit Card Debt

Weighed down by credit card debt? Find out the best way to ditch that debt for good!

What’s up, guys! I’m Jade. Ever since paying off over $460,000 in debt with my husband, Sam, I’ve been coaching others on how to pay off their own debt by shifting their mindset, beliefs and actions around money. I absolutely love talking to people about all things finance (especially if there’s food involved), and I can’t wait to get to know you!

What’s up, guys! I’m Jade. Ever since paying off over $460,000 in debt with my husband, Sam, I’ve been coaching others on how to pay off their own debt by shifting their mindset, beliefs and actions around money. I absolutely love talking to people about all things finance (especially if there’s food involved), and I can’t wait to get to know you!

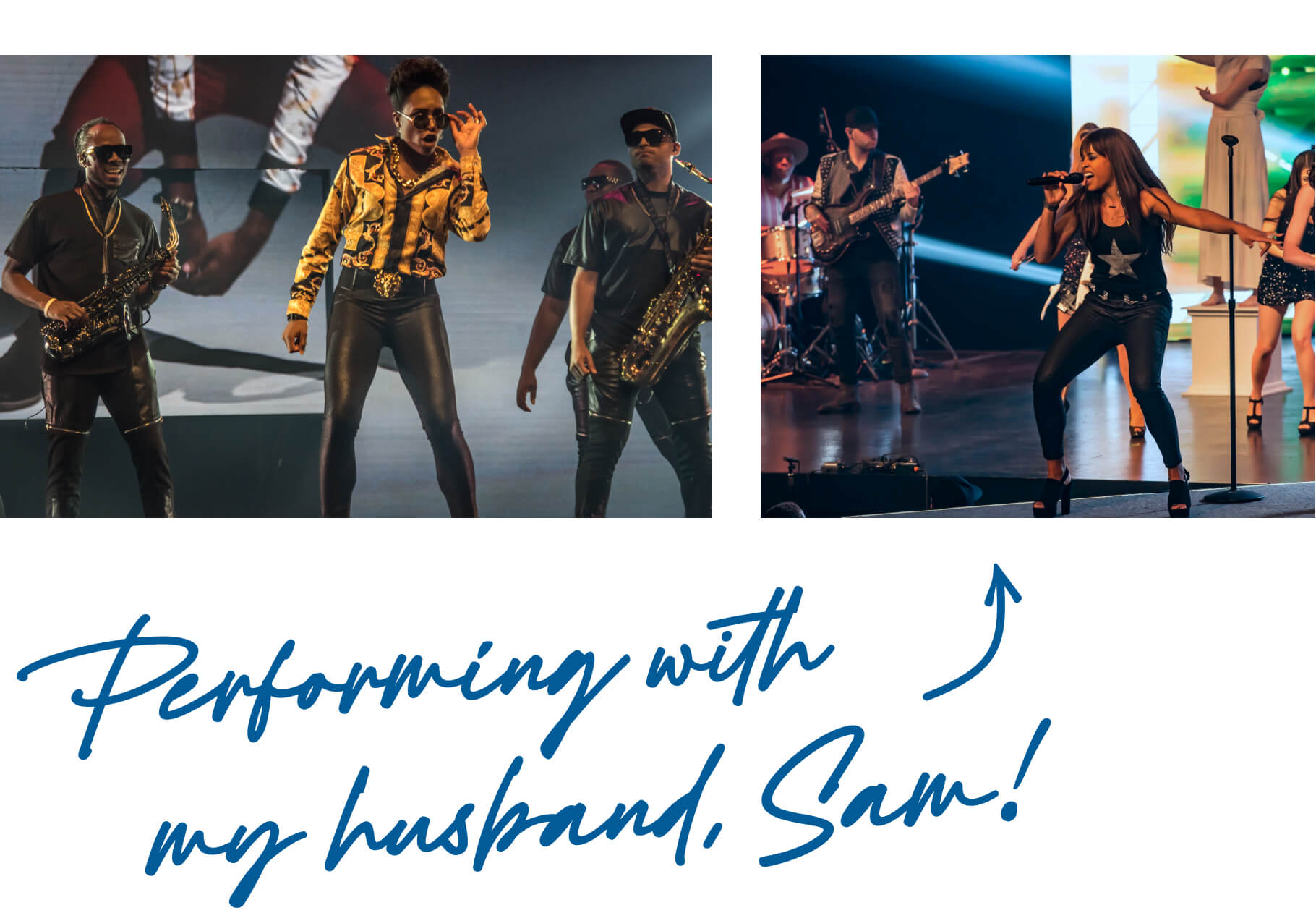

My background is in music. I was a professional vocalist for 15 years! I’ve performed in 92 countries alongside my husband, who’s also a musician, which sounds pretty cool until you add in the fact that we had almost half a million dollars of debt. $460,052 to be exact. Yikes.

Sam and I got married in 2007, one week after college graduation. We had $280K just in student loans! We also had credit cards, two cars we couldn’t afford, and a small townhome to round it out. This was a big problem (which we were blissfully ignorant about).

But in 2008, we started listening to The Ramsey Show and learned all about the Baby Steps and what we needed to do to become debt-free. It took us a while to shake our old habits, but once we truly got fired up, we did whatever we could to earn more money—from teaching voice lessons, to designing websites, to hosting jet ski tours, to working at a vinyl tint and lettering garage. We even sacrificed by getting roommates (10/10 would not recommend doing this as a married couple).

(And here’s a playlist we listened to that helped motivate us on our debt-free journey.)

But I was determined that we weren’t going to sacrifice when it came to food. See, when I was a kid, no matter what hard times we faced, my mom always cooked an amazing meal. We almost always ate together as a family, and for me, that was peace. I remembered what that meant to me and decided I could do the same, so I started couponing and ad matching and buying whatever was on sale to make the most delicious meals I could. That was our reward for a day well done. This eventually led me to share my recipes online and start building a community with other people who were also trying to live the debt-free lifestyle.

