Key Takeaways

- Open enrollment is a window of time when you can buy health insurance through your employer or on the open market.

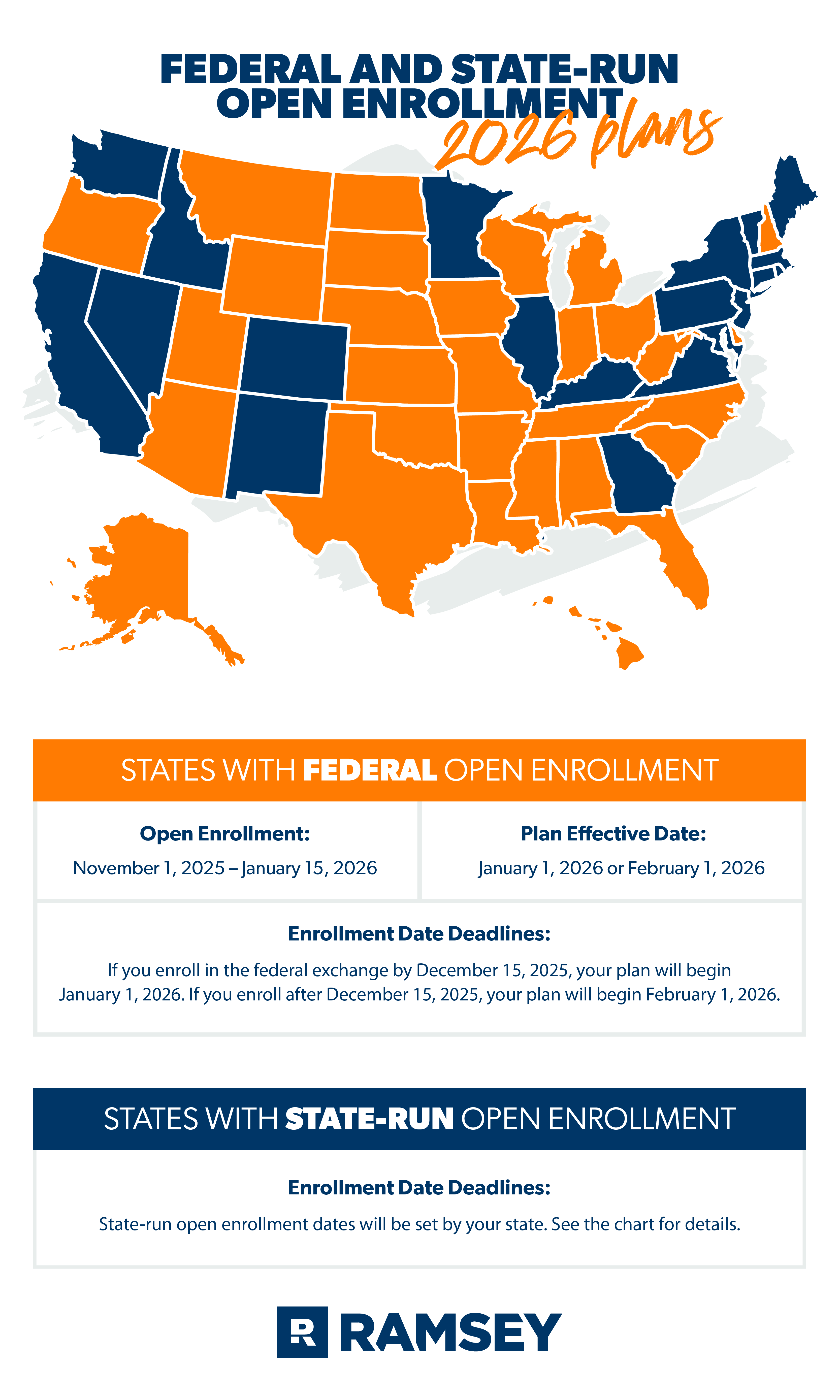

- Open enrollment for federal marketplace coverage during 2026 starts November 1, 2025, and closes January 15, 2026, while state-run exchanges have their own dates within that window. So be sure to find out if your state has its own marketplace and, if so, what your enrollment deadline will be.

- If you’re getting coverage through your employer, they’ll let you know about your open enrollment dates, which usually run about two weeks in November or early December.

- You don’t want to miss open enrollment. The only other time you can buy health insurance is when you have a qualifying life event (getting married, having a kid, losing coverage and a few more).

- Getting health insurance through your employer is usually cheaper, but you’ll have more plan options through the federal or state marketplace.

Open enrollment for health insurance got you feeling confused? We hear you!

