Key Takeaways

- A savings account is a type of bank account (separate from a checking account) where you can earn a little bit of interest.

- A money market account is a type of savings account that usually pays a better interest rate than a regular savings account.

- Both money market accounts and savings accounts are good places to put your emergency fund or money for short-term savings goals.

- Where you should save your emergency fund comes down to accessibility, minimum balance requirements and interest rate.

Both money market accounts and savings accounts are great places to stockpile cash for emergencies or short-term savings goals.

Get expert money advice to reach your money goals faster!

But while they look the same on the surface, there are some key differences in how you use them. And it’s important to know the pros and cons of each—so you can figure out which savings account is best for you.

What’s the Difference Between a Money Market Account and a Savings Account?

A savings account is an account you can open with your local bank or credit union, separate from your checking account. It gives you a safe place to put your hard-earned money that you don’t plan on touching for a while, and it also usually earns a little bit of interest.

A money market account is a type of savings account that usually offers a higher interest rate and easier access to your money than a regular savings account. You can open a money market account with your local bank, an online bank or a credit union.

Quick note: Money market accounts are very different from money market fund accounts (sometimes called money market mutual funds). Money market funds are investments—which means they aren’t used to stash savings you might need for emergencies.

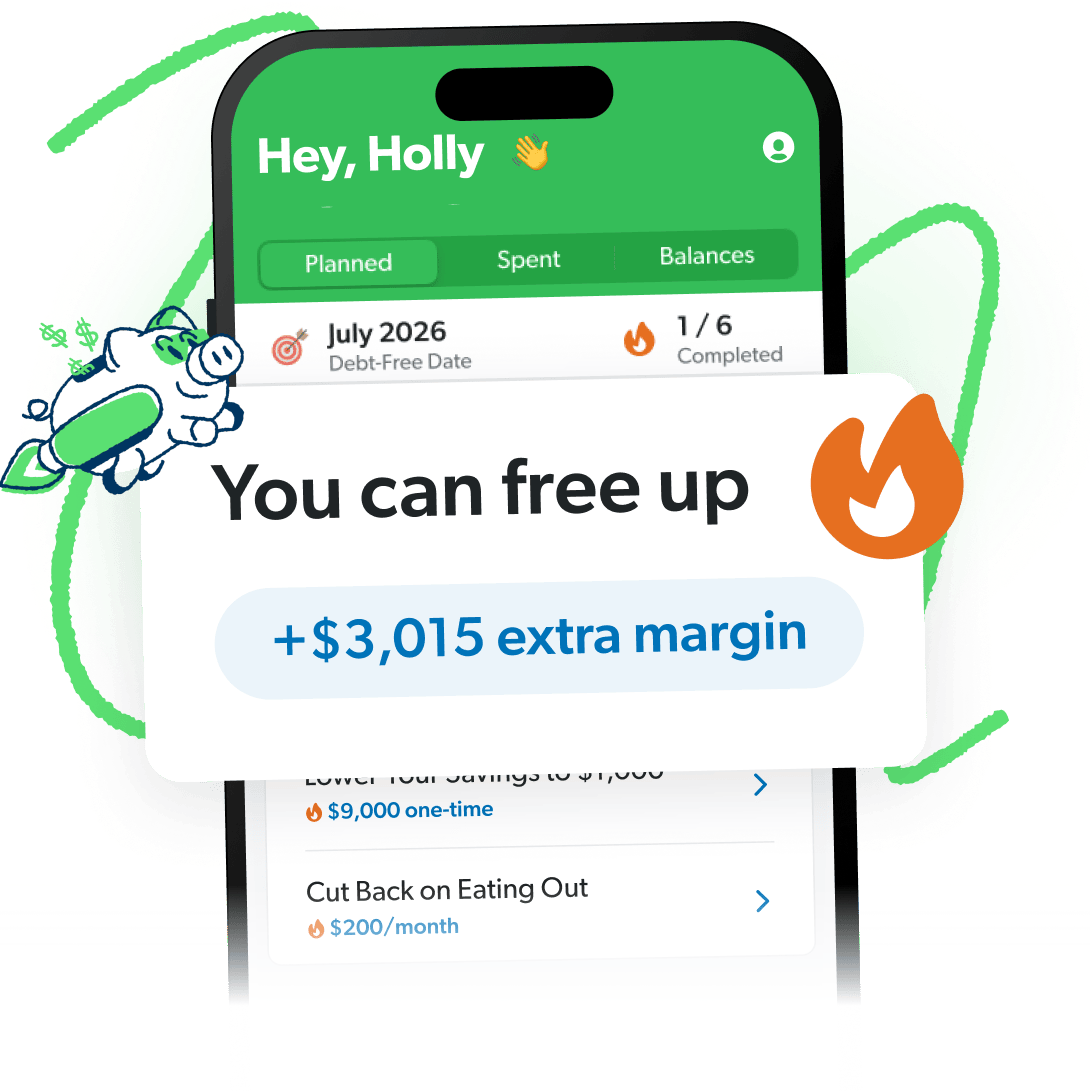

More Margin Means More Money in the Bank

In just minutes, the EveryDollar budgeting app helps you find margin you didn’t know you had—you’ll feel like you got an instant raise!

