Say you live in Minnesota: You’re driving along eating your tapioca pudding on your way to play ice hockey when a deer steps into the road. You slam on the brakes and the guy behind you plows into your trunk.

Now say you live in Arizona: You’re driving along eating prickly pear jerky on your way to hike the Sonora when your tire explodes from the scorching asphalt. The guy behind you doesn’t stop. Smash.

In Minnesota, your insurance pays for your injuries. In Arizona, the other guy’s does. Confusing? Yep. It boils down to no fault insurance. Let’s take a look at what it is, how it works and what states require it.

What Is No Fault Insurance?

No fault insurance is insurance that covers your personal injuries no matter who’s at fault in the accident.

Home and auto insurance aren’t just about low rates—they’re about the right coverage level. Talk to a trusted pro who can help you get both.

With a no fault system, everybody’s basic injuries or medical expenses are covered by their own no fault insurance, usually called personal injury protection (PIP) insurance (up to a certain limit). People often use no fault insurance and PIP to mean the same thing, but this can get confusing. Just remember, no fault can also refer to the legal system that lays out who pays for an accident.

The idea behind no fault insurance is to make sure everyone can get the medical attention they need without waiting to figure out who caused the accident (and whose provider is on the hook for the medical bills).

No fault insurance is part of the no fault system of laws many states have that require people to carry special insurance to pay for their own medical treatment if they’re injured in an accident.

Another big deal with no fault laws is they restrict your ability to sue the person at fault for the accident.

Not every state has no fault laws, and even in states that do have a no fault system, the laws still vary. We’ll get into that more in a minute.

What Does No Fault Insurance Cover?

This kind of insurance covers pretty much everything that doesn’t have to do with the car (so no fault will cover the cost to get your back’s slipped disc rehabbed, but it won’t cover the cost to fix your BMW’s disc rotors).

Here’s what no fault insurance covers:

- Medical expenses

- Funeral expenses

- Lost income (if you’re injured and can’t work)

- Childcare expenses (if you’re injured and can’t care for your kids)

- Survivors’ loss benefits (if you die and have dependents this will cover the loss of financial support you would’ve provided—this doesn’t replace your need for life insurance though)

- Household services (if you’re injured and can’t run your household)

Types of No Fault Insurance

Just because your state has no fault insurance doesn’t mean the rules are the same from state to state. In fact, they can be quite different depending on where you live. One of the biggest factors, as you’ll see, is whether your state allows you to sue the at-fault driver or not.

