Key Takeaways

- Microretirement means quitting your job or leaving your career for a long, intentional break (usually a few months to a year) before you reach retirement age. Unlike traditional retirement, when your microretirement’s over, you’re headed back to work.

- Microretirement isn’t realistic for most people. It also comes with risks for your money, your career and your golden years.

- Even with those risks, microretirement is a trendy way to tackle burnout, (re)discover purpose, or simply enjoy a refreshing break between careers.

- It may be possible to microretire responsibly. But you’ll need to make a plan, think ahead, and definitely give yourself some financial cushion—because things might not go smoothly (especially when it’s time for you to reenter the workforce).

Most people spend their working life saving up for “one day” when they can leave the daily grind once and for all. Some folks want to buy an RV and travel the country, while others want to move south, buy a home near a golf course, and sip sweet tea on the porch. One day, they tell themselves . . .

Market chaos, inflation, your future—work with a pro to navigate this stuff.

But hey—maybe you’re not most people. Maybe you hate golf and want to live life differently. Maybe you’re asking yourself, Why should I wait until I’m 65 to enjoy my life? Will I even be able to have fun when my hair’s gray (or gone) and it hurts to just get out of bed?

Or maybe you’re feeling overworked and stressed and you know deep down in your gut that a two-week getaway just isn’t going to cut it for you this time.

Whatever your reasons, maybe you’re thinking about what some social media influencers are calling “microretirement.”

What Is a Microretirement?

A microretirement is an intentional, extended break from work before you reach traditional retirement age. Usually, this break lasts from six months to a year. In a microretirement, you pause your career not because you’re financially set for life but usually because you’re fried and need a break (or you crave adventure like some folks crave a decent latte).

For all the hype, microretirement really isn’t new. Taking a seasonal break from hard work has been a thing since the farmer was invented (which was long before “influencers” were carefully documenting their life choices with short-form videos).

But the idea behind microretirement is kind of cool: You leave the rat race to figure out your work-life balance, explore a career change, combat burnout, or test the waters on that one thing you never had the guts to try until now. You live life now (while you’re young and gorgeous), then reenter the workforce wiser, better, stronger, and (maybe most importantly) well rested.

What’s the Difference Between Microretirement and Traditional Retirement?

A microretirement (aka mini-retirement, adult gap year or extended vacation) is really just a season of unemployment. It has a trendier, built-for-YouTube name these days, but when you read the ingredient list, it’s pretty much made of the same stuff.

We’ll say it again because this matters: The main difference between microretirement and traditional retirement—whether it’s an early retirement or not—is that it requires you to go find a freakin’ job when the fun’s over (and usually too soon).

| Microretirement | Traditional Retirement | |

|---|---|---|

| Requires You to Leave Your Job | Usually | Yep |

| Requires You to Find Another Job | Usually | Nope |

| Requires Years of Planning and Preparation | Definitely | Definitely |

| Looks Great to an Employer | Probably not | Who cares? You’re retired now! |

Trendy or not, microretirement may sound like a good idea to you. But is there a catch? Let’s dig into the details.

What Are You Risking With a Microretirement?

If you’ve been in the workforce for a little while (you’ve come to grips with making rent and feeding yourself), you may agree that it’s important to hold down a job . . . even when it’s not fun (it’s real out there, y’all). So, what exactly are you risking if you take a microretirement?

Your Money

Most people have to work to survive, so unless you’re already fabulously wealthy, not having a job means not having an income—and that means you’re setting aside your No. 1 wealth-building tool. It also means contributions to your 401(k) or IRA will probably have to come to a screeching halt (so you can fund your time off), which means you’ll miss out on all kinds of compound interest growth. You may need to work a job much deeper into your golden years to compensate for those lost earnings today.

And the younger you are when you microretire, the more you’ll suffer lost opportunity if you choose to pause contributions to your actual retirement. The simple fact is, the modern economic system really isn’t built to accommodate microretirement:

- If you make early withdrawals from your retirement savings accounts (like your 401(k) and IRA) to fund your microretirement, you’ll probably have to pay taxes and an early withdrawal penalty.1

- There’s also inflation risk—delaying your actual retirement means you’ll have more exposure to inflation over a longer period of time (which means your money won’t go as far).

- And don’t forget longevity risk—more time not working, coupled with longer life expectancy, means you’re more likely to outlive your money.

