What Is a Roth Conversion? And How Does It Work?

15 Min Read | May 8, 2025

You may already know about the tax advantages of investing for retirement with a Roth retirement account. Tax-free growth and tax-free withdrawals in retirement? Sign us up for that every time!

And if your money gets to grow from the start in a Roth account, all the better. But you may say, My retirement savings started out in a regular 401(k), 403(b) or IRA—can I still take advantage of a Roth?

Well, friend, you need to hear about the Roth conversion. Let's dive in!

What Is a Roth Conversion?

Basically, a Roth conversion is just the process of transferring funds from a traditional retirement account, like a traditional 401(k) or IRA, into a Roth account.

What Are the Benefits of a Roth Conversion?

The main reason you’d do a Roth conversion is so you can enjoy the tax advantages of a Roth IRA or Roth 401(k). Of course, you’ll have to pay whatever taxes you owe on the money you’re converting to get those benefits . . . but under the right circumstances (more on that later), a Roth conversion could give your retirement savings a major boost over the long run.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Here are three main benefits that come with a Roth conversion:

1. Tax-Free Growth on Your Retirement Savings

After a Roth conversion, all of your investment growth will be shielded from taxes inside of the Roth account. That means you won’t have to pay a single cent in taxes on the money you make from your investments.

This is a huge deal! If you let your investments grow over several decades, that could lead to tens of thousands of dollars in tax savings.

2. No Taxes on Your Withdrawals in Retirement

When you invest for retirement with a traditional retirement account, you’re investing with pretax dollars. Translation? You don’t pay taxes on the money you put in—at least, not yet.

Instead, you get a tax break now (in the form a tax deduction), but you’ll pay taxes on the growth and withdrawals in retirement later (when you hear someone say tax-deferred growth, that’s what that means).

If that doesn’t sound great to you, then a Roth conversion solves that problem. Once you convert your traditional, tax-deferred retirement savings to a Roth account, you’ll pay your taxes now so you can enjoy tax-free withdrawals in retirement!

3. More Control Over Your Retirement Withdrawals

Remember, the money inside your traditional IRA or 401(k) hasn’t been taxed yet. But at some point, Uncle Sam is going to want his cut . . . that’s where required minimum distributions (RMDs) come in.

If you have a traditional IRA or 401(k), you’ll be forced to start taking money out of your account once you reach age 73 (if you reach age 72 after December 31, 2022).1 Ready or not, you’ll have to start paying taxes once those RMDs kick in.

Roth IRAs and Roth 401(k)s don’t have RMDs—which means you get to decide how and when you take money out of your account in retirement after a Roth conversion.

What Are the Tax Implications of a Roth Conversion?

So, when you convert money from a traditional account to a Roth account, you’ll have to pay taxes on all the funds you’re moving into the Roth account . . . but then you get to enjoy those sweet tax advantages we just talked about.

It’ll feel like ripping off a Band-Aid—painful at first, but then you won’t have to worry about taxes on that money ever again. Here’s an example to show you just how powerful a Roth conversion can be in the long run:

