You want to set a solid foundation for your financial future, but it feels like there’s so much to do. You know you need to save for retirement, emergencies, vacations, a house, your kids’ college tuition—the list goes on and on.

And then there’s your debt. You figure you should probably pay off those student loans before your own kids go to college. But what comes first? Should you pay off your debt or save for the future? Or should you try to do it all at once?

If you’re feeling overwhelmed, you’re not alone. In fact, about 46% of Americans expect to retire with debt.1 But the good news is, there’s a way to get rid of your debt and have enough for retirement—where you’re not treading water. We’re going to show you the best way to make progress with your money today and feel confident you’re making the right decisions for tomorrow.

Should I Pay Off Debt or Save for the Future?

Which should you tackle first—the debt or the nest egg?

Pay off debt fast and save more money with Financial Peace University.

Around here, we’re all about the Baby Steps, the tried-and-true financial plan to getting out of debt and building wealth. The 7 Baby Steps lay out a clear path for you to follow so you can attack each goal and always know the next right step for your money. Because when you focus your energy on one goal at a time (instead of trying to do too many things at once), you make more progress.

Here are the 7 Baby Steps in order:

Baby Step 1: Save $1,000 for your starter emergency fund.

Baby Step 2: Pay off all debt (except the house) using the debt snowball.

Baby Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Baby Step 4: Invest 15% of your household income in retirement.

Baby Step 5: Save for your children’s college fund.

Baby Step 6: Pay off your home early.

Baby Step 7: Build wealth and give.

Trust us (and the people who’ve become millionaires with this plan)—if you do each step in order, you’ll get where you want to be. Because when you don’t owe anything to anyone, you can invest way more of your income! And listen, how much money you invest is just as important as the actual act of investing.

Plus, while doing research for our Baby Steps Millionaires book, we found that those who reached millionaire status by following the Baby Steps took about 20 years or less to hit the million-dollar mark. (That includes the time it took for them to get out of debt, build up their emergency fund, invest 15% of their income toward retirement, save for their kids’ college, and pay off their home early!) Yeah, this stuff works.

So, if you’ve got any debt (other than your mortgage), your goal is to pay it all off before you start saving or investing for your future. (Don’t worry, we’ll explain exactly how to do that in a minute.)

And if you’re debt-free, your next right step is to build up your emergency fund and then move on to investing for retirement (keep reading for a step-by-step plan for how to get started).

But that’s the short answer. Let’s dig a little deeper into why paying off your debt before you save for the future is your best option.

Find More Margin. Beat Debt Faster.

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

Why You Should Pay Off Your Debt Before You Save for the Future

Here’s the deal: Debt is stealing from you. Going after your money goals when you still have debt is like climbing a mountain with weights tied around your ankles. As long as you’re making payments, you’ll always feel like you’re way behind where you want to be. The best thing you can do for your financial future is ditch your debt so you can free up your income and start building wealth faster.

