Key Takeaways

- Ignoring your tax bill is the worst move you can make. All that does is pile on penalties and interest that you’ll have to pay down the line.

- The longer you wait, the worse it gets. Interest and penalties start immediately after Tax Day. Over time, the IRS will send warnings and could eventually seize your assets if you don’t pay.

- Stay calm—you’ve got options. You can set up a payment plan with the IRS, request a temporary collection delay, or apply to settle your tax debt for less than you originally owed (this is rarely approved, though).

You just finished working on your taxes. Now you feel sick to your stomach—yep, you owe the IRS a lot of money.

Get expert money advice to reach your money goals faster!

You might experience denial at first. There must be a mistake. Did I forget some deductions? Then anger. Taxes suck. They’re too high! Then questions flash through your mind. How long do I have to pay my taxes? Can I go to jail for not paying taxes? Can the IRS take my house?

Stop. Take a breath. It’s going to be okay. You’re not going to prison.

But that doesn’t mean you can ignore your tax bill—that’s probably the worst thing you could do right now. Penalties will pile up, and you’ll owe even more down the line. The best solution? Face it head on.

With some hard work, you can climb out of even the deepest tax hole and avoid tax trouble in the future—we’ll show you how.

What Happens if You Don’t Pay Taxes?

First, let’s talk about what happens if you don’t pay Uncle Sam on time. Here’s a general timeline of what to expect when you don’t pay your tax bill:

- Immediately after Tax Day: If you don’t pay what you owe by Tax Day, the IRS will start charging interest and penalties immediately, even if you filed a tax filing extension . . . and they’re not pretty. The interest rate for failing to pay is the federal short-term rate (which is set at 4% for individual taxes for the first quarter of 2025) plus 3% compounded daily.1

And on top of that, the IRS will hit you with a failure-to-pay penalty of 0.5% each month—with a maximum penalty of 25% of your tax bill—until your tax bill is paid in full.2 That’s why it’s so important to pay as much as you can ASAP and set up a payment plan for the rest (we’ll talk about payment plan options below).

- One to three months after Tax Day: Within a few weeks of Tax Day, expect some stern letters in the mail from Uncle Sam if you still haven’t paid your taxes. They’ll tell you how much you owe, along with any interest and penalties you can expect to pay on top of that. And the letters will keep coming until you’ve paid in full. “Forgive and forget” isn’t exactly the IRS motto.

- Three to six months after Tax Day: When the snail mail letters don’t work, Uncle Sam will start making collection calls and taking out tax liens against you. A tax lien is when the government makes a legal claim against your property (including personal property, real estate and financial assets) when you don’t pay your taxes.

The IRS will file a Notice of Federal Tax Lien, which alerts your creditors that the government has a legal right to your property. Uncle Sam won’t seize your property (yet), but liens are public record and they can show up when you try to get a mortgage or start a new job. That’s not a good look!

So, how do you get rid of a tax lien? Pay your tax debt in full! The IRS might also send your back taxes to a private collections agency, and they’ll start bugging you to pay up too.

- More than three months after Tax Day: If the IRS has filed a lien on your property and you still don’t pay your tax bill, they can send you a letter titled “Final Notice of Intent to Levy and Notice of Your Right to a Hearing.” This is a levy notice. When the IRS wants to levy something of yours, that means they’re planning to impose a fee or tax on something you own—like your house or a bank account—or take money out of your paycheck to pay your tax bill.

Thirty days after you’ve received this notice, Uncle Sam can legally seize your assets, including personal property, real estate and bank accounts. The IRS can also garnish your wages and apply all the money they make from the sale of your property to your unpaid tax bill.3

What Should You Do if You Can’t Pay Your Taxes?

As you can see, not paying your taxes can have some serious, far-reaching consequences. But what if you’re struggling financially and paying your taxes on time feels impossible this year? If that’s you, take another deep breath and let’s talk about crafting a game plan that’ll get you back on your feet.

It’ll take some intentional steps on your part, but you can get out of this mess!

Step 1: File by the regular deadline, even if you can’t afford to pay your taxes on time.

As soon as possible, find an experienced tax professional to help you file your taxes. They may be able to find tax credits and deductions that’ll lower your tax bill. And when you owe the IRS, every dollar counts!

