Key Takeaways

- Maxing out your 401(k) contributions can help you build a solid nest egg for retirement, help your investments grow faster, and allow you to enjoy more of the tax benefits that come with your workplace retirement plan.

- The IRS sets contribution limits to determine how much you're allowed to invest in your 401(k) each year. For 2025, you can invest up to $23,500 in your workplace retirement plan (there are additional "catch-up contributions" for everyone age 50 and older).

- However, maxing out 401(k) contributions might not be for everyone. You should only consider maxing out your contributions if you're completely debt-free, you're a high-income earner, or if you need to catch up on your retirement savings.

- If you’re still thinking about maxing out your 401(k) and have questions about the impact it’ll have on your finances, nest egg and tax situation, reach out to an investment professional for help.

We all know that person who does everything to the max. When he goes to a restaurant, he orders the most expensive item on the menu. When she goes on vacation, she books the fanciest hotel she can find. There’s no going halfway!

Market chaos, inflation, your future—work with a pro to navigate this stuff.

What if you took that all-in approach to your retirement savings? Is it worth it or even realistic to max out your 401(k) each year?

The truth is, maxing out contributions to a 401(k) plan isn’t the right choice for everyone. But if you’re at a point in your financial journey where you can invest more money toward retirement, it could be a game changer.

How Does a 401(k) Work?

Okay, here’s a quick rundown: 401(k)s are employer-sponsored retirement plans that make it easier for employees to save for retirement. They’re a great option because they come with special tax advantages, and most employers offer a company match on your contributions (which is free money).

Generally, there are two types of 401(k) plans out there: traditional and Roth.

Traditional 401(k)

When you put money in a traditional 401(k), those contributions lower your taxable income for the year—which means you’ll pay less in taxes that year. But there’s a catch: You’ll have to pay taxes on your withdrawals when you take your money out in retirement. Basically, you’re kicking your tax bill down the road.

Roth 401(k)

Roth 401(k)s are a different beast altogether—when it comes to taxes anyway. You won’t get a tax break on your contributions to the account because you’re funding the account with after-tax dollars, which means the money you put in has already been taxed.

But then you get something more valuable in return: Your investments grow tax-free, and you won’t pay any taxes on your withdrawals in retirement.

Side note: If you have a company match, your employer’s contributions go into a separate pretax account. That means you’ll pay taxes on the money and its growth when you take the money out in retirement. If you want tax-free growth and withdrawals on that money too, you’ll need to do an in-plan Roth rollover each year and pay taxes on whatever amount you transfer.

Invest Like No One Else

From investing advice to wealth management, find a SmartVestor Pro who speaks your language.

Ramsey Solutions is a paid, non-client promoter of participating pros.

How Much Would It Take to Max Out My 401(k)?

For 2025, you can invest up to $23,500 in your workplace retirement plan. That means you need to contribute $1,958.33 from your paychecks each month to max out your 401(k). If you’re over 50 years old and need to play catch-up, you get to save an extra $7,500 (for a total of $31,000). And if you’re between ages 60 and 63 and still need to get back on track, you get an even higher catch-up contribution limit of $11,250 (for a total of $34,750).1

If that sounds like a lot, that’s because it is a lot! Let’s be clear: You don’t have to max out your 401(k) to build a solid nest egg. Later in the article, we’ll talk about when it makes sense to max out your 401(k)—and when it doesn’t. For now, you may be wondering why you should even consider it.

What Are the Benefits of Maxing Out My 401(k)?

Maxing out your 401(k) has some pretty clear benefits—especially if you want to grow your nest egg faster or if you’ve fallen behind on your retirement savings goals.

You’ll Have More Money Saved for Retirement

It goes without saying: You’ve got to save money for retirement to have money for retirement. And the more you save, the more likely you are to have enough money to retire with dignity and even leave a lasting legacy for your family.

So, maxing out your 401(k) contributions is a Shaquille O’Neal-level slam dunk that can help you build a massive nest egg over time.

You’ll See Your Investments Grow Faster

Investors love talking about compound interest, which is the money your money makes when you invest it. And when you max out your 401(k), you’re basically pouring gasoline on a potential explosion of compound growth for your investments.

