Why You Should Be Offering Financial Education for Your Employees

4 Min Read | Aug 2, 2024

.png)

Financial education. Corporate financial literacy. A financial wellness benefit. No matter what name you use, they’re all about one thing—helping your employees learn how to manage their money.

Like it or not, money is a big part of life. And when your employees have money problems at home, it’s tough to keep them from spilling over into the office. But you can help by offering your employees financial education.

The good news is, your employees want your help. Over 75% of employees think a financial wellness benefit is an important part of a compensation plan. The bad news? According to a study done by SmartDollar, only 23% of employers offer one.

Let’s take a look at even more reasons why you should offer financial education for your employees.

Offer Your Employees Financial Education

With SmartDollar, your employees can learn the skills they need to stick to a budget, get out of debt, save for the future, and build lasting wealth.

The Financial Crisis Your Employees Are Living in Everyday

First, let’s start with a question to help you get a better idea of your employees’ financial situation. Which statement is false?

- 47% of employees say their personal finances cause them to lose sleep.

- 55% of employees worry about their personal finances daily.

- 24% of employees are either struggling financially or in crisis.

- 36% of employees have missed work due to a financial problem.

They all sound pretty scary for employees. But guess what?They’re all true (see for yourself in the 2022 SmartDollar Employee Benefits Study).

You probably thought running a business sounded fun—until you realized it would actually run you. Discover the EntreLeadership System—the small-business road map that takes the guesswork out of growth.

But here’s where the problem gets even stickier . . .

The money problems your employees are facing probably started way before they began working for you. When asked if they learned about money growing up, 53% of Americans said they were never taught at home, according The State of Personal Finance in America. And only half of states require students to pass a personal finance course to graduate high school.

So, why does that matter for your business? Your employees likely didn’t learn enough—if anything at all—about personal finance. Now they work at your company, earn a paycheck, and don’t know how to spend or save their money wisely.

While a lack of personal finance skills among your workforce isn’t a result of bad business leadership, it sure as heck affects employee engagement, productivity, retention and absenteeism. And that’s just bad for business.

What Is Financial Education for Employees?

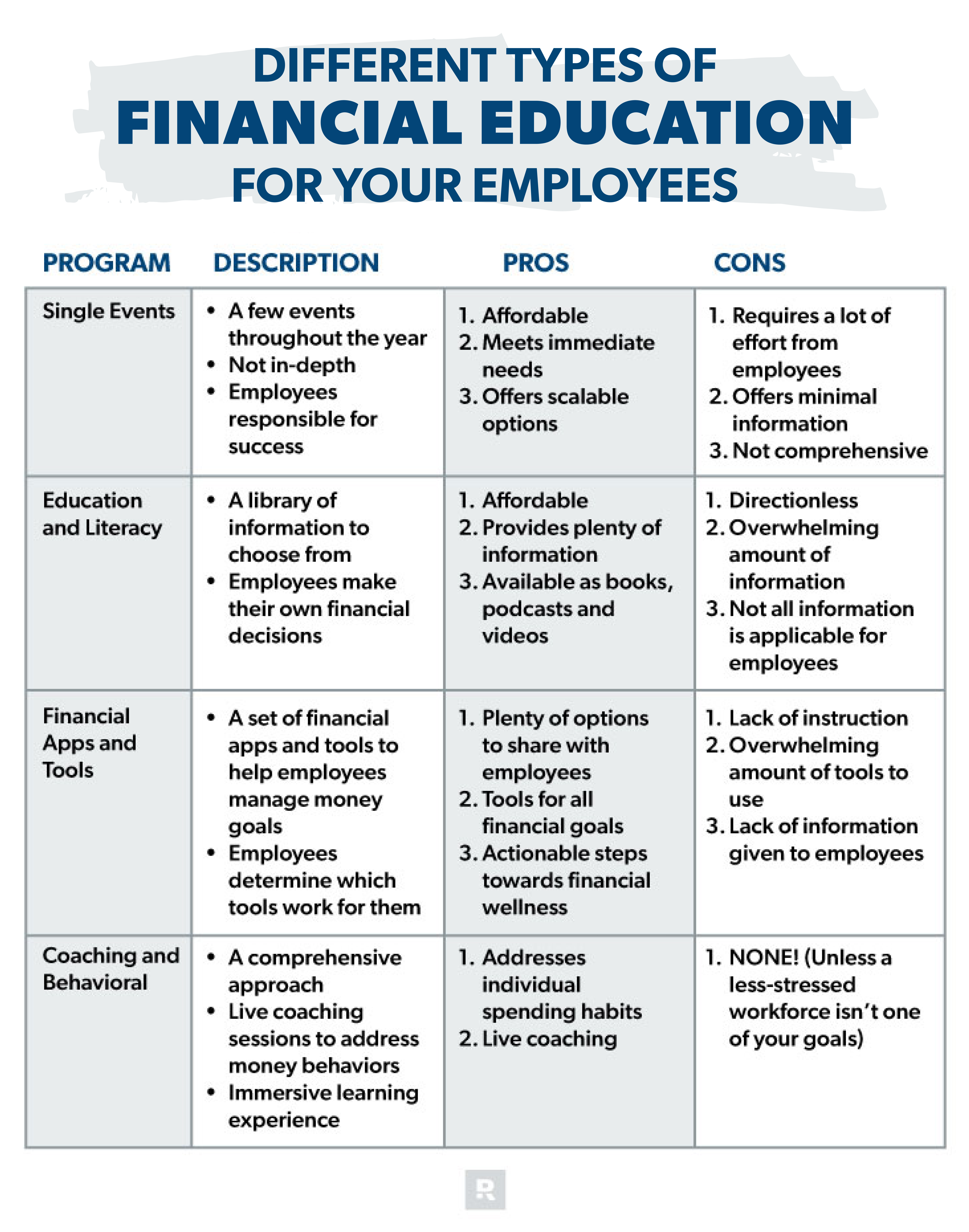

Personal financial education is any program or benefit that teaches employees about money management. And like anything else, some programs are better than others. But how do you choose the one that will help your employees the most? Here are some of the most common options:

- One-off events and activities include enrollment meetings and one-time workshops that give employees good information but not nearly enough coaching to make a difference in their financial habits.

- Education and literacy programs provide a library of personal finance information employees can use to learn more about personal finance topics.

- Financial apps and tools build off the knowledge employees learn elsewhere and give them a place to turn their knowledge into practice and improve their finances.

- Coaching and behavioral programs get to the heart of personal finances and teach employees how to change their spending and saving behavior.

While any personal finance program is better than no program at all, we strongly recommend employers invest their time and money into coaching and behavioral programs, like SmartDollar.

Personal finance is 80% behavior and only 20% head knowledge. When it comes to financial stress, the solution requires more than a new budgeting app or a new book. Financial stress is a deep-rooted problem that can only change through new behaviors and habits.

What Can HR and Business Leaders Do About Financial Education for Employees?

The financial struggles of your employees shouldn’t remain personal. No, you don’t need to see their budget. But their stress and sleepless nights follow them to work. And that’s not something your company can afford to ignore. If it affects business, HR and business leaders need to address it.

Adding financial education for employees to your benefits package is a step in the right direction for helping them go from fight mode to freedom mode. Learn how SmartDollar can elevate your company and help your employees get their finances on track.