Should I Pay Off the Mortgage Early or Invest?

10 Min Read | Apr 17, 2025

Link copied!

Unable to copy link. Please try again.

Key Takeaways

- Investing for retirement and paying off your mortgage early are key to reaching financial peace and a secure retirement, and it’s possible to work toward both goals at the same time.

- Investing 15% of your gross income for retirement is essential because you need a nest egg to live from in retirement. The earlier you start, the more time you give compound interest to grow your money.

- Meanwhile, paying off the mortgage early is important because a paid-for house provides stability, and having no more mortgage payments means more margin in your budget.

- If you’re trying to decide between investing and paying off the mortgage early, investing for retirement always comes first. But once you’ve invested 15% of your gross income for retirement, you can put any surplus cash toward extra mortgage payments.

Saving for retirement and paying off the mortgage are two of the biggest money goals most people will ever tackle. And deciding which one to tackle first can feel like a financial tug-of-war.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

On one side, you have the freedom and peace that comes with a paid-for house. But on the other hand, the magic of compound interest is pulling you toward investing. So which one should take priority in your financial journey?

The answer is . . . drumroll, please . . . both!

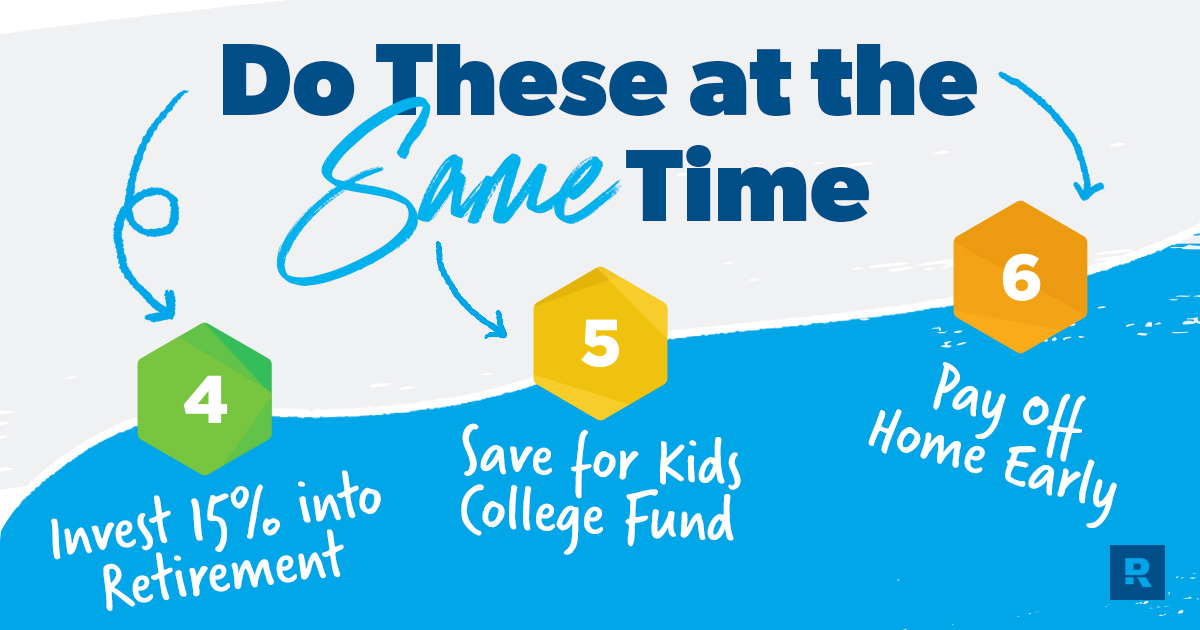

Both investing and paying off the mortgage play a huge role in setting yourself up for retirement. And guess what? It’s 100% possible to pay off your mortgage early while also investing. If you follow the Baby Steps, you know we recommend investing 15% of your income for retirement in Baby Step 4 and then putting any extra money you can toward the mortgage simultaneously (that’s Baby Step 6).

So, let’s take a look at why investing and paying off the mortgage early are key to your retirement’s financial outlook and how you can reach those goals!

Paying Off the Mortgage and Investing: Why Both Are Important

We want to be clear: Before you can retire, you’re going to want both a solid nest egg and a paid-for house. Together, these two financial goals will set you up for a more secure, financially stable retirement.

Let’s talk about why both are an important part of your financial journey and plans for the future.

Saving for Retirement

Newsflash: You’re going to retire someday. That’s a fact! What your retirement looks like, on the other hand, is mostly up to you. Here are some reasons you need to start saving for retirement sooner rather than later.

You need a nest egg for retirement.

Listen, folks—your living expenses and bills won’t magically disappear the day you retire. You’re still going to need money in the bank to live on, and that’s why it’s important to start investing to build a nest egg. It’ll be a lot easier to enjoy the fruits of your labor and live comfortably in retirement if you aren’t constantly worrying about money.

The earlier you start, the more time you give compound interest to grow your money.