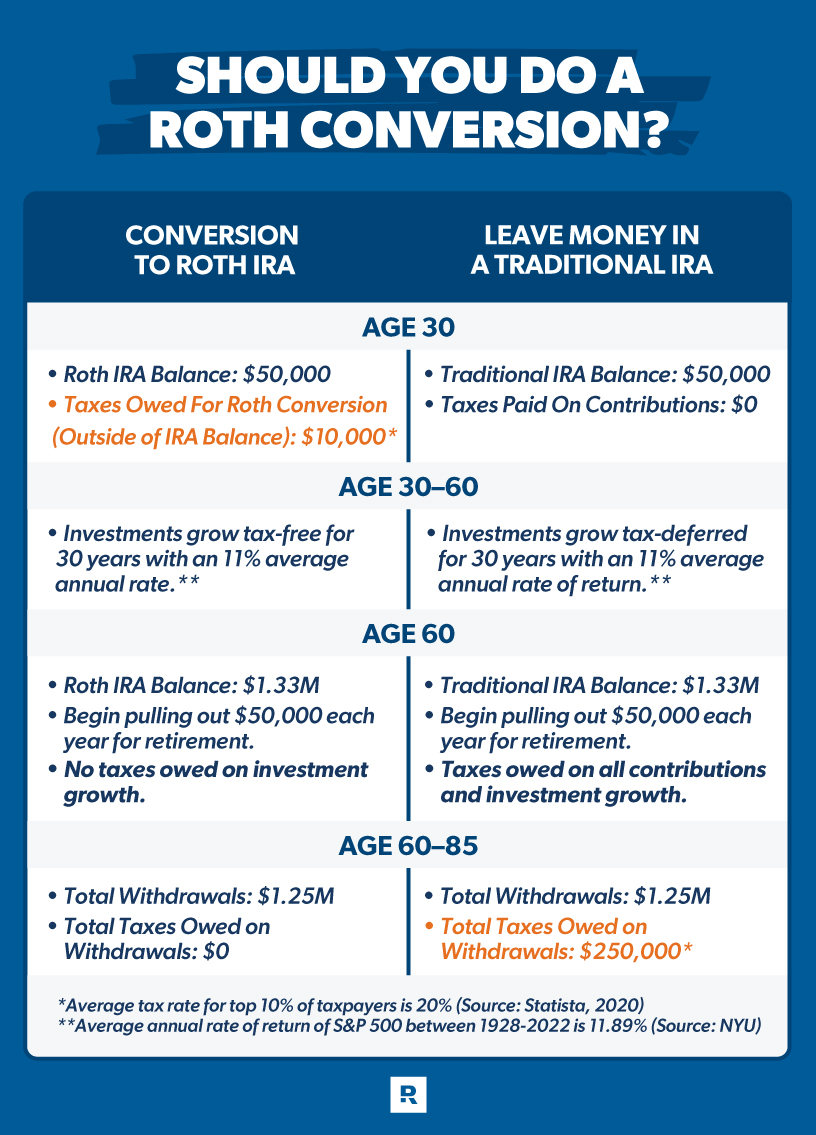

Let’s say you’re 30 years old and you have $50,000 sitting in a traditional IRA. Now you’re trying to decide whether to convert that money to a Roth IRA or leave it in the traditional IRA.

Currently, the average income tax rate for the top 10% of taxpayers in the U.S. is roughly 20% (to keep things simple, let’s say that average tax rate will stay the same in the future).2

If you want to transfer those pretax retirement funds into a Roth IRA all at once, you’re probably going to pay $10,000 in taxes to do so (and you should pay that tax bill with money from outside of the traditional IRA . . . more on that later).

But then that $50,000 can grow tax-free inside of a Roth IRA and you won’t pay taxes on any of that investment growth when you take it out in retirement. The average annual rate of return of the stock market is between 10–12%.3 So if you don’t invest a single dollar more, that $50,000 will grow by more than $1.2 million over the next 30 years . . . and you won’t pay taxes on any of it.

What if you choose to leave that $50,000 in a traditional IRA instead? Well, then you’ll have to pay taxes on the original $50,000 and all the investment growth when you take money out in retirement.

So, if you retire at age 60 and started taking $50,000 each year for the next 25 years out of your traditional IRA, you’ll likely end up paying around $250,000 in taxes total over that period of time.

That $10,000 you paid to do a Roth conversion 30 years ago looks pretty good right about now, doesn’t it?

How Many Ways Can You Do a Roth Conversion?

Depending on what situation you find yourself in, there are several ways a Roth conversion could work for you! You can do a Roth conversion in one of three ways.

In-Plan Rollovers: Traditional 401(k) to Roth 401(k)

The first can be done when you move your money from a traditional employer-sponsored plan—think 401(k) or 403(b)—to a Roth employer-sponsored plan. In this scenario, the money stays in the employer-sponsored plan, but converts from a traditional option to the Roth.

This can happen when your employer adds a Roth option to their workplace retirement plan. If they do that, you should seriously consider a conversion only if you can afford to pay the taxes—more on that in a minute.

What if you’re already investing with a Roth 401(k) at work? Your contributions are going in with after-tax dollars, so you’re all set there . . . but your employer’s matching contributions are a different story. Those matching funds have to go into a separate pretax account.4

That means if you want to enjoy tax-free growth and withdrawals in retirement on your matching contributions, you’ll need to roll those funds into the Roth side of your account with an in-plan rollover.