If you owe money to the IRS, you might think it’s best to wait to file your taxes. But the penalty for not filing a return or filing a late return can be 10 times as much as the penalty for not paying on time.

Keep in mind, even if you file your tax return in February or March, your tax bill isn’t due until Tax Day. So if you file early but wait until the deadline to pay, you could have a couple of months to save or earn some extra money.

You might be wondering if a tax filing extension will give you more time to pay. It won’t. An extension just gives you more time to file, but your taxes are still due on Tax Day—if you pay late, you’ll have to pay interest and penalties on any taxes you owe for the year. So make sure you file your return on time!

Step 2: Pay as much as you can by the tax deadline.

When David D. was hit with a $14,000 tax bill, he didn’t have much time to come up with the money.

“My wife and I were expecting our first kid, so we were trying to save up for that,” David said.

David didn’t want to pay penalties and interest for paying his bill late, and he was determined not to be in debt. So he sold one of his two cars—which was paid for—and used the money to pay his taxes.

Not everyone can afford to sell a car, but you probably have stuff lying around the house you can sell for extra cash. The more you pay on your tax bill, the more you save on penalties and interest.

Now listen—if you find yourself out of work, don’t panic. Forget the tax bill (for now). When the going gets tough, you need to focus on the things you really need to survive. Take care of the Four Walls—food, utilities, shelter and transportation—before you do anything else. Once you’ve put food on the table and kept the lights on, then pay Uncle Sam what you can.

Step 3: Keep paying the taxes you owe after you file, and talk to the IRS about a payment plan.

Once Tax Day passes, you’ll have a month or two before the IRS starts contacting you about the rest of the taxes you owe. During that time, keep throwing every available dollar at the balance with the goal of paying it off before they ever contact you.

If you can’t pay off your tax bill within a couple of months, you should apply on the IRS website for a payment plan. And good news—you can set up the plan online without having to call the IRS and wait on hold for hours!

Jennifer M. found the IRS easy to work with when she set up a payment plan.

“They were flexible and willing to work with our specific situation. Basically, they asked us what we could afford each month, and we went from there,” she explained.

The IRS offers a short-term payment plan (120 days or less) for bills that are less than $100,000. Long-term monthly plans are available for balances less than $50,000.4 Long-term plans require a setup fee that ranges from $22–69, but the fee could be waived if you fall into the low-income category.5

Jennifer put her tax debt at the top of her debt snowball plan and was super motivated to get rid of it as fast as possible. And she did, in less than a year!

Step 4: Ask the IRS to delay the collection process or settle your tax debt, if applicable.

If you’re going through a tough time financially—like dealing with the death of a spouse or a job loss—don’t let your tax bill fill you with even more dread. You have some flexibility here.

Here are two things you can do to help you avoid getting into more hot water with the IRS:

Ask to temporarily delay collection.

If you can prove financial hardship, you can actually ask the IRS to report your bill’s status as currently not collectible. This will give you more time to pay (and get the bill collectors off your rear end for a while), but the late penalties and interest will keep piling up until you pay your bill in full.6

Apply for a tax debt settlement.

You could apply for something called an offer in compromise, or OIC. This lets you settle your tax debt for less than you actually owe. When you apply for an OIC, you’re basically offering the IRS an amount you can pay right now, hoping they’ll accept the lower amount and settle your tax debt.

Before accepting it, the IRS will look at your ability to pay, your income, your expenses and how much your stuff is worth to decide if your offer really is all they’ll be able to get from you.

But don’t get your hopes up. The odds of qualifying for an offer in compromise are pretty low. Applications for tax debt settlements are rarely approved, and you usually have to be in a really bad financial situation for the IRS to accept your offer. To see if you might qualify, try the IRS’s offer in compromise pre-qualifier tool.7

Step 5: Correct the problem so you don’t have an unaffordable tax bill again.

Work with a tax expert you can trust to make sure you’re not stuck with taxes you can’t afford again. That may mean setting aside profits from a side business, making quarterly tax payments, or adjusting how much you withhold from your paycheck for taxes. Whatever the issue, a tax pro will be able to spot the problem and help you fix it going forward.