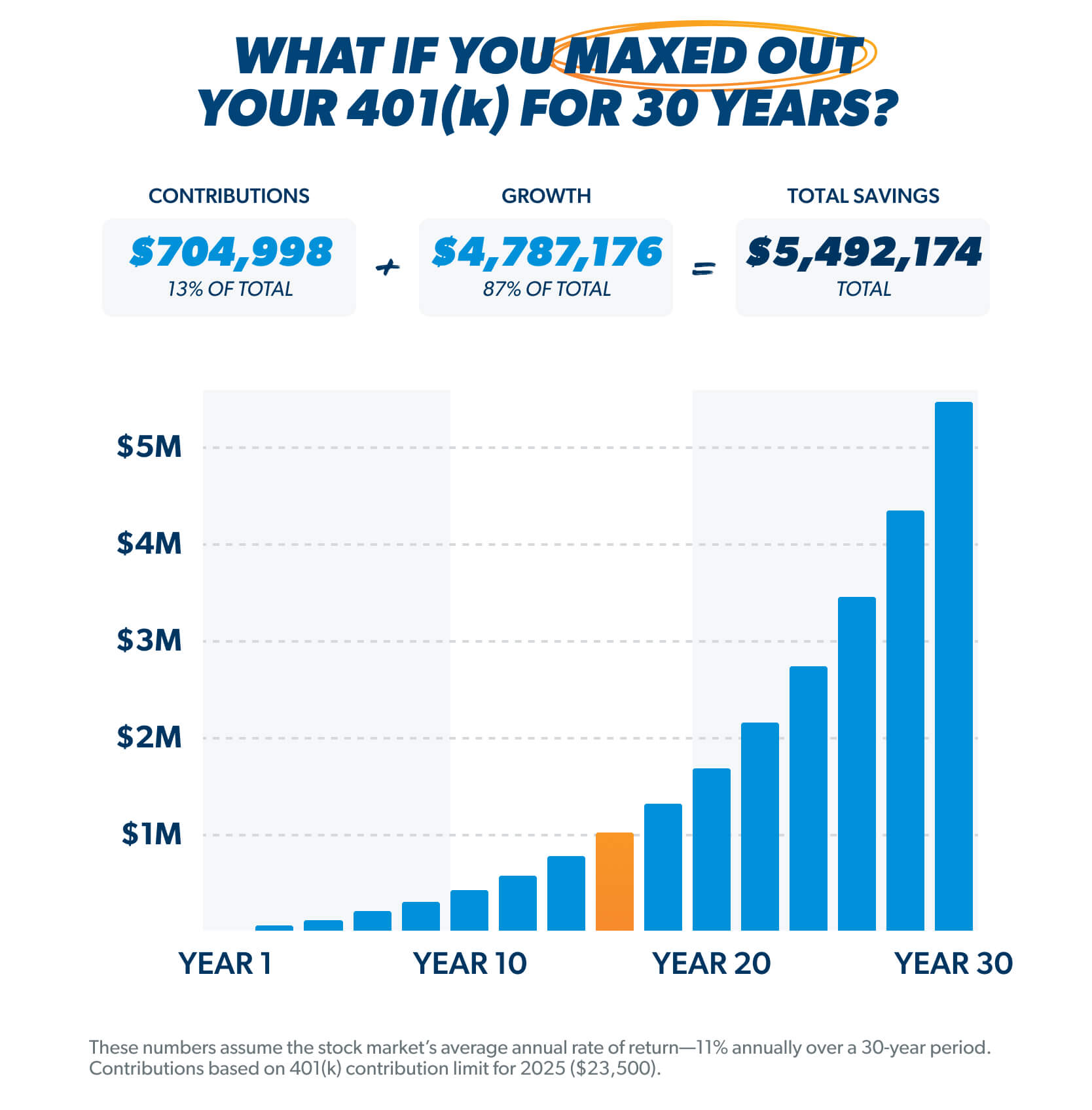

Assuming the stock market’s average annual rate of return (11%), you could have more than $5.4 million in your 401(k) if you max out your contributions every year from age 30 to 60.2 And the vast majority of that money ($4.7 million) would be compound growth. Boom!

You’ll Enjoy More Tax Benefits

If you have a traditional 401(k) at work, the money you put into it lowers how much of your income gets taxed for the year and potentially puts you in a lower tax bracket. That means the more money you put in your IRA, the lower your tax bill will be when you sit down to do your taxes next year. Score! (Just remember that the investments in your 401(k) will grow tax-deferred, so you’ll have to pay taxes when you withdraw those funds in retirement.)

Now, maxing out your 401(k) is great, but what would happen if you maxed out a Roth 401(k) instead? In that case, all the money you contribute gets to grow tax-free and you won’t pay any taxes on your withdrawals in retirement.

You’ll set yourself up for a great retirement with either option. But if you have the choice between a traditional or Roth 401(k), we’ll tell you to go with the Roth every time. That’s because those tax-free withdrawals will make your retirement savings go even further.

But before you start thinking about maxing out your 401(k) contributions, your first goal is to invest 15% of your income. Here’s how we recommend figuring out where to invest for retirement based on the type of 401(k) you have:

- If you have a traditional 401(k): First, invest up to the employer match—that’s free money. Then, open a Roth IRA—that stands for individual retirement account—and max out your contributions there. (The great thing about the Roth IRA is that it allows you to take advantage of tax-free growth and withdrawals in retirement, but the downside is that it has lower contribution limits.) If you still haven’t reached 15%, go back to your 401(k) and bump up your contributions until you do.

- If you have a Roth 401(k): If your plan offers a Roth option with good growth stock mutual fund to choose from, you can invest your entire 15% in your employer plan. If your options aren’t great, follow the steps above.

When Does It Make Sense to Max Out My 401(k)?

