Get Out of Debt

You don’t need a finance degree to transform your money—it’s 80% behavior and 20% head knowledge. Get the tools you need to help you take control once and for all.

Get EveryDollar: the app that makes creating—and keeping—a budget simple. (Yes, please.)

In the first month, most EveryDollar budgeters . . .

Uncover up to $395 to use toward money goals

Cut monthly expenses by 9%

Build better budgeting habits

From budgeting to saving to tax tips and more, see how simple steps will lead to big money wins.

Tune in to real-time stories and practical advice for life’s tough money questions.

The Ramsey Show

Filter what episodes and topics you want to hear using the Ramsey Network app.

Get in-depth articles full of practical steps to help you budget, pay off debt for good, and build lasting wealth.

Both money market accounts and savings accounts are great places to stockpile cash for emergencies or short-term savings goals. Find out which one is right for you.

What is a high-yield savings account? And how to you pick the best high yield savings account? Let’s answer those questions.

Got some money you want to transfer to your bank account? Here’s what you need to know before you do a cash deposit.

Learning the difference between a checking account and savings account is a crucial step to understanding and winning with money. Find out all you need to know right here.

Vaults and steel doors aren’t the only thing protecting your money at a bank. In case a bank fails, the Federal Deposit Insurance Corporation makes sure your money is safe by insuring deposits up to $250,000.

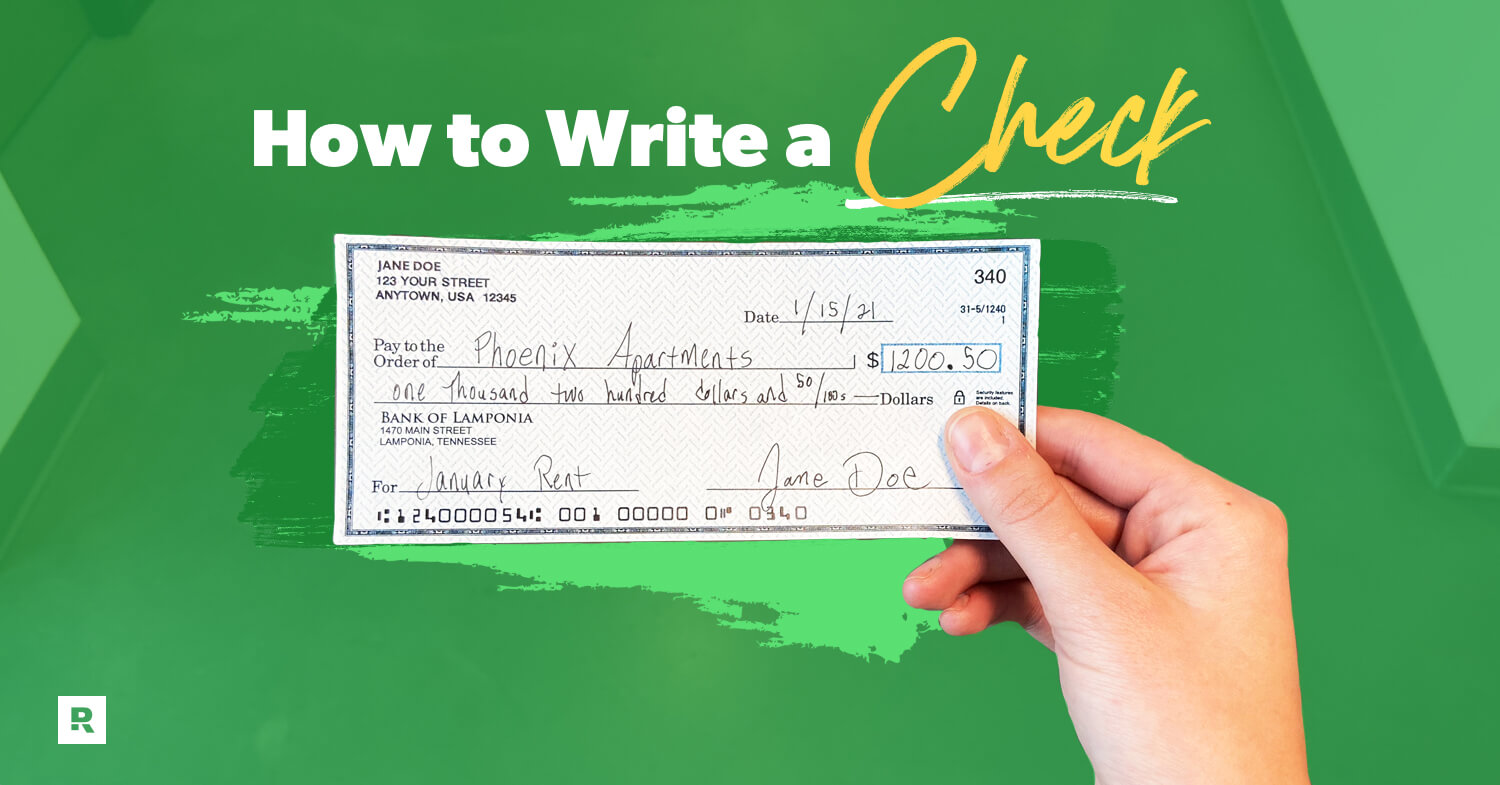

Learn how to write a check in six easy steps, plus how to deposit checks and balance a checkbook.

Every week, receive expert guidance and practical steps to help you stay on track with your goals and create a strong financial future.