You’ve got dates to remember, plans to compare and sometimes higher costs to budget for. Worse—the information you need is usually scattered all over the internet. This season can be a little frustrating.

But it's also a great opportunity to find the right health insurance plan at the right price. So before you bang your head against a wall, let’s sort some things out.

We included everything you need to know in one place, so you can bookmark and reference it any time and be confident about your 2026 health insurance decisions.

What Is Open Enrollment?

First things first: What is open enrollment? Open enrollment is the once-a-year window of time when you can sign up for your employee benefits like health insurance. It’s also when you can buy marketplace health insurance run by the federal or state government.

Open enrollment is a big deal because it’s the only time each year when you can sign up for these things under normal circumstances. The only exceptions are if you have what’s called a qualifying event (aka losing coverage, having a baby, getting married, or starting a job—hopefully not in that order).

You don’t want to miss it!

Here's A Tip

Remember, you need health insurance. Without it, you’re potentially one hospital visit away from financial disaster.

Matthew T. can attest to the vital need for health insurance from a personal experience he shared with the Ramsey Baby Steps Facebook Community.

“I spent the last 20 years of my life without health insurance,” he said. At the age of 40, Matthew signed up for a high-deductible, low-premium health plan.

“Fast-forward 30 days (you read that right), I began experiencing pain in my neck, which radiated up the back left side of my head.”

After several tests, doctors diagnosed Matthew with a serious brain condition that required immediate treatment and a three-day hospital stay. Total cost: $169,912!

“Insurance kicked in and I am responsible for $8,550,” he said. What a huge difference!

How Long Is Open Enrollment for Health Insurance?

This is such an important season—so mark your calendar! How long do you have to learn about and choose your health insurance options for 2026? Well, that depends on a few factors, like who you’re getting your health insurance through and sometimes which state you live in.

- If you’re going through your employer, your open enrollment period will be set by them and the carrier they choose—probably somewhere around two weeks in November or early December.

- If you’re going to the federal-run open market, you’ll have 2 1/2 months (from November 1, 2025, to January 15, 2026).

- If you’re getting health insurance from a state-run marketplace, your enrollment period will be different depending on the state you live in. But most states have open enrollment periods similar in length and timing to the federal one.1

- If you're getting Medicare, your open enrollment goes from October 15 through December 7.

Do You Have to Apply for Health Insurance Every Year?

What if you really love your health insurance and don’t want to make any changes—do you have to apply again? Not necessarily. By November 1, you should receive two letters about your coverage: one from your current insurance company and the other from the federal marketplace. Depending on your current plan as well as your expected 2026 income, those letters will tell you if you’re eligible to be automatically re-enrolled.2

But even as convenient as auto-renewal sounds, we don’t recommend leaving your health insurance on set-it-and-forget-it mode. Things can change year to year, both in the marketplace and with you. For example, the premium tax credits introduced as part of the Affordable Care Act are set to expire at the end of 2025 and were not extended as part of this year’s One Big Beautiful Bill Act.3 That change is expected to increase costs for marketplace plans, so you’ll want to look at all your options before you get locked into a plan you can’t afford. Plus, you may find new, better options that weren’t available when you enrolled last year.

Open enrollment is the best time to reevaluate your situation and actively reapply. That way you know you’re signing up for the best option for your family and your budget.

If you get your health insurance through your employer, you’ll probably need to sign up every year. Check with your employer to make sure!

When Is 2025 Open Enrollment for 2026 Health Insurance Coverage?

Before we dive into specific dates and deadlines, you need to know where you’ll be getting your coverage from. If you’re not getting it through your employer, you’ll need to explore your health coverage options through a health insurance marketplace. Depending on your income, family size and other factors, you could qualify for discounts on coverage you get through these marketplaces. Let’s hope so!

While most states rely on the federal marketplace (aka exchange) to offer health insurance plans, there are currently 20 states plus Washington, D.C., that run their own health insurance exchanges. Check out our map below to figure out which marketplace your state uses.

Now, let’s talk about open enrollment deadlines for the states that use the federal marketplace. That enrollment window starts on November 1, 2025, and the deadline to get coverage by January 1, 2026, is December 15, 2025. To get coverage by February 1, 2026, you’ll need to enroll by January 15, 2026.

Next, the states that run their own health insurance exchanges have individual enrollment deadlines and plan effective dates. Let’s look at those dates in detail, along with the states that use the federal marketplace.

Get the health insurance you need from Health Trust Financial today!

When RamseyTrusted partner Health Trust Financial is in your corner, you’ll have peace of mind knowing you have the right health insurance that won’t break the bank.

Dates and Deadlines for 2026 Health Insurance Coverage

The map and chart below show the open enrollment and plan effective dates for all 50 states and Washington, D.C.

