Most of the time when you buy insurance, it’s to protect yourself. But once in a while you have to buy insurance to protect something weird—like a bank. Wait . . . what?

Yes. If you ever need a mortgage to buy a home, you’ll be required to purchase lender’s title insurance. The word lender’s gives you a hint about who’s being insured. It’s a policy to protect your lender from any problems with the title to your property.

If this is sounding a little complicated, don’t worry. It’s not a big deal. In fact, lender’s title insurance is an affordable coverage you only pay for once, and hopefully never think about again.

Let’s define it, figure out how it works, and get the details about what it really covers.

What Is Lender’s Title Insurance?

If you have a mortgage, lender’s title insurance protects your lender from problems that might surface with your home’s title someday—stuff like long-lost heirs, mistakes in public records, or any kind of legal claim that could put the bank’s investment at risk.

If you didn’t know, the title of a house is the complete history of who has owned the property you want to buy. Usually, the transfer of ownership is smooth and clear—either an heir gets it when the owner dies, or the owner gives it away, or they sell it to a new buyer. In those cases, all parties agree about the new ownership and the records are public.

But there can be oversights, mix-ups and miscommunications! And that’s when title insurance is essential. Banks need this protection since the mortgage is their lien (the legal right to someone’s property until they settle their debt). Without it, some greedy cousin or a newly discovered will could jeopardize their investment—not to mention your house!

Lender’s title insurance is usually paid for by the buyer taking out the mortgage, and it’s pretty much guaranteed to be a part of the mortgage application. (Hint: You’re going to want both lender’s and owner’s title insurance, and we’ll cover owner’s later on.) It’s very cheap—usually just a few hundred dollars.

How Does Lender's Title Insurance Work?

If you’ve ever bought a house, you probably remember going to a title company to sign all the paperwork. (Just talking about it makes our wrists ache!) A title company’s job is right there in the name—they’re a third party that helps both you and your lender get all the history and facts about the title on the property you’re buying.

Your lender uses a title company to do two main things:

- Search to be sure the seller is the true and undisputed owner with the legal right to sell the property with a clean title

- Issue a lender’s title insurance policy

The face value of a lender’s title policy will match the amount of the mortgage itself. As you pay the loan down, the value of the policy will go down at the exact same rate. Someday, the policy will expire (but since you’ll have paid off your house by then, you probably won’t even notice.) Cheers!

The lender’s side of title insurance kicks in anytime there’s a challenge to your status as the true owner of a property. Title companies try to get the full history of any property they handle in a real estate transaction—but nobody’s perfect. Even the most thorough research can miss a title defect. (That’s a legal issue with the title where the true owner can be disputed.)

When that kind of challenge comes up, your house is on the line. Hopefully any disputes about the status of your happy home turn out in your favor! But just in case some ex-spouse or hidden easement pops up to cancel your title, your lender will make a claim on the lender’s insurance you bought. If it turns out you’re actually not the owner, the house you borrowed for is no longer yours or the bank’s—and they’ll need to recoup the money they’re losing in the deal.

Like we said above, the premium on a lender’s title policy is something you only pay once. Usually, it’s part of the closing on your house.

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted® insurance pros are independent and vetted—and they help you fill the gaps in your policies. They make getting insurance (like home, auto and umbrella) one less thing to stress about. Plug in your zip code to connect with an agent who understands the coverage needs in your area.

