Key Takeaways

- A tax bracket is a range of income that’s taxed at a specific rate, while a tax rate is the percentage of tax you pay on any income inside a given bracket.

- For 2025 and 2026, there are seven different tax brackets, each with its own tax rate. Every tax bracket (or range of income) is assigned a specific tax rate based on your tax filing status.

- Knowing what tax bracket you’re in will help you figure out how much you’ll owe in federal income tax.

- Your marginal tax rate is simply the top bracket your level of income slots into, while your effective tax rate is the actual percentage of your taxable income that you owe the federal government.

If there’s one topic we doubt you were planning to bring up at your next dinner party, it’s federal income taxes. Talk about a buzzkill—no one likes to think about taxes (especially at parties). But if you want to keep Uncle Sam off your back, you’re going to need to know how much he expects you to shell out this tax season—and that means you need to at least start thinking about this stuff.

Get expert money advice to reach your money goals faster!

Federal tax brackets and tax rates change depending on the year and the law, and if you’re like most people (read: normal), you probably don’t follow tax news too closely until you have to. So, let’s dive right in and take a gander at your federal income tax brackets and tax rates for 2025 and 2026.

Tax Brackets vs. Tax Rates

As with most things involving the federal government, taxes tend to be more confusing than they need to be. The IRS uses fancy terms like tax brackets and ordinary income tax rates, but all they’re interested in is how much money you earned and how much money you owe them in taxes. Here’s what they mean by tax brackets and tax rates:

- A tax bracket is a range of income that’s taxed at a specific rate.

- A tax rate is the percentage of tax you pay on any income inside a given bracket.

For 2025 and 2026, there are seven different tax brackets, each with its own tax rate. Every tax bracket (or range of income) is assigned a specific tax rate based on your tax filing status (single or married filing jointly, for example) to help you figure out how much you’ll owe in federal income tax.

Federal Income Tax Rates and Brackets for 2025 and 2026

We get it—taxes are an unpleasant business. But don’t forget inflation, which is busy making everything more expensive. You probably had to make some adjustments to your budget and spending habits this year as a result. On the bright side, the IRS also adjusted income limits in every tax bracket to account for inflation (they’re trying to be helpful).

In the tables below, you can find out which tax bracket you land in based on your taxable income and your filing status in 2025 and 2026.

2025 Federal Income Tax Brackets and Rates for Taxable Income

|

Tax Rate |

Single Filer |

Married Filing Jointly |

Married Filing Separately |

Head of Household |

|

10% |

$0–11,925 |

$0–23,850 |

$0–11,925 |

$0–17,000 |

|

12% |

$11,925–48,475 |

$23,850–96,950 |

$11,925–48,475 |

$17,000 –64,850 |

|

22% |

$48,475–103,350 |

$96,950–206,700 |

$48,475–103,350 |

$64,850–103,350 |

|

24% |

$103,350–197,300 |

$206,700–394,600 |

$103,350–197,300 |

$103,350–197,300 |

|

32% |

$197,300–250,525 |

$394,600–501,050 |

$197,300–250,525 |

$197,300–250,500 |

|

35% |

$250,525–626,350 |

$501,050–751,600 |

$250,525–375,800 |

$250,500–626,350 |

|

37% |

Over $626,350 |

Over $751,600 |

Over $375,800 |

Over $626,3501 |

2026 Federal Income Tax Brackets and Rates for Taxable Income

|

Tax Rate |

Single Filer |

Married Filing Jointly |

Married Filing Separately |

Head of Household |

|

10% |

0–$12,400 |

0–$24,800 |

0–$12,400 |

0–$17,700 |

|

12% |

$12,400–$50,400 |

$24,800–$100,800 |

$12,400–$50,400 |

$17,700–$67,450 |

|

22% |

$50,400–$105,700 |

$100,800–$211,400 |

$50,400–$105,700 |

$67,450–$105,700 |

|

24% |

$105,700–$201,775 |

$211,400–$403,550 |

$105,700–$201,775 |

$105,700–$201,750 |

|

32% |

$201,775–$256,225 |

$403,550–$512,450 |

$201,775–$256,225 |

$201,750–$256,200 |

|

35% |

$256,225–$640,600 |

$512,450–$768,700 |

$256,225–$384,350 |

$256,200–$640,600 |

|

37% |

Over $640,600 |

Over $768,700 |

Over $384,350 |

Over $640,6002 |

How Do Federal Income Tax Rates Work?

Here in the U.S., we have what’s called a progressive tax system. Basically, that means the more money you earn, the more tax you pay.

So, how do you know what rate you’ll be taxed at? This is where those tax brackets we talked about earlier come in.

First, you need to know your taxable income. This is your income after you’ve subtracted any deductions, which lower the amount of your income that’s subject to taxes (that’s a good thing). Once you have that number, find which income range (or bracket) you fall into.