To save time and hassle, make sure you gather the right paperwork the first time around. Not sure what kind of paperwork you need? Download our free Tax Prep Checklist.

April N. underestimated her income and ended up owing a couple thousand dollars at the end of the year.

“I messed up last year by not setting aside taxes for my second job or home business,” she said.

Not wanting to face the same situation the following year, she enlisted the help of a tax expert who set her up with the right tax plan.

“Now I have a CPA to help organize quarterly payments for this year so it won't happen again!” she said.

What Happens if You Don't File Your Taxes?

You’re playing with fire if you don’t file a tax return when you owe taxes. It’s not just irresponsible. It’s illegal. And the IRS will penalize you.

The failure-to-file penalty is 5% of the total of your unpaid taxes for each month your taxes are late. After five months, the penalty tops out at 25% of your tax bill. Oh yeah, and the IRS also tacks on interest on top of penalties.8

According to the IRS, failing to file a return could land you in jail for up to a year for every year you fail to file, cost you a maximum fine of $25,000, or both.9 But the IRS will usually look for other ways to resolve an issue with a taxpayer before putting them behind bars.

Filing Your Taxes Late

So, when it comes to filing your taxes, the old saying holds true—better late than never! You’ll be in a much better spot with the IRS if you just go ahead and file your tax return, even if you don’t have the money to pay your bill. Don’t wait for the IRS to catch you. Once you file, you’ll also get a break on penalties and interest.

Can You Go to Jail for Not Paying Your Taxes?

Okay, we’re not living in the time of Charles Dickens anymore. You can’t go to debtors’ prison—yeah, that was a real thing—for not paying your taxes. (The United States actually outlawed debtors’ prisons back in 1833.)10

But if you have a tax bill and aren’t making an effort to pay it (dumb move), the IRS can take several of what they call enforcement actions. Like we talked about earlier, they might do some combination of the following:

- Garnish your wages (have your employer withhold a portion of your paycheck until the debt is paid)

- Levy your bank account (take money out of your account without your permission)

- Put a lien on your property (the government could say they have a legal claim on your home until the debt is paid off)

- Seize your assets

Now, here’s the thing—if you purposely hide large sources of income or don’t file a return to avoid paying taxes, you’ll be guilty of tax fraud (or tax evasion). And yes, that could land you in jail, depending on how severe the crime is.

So, just . . . don’t do that.

Take a Deep Breath—You Can Do This

Feeling a little better now? As you can see, if you can’t pay your taxes, you’ve got options (and jail isn’t one of them). So chill out, review your choices, and act. Like we said, you can climb out of even the deepest tax hole if you tackle it head on. Now go handle it like a pro and get back to living your life.

Next Steps

- Do you owe Uncle Sam and you’re not sure why? Here are some common reasons why you might owe the IRS a chunk of cash.

- But if you find yourself in a tax mess, you don’t have to clear it up alone. Get in touch with a RamseyTrusted® tax pro who can help you get the IRS off your back. These agents know their stuff, and that’s why we trust them to help you.

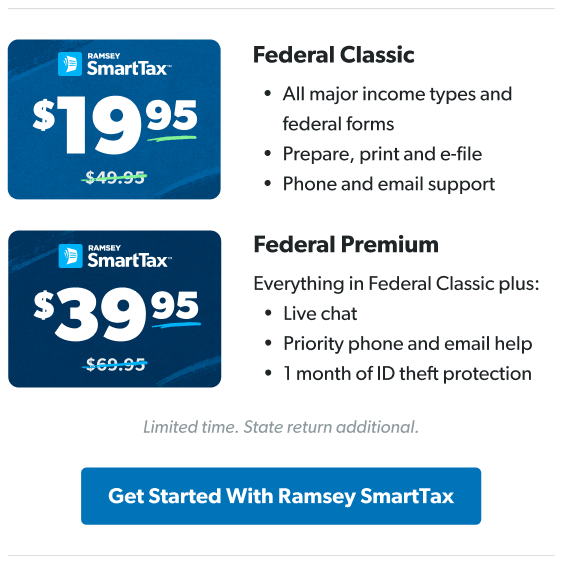

- If you’re confident you can handle your taxes on your own and just want easy-to-use tax software, check out Ramsey SmartTax.