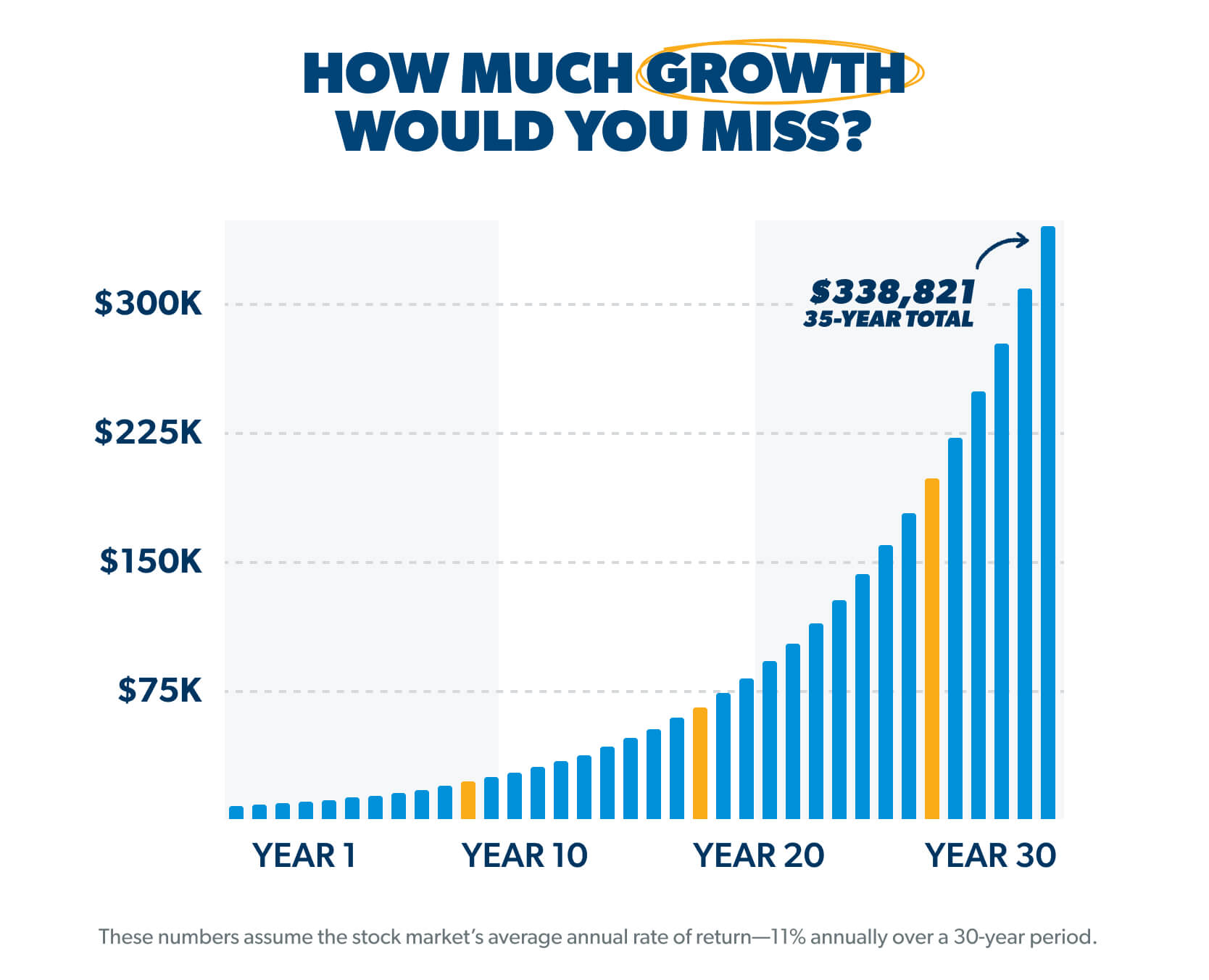

How much will a single year of microretirement cost you in retirement savings because of lost compound growth of your money over time?

Here’s an example. Let’s say you earn $50,000 a year, you’re out of debt, and you follow our advice of investing 15% of your income for retirement. Taking a year off means not investing that 15% (in this case, $7,500). If you get an average annual rate of return of 11% on your retirement investments for 25 years, that $7,500 could grow to $115,000. Keep it there 30 years and it could be more than $200,000. After 35 years, what started as $7,500 could grow to more than $300,000!

And even if you don’t want to go to work right now, at least you’re still able to work. You may not have that luxury later in life. Missing out on thousands of dollars’ worth of salary during your prime working years might come back to haunt you later.

Still stoked about that trip to Machu Picchu this year, or can it wait?

Your Career

Imagine yourself in a post-microretirement job interview. You’re comfortable, you’re charming, you’re the ideal team player (it’s going really well). But when it comes time to explain that huge gap in your employment history, you feel like your explanation of what a microretirement is and why it was so cool falls flat with the hiring manager. Then you hear, “We’ll call you,” instead of a job offer. The hard truth is, taking a microretirement could be a huge turnoff to your next employer.

Listen, we get it. Sometimes your job hates you, you hate your job, or you just need a break. But sometimes choosing the exit door at the wrong time could mean missing out on better job opportunities later. Employers tend to reward pluck, grit and stick-to-itiveness. Now, if you’re in a toxic work environment, by all means, get out of there. But sometimes overcoming hard stuff is the only way to really advance.

It’s important to realize that reentering the workforce after microretirement may take longer—and turn out to be harder—than you think. You may end up working a stopgap job you don’t love (or even hate) while you interview and compete for the one you really want.

Your Life

Not everybody is in a situation where it’s totally fine if they just walk away from a job for six months to a year because they feel like it. If you’re married, for example, is your spouse on the same page with you about taking a microretirement? And if you’re not married, what will your cat think?

