Let’s be honest here: Impulse buying is kind of fun—at least in the moment. You walk into Target for diapers, and before you know it . . . boom. Your cart is full of Chip and Joanna’s amazing throw pillows. Oops.

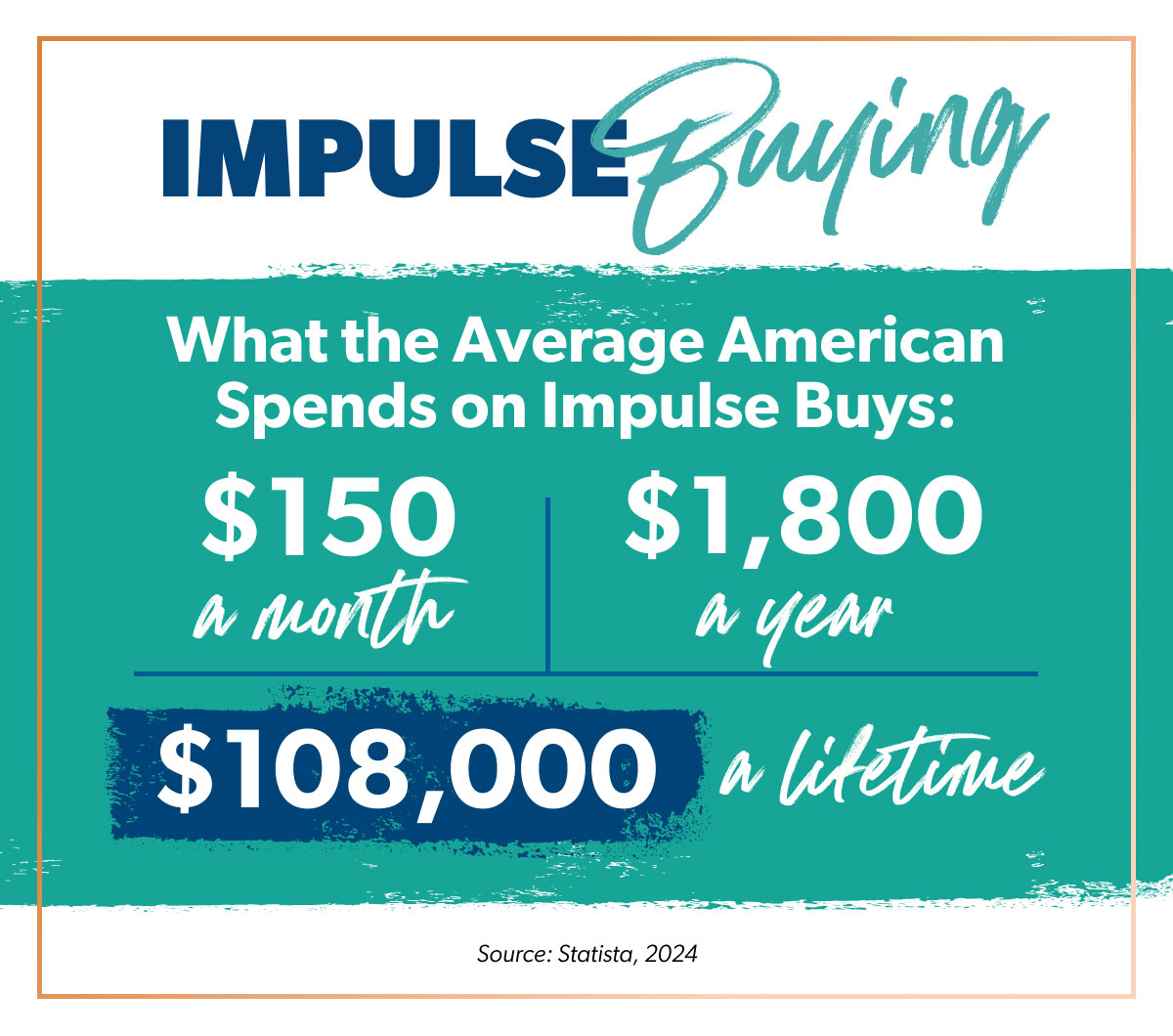

This is actually really normal. Americans impulsively spend an average of $150 every month.1 That adds up to an extra $1,800 spent every year and about $108,000 in a lifetime. Ouch!