The more we worked, the more God gave us opportunities to work. And then one day in 2015, He gave us an idea for a business we started without using debt, and it grew like crazy. (It was a good thing too, because our car was literally falling apart.)

In 2017, our business had a great year, and we were able to pay off the last of our debt: a 91K student loan. Then, Sam and I were able to go on The Ramsey Show and do our debt-free scream!

We had made the personal decision to wait to have kids until our debt was finished, and now we could skip to the “good part” and finally start our family. God blessed us with not one but two kiddos. It’s almost like God meant it when he said, "My purpose is to give them a rich and satisfying life" (John 10:10 NLT).

Today, I’m in my dream job at Ramsey Solutions. I love that I can give hope to millions of listeners every time I’m on The Ramsey Show—the same show that gave me and Sam hope years ago! And I love that I get to write books that help people push past what’s really been sabotaging their progress with money so they can finally win. What a blessing that I have the opportunity to do what I'm most fired up about: Using my debt-free story to show people that it is possible to get out of six-figure debt (or any amount of debt) and give them the tools to do it. Trust me—if my husband and I could do it, you can too. So if you need help, I’ve got your back. Let’s do this.

Weighed down by credit card debt? Find out the best way to ditch that debt for good!

Do you actually need a credit card? Despite what everyone says, you don’t need a credit card to build credit or buy a house. Here’s why.

Weighed down by credit card debt? Find out the best way to ditch that debt for good!

Do you actually need a credit card? Despite what everyone says, you don’t need a credit card to build credit or buy a house. Here’s why.

Need help saving up your starter emergency fund? From selling your stuff to picking up a side hustle, here are 30 ways to make $1,000 this month!

This is my book that gets to the heart of money issues.

Feeling stuck? Win your fight with money for good.

This is the budgeting app I can't live without.

Contact us for media inquiries.

Sign up to get practical tips and real encouragement to help you make progress with your money.