Source: Kaiser Family Foundation.4 State-run exchange plan information subject to change.

If you’re still unsure about your state-run exchange’s plan effective date, check with your state’s marketplace for further details.

State-Run Open Enrollment for 2026 Plans

|

State |

Open Enrollment Dates |

Plan Effective Dates |

|

California New Jersey Rhode Island |

November 1, 2025–January 31, 2026 |

For your coverage to start January 1, 2026, you need to enroll by December 31, 2025. But if you don’t enroll until sometime in January, your coverage won’t begin until February 1, 2026. |

|

Colorado Connecticut Georgia Illinois Kentucky Maine Maryland Minnesota Nevada New Mexico Pennsylvania Vermont Washington |

November 1, 2025–January 15, 2026 |

In Maryland and Nevada, you must enroll by December 31, 2025, for coverage to start January 1, 2026. In every other state in this category, if you enroll by December 15, 2025, your coverage will start January 1, 2026. After that, coverage purchased by January 15, 2026, starts February 1, 2026. |

|

Idaho |

October 15, 2025–December 15, 2025 |

For everyone who enrolls during open enrollment, coverage will start January 1, 2026. |

|

Massachusetts |

November 1, 2025–January 23, 2026 |

For coverage that starts January 1, 2026, enroll by December 23, 2025. Coverage for those who enroll between December 23 and January 23, 2026, will start February 1, 2026. |

|

Virginia |

November 1, 2025–January 30, 2026 |

If you enroll by December 15, your coverage will start January 1, 2026. If you enroll between December 16, 2025, and January 30, 2026, your coverage will start February 1, 2026. |

|

New York Washington, D.C. |

November 1, 2025–January 31, 2026 |

If you enroll by December 15, your coverage will start January 1, 2026. If you enroll after that but before the January 31, 2026, deadline, your coverage will start February 1, 2026. |

Source: healthinsurance.org.5 State-run exchange plan information subject to change.

Are There Any Health Insurance Changes for 2026?

For folks already signed up for health insurance, the open enrollment period can bring up some anxiety. It’s natural to wonder, Will things change for the new year and disturb my perfectly ironed-out health plan? Probably the biggest worry on everyone’s mind is a rate hike. We can relate!

First, we know that a new Marketplace Integrity and Affordability Rule in 2025 includes higher maximum out-of-pocket limits, and this will affect all marketplace plan participants. Thankfully, the increase is pretty small.

But across the board, premium rates are going up. The median rise in premiums for Affordable Care Act marketplace plans during 2026 is expected to be 18%.6 Factors contributing to that increase include:

- Increasing medical costs (what else is new?)

- Overall inflation

- Workforce shortages

- The expiration in 2025 of tax credits previously included as part of the Affordable Care Act7

Here's A Tip

Think ahead about the 2027 plan year! The same new Marketplace Integrity and Affordability Rule we mentioned above will have a huge impact on next year’s marketplace open enrollment. The federal marketplace enrollment period will run from November 1 to December 15, 2026, a whole month shorter than in previous years. And the enrollment period for state-run exchanges must begin no later than November 1, end by December 31, and last no more than nine weeks.

Listen. We realize that kind of increase can raise eyebrows, especially as tight as most people’s budgets are these days. But skipping health insurance is simply too big a risk for you and your family to take. Take a look at your budget and see where you can save a little to cover the extra cost.

What Information Do I Need to Enroll in a 2026 Health Plan?

Now that you know when you need to enroll, let’s go over what you need to know before you enroll.

Don’t worry. You won’t have to learn anything complicated or dig up ancient paperwork. You’ll just need to follow some simple guidelines before signing up for a year-long commitment. We’re going to break each one down.

Identification

You’ll need some basic personal information for everyone you want to include in your plan:

- First and last name

- Email address

- Birth date

- State of residence

- Immigration status

- Social Security number

- Estimated income for the year you want coverage (include all household members even if they don’t need health insurance)

Terms to Know

Whether you’re enrolling in a plan just for yourself or for your entire family, you’ll need to understand some basic health insurance industry jargon. It’ll help you select the best plan for the best price. Before you sign anything, make sure you’re clear on these terms.

- Premium: A premium is the dollar amount you pay to an insurance company for an insurance policy. Premiums are usually paid on a monthly or yearly basis, but quarterly and every six months aren’t unheard of. For employer plans, your premiums are usually deducted from your pay.

- Deductible: A deductible is the dollar amount you must pay out of pocket before your insurance company starts chipping in.

- Copay: The copay is the dollar amount you pay each time you need a specific medical service (copays don’t usually contribute to your deductible).