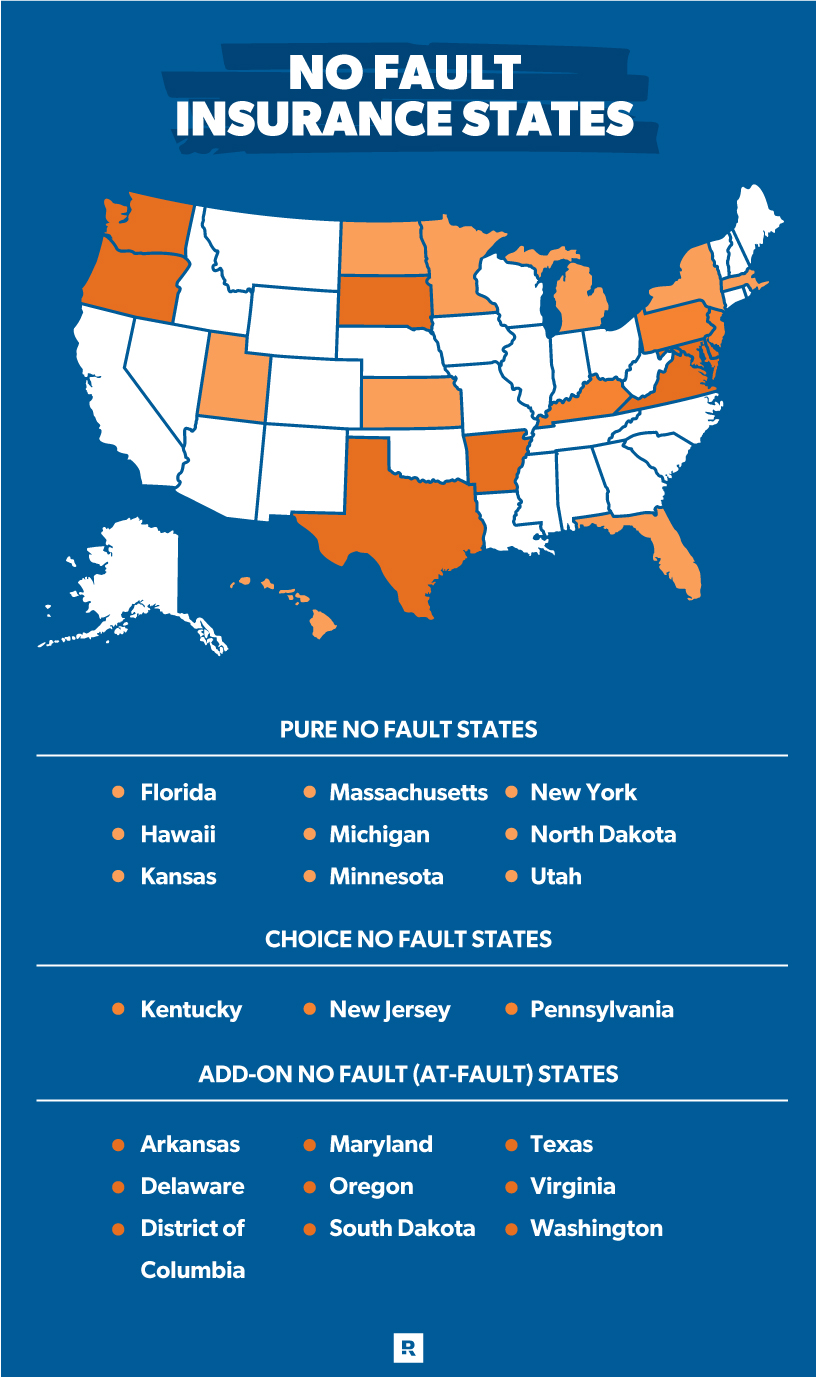

Pure No Fault

Like pure Angus beef with no fillers, pure no fault is the real deal. If your state has it, then every driver must buy it—no ifs, ands or buts. Drivers aren’t allowed to sue when injury expenses fall under a certain amount (states set the amount). And you can’t opt out. There are nine states with pure no fault laws.

Choice No Fault

This is where the fillers come in (you could call this your McDonald’s patty). With this kind of no fault law, you can choose to buy no fault insurance or opt out. If you opt out, your premium will be cheaper, and if you’re in an accident, you can sue the other person involved. But that also means other drivers out there can sue you too!

Add-On

This kind gets tricky (straight Beyond Burger stuff). In some states with this label, no fault is simply one of many insurance options available. Drivers might choose to add PIP (aka no fault) to their auto insurance coverage because they don’t want the worry of figuring out who’s at fault before their insurance kicks in to pay their medical costs. In other add-on states, PIP is required, but they don’t limit lawsuits.

In both cases, the states get labeled add-on, though, because as long as a state doesn’t restrict your ability to sue the at-fault driver, they technically aren’t a no fault state—even if PIP is required. Yeah, confusing.

How Does No Fault Insurance Work?

Let’s go back to our Minnesota example at the beginning: If someone rear-ends you and you get whiplash, your PIP kicks in immediately and pays for an X-ray and whatever other medical attention you need. If the guy who hit you smashes his head, his PIP pays for his ER visit and lost wages if he can’t work for a while.

Here's another scenario: In Florida (a no fault state), you swerve to keep a truck from hitting you, but you hit someone else. That person dies and you’re seriously injured.

The other driver’s PIP would pay for their funeral expenses and also pay their spouse for the driver’s lost income. Your PIP covers your hospital bills, rehab, lost wages from not working, and house visits from a nurse to care for your mom because you can’t care for her while you’re injured.

In both cases, whether you’re at fault or not, each drivers’ PIP insurance covers their medical and other related expenses.