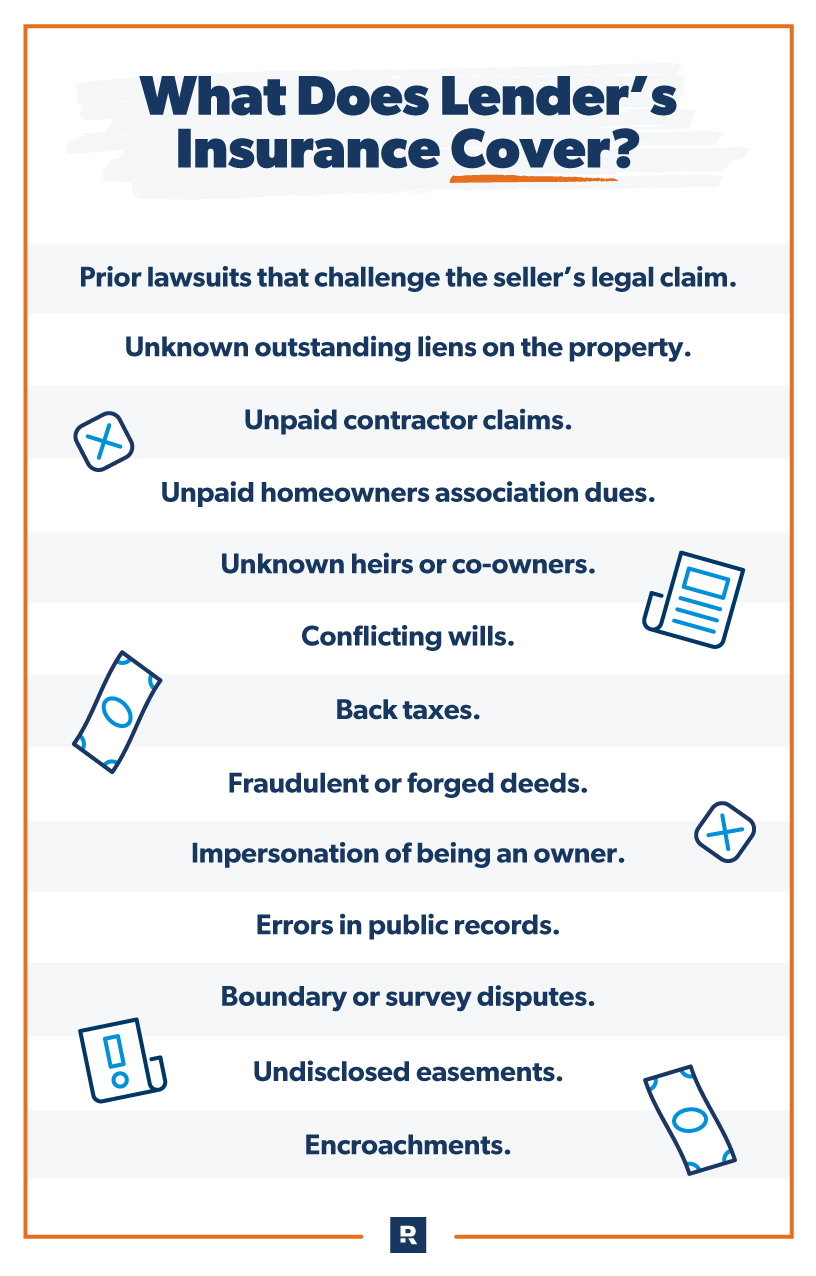

What Does Lender's Title Insurance Cover?

To be obnoxiously clear: Lender’s title insurance in no way covers you, the homeowner. Even though you are the one who has to pay for it when you take out a mortgage, its only purpose is to protect the bank. If the title company told you the title was clean when you bought the house, that’s great! And hopefully it stays that way. But it’s also worth knowing about some of the depressing defects that can surface—sometimes long after you’ve moved in.

Let’s look at a few of the situations in which a lender’s title policy could come into play:

- Prior lawsuits that challenge the seller’s legal claim

- Unknown outstanding liens on the property

- Unpaid contractor claims

- Unpaid homeowners association dues

- Unknown heirs or co-owners

- Conflicting wills

- Back taxes

- Fraudulent or forged deeds

- Impersonation of being an owner

- Errors in public records

- Boundary or survey disputes

- Undisclosed easements

- Encroachments

And you thought it was just a buyer and a seller and a bank! Who knew there were so many kinds of legal mishaps that could threaten your house?

Is Lender’s Title Insurance Worth It?

If you need a mortgage to get into a home, then lender’s title coverage is definitely worth buying—in fact, it’s nonnegotiable! The minute you turn in your paperwork to get the mortgage train rolling, the title search begins. And the bank won’t approve your loan until they know that loan’s insured.

But maybe you couldn’t care less about protecting some bank (relatable!) There’s another big reason to use a title company for any home purchase—because as the homeowner, you want to confirm that your new house is really yours. Title companies are the experts in going through all the public records to discover every possible detail about your property’s history.

And remember, it’s super affordable. The formula is typically somewhere between 0.5% to 1% of the loan amount, and it’s something you pay only once. There are many far more expensive—and way less useful—forms of insurance.

What Are the Risks of Not Having Lender’s Title Insurance?

The main risk of not having lender’s title insurance is that you won’t be able to get a mortgage. (Actually, that’s not a risk, it’s a promise.) If you can buy a house with 100% cash down, that’s stupendous! But don’t expect to get a mortgage unless you’re willing to cough up a few Benjamins for lender’s title insurance.

What Is an Owner’s Title Policy?

All this talk about property disputes and missing uncles who want to claim your house should raise an obvious question in your mind—what about protecting myself as a homeowner? That’s a whole different kind of policy.

There are two types of title insurance: owner’s and lender’s. And even though banks will require you to get lender’s title insurance to protect themselves, owner’s is optional—technically! But if you don’t get it, you’re making a huge mistake.

Owner’s title insurance covers you (the owner) from being sued if someone has a beef with your property. Let’s say the previous owner had a lawn care specialist . . . but stopped paying their bill before they sold the home to you. The lawn care company put a lien against the home in hopes the owner would settle up. If you didn’t get owner’s title insurance, the previous owner’s lawn care bills are now your problem.

And that big scary list of potential title defects above? Yeah, all of those same problems that put the lender at risk could possibly impact you as an owner someday too. So even though getting owner’s title insurance is optional, it would be insane to go without it.

Of course, as a homeowner you should know that having a homeowners insurance policy is essential coverage to protect your home. And it’s protection that works alongside your owner’s title policy to protect your property and its value.

How Do You Buy Lender’s Title Insurance?

Your lender or real estate agent may have a specific title company in mind they recommend you work with. But you don’t have to go with their suggestion. Shopping around, you might like one title company more than another.

Buying lender’s title insurance is usually part of the closing process. Most people just sign off on it without paying much attention—because it’s hard to notice everything while you’re plowing through all the documents they make you sign!

And what about homeowners insurance to go along with your title coverage?

One way to get it is to shop around and buy directly from a carrier. But this can take a lot of time and still leave you without the best protection. With so many different coverages and add-ons, it’s easy to miss one you need or accidentally buy one you don’t.

What if you could delegate this to someone else? You can!

Sitting down with a RamseyTrusted insurance pro can take the mystery out of homeowners insurance. They’ll be sure to help you understand what’s covered—and what isn’t—while getting you all the coverage you need to protect your home.

Plus, working with an independent agent who isn’t tied to one insurance company might help you save money on homeowners insurance. That’s because they can shop around for rates from dozens of different companies and find the best deal for you.

Connect with a pro near you today!

Interested in learning more about homeowners insurance?

Sign up to receive helpful guidance and tools.