Compound interest is the secret sauce for building wealth. It’s your best friend as you continue to save and invest for the future, helping your money grow faster and faster.

But here’s the deal: Compound interest takes time to work. A lot of time! Investing is a marathon, not a sprint. That’s why we recommend putting 15% of your income toward retirement first before you start throwing extra money toward your mortgage.

Want to retire early? Investing is key.

Some people may tell you retiring early is impossible, especially in this economy. But it isn’t just a dream reserved for a lucky few—it’s a tangible goal you can work toward. Retirement isn’t an age, it’s a financial number. And although it takes a lot of hard work and sacrifice to reach that number, it all starts with the two goals we’ve been discussing: investing and paying off the mortgage.

This is a good place to pause for a friendly reminder: Don’t skip ahead in the Baby Steps (which we’ll go over in detail below) and start investing before you’re ready. Paying off debt first and staying out of debt will free up more of your income to save, so stick with the plan and you could be well on your way to retiring early or semi-retiring to start the small business you’ve been dreaming of.

Most millionaires invest in their company’s 401(k).

According to Ramsey’s National Study of Millionaires, 8 out of 10 millionaires invested in their company’s 401(k). And 3 out of 4 said regular, consistent investing was the key to their success.

And the top five careers of millionaires? Engineers, accountants, teachers, managers and attorneys. In fact, only 15% of millionaires held senior leadership roles (like CEO, CFO or COO). Ninety-three percent said they got their wealth because they worked hard and consistently invested in their retirement account, not because they had big salaries.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Paying the Mortgage Off Early

When you make that final mortgage payment on your home and you own it outright, the grass just feels different under your feet. We want you to experience that feeling someday! Here are a couple reasons why having a paid-for home is an important part of your financial journey.

A paid-for house provides stability.

There are a lot of uncontrollables when it comes to retirement. Who knows what the price of gas and groceries will be when you get ready to retire (not to mention what interest rates will be like)?

But having a paid-for house is like having your own personal anchor made of brick and mortar. It’ll help keep your finances steady, no matter how stormy the stock market or economy might be during your retirement. When you pay off your mortgage early, you won’t have to spend your retirement worrying about fluctuating interest rates or what the housing market is doing.

Here's A Tip

Pro Tip: Check out our Mortgage Payoff Calculator to see how increasing your monthly payment can shorten your mortgage term.

No more mortgage payments means more margin in your budget.

Mortgage payments can suck your retirement savings dry every month. They can keep you from spending money on the very things that made you want to retire in the first place, like spending more time with grandkids, visiting your bucket list national parks, or starting your own llama farm (because why not?).

More margin in your budget means more flexibility and freedom, which is what retirement is all about!

Keep Boosting Your Investing Know-How

Every two weeks, the Ramsey Investing Newsletter will send you practical insights, easy-to-use resources, and the latest investing news. All explained in plain English.

Should You Pay Off the Mortgage Before or After Investing for Retirement?

Investing for retirement comes first—it’s the priority. We know you’d love to get out from under the weight of a mortgage. Being completely debt-free feels so liberating! You’ll get there, we promise.

But by investing first, you’re giving time and compound interest the opportunity to work. (Just play around with our Investment Calculator to see for yourself.) Not only that, but you’ll also earn a lot more in interest in an investment than you’d be saving if you paid off your house first.

Let’s crunch the numbers, starting with our Mortgage Payoff Calculator.

Pretend you have a $200,000, 15-year fixed-rate mortgage at an interest rate of 6.5%. You’d be making monthly mortgage payments of about $1,740. In 15 years, you’d pay around $113,600 in interest. But if you paid $300 extra per month, you’d save about $26,500 in interest and pay it off about three years sooner. Not bad.

But what if you put that $300 into a retirement fund instead? For this math, we used our Investment Calculator. Here’s what we learned: After 15 years, you’d have over $136,000, assuming an 11% annual rate of return. Now here’s where it gets fun. If you left that money in the investment account for another 10 years, you’d have almost $408,000. Compound interest does its best if you give it plenty of time to work.

Will you work hard to pay off your house early? Absolutely. But remember, as you hit the prime of your career, you’ll be making a lot more. After you invest your 15% every month, you should have money left over to put toward extra mortgage payments.

If all you have for retirement right now is a paid-for home—or you’re pushing hard toward that goal—then you’re ahead of the crowd by far. You already have the drive and ambition to make wise money choices. But you still have some work to do.

Start by partnering with an investing professional to create a workable plan. They’ll show you how a paid-for home fits into your overall financial goals. Plus, they’ll give you valuable perspective on how much money you’ll need to enjoy your golden years.

How You Can Pay Off the Mortgage Early and Invest at the Same Time

According to a recent Ramsey Solutions research study, more than half of Americans aren’t saving enough for retirement. Only 1 in 10 Americans saves the recommended 15% for retirement. While cost of living is the number one reason non-savers aren’t stashing away cash for retirement, lack of planning is another barrier to saving.