These are serious questions, people.

Most people in their 20s or 30s don’t have a huge cash reserve to draw on as they vlog their way across the globe. And if you’re only in your 30s today, 40 years in the future is longer than you’ve been alive (which probably makes it sound like forever). But if you do decide to take a microretirement (or two) while you’re younger, an unintended consequence might mean having to work well into your 70s to pay the bills.

The funny thing about time is that the more you use, the faster it goes. You don’t have forever, so think hard about how valuable that work-life balance is right now. You may be surprised how much hard stuff you can do. Especially while you’re young and gorgeous.

How Do I Microretire Responsibly?

As we’ve often said, children do what feels good, but adults devise a plan and follow it. So, if you’re still set on taking a microretirement, let’s get to the nuts and bolts of how to do so responsibly. That way, when you do return to work, you’ll have no regrets.

1. Save, budget and plan.

The first thing you’ll want to do is make sure all your consumer debt (all debt except the house) is paid off. Once you’re debt-free, make sure your emergency fund is fully funded (3–6 months of expenses in the bank). You should not take a microretirement if you’re still in debt or if you don’t have enough money to cover a real emergency—period.

After you’ve paid off your debt and saved an emergency fund, it’s time to get crystal clear on what your expenses will be during your microretirement. Make a detailed budget that allows you to estimate how much money you’ll need each month to keep up with your bills, put food on the table, and do some of the fun stuff you want to do during your time off. And don’t forget to plan for things like health insurance costs. Chances are, your employer won’t help pay your premiums while you’re gone—and it’s not exactly cheap out there on the open market.

Once you have a good idea of how much money you’ll need, set up a sinking fund to save money specifically for your microretirement. It should go without saying, but don’t use your emergency fund or go into debt to fund your microretirement—because microretirement is not an emergency.

2. Use your time wisely.

Ephesians 5:15-16 (NIV) says, “Be very careful, then, how you live—not as unwise but as wise, making the most of every opportunity, because the days are evil.” In other words, make the best use of the time you have. Time is the only resource we can’t grow—so if you’re going to spend it, do something that adds value (especially for the people around you).

Rest is good, but don’t waste all your time binge-watching shows on Netflix or scrolling on social media. If you have a daily routine, keep at it. Go to the gym, eat right, stay connected to good people, read life-giving books. In other words, be who you always dreamed you’d become when you were a kid.

3. Plan now for reentry.

Think hard about what your reentry will look like before you get there (ideally, before you leave your job for that microretirement). Don’t make your life harder than it has to be.

- How will you talk about your microretirement in an interview with your next potential employer?

- Have you considered that you may not land a job that lets you pick up right where you left off? This is especially true in career fields that require up-to-date experience.

- You may want to budget an extra month of expenses (or more) for a re-entry cushion.

- You may lose career momentum or not be as promotable when you reenter the workforce.

You might be able to get your current employer to promise to rehire you before you leave (if you’re currently working a job you want to go back to). After all, they know it costs tons of money (and a lot of time) to recruit, onboard and train your replacement, so maybe they’ll work with you.

What Are Some Alternatives to Microretirement?

If burnout is lurking in the dark corners of your life, you don’t have to take a permanent vacation to fight it. Let’s check out a few other options.

Traditional Vacation

If you have a paid time off (PTO) benefit, you can redeem it in exchange for some vacation time and still get paid (hallelujah). The best part is that when you come home, you still have a job and an income. It’s possible that a few days on the road or at the beach—or even a staycation—can make all the difference in your morale.

Sabbatical

A sabbatical is usually longer than the average vacation. If it’s an option with your employer, there may be an application process. There will probably be limits on its purpose, how long you can be gone, and whether it’s paid time off. In some cases, you’re only eligible for sabbatical after being employed for a certain length of time (think around five years). But there’s certainly no harm in asking your HR rep. Even if you don’t technically qualify, they may make an exception for you.

Career Change

If things are really bad for you at work, maybe it’s time to spread your wings and fly to a new job or career. People do this all the time, and there are more resources out there to help today than ever before. Finding a new situation that’s a better fit for you and your mental health might even feel like a microretirement in itself.

We have a whole career resource hub with books, articles and other tools that can help you transform your work life and find the career you were always meant to have.

Should You Take a Microretirement?

If you’re going to do a microretirement, do it right: Make a plan, have a really good reason for doing it, and use the time as well as you can. In the end, a microretirement might just change your life. Will that change be a bad thing or a good thing? That’s totally up to you.

Next Steps

- Maybe after reading this article you realize it’s high time you paid down your debts—or saved for an emergency—instead of jumping into a choice you can’t unmake. You may want to talk to a financial coach for more insight about how you can win with money.

- Don’t love your current job? Ramsey Personality Ken Coleman’s article How to Find a Job You Love can help you begin the process of finding the place where your talent, passion and mission intersect.

- If you’re ready to start investing for your retirement, talk to a SmartVestor Pro who can guide you through the process.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.