There’s a time and a place for everything, and that applies to maxing out your 401(k) too. Based on Ramsey’s 7 Baby Steps—the financial plan that’s helped millions of families get out of debt and build real wealth—there are three scenarios where it makes sense to contribute all you can to your workplace retirement plan. Let’s walk through each one together.

1. You’re Completely Debt-Free

No matter how gung ho you are about investing for retirement, you should wait to max out your 401(k) until you’re completely out of debt—which means you have zero consumer debt and a paid-for house (that’s what we call Baby Step 7).

When you don’t have any debt payments or mortgage payments, that frees up hundreds (or even thousands) of your hard-earned dollars for investing. And at that point, you can use more of your income than ever before to max out all your retirement plans, pile up cash, and be outrageously generous.

2. You’re a High-Income Earner

The more money you make, the more you can invest in your 401(k). Pretty straightforward, right?

We recommend investing 15% of your gross income in retirement (that’s Baby Step 4, by the way). So if you’re 100% debt-free and have an annual salary of around $156,600 or more, you could max out your 401(k) simply by investing your entire 15% through your workplace retirement plan.

And like we mentioned earlier, don’t forget to take advantage of an individual retirement account (IRA) in addition to your 401(k). If you’re a high-income earner, chances are you won’t be able to contribute to a Roth IRA because of the IRS income limits on those accounts. But you could still invest with a traditional IRA, which has no income limits.

Remember, in a traditional IRA, your contributions grow tax deferred (meaning you have to pay taxes when you start withdrawing the money). But there’s a way to move that money into a Roth IRA with something called a backdoor Roth IRA (it sounds sketchy, but don’t worry—it’s completely legal). Just remember, you’ll have to pay taxes on your contributions when you move them over.

3. You Need to Catch Up on Your Retirement Savings

According to Ramsey Solutions’ State of Personal Finance study, most Americans (61%) don’t feel like they’re making meaningful progress with their retirement savings goals. If that’s you, there’s still time to get back in the game.

Again, as long as you’re completely debt-free (including no house payment) and have a fully funded emergency fund, you should throw as much money toward retirement savings as you can. Look for expenses you can cut from your budget or opportunities to boost your income so you can reach your savings goal faster.

The more money you can invest in your 401(k), the faster you can catch up on your retirement savings.

When Should I Avoid Maxing Out My 401(k)?

Maxing out your 401(k) is a good goal to have, but it’s very possible that now isn’t the right time for you (and that’s okay!). Here are some situations where it doesn’t make sense to push your 401(k) contributions to the limit:

1. You’re Still Getting Out of Debt

Your income is your most powerful wealth-building tool, but you can’t fully unlock its potential if you still have credit cards, student loans and car loans dragging you down. That’s why your first priority is to get out of debt—fast!

At this point, don’t even think about maxing out your 401(k). In fact, stop all your investing until you get debt out of your life for good. Use the debt snowball method to pay off your debts from smallest to largest. That’s your main focus right now.

2. You Don’t Have Money Saved for Emergencies

When you don’t have enough cash on hand, even the smallest emergency can turn into a major crisis. And as a result, some folks resort to taking money from their 401(k)s to cover the costs.

Not long ago, a record number of Americans raided their 401(k) plans for hardship withdrawals, which allow people who are short on cash to take money out of their retirement plans to handle certain kinds of emergencies—think medical expenses or payments to avoid eviction.3

Taking money out of your 401(k) is a massive mistake. Not only will you pay whatever taxes and penalties you owe on the funds you withdraw, but you’re potentially sacrificing hundreds of thousands of dollars of future growth in the process.

Don’t put yourself in that situation! Before you invest, get a fully funded emergency fund in place—that’s 3–6 months of expenses stashed in a high-yield savings account or money market account. That way, you won’t have to sacrifice your future to stay afloat in the present when a real emergency pops up.

3. You’re Saving for Other Financial Goals

If you decide to max out your 401(k), you’re making a choice not to use that money until you retire. Because if you take money out before age 59 1/2, you’ll have to pay early withdrawal penalties and any taxes you owe on the money you withdraw.4 Your 401(k) is your nest egg, not a piggy bank.

That’s why we recommend saving 15% for retirement when you’re ready to start investing. You need to keep some room in your budget for other important financial goals, like saving for your kids’ college fund (Baby Step 5) and paying off your house early (Baby Step 6).

Once there’s enough money set aside for Junior’s college education and you send your last mortgage payment to the bank, then you can start thinking about maxing out your 401(k).

Next Steps

- Ready to dive deeper into the world of investing? Ramsey’s Complete Guide to Investing will show you how to grow your wealth and leave a legacy for those you care about.

- One of the most important factors for retirement success is your savings rate—how much you’re saving for retirement. Our Retirement Calculator can help you figure out whether or not you’re saving enough.

- If you’re ready to start investing, our SmartVestor program will connect you with investment professionals in your area who can help you create a plan to save and invest for retirement.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.