But how can we stop the impulsive shopping habit? Let’s find out.

Key Takeaways

- An impulse buy is any purchase you make when you weren’t planning to.

- Common impulse purchases include checkout line items, clothing, takeout and groceries.

- Retail therapy and emotional spending are a top cause of compulsive shopping.

- Making a budget (and planning for fun spending) is one way to stop impulse shopping.

What Is an Impulse Buy?

An impulse buy is any purchase you make when you weren’t planning to. If it’s not planned for in your budget ahead of time, it’s an impulse buy.

It can be as small as grabbing a candy bar in the checkout line (that wasn’t on your grocery list) or as big as walking into a car dealership “just to browse” and driving off in a brand-new SUV.

Almost all of us have fallen for this temporary excitement. In fact, a Ramsey Solutions study, The State of Personal Finance, reveals 48 of Americans say they struggle to avoid impulse buys.

Examples of impulse buying:

- Candy, gum and energy drinks in the checkout line

- Clothing and shoes

- Video games

- Candles (HomeGoods is basically an entire store of impulse buys, am I right?)

- Home improvement purchases

- Toys (to keep the kids under control at the store)

- Extra cleaning supplies (just in case)

- Cars (yes, even cars!)

- Books

- “Treat yourself” buys

- Coffee and takeout

Of all those, research shows the top impulse purchases are clothing, household goods, and food and groceries.2

Why Do We Keep Impulse Buying?

Do you ever wonder how impulse buying gets you? There are four main reasons I see for why people impulse buy.

We impulse buy because of emotions.

When you’re having a rough day, does a little retail therapy sound like the cure? Maybe it’s not a huge purchase. This time. But making decisions based on pure emotion is a surefire way to let impulse buying take control.

And sneaky marketers know this. They’ll play on your emotions with their ads, hoping it’ll hit a nerve that causes you to buy.

We impulse buy because of our past.

If impulse buying and overspending are problems for you, it could be that you were never taught how to handle money well.

The way money was handled in the household you grew up in shapes your money mindset. But—don’t just blame your past. Do some digging on how it affects your spending today and make changes!

Here's A Tip

Check out my book, Know Yourself, Know Your Money. You’ll see the way your past and personality affect how you handle your money—and learn how to start moving forward with your finances.

We impulse buy when we believe it’s a deal.

I totally get this one because I love a good sale.

But, you guys, this is a total marketing tactic. When you think you’re getting a deal or “free shipping,” you’re way more likely to pull the trigger on the purchase—and that’s exactly what the marketers want you to do. I’m sorry, but it’s the truth. I’d bet Jeff Bezos’ fortune on it.

We impulse buy because we enjoy shopping.

Shopping really does make you feel better in the moment. When we shop, the body releases dopamine—that’s right, the brain’s happiness drug.

Start budgeting with EveryDollar today!

This love of shopping, in and of itself, isn’t a bad thing. What’s dangerous is when that turns into compulsive shopping or a shopping addiction. Your body starts relying on that dopamine hit, so you continue to feed it with more and more spending. Know it. Own it. And keep reading to see how to stop it.

How to Stop Impulse Buying

Okay, so how the heck do you keep impulse buying at bay? Whether you’re on Baby Step 1 or Baby Step 7, I’ve come up with 10 tips to help you dodge the temptation to overspend.

1. Make a budget and stick to it.

First things first: You need a budget. If you don’t already have one, stop right now and download our free budgeting app, EveryDollar.

Then, once you make that budget—you have to actually stick to it! A budget isn’t a magic wand that will suddenly make all of your money behave. It’s on you to tell your money where to go each month and then follow through with that plan.

If it’s not already budgeted for, don’t spend the money. It’s as simple and as hard as that. You can do this!

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)

2. Give yourself permission to spend.

Yep, I just told you to stick to your budget—and you always should. But it’s also important to throw a little fun money in there too! It might be just a little depending on your situation, but give yourself (and your spouse, if you’re married) a line item in the budget with your name on it for your fun spending.

