Get Out of Debt

You don’t need a finance degree to transform your money—it’s 80% behavior and 20% head knowledge. Get the tools you need to help you take control once and for all.

Get EveryDollar: the app that makes creating—and keeping—a budget simple. (Yes, please.)

In the first month, most EveryDollar budgeters . . .

Uncover up to $395 to use toward money goals

Cut monthly expenses by 9%

Build better budgeting habits

From budgeting to saving to tax tips and more, see how simple steps will lead to big money wins.

Tune in to real-time stories and practical advice for life’s tough money questions.

The Ramsey Show

Filter what episodes and topics you want to hear using the Ramsey Network app.

Get in-depth articles full of practical steps to help you budget, pay off debt for good, and build lasting wealth.

How much of your paycheck you should save depends on your financial situation and money goals. Follow these steps to calculate how much of your income to save.

See how much the average American spends each month—and how your own spending stacks up.

Whether you’re making your first budget or you just want to make sure you’re not forgetting anything, here’s a list of 51 monthly expenses to include in your budget.

Fixed expenses stay mostly the same amount each month. Variable expenses change in dollar amount, often based on use. Here's how to budget for and save on both.

Deep down we know the difference between a need and want. But in a world of next-day shipping and upgrades, that line can get blurry. Let's get clear on what's what and see how to budget for it all.

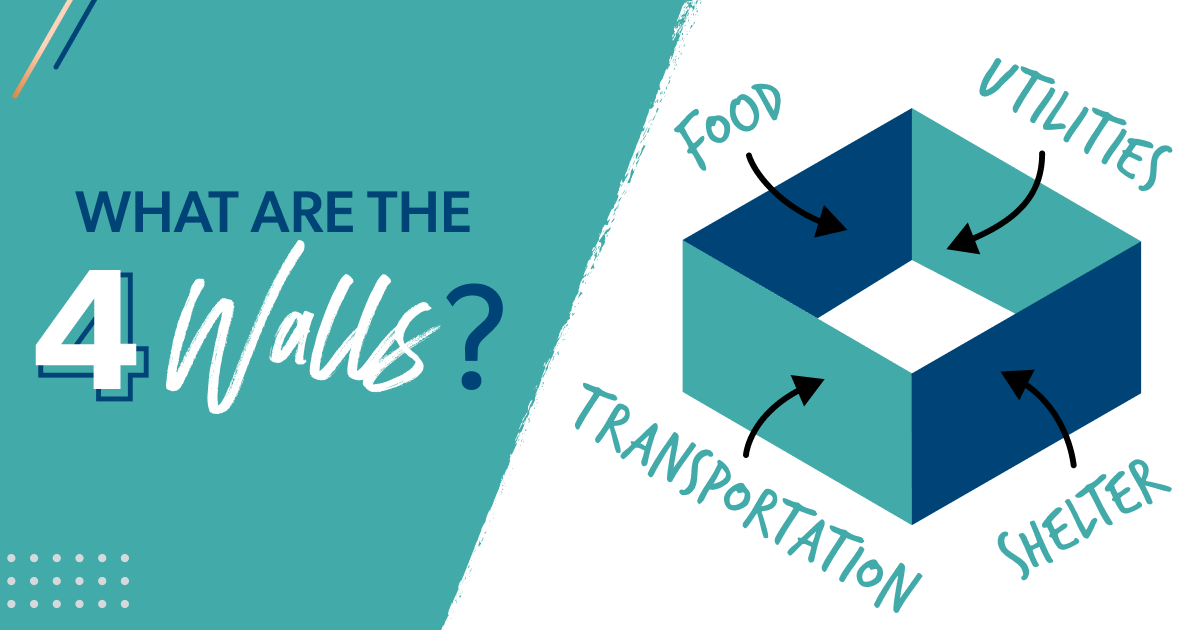

The Four Walls are kind of like a "start here" sign for your budget—they help you prioritize your spending and cut costs in a financial crisis. Here’s how.

Every week, receive expert guidance and practical steps to help you stay on track with your goals and create a strong financial future.