- HMO or PPO: HMO and PPO are types of insurance plans—HMO stands for health maintenance organization and PPO stands for preferred provider organization. We’ll talk more about these and other types of plans below.

- Coinsurance: Coinsurance is the percentage of the cost you pay after you reach your deductible.

- HSA: HSA stands for Health Savings Account. Essentially, it’s a tax-advantaged savings account dedicated to health care costs.

The more you understand these terms, the easier it’ll be to lower your insurance bill. For example, understanding the relationship between premiums and deductibles could save you a boatload of money. Why? Because choosing to pay a higher deductible usually decreases the cost of your insurance premiums.

But before you sign up for a $10,000 deductible, let’s talk about when this works and when it doesn’t.

Coverage

While health insurance is an essential part of your financial plan, the right health insurance policy looks different for different families. Go over all your options to see what makes sense for you, your family and your money goals.

If you’re healthy with a healthy emergency fund to match, you could opt for that high-deductible health plan (HDHP) that qualifies you for an HSA to save on premiums. On the other hand, if you or your family members need care more frequently, a lower deductible might make sense for you.

Spend some time on this decision and do your research. Remember, you’ll have to stick with the plan you choose for a full year.

What Are My Health Insurance Options?

You can get health insurance through an employer or the open market. If you’re using the latter option, you’ll get it through the federally run market—unless you live in a state that runs its own health insurance market (check the map above to see if you do).

From there, you choose between different plans like an HDHP or a PPO. If you’re going through your employer, you should have a few plans to choose from. Buying from the open market means you have all options available, like:

- Health maintenance organization (HMO): HMO plans limit you to doctors within a certain network. That means you’ll need a referral to see a specialist. HMOs are usually the strictest plans but can have lower premiums.

- Preferred provider organization (PPO): PPO plans are similar to HMOs but give you a little more flexibility. You’ll pay less for medical care if you use a provider within the plan’s network. You are allowed to access out-of-network providers, but they’re more expensive.

- Exclusive provider organization (EPO): EPO plans limit you to in-network providers, except for emergencies.

- Point of service plan (POS): POS plans offer benefits like lower medical bills if you use doctors, hospitals and health care providers in the plan’s network. Keep in mind, though, you’ll usually need a referral from your primary care doctor in order to see a specialist.

- High-deductible health plan (HDHP): HDHP plans are exactly what they sound like. You pay a higher-than-normal deductible, but you get much lower premiums. An HDHP also makes you eligible to save money in a pretax HSA.

- Short-term plan: Short-term plans are temporary health insurance policies that bridge the gap when you’re between jobs. They usually last from three months to just under a year.

- Catastrophic plan: Catastrophic plans have lower premiums and high deductibles, so you’d foot the bill for most of your medical expenses. But you’d be protected if, for example, you had unexpected, huge medical bills from being injured in a car accident. These plans are typically limited to those age 30 and under, but age-limit exceptions can also be made for financial hardship applicants.

When it comes to marketplace health care plans, there are five different levels of coverage—catastrophic, bronze, silver, gold and platinum. These tiers give you different options for how much your plan will pay out versus how much you’ll pay. They do not affect the quality of care you have available.

With a catastrophic plan, you pay the most out of pocket, and with a platinum plan on the other end of the spectrum, insurance pays for 90% of your costs. As you might guess, the platinum plans have the most expensive premiums. Most folks opt for the bronze, silver or gold.

What Happens if I Miss the Open Enrollment Deadline?

If you don’t sign up for health insurance during the normal enrollment period, it’s possible you won’t be able to enroll or change your health insurance plan until next year’s enrollment period.

Really? Yes, really.

As we touched on earlier, the only time you can make changes or sign up after the deadline is if you experience a major life event (marriage, birth, job loss, etc.). Events like that trigger nervous tics. No, wait—they trigger a special enrollment period (SEP—pronounced as a word, just like it’s spelled) when you can update your health insurance choices for the year. How convenient!

But to enroll outside the normal timeline, you first need to qualify. The health insurance industry calls these events qualifying life events. Another qualifying factor could be exceptional circumstances like a natural disaster.8 Let’s go over the life changes that qualify for a SEP.

Loss of Prior Health Coverage

Losing your health insurance can be scary, but the good news is that any of the following events will qualify you for a SEP:

- Losing your job

- Turning 26 years old

- Getting canceled by a private carrier

- Losing your eligibility for government-funded coverage

Moving

Whether you’re moving out of state or to a different town in the same state, you could qualify for a SEP if your move is permanent. If you have questions, the U.S. Department of Health and Human Services (HHS) maintains up-to-date guidelines for the use of a permanent move for SEP eligibility.