But when folks get on a proven plan and stick with it, they can change their financial outlook and set themselves up for a great retirement with a paid-for house and more savings than they ever thought possible.

Let’s back up for a second and explain the 7 Baby Steps, the financial game plan that has helped millions of people get out of debt and build wealth. Here are the first three steps:

- Baby Step 1: Save $1,000 for your starter emergency fund.

- Baby Step 2: Pay off all debt (except the house) using the debt snowball.

- Baby Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

When you’re working through those first three steps, you do them in order. One step at a time. But with Baby Steps 4–6, it works a bit differently. First off, here’s a quick definition of them:

- Baby Step 4: Invest 15% of your household income in retirement.

- Baby Step 5: Save for your children’s college fund.

- Baby Step 6: Pay off your home early.

You start with Baby Step 4 because investing for retirement comes first—it’s the priority. Then, if you have kids and a mortgage, put any extra cash you can toward those Baby Steps while you’re saving for retirement.

How much should you put toward paying off your mortgage early? That’s entirely up to you and how much money you (and your spouse) are willing to throw at the house. But keep in mind that making one extra mortgage payment each year could shave several years off the life of the loan and save you thousands of dollars in interest.

Once the mortgage is paid off and the kids are through college, you can put check marks next to all three of those and move to Baby Step 7: Build wealth and give. This is the goal. Because when you don’t have any payments in the world, you’ll be able to stash away tons of cash in investments and savings. And even better than that, you’ll have the ability to be outrageously generous, which is the most fun you’ll ever have with money.

Work With a Financial Advisor

If the thought of investing for retirement while paying off the mortgage early has you feeling, well . . . overwhelmed, don't worry. You don't have to go it alone!

Working with a financial advisor or investment professional can help you tackle each step of the process without sabotaging your overall goals. An investment professional like those in our SmartVestor program can help answer any questions you may have about planning for retirement and staying on track.

Next Steps

- It’s hard to reach your financial goals when you don’t know where your money is going. Check out the EveryDollar app for an easy way to get started budgeting today!

- Before you start paying down your mortgage or saving for retirement, use the Baby Steps to pay off your consumer debts from smallest to largest, then save a fully funded emergency fund.

- If you’re ready to start investing, our SmartVestor program can connect you with a financial advisor or investment pro. They have years of experience and can help answer any questions you have along the way!

Frequently Asked Questions

-

Why should I invest 15% for retirement?

-

People always want to know: Do I really need to invest 15% in retirement? Why not 6% or 8%? There are a couple of reasons.

First, most financial advisors agree if you invest 15% now, you’ll likely build up enough savings to enjoy a comfortable retirement.

Now, we’ll add this: If you’re behind on your retirement planning, that 15% might not be enough. It’s a good place to start while you’re paying off the house, but after you send in that last mortgage payment, throw everything you can at your retirement fund.

Second, 15% leaves room for college and the mortgage. If you’re investing 15% of your income, you can still put money toward Baby Step 5 (saving for your kids’ college) and Baby Step 6 (paying off your home early).

Yes, you could invest a lot more than 15%—and you will later—but until you get Baby Steps 5 and 6 out of the way, just stick to the 15%.

-

Why do I need more than a paid-for home in retirement?

-

Having the mortgage paid off before retirement is a game-changer when it comes to living the retirement of your dreams. But guess what? The everyday costs of living don’t magically stop after you turn 67.

Your household budget will still include ongoing expenses like food, utilities, insurance, property taxes and vehicle maintenance, not to mention health care costs. Nothing says budget buster quite like the unexpected medical expenses that are sure to come with aging.

And don’t forget: Retirement is supposed to be fun too! If you want to travel more to visit grandkids or landmarks you’ve always dreamed of seeing, you’ll need extra money to make that happen.

For all these reasons, it’s important to invest 15% of your income for retirement as soon as you become debt-free. Keep to your budget, and you should have enough to reach your other financial goals, including paying off your mortgage early.

-

Should I pay off my mortgage with my 401(k)?

-

Cashing out your 401(k) to knock out your mortgage in one fell swoop can be tempting, but it’s a terrible idea for a couple reasons.

First off, you’re going to need that money for your daily expenses if you ever want to retire, and taking money out of your 401(k) prematurely could set you back thousands of dollars in investment growth over the long haul.

And second, you’ll be hit by taxes (at your withholding level) and a 10% early withdrawal penalty. So you’ll lose 30% or more of your money before you can even put it toward your mortgage. No thanks!

-

Will paying off my mortgage affect my taxes?

-

If you claim the mortgage interest tax deduction, paying off your mortgage early will lead to a higher tax bill. But you’d actually pay more in interest by keeping your mortgage than you’d save in taxes.

Let’s say you pay $10,000 a year in interest and you fall into the 25% tax bracket—well, you’d only get a $2,500 tax deduction. It’s a nice perk while you’re paying off your mortgage, but it’s a terrible reason to intentionally keep your mortgage. That would be like trading a dollar for a dime.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.