Now, here’s the good news: You don’t have to pay that tax rate on every dollar you earn! Your taxable income gets split up into the brackets, and only the income that falls into each range is taxed at that rate. For example:

Let’s say you’re a single filer for tax year 2025 and your taxable income was $50,000:

- You’ll pay 10% on the first $11,925 you make.

- Then you’ll pay 12% on everything you make from $11,925–48,475.

- Then you’ll pay 22% on everything you make from $48,475–50,000.

The good news is, whatever bracket you find yourself in, you don’t have to pay that percentage on every dollar you earn—just the portion that lands inside that range.

To see what the cost is in real life, let’s take a look at your federal income taxes through two different lenses: marginal tax rates and effective tax rates.

What Is a Marginal Tax Rate?

Very few taxpayers have just one tax rate (most people have three or four).

Like we said, you pay income taxes based on each chunk of your income that fits inside each bracket. Your marginal tax rate is simply the top bracket your level of income slots into. So if you’re single and your taxable income is $50,000, your marginal tax rate is 22%.

Tax rates go up as your income goes up, all the way to the top marginal rate of 37% for anything over $626,350 in 2025.3

What Is My Effective Tax Rate?

Now, even though it’s the government’s specialty to complicate everything it touches, there is a way to simplify your life when it comes to understanding your federal taxes. You can do this—and gain a solid understanding of what you’re actually paying Uncle Sam—by finding your effective tax rate, which is the actual percentage of your taxable income that you owe the federal government in taxes this year. (It’s easy math—don’t worry.)

Once you know what you owe in taxes (your total tax liability) based on all those tax brackets your income fits into, you can find your effective tax rate by simply dividing the amount of tax you owe by your taxable income (your income after any deductions you claim on your tax return).

Let’s say you’re married and filing jointly in 2025 with an income of $225,000, which means you have a marginal tax rate of 24%. Here’s what your tax bill might look like:

- $2,385 in the 10% bracket (up to $23,850)

- $8,772 in the 12% bracket ($23,850–96,950)

- $24,145 in the 22% bracket ($96,950–206,700)

- $4,392 in the 24% bracket ($206,700–225,000)4

Add up all those amounts due ($2,385 + $8,772 + $24,145 + $4,392) and your total tax bill is $39,694.

Now that we have that tidy sum, all we have to do is find your effective tax rate. To do that, simply divide what you owe by what you earned—in this case, $39,694 / $225,000. That means, for this example, your effective tax rate is 17.6%.

The Standard Deduction vs. Itemized Deductions

At the risk of seeming like we’re trying to find the silver lining in a dumpster fire, there’s good news! You can legally reduce your taxable income with deductions.

Option one: Keep receipts for every tax-deductible purchase and submit a lengthy, itemized tax return. But be careful. This strategy is like consuming a half-dozen warm cookies, plus hot cocoa (with marshmallows on top)—naptime is kind of inevitable, even for a hardened IRS auditor.

To keep tedious itemization (and snoozing) at bay, the IRS has provided option two: a juicy standard minimum deduction.

This means instead of spending hours of valuable time combing through and documenting thousands of receipts, you can just take the standard deduction the feds provide and call it a day. It could land you in a lower tax bracket, which means reducing your tax liability.

And because inflation has been such a wild ride lately (woo-hoo), the standard deduction is another thing that’s going up for tax year 2025 and 2026:

Standard Deduction for Tax Years 2025 and 2026

|

Single, Married Filing Separately |

Married Filing Jointly, Surviving Spouses |

Heads of Household |

|

|

2025 |

$15,750 |

$31,500 |

$23,625 |

|

2026 |

$16,100 |

$32,200 |

$24,1505 |

However you slice it, that’s a lot of Benjamin Franklins.

Remember, the only time it makes sense to itemize is when the total amount of your itemized deductions is greater than the standard deduction. Otherwise, save the trouble and stick with the standard deduction.

How to Calculate Your Federal Income Tax

Federal income tax rates only apply to your taxable income, so do yourself a favor and take out any deductions you qualify for before doing the math on what you owe.