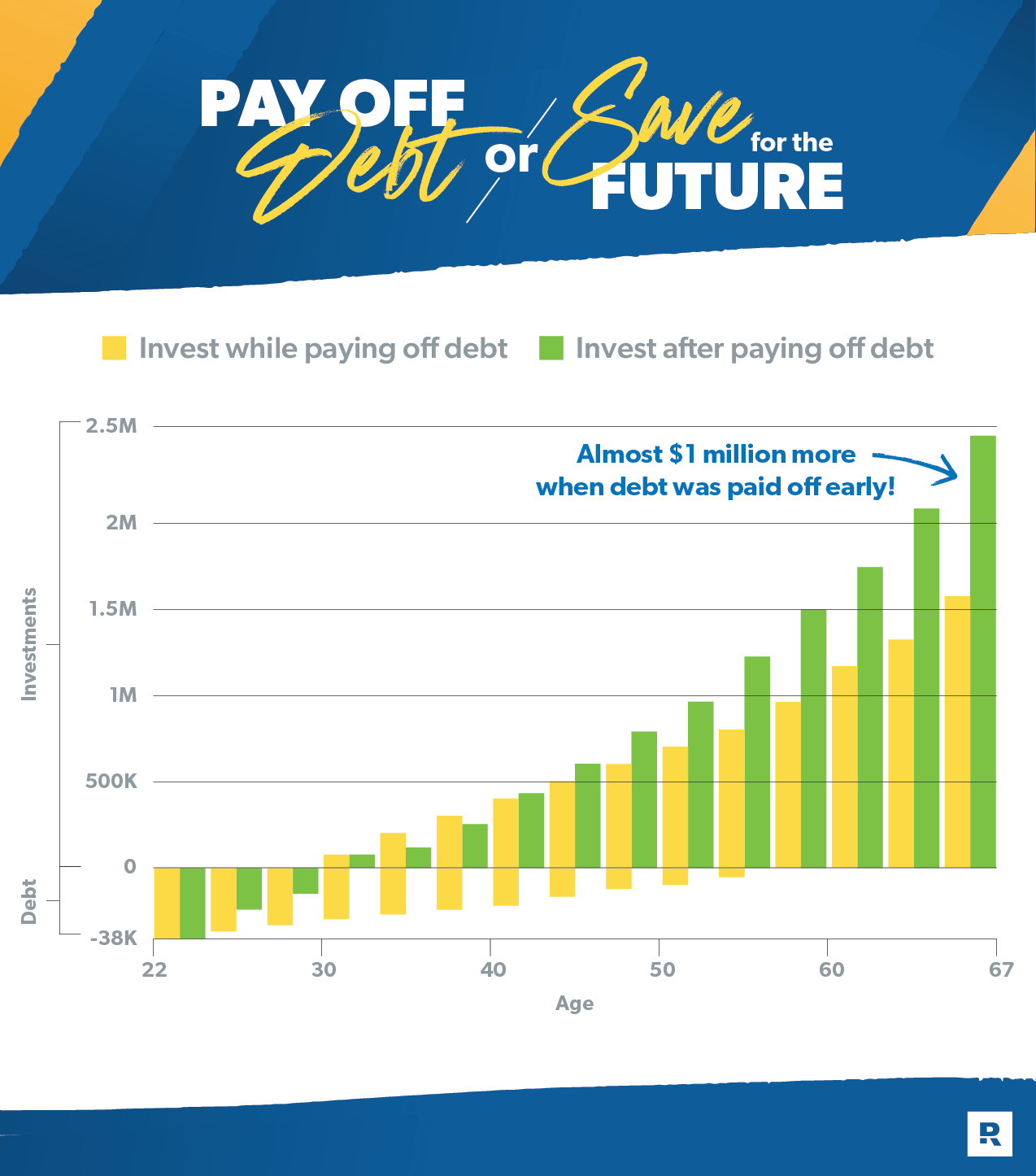

But the real proof is in the math. Let’s take a look at two different scenarios (using our Student Loan Payoff Calculator and Investment Calculator).

Scenario 1: Invest While Still Paying Off Debt

The average American with student loan debt has a balance of $38,792 with an interest rate of 5.8%.2,3 It typically takes someone 20 years to pay off their student loans, but it can take up to 45 years!4 For this example, we’ll use 30 years.

So, if it took you 30 years to pay off a $38,792 loan with 5.8% interest (which would end up as a $227 monthly payment), you’d hand over $43,526 in interest alone. And if you started paying off your student loans at the age of 22, you’d be in debt until you’re 52!

Let’s say, when you turn 30, you decide to start investing. You put that same amount of $227 toward retirement, while still paying $227 toward your debt. At age 52, you pay off your student loans and use that payment to bump up your investing to $500 each month.

With an 11% annual return, you’d have a little over $1.5 million in retirement when you turn 67. Yeah, that’s a lot of money, but we’re not done doing the math.