What if both parties are at fault in an accident?

Car accidents aren’t always cut and dry. Sometimes both drivers share fault for the collision. When it comes to bodily injury claims, this doesn’t really matter in a no fault state. Each driver’s PIP covers them no matter what.

If this happens in a state that isn’t pure no fault, the state’s negligence laws (rules that lay out what’ll happen if someone doesn’t do what they should have) will determine how much each party will pay often based on percentages of fault.

Is no fault insurance required?

Whether you’re required to carry PIP or not is entirely up to the state you live in. And like we said before, some states are called no fault and say PIP is mandatory, but there’s still an option to waive PIP and opt out of the no fault system. Let’s get into which states have no fault laws and which don’t, and which ones require PIP.

No Fault Insurance States

You may have heard that Florida is a no fault state—or New Jersey is a no fault state. If you’re like a lot of people, you may have wondered, What the heck does that mean? States are labeled no fault and at-fault depending on how they handle lawsuits and who pays for what in an accident.

In a no fault state, you’re not allowed to file a lawsuit against the other driver if your medical expenses fall under a certain amount (set by the state). If your injuries and losses are extreme though (greater than the set limit), then you can sue their butts (but please don’t be one of those guys firing off frivolous lawsuits).

Pure No Fault States

In order to hit the roads in these nine “pure” no fault states, you must carry PIP insurance.

- Florida

- Hawaii

- Kansas

- Massachusetts

- Michigan

- Minnesota

- New York

- North Dakota

- Utah

Choice No Fault States

The next three are “choice” no fault states, which means drivers can choose to opt out of the state’s no fault system. This lets drivers who don’t have PIP coverage sue other drivers for damages.

- Kentucky

- New Jersey

- Pennsylvania (their no fault system uses Medical Benefits insurance rather than PIP, but the same idea applies)

Add-On No Fault (At-Fault) States

The final group is “add-on” no fault states. In some of these states, drivers can choose to carry PIP or not. In others, PIP is mandatory. But in all of them, there are no limitations on whether you can sue an at-fault driver, and so these states are called at-fault (yeah, so confusing—Beyond Burger, remember?).

- Arkansas

- Delaware

- District of Columbia

- Maryland

- Oregon

- South Dakota

- Texas

- Virginia

- Washington

In our Minnesota rear-end example from earlier, both drivers are required by state law to carry PIP because it’s a pure no fault state. They also can’t sue each other unless their injuries are above a certain amount. If we move our rear-end example to Texas though, things are different.

If the accident is not your fault, your insurance will cover your medical expenses immediately—unless you chose to waive PIP. In that case, you would be responsible to pay for medical expenses out of your pocket or through your health insurance. Regardless of whether you waived PIP or not, you could sue the other driver at any point.

If the accident is your fault, you would be open to a lawsuit from the other driver. The other driver’s PIP would cover their medical expenses unless they waived it—then it would come out of their pocket.