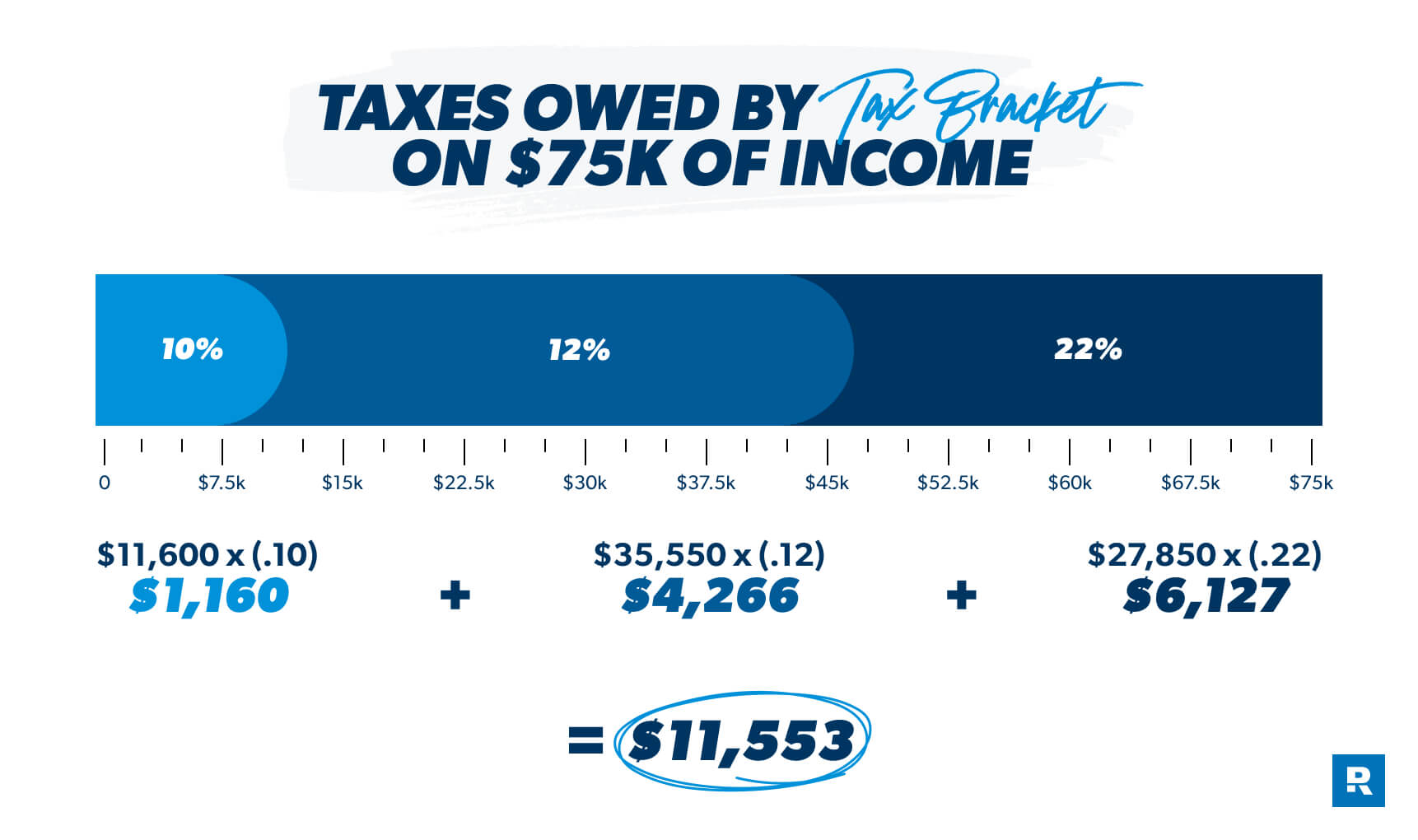

Let’s look at how it works with another example for single filers. For 2025, let’s say your taxable income (after taking the standard deduction) comes out to $75,000. That number puts you in the 22% tax bracket, but remember, the whole amount won’t be taxed at 22%—just a portion. Here’s how it breaks down for this example:

- Your first $11,925 is taxed at 10%. That’s $1,192.50.

- Your next $36,550 ($48,475 minus $11,925) is taxed at 12%. That’s $4,386.

- After that, you have $26,525 left that falls into the 22% tax bracket. That’s $5,835.50.

- Add it all up, and you owe Uncle Sam a total of $11,414.

In this case, your marginal tax rate is 22% (which is the percentage your last dollar of taxable income is taxed at) and your effective tax rate is 15.2% (which is how much of your taxable income you paid in taxes this year).

Here’s an important note: These are federal taxes we’re talking about. Don’t forget to account for any state income tax you might owe. Some states charge a flat income tax, while others have their own set of tax brackets—and then there are a handful of states that don’t have an income tax at all.

Oh, and don’t forget to claim any tax credits you might be eligible for after you find out how much you owe in taxes. Tax credits are extremely valuable because they lower your tax bill dollar for dollar.

For example, the child tax credit allows taxpayers to claim up to $2,200 per qualified child.6 So if you have two kiddos at home under 17 years old, you could claim that credit and potentially cut your tax bill down by $4,400.

File Your Taxes With Confidence

If the idea of doing all this tax math has you running for the hills, we get it. It can be a lot to figure out, plus there’s the anxiety that you’ll make a mistake . . . with the IRS. Yikes! The great news is, you don’t have to crunch the numbers all by yourself.

A RamseyTrusted® tax pro can walk you through the process from beginning to end so you can conquer your taxes with confidence. And even though that’s tax related, it’s definitely something you could share at your next dinner party.

Maybe your taxes are pretty simple, or you’re confident you can handle them on your own. Great! Say hello to Ramsey SmartTax—the tax software designed with you in mind.

With Ramsey SmartTax, you’ll always know right up front how much you owe when you e-file your taxes. No hidden fees, no gimmicks, no stupid predatory loan offers, no games.

Check out Ramsey SmartTax today!