401(k) Rollover: Traditional 401(k) to Roth IRA

Do you have money sitting in a traditional 401(k) you had at your old job and you’re not quite sure what to do with it? Then the 401(k) rollover is for you!

This happens when you convert the funds from a traditional employer-sponsored plan to a Roth IRA. You’re moving your money out of the employer-sponsored plan to a personal Roth where you decide where to invest the money—with the help of an investment pro.

Side note: If you have a large amount to convert and the idea of paying thousands of dollars in taxes makes you break into a cold sweat, then you could always roll the funds into a traditional IRA instead. That way, you’ll still have more control over your retirement investments and you won’t owe any taxes on the money you transfer.

Backdoor Roth IRA: Traditional IRA to Roth IRA

The third option is moving money from a traditional IRA to a Roth IRA. This is a great option for folks who can't contribute to a Roth IRA because their income exceeds the limits set by the IRS, which are $240,000 for couples and $161,000 for singles in 2024.5 They can get around these limits by converting a traditional IRA into a Roth IRA in stages. This process is known as a backdoor Roth—and don’t worry, it’s completely legal.

But there’s one catch. Remember, when you put money into your traditional employer-sponsored plan or a traditional IRA, you used pretax dollars. That means you haven’t paid taxes on that money yet. So, when you transfer that pretax money into a Roth employer-based plan or IRA, which is funded with after-tax dollars, you’ll have to go ahead and pay taxes on that money now.

When Does a Roth Conversion Make Sense?

Paying the taxes up front for a Roth conversion—if you can afford it—so you can take the money out tax-free in retirement is one of those times when paying a little now can save you a bundle later.

But don’t get all gung ho just yet! A Roth conversion isn’t for everyone. It could be the right call for you if:

Your timeline to retirement is more than five years.

The money you convert into a Roth IRA must stay in the account for a five-year period.6 If you withdraw money before the five years are up, you may pay a 10% penalty and additional income taxes.

And regardless, the more time your money has to keep growing tax-free after the conversion, the better. It makes no sense to do a Roth conversion if you’re just going to take the money out in a few months.

You can pay the taxes on a Roth conversion with cash on hand.

You should only do a Roth conversion if you have money in the bank to pay for the taxes you’d owe on the money you’re transferring over. Whatever you do, you should never take money out of your retirement account to make a Roth conversion happen. That’s just stupid!

It’s so important that we're going to say it again: You must be able to afford to pay the tax bill with cash for a conversion. If you can’t do that, don’t do the conversion. Get it? Got it? Good.

And remember. you don’t have to convert all your traditional retirement funds at once! You could convert some of your traditional retirement funds this year—whatever amount you can afford to pay taxes on with savings or by cash flowing it—and then convert the rest later.

You’re completely out of debt (including your mortgage).

If you don’t have any debt whatsoever—that means no credit cards, no student loans, and no mortgage—congratulations! That means you are on Baby Step 7, and you’re probably in a position to make financial moves that can help you make some headway on your retirement goals, including a Roth conversion.

Not having to send hundreds or even thousands of dollars in payments every month to a bank or mortgage lender gives you the kind of flexibility that makes it easier to cash flow or set aside the cash you need to pay a potentially large tax bill after a Roth conversion.

No matter where you stand financially, a Roth conversion is a big financial move that could have a serious impact on your tax situation and investing strategy. That’s why you should always talk to a financial advisor before you get the ball rolling on yours.

How to Do a Roth Conversion

We’ve talked about what a Roth conversion is, the different ways you can convert your money from a traditional account to a Roth, and when it makes sense to go through with the process.

Now it’s time to walk you through how to do a Roth conversion in a few simple steps! Here’s what you need to do:

1. Make sure you’re financially ready to do a Roth conversion.

Remember, that means you’re not planning to take money out of your retirement accounts for at least five years, you have the cash on hand to pay the taxes after the conversion, and you have no debt.