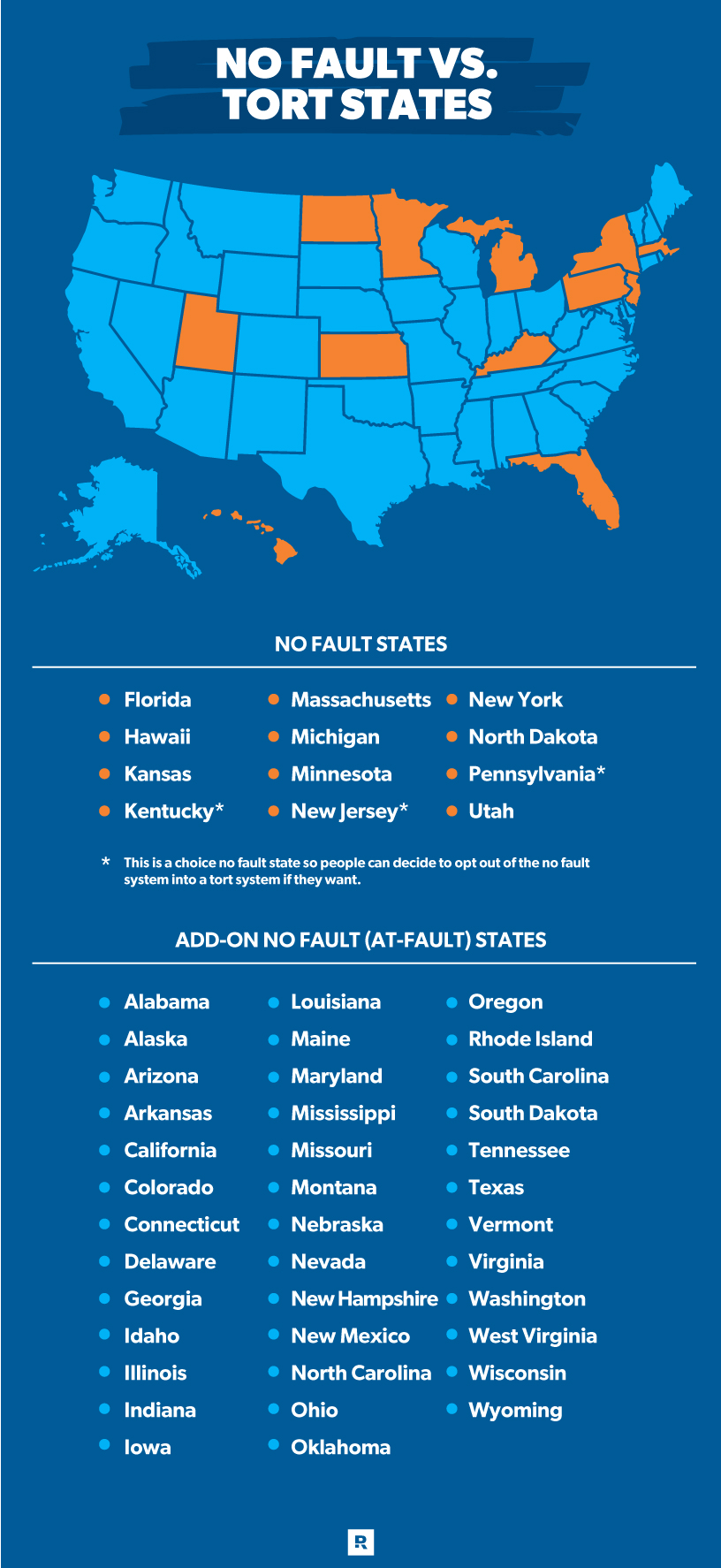

All states not listed in the table above are called tort states and don’t offer a no fault system (but some still offer PIP insurance). We’ll talk about those next.

No Fault vs. Tort

A tort system is another name for the at-fault system and is the set of state insurance laws that lays out who has to pay for damages and injuries caused by a traffic accident. In a tort system, fault is assigned to one of the drivers (or sometimes split) and that driver’s insurance must pay for everything (car damage, medical expenses, etc.)

If both drivers caused the accident, fault is doled out in percentages (we mentioned this earlier). So, if Suze doesn’t see Damien coming up on her left, changes lanes and smashes into Damien, but part of the reason why Suze didn’t see him is because Damien was speeding 15 mph over the limit, Suze would pay something like 70% of damages and Damien 30%.

No Fault States vs. Tort States

Another big difference between no fault and tort systems is tort states don’t put restrictions on lawsuits. So if Gerry gets in a crash and loses the use of his pinkie toe, he can sue the other driver for medical expenses, pain and suffering, and anything else his billboard lawyer can think of.

In a no fault system, drivers can’t sue each other unless they meet state-specific thresholds—and even then, you can’t sue for things like pain and suffering or emotional scarring. Some states’ threshold is bodily injury, like in Florida where you must either lose important body function or suffer permanent injury, scarring disfigurement or death. Other states use a monetary threshold, like in Hawaii where you can go to court briefcases blazing if your medical expenses exceed $10,000.

No fault states require drivers to purchase a certain amount of PIP, so everybody can pay for their own injuries. Tort states don’t require PIP, but they do still have minimum mandates for other types of insurance, like uninsured motorist and liability.