You’ve already budgeted a small portion of spending money for it, so that reward or treat isn’t an impulse buy anymore.

3. Wait a day (or longer!) before you make a purchase.

These days it’s so easy to see something we want and click, click, click it into a purchase.

One way to help here is to give yourself a day or so before you buy something. Then ask yourself if you’ll actually use this thing and if you can pay cash for it now.

And watch out for deals that are only good for 24 hours. Don’t let a countdown rush you into buying anything! Because a sale will come back around. Trust me.

4. Shop with a plan in mind and cash in hand.

Make a list before you shop and head to the ATM to take out only the cash you’ll need. And then don’t let yourself pull out that debit card or Apple Pay on your phone. Stick to the plan.

P.S. The best way to curb those grocery and takeout impulse buys is with a meal plan—and I’ve got a free meal planning and grocery guide that can save you from stress and overspending!

5. Don’t shop when you’re emotional.

We just talked about this, but it’s worth mentioning again—don’t let your emotions control your spending habits! This can look like impulsive shopping to reward a good day or numb a bad day.

We’ve all been there before. But how can you fix it? Whether you’re celebrating or trying to cheer yourself up, don’t buy anything when your emotions are riding a roller coaster.

6. Stop the comparisons.

If you always compare what you have (or don’t have) to others, you’ll never be satisfied. And no amount of compulsive shopping or impulse buying will help.

Here are two things that can help. First, if I’m trying to decide on a purchase, I sometimes ask myself, “If no one ever sees this thing I’m about to buy, do I still want it?” It helps me put my motivation in check!

And on a bigger level, instead of looking at what someone else has and thinking, Oh, I need that too, work to be grateful for what you do have.

If you change your perspective, you’ll find you already have a lot to be grateful for.

7. Get off social media.

If you know you have trouble being content when you scroll past everyone’s highlight reel, then remove the source of the problem. Try deleting Instagram and Facebook for a week (or more) and see if you notice a difference.

Even if you don’t find yourself falling into that comparison trap, the reality is that social media is one big billboard for impulse buying. But if you’re not on the app, you won’t see all the ads for flashy sales and new products practically begging you to spend your hard-earned dollars.

8. Do a no-spend challenge.

If you haven’t heard of this before, a no-spend challenge is pretty much just like it sounds—you don’t spend any money on any extras.

Rent? Yes. Restaurants? No. A third trip to the grocery store for actual groceries? Yes. A third Stanley because they just released a new color? No.

Try this for a month. It’s a great reset for anybody! If you haven’t been paying attention to your spending habits overall, a no-spend challenge is eye-opening. It’s also a simple way to press pause on the impulsive shopping. (And maybe your first step to stopping it completely.)

9. Ditch the credit card(s).

If you put those impulse buys on a credit card—and don’t pay off the balance—you end up paying even more than the average $150 a month I mentioned earlier. Why? Because you’ll have to pay the average credit card interest rate too. Yup, you’ll have to pay 21.59% more on those things you didn’t plan to buy and probably don’t even need.3

You guys, don’t let the temptation for rewards lure you in to using credit cards (that includes store cards too). They make it way too easy to turn today’s purchase into tomorrow’s problem—because you don’t see the cash leave your wallet or your checking account balance go down. It’s too simple when you don’t technically have to pay for it then and there, which is exactly how credit cards work.

Ditch the credit cards and the impulse buys.

10. Keep your goals in mind.

Giving in to an impulse buy won’t help you achieve your financial goals—whether that’s getting out of debt, paying off your mortgage, or investing for your future. Buying on impulse and overspending will eat up any extra money you were saving to put toward those awesome goals.

So don’t shoot yourself in the foot here. Help yourself out by remembering the important goals you’re working toward!

Trust me. I know this: Spending money can be super fun, especially if you’re a spender like me. But the excitement of impulse buying never lasts.

I want you to take control of your spending for good. And you can! Download EveryDollar and start being intentional—not impulsive—with your money.