2. Decide how much money you want to convert to a Roth.

Like we mentioned, if the thought of adding thousands of dollars to your tax bill this year sounds like way too much to handle, you don't have to convert your entire nest egg all at once. In fact, you could spread the conversion over several years, breaking down your tax obligation into manageable, bite-sized chunks.

3. Estimate how much you’ll owe in taxes after the conversion.

There’s only one thing worse than math, and that’s tax math. But it has to be done. Before you go through with a Roth conversion, you’ll need to calculate the taxes you’ll owe on the converted amount. Once you have that amount figured out, make sure you set aside the money to cover the tax bill.

Here’s a warning: The amount you convert will be added to your taxable income for the year, so your Roth conversion might bump you into a higher tax bracket. That’s why it’s a good idea to get on the phone with your tax professional and have them walk you through the tax implications of your Roth conversion.

4. Start the Roth conversion process.

If you’ve checked off the boxes for Steps 1–3, it’s time to get the ball rolling on your Roth conversion! (Note: You could do Steps 4 and 5 yourself, but we recommend you work with an investment professional who can walk through the steps with you and make sure it’s done right.)

Get in touch with your 401(k) administrator or the financial institution that handles your IRA and let them know you want to do a Roth conversion. They’ll let you know what paperwork you need to fill out and help you complete the conversion.

Just be prepared to give them the information they’ll need to complete the process, including account details, the amount you want to convert, and some other personal details.

5. Review and follow up on the Roth conversion process.

Once you’ve got all the paperwork ready to submit, double-check all the details before submitting it to make sure all the i’s are dotted and the t’s are crossed. You’ll also want to make sure the conversion amount and the account information you provided is all correct.

Once you submit that paperwork and give the thumbs up, keep track of the conversion process and confirm that it’s completed successfully—which means getting confirmation that the funds have been transferred to your Roth account from the financial institution managing that account.

6. Pay the tax bill.

Here’s the last (and most painful) step—giving Uncle Sam what he’s owed. It’s worth another reminder that you should never withhold taxes from the amount you’re converting to a Roth. Always pay the taxes separately when you file your tax return in the spring.

Roth Conversion Rules: What You Need to Know

Yes, there are some rules you need to follow if you decide to do a Roth conversion. If you don’t follow these rules, you could end up getting penalized by the IRS . . . so pay attention!

Direct Transfers and Indirect Transfers

There are basically two ways to transfer money from a traditional account to a Roth account. You can do a direct transfer or an indirect transfer. The differences between the two are very important, so let’s talk about it a little more.

With a direct transfer (sometimes called a trustee-to-trustee transfer), you tell the financial institution that holds your traditional retirement account to transfer the money directly to your Roth account . . . and that’s it, you’re done. This is the cleanest, simplest way to get a Roth conversion done.

An indirect transfer, on the other hand, complicates things more than a love triangle from one of your favorite daytime soap operas. With this method, you’ll receive a check with the funds you want to transfer from your traditional account and then deposit that money into a Roth account yourself.

Once you get that check, that money becomes a ticking time bomb. You have just 60 days to deposit those funds into your Roth account. If you miss that deadline . . . boom! You’ll have to pay a penalty on top of the taxes you already owe to convert the funds from a traditional to a Roth.7

The moral of the story? Keep it simple and complete your Roth conversion with a direct transfer.

Income Limits and Conversion Limits

While there are income limits on who can open a Roth IRA (and how much money you can invest in an IRA in a single year), Roth conversions are a different story altogether.

There’s no limit on how much money you can convert from a traditional retirement account to a Roth IRA in a single year. It also doesn’t matter what your income or tax filing status is, anybody and everybody can do a Roth conversion.

And here’s some more good news: There are no limits on how many Roth conversions you can make in a single year. Whether you want to convert all your traditional, tax-deferred savings in one large transfer or break them down into multiple Roth conversions throughout the year, you’re good to go either way.

Get With a SmartVestor Pro!

If you’re seriously thinking about moving some of your retirement funds, talk with a SmartVestor Pro. They’ll know what options you have based on your timeline to retirement, tax obligations, your future tax bracket, and anything else relevant to your situation. And they can walk you through it all.

Expand Your Investing Toolkit

Nobody retires well by accident. Access free calculators, guides and other resources that can help you invest like no one else.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.