Money Market Account vs. Savings Account: Pros and Cons

As you can see, money market accounts and savings accounts are kind of like siblings. They’ve got similar DNA, but they look (and act) a little differently. That said, let’s compare some of the main features of these accounts a little more closely.

| Money Market | Savings Account | |

| Earns interest (variable) | ✅ | ✅ |

| Includes debit card and check-writing | ✅ | ❌ |

| Has ATM access | ✅ | ✅ |

| May have withdrawal/transfer limits | ✅ | ✅ |

| Requires minimum deposit and balance | ✅ | ❌ |

| Insured by FDIC or NCUA | ✅ | ✅ |

Accessibility

The biggest difference you’ll find between a money market account vs. a savings account is the access you have to your money.

A money market account (MMA) gives you the freedom and flexibility of writing checks and making withdrawals straight from your account. Many even come with a debit card.

On the flip side, a savings account is meant to be more stable for deposits—so usually no checks and no debit card (though some come with an ATM card). In most cases, if you want to spend out of your savings account, you’ll have to transfer the money to a different account first.

Sidenote: Some banks limit the amount of withdrawals or transfers out of both MMAs and savings accounts (usually six per month)—so don’t use these accounts for your everyday spending (that’s what your checking account is for!).

Interest

Both money market and savings accounts are interest-bearing—meaning you can earn interest on the amount you keep in the account (this is when interest is a good thing!). But how much you earn depends on your bank’s current interest rates.

Right now, the APY (annual percentage yield) of a traditional savings account is 0.46%.1 Money market accounts usually pay a little bit more interest with around 0.66% (though you may find some with higher rates).2 But there are also high-yield savings accounts that can earn you over 4% in interest (that’s 10 times more than the average!).

Keep in mind that most APYs for any kind of savings account are variable (meaning they can change). So do your research to see what the current interest rates are for each account.

And remember: You’re not trying to build wealth with these accounts (that’s what investing is for). MMAs and savings accounts are more like an insurance policy for emergencies—or for short-term goals, like a down payment on a house, a family vacation, a new car, or even next year’s Christmas fund.

Minimum Balance

With most money market accounts, you have to make an initial deposit to open the account (anywhere from $500 to $5,000). Plus, you usually have to keep a certain amount in your account to avoid paying a minimum balance fee.

On the other hand, banks usually don’t require a lot of money to open a savings account. You may have a minimum balance—which is okay because you should keep money in your savings anyway!

But since MMAs typically require a higher monthly balance than a savings account, which one you choose will depend on how much you have to put toward savings.

Protection

Both money market accounts and savings accounts protect you in case your bank goes under—this includes online banks (aka neobanks) and brick-and-mortar banks.

In fact, the Federal Deposit Insurance Corporation or the National Credit Union Administration will cover your deposits all the way up to $250,000. In other words, your savings are safe with either account.

Which Savings Account Should I Choose?

When deciding between a money market account vs. savings account, your choice really depends on accessibility, the minimum balance requirement, and the interest rate.

A regular ole savings account works best for storing your starter emergency fund—mostly because some money market accounts require a minimum deposit higher than $1,000. But where should you park the rest of your emergency fund or sinking funds for big purchases?

The most important thing is that you can get to your money when you need to—especially in case of an emergency. You don’t want to be scrambling to move cash around or waiting on transfers to go through if you need money ASAP. In that case, a money market account with a debit card will do great!

But if you don’t have enough to meet the initial deposit amount, a high-yield savings account could be your best option—even better if you find one with a solid interest rate. Most high-yield savings accounts are only available through an online bank, but they usually come with an ATM card to take out cash for emergencies.

Whatever account you choose to store your emergency fund, make sure:

- It’s easily accessible

- It’s FDIC- or NCUA-insured

- You have enough for the initial deposit

- There are no penalties to withdraw your money (that rules out CDs)

- You don’t have to pay monthly maintenance fees (or any other fees)

And hey, if you want to split up your savings into both a money market account and a high-yield savings account so some of your money is easier to get to while some earns you more interest, that’s okay too!

Bottom line: Those dollars won’t save themselves. So if you want to stop cringing when you check your bank account, you need a budget. You need EveryDollar.

Our budgeting app does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.

Next Steps

- Open a money market account or savings account with a bank or credit union.

- Start saving and keep track of your savings goals with the EveryDollar budgeting app.

- Learn how to save wisely and build wealth with Financial Peace University (FPU).