Marriage

Congrats! Finding the love of your life is cause for celebration. Even better? You might qualify for a SEP so you can officially add your spouse to your health insurance.

Household Change

A happy family event like giving birth or adopting a child qualifies for a SEP. More celebrations are in order! You can now add your new family member to your existing health insurance plan.

A not-so-happy event like death or divorce can also trigger a SEP—but only if the event results in a loss of coverage.

How Long Do You Have to Enroll After a Qualifying Event?

If you’re enrolled in a federal marketplace health care plan and you qualify for a SEP, you usually have 60 days before and 60 days after the qualifying event to enroll or change your health insurance details.9 Once that window closes, the SEP is over and you’ll need to submit an application for a new SEP.

If you’re enrolled in a state-run plan, the SEP timing requirements are managed by your individual state. If you’re unsure about your state’s SEP dates, check with your state’s marketplace for further details.

Job-based health care plans have their own SEP timing requirements that are also different from the federal marketplace. Companies must provide a SEP of at least 30 days.10

Our advice? Regardless of where you get your health insurance, don’t put off a SEP application. If you qualify for a SEP, sign up or make changes to your plan as soon as possible. The longer you wait, the longer you’ll be without the health insurance you need, and the longer you’ll be risking financial disaster.

Questions to Ask Your Employer

We collected questions employees most often ask about employer-sponsored health plans. We can’t provide specific details about your employer’s health plan, but we can guide you toward the questions you should ask to get the answers you need.

1. What are the plan’s enrollment and effective dates?

Most enrollment periods for company-sponsored health insurance plans are scheduled in November or early December, and the plan effective date is usually January 1 of the following year. But companies do have some wiggle room here. Be sure to ask your company’s plan administrator what the specific enrollment/effective dates are for your company.

2. How does the plan manage prescription drug costs?

Changes in health insurance provider drug coverage happen all the time. Before you enroll in or change your health plan, find out if your employer has added or excluded coverage that could affect how much you pay for your prescriptions.

3. What’s the cost for covering my spouse and children?

If you previously had coverage for a working spouse, ask your company’s plan administrator if they’re adding or increasing a surcharge for your spouse’s coverage. Also, companies can make changes in employee premium contributions to cover dependent children. Ask about that too.

4. Can I go to my preferred doctor and hospital?

Some employers change health insurance companies, plans or provider networks to keep costs down. This can mean that your preferred doctors and hospitals might not be available on your plan anymore. Ask your plan administrator about this so you can adjust if needed.

5. Does this company do anything to help employees save money on health care costs?

Everyone is concerned about health care costs. Companies too. In fact, some companies have made changes specifically designed to lower health care costs for their employees, including lower out-of-pocket costs and lower premiums for low-wage workers. And some have even made contributions to employee HSAs. Ask your company’s plan administrator if your employer has taken any actions like this to help you save money.

Choosing the Best Health Insurance for You

That was a lot of info! If you’re feeling a bit overwhelmed, we get it. Health insurance is complicated. There are so many different options that it can be hard to figure out which one is your best bet. And you want to make sure you get the right coverage.

To help you accomplish that, we've put together a list of practical next steps you can take right away to get health insurance done now.

Next Steps

- Read more about why health insurance is an essential part of a smart financial plan.

- Go deeper to learn more about how to get health insurance.

- To choose the right type of health insurance for you and your family, talk to our RamseyTrusted® health insurance partner Health Trust Financial. Their independent agents really know their stuff. In fact, they’ve been serving Ramsey customers for over 20 years. When you work with Health Trust Financial, they can set you up with the best health insurance quotes and policies for your situation and explain all the insurance jargon to you. Plus they’ll never try to sell you something you don’t need. Connect with them now!

Interested in learning more about health insurance?

Sign up to receive helpful guidance and tools.

Frequently Asked Questions

-

How do I know if I can enroll in the marketplace as a self-employed person?

-

You’re eligible to enroll in the marketplace if you’re a freelancer, consultant or an independent contractor who doesn’t have any employees.

-

Are there enrollment exceptions if I missed the cutoff date?

-

Yes. If you qualify for a special enrollment period (SEP), you can enroll in a health insurance plan outside of the normal enrollment dates. But only if you’ve experienced what the health insurance industry calls a qualifying life event. Qualifying life events can be things like marriage, birth and moving.

-

What if I missed the open enrollment deadline and I don’t have a qualifying life event?

-

No need to panic. You still have fallback options, including private health insurance companies and health care cost sharing ministries like Christian Healthcare Ministries that could help. We recommend you connect with a RamseyTrusted insurance pro—they can help you figure out your fallback options.