*This is a choice no fault state so people can decide to opt out of the no fault system into a tort system if they want.

Filing a No Fault Insurance Claim

Since you don’t need to establish fault in a no fault state, you can file a claim immediately with your insurance company. You can file online right away, on an app or call them up just like you would with any other claim.

Make sure to pay attention to any filing deadlines your carrier has. Some have a strict window after an accident in which you need to file. After your insurer gets your claim, they’ll look it over and decide whether your claim is covered and how much they’ll pay. They might make you get an examination by a doctor they choose.

Like we mentioned earlier, no fault insurance only covers medical expenses and other injury-related expenses and not that massive dent in your sweet Mustang.

Since PIP doesn’t cover damage to your car, you’ll have to deal with the other guy’s insurance to get that covered—unless it was your fault, and then your collision and liability coverages will kick in.

How Much Is No Fault Insurance?

Minimum coverage required by each no fault state is very different—New York requires $50,000 in coverage while Utah only mandates $3,000! These variations make the cost to purchase PIP fluctuate wildly based on where you live.

If you’re in one of the 12 states where PIP’s required, check out your state’s minimum PIP coverage amount to get an idea of how much it’ll cost you (the higher it is, the more it’ll cost):

- Florida: $10,0001

- Hawaii: $10,0002

- Kansas: $4,5003

- Kentucky: $10,0004

- Massachusetts: $8,0005

- Minnesota: $40,0006

- Michigan: $50,0007

- New Jersey: $15,0008

- New York: $50,0009

- North Dakota: $30,00010

- Pennsylvania: $5,00011

- Utah: $3,00012

In each state, more coverage is usually available if you want more protection—this is just the bare minimum you’re required to purchase.

How to Buy No Fault Insurance

When you go to buy insurance on your car, PIP will be a mandatory part of your policy if you live in a no fault state or one of the tort states that still mandates PIP.

As you select your coverages, the only option you’ll have when it comes to PIP is how much you buy. If you have a really great health insurance policy that will cover you after an accident, you could go with the state minimum for PIP coverage. If you want more protection or your state minimum is very low, you might want to buy extra.

If you live in a “choice” no fault state and don’t want to buy PIP, you’ll have to file a no fault rejection form or waiver with your state. In Kentucky, for example, you’ll need to file with the Department of Insurance.

For anyone in a state with “choice” or “add-on” no fault insurance, the decision to buy or pass on PIP is up to you. If you’re trying to decide if you need PIP, now would be a good time to do a coverage checkup—because if you have basic health insurance, it’s a good idea to get PIP.

Connecting with an independent insurance agent can help you save on car insurance—even if your state mandates $50,000 in PIP. Because an independent agent doesn’t work for any specific company, they’re free to work for you. By comparing quotes from all over, a RamseyTrusted insurance pro can find you the best deal.

Talk with an independent insurance agent today.

Frequently Asked Questions

-

Are PIP and no fault insurance the same thing?

-

Pretty much. Those are both names used for insurance that covers your medical expenses no matter whose fault the accident was.

But don’t get confused. No fault can also refer to the whole system of laws in a state where drivers rely on their own insurance to pay for injuries and aren’t allowed to sue each other. Personal injury protection (PIP) is just the insurance you buy that covers you.

-

Should you waive PIP or opt out of no fault insurance if you live in a “choice” state?

-

Usually, waiving PIP will save you money on the front end by bringing your premiums down, but saving money in the short run isn’t always the best plan. In many cases, opting out of your state’s no fault system will open you up to the potential for lawsuits from other drivers if you cause an accident—and this could cost you a lot more than an extra couple hundred dollars a year.

You also want to think about what kind of health insurance plan you have. If you’re sittin’ pretty with a policy that provides excellent coverage, you might be able to get by without it. On the other hand, if your health coverage is on the basic side, keeping PIP is a good idea—even if it costs a little more.

-

Can I get no fault insurance in an at-fault state?

-

Many at-fault states also offer no fault or PIP insurance. Just shop around insurance providers in your state to see if they have it. Keep in mind, you will still be at risk of being sued if you cause an accident even if you have PIP insurance in an at-fault state.