Scenario 2: Pay Off Debt Before Investing

You still start out with $38,792 in student loans. But when you turn 30, you decide to get rid of your student loans before investing in retirement. Instead of dragging out your debt payments for another 22 years, you buckle down and pay off the rest of your student loans in two years. That may seem impossible right now—but that’s only $481 a month more than what you were already paying. And it’s totally doable if you get on a budget, cut back your spending, and maybe even get a side hustle. A little bit of sacrifice for two years can save you two decades of interest!

So, at the age of 32, with no debt payments, you’re able to invest 15% of your income toward retirement. (For this example, let’s say you make $40,000 a year—so you’d be investing at least $500 each month for the next 35 years.) With an average rate of return of 11%, you’d have almost $2.5 million in retirement at age 67. And that’s if you never get a raise or increase your contributions!

Did you catch that? You earn almost a million dollars more, just by paying off your debt first—even though you started two years later! Plus, you’re not paying an extra 20 years’ worth of interest on your student loans. Win-win! That, friends, is the power of following the Baby Steps.

Go ahead and plug in your own numbers to see just how much extra you can have for retirement and how much interest you can save by paying off your debt sooner.

So, now that you know whether your next right step is to pay off your debt or save for the future, let’s talk about how to actually make it happen.

How to Pay Off Debt

If you’ve got debt, your priority right now is paying it all off—as fast as you can (aka Baby Step 2). You may be thinking, That’s going to take me forever! But you can pay off your debt way faster than you think when you use the debt snowball method.

Here’s how it works: You list your debts in order from smallest to largest (ignoring the interest rates) and put any money you can find toward attacking your smallest debt. When the smallest debt is paid in full, you roll the payment you were making on that debt into the next-smallest debt payment. It’s like a snowball rolling downhill, except you’re the power behind that growing momentum!

You should also pause your other money goals (like saving and investing) so you can use any extra money to knock out your debt faster. Remember what we said about the power of doing things one at a time? Pausing your retirement savings may make you feel like you’re falling behind, but taking care of your debt first will only boost your progress later (just take another look at that earlier example if you’re skeptical).

How to Save for Retirement

Once you’re out of debt and have your fully-funded emergency fund, you’re ready to start building wealth in Baby Step 4. You’ll do this by investing 15% of your gross household income (that’s how much you make before taxes are taken out) into retirement accounts.

Start with your employer’s 401(k), if you have one, and invest up to the match. Then move to a Roth IRA and invest the rest of your 15%. If you max out your Roth IRA contributions and still haven’t reached your 15% goal, go back to your 401(k) and contribute more there! (Sidenote: If your employer doesn’t offer a match on your 401(k) contributions, start by maxing out your Roth IRA.) However, if your employer offers a Roth 401(k) with a match and you like your investment options, things get a lot easier—you can invest your whole 15% in your workplace plan.

There’s no secret trick or magic formula when it comes to investing—if you invest every month, it will add up. In fact, about 80% of millionaires consistently invested in their employer-sponsored retirement plans—aka their 401(k).5 It may sound boring, but it works (remember those Baby Steps Millionaires we mentioned earlier)! And if you’re still not sure where to start when it comes to investing, one of our SmartVestor Pros will show you.

Get Where You Want to Be Faster

Listen. Your income is your greatest wealth-building tool. When any part of it goes toward paying off the past (aka debt), it can’t go toward the future (emergency savings, retirement, etc.). So, take back your income. All. Of. It.

The retirement of your dreams doesn’t have to stay a dream. You can retire a Baby Steps Millionaire. And you can have a savings account ready for whatever life throws at you. And you can be debt-free and in control of every single dollar of your income. You just need to follow the steps. In order.

If you’re ready to knock out your debt so you can start investing, Financial Peace University will show you how—step by step. You’ll learn how to take control of your money and make confident decisions for your future so you can get where you want to be faster. Start Financial Peace University right now! It’s time to ditch the payments—because the sooner you’re debt-free, the sooner you can start investing and the more wealth you can build.