Key Takeaways

- Stop adding more debt. Don’t rely on credit cards, payday loans, or other “quick-fix” debt options because they’ll worsen your financial situation and keep you in a cycle of debt.

- Cut unnecessary spending and prioritize basics—food, utilities, shelter, and transportation—before anything else.

- Look for ways to bring in extra money (like side jobs, selling unused items, reducing big expenses such as car payments) so you can catch up on bills.

- Contact your lenders proactively, explain your situation, and try to negotiate payment plans rather than ignoring bills.

It’s the end of the month. Your bills are piling up on the kitchen table, and your paycheck can’t seem to stretch far enough to cover even half of them. If you’re wondering what to do when you can’t pay your bills, you’re not alone. In fact, 78% of Americans are living paycheck to paycheck too. Not being able to cover your bills is pretty normal. But it doesn’t have to be!

Pay off debt fast and save more money with Financial Peace University.

It’s time to say goodbye to stress and start moving forward with practical next steps. These tips will help you take the next step when your paycheck isn’t cutting it.

1. Cover your Four Walls.

When creditors are calling (emailing, texting or sending snail mail), it’s easy to get bullied—which hits even harder when you already feel like you’re drowning in debt. Most of the time, they’ll try to convince you that paying them is more important than keeping the lights on.

Listen closely: The most important thing you can do is take care of your Four Walls first—and in this order:

- Food

- Utilities

- Shelter

- Transportation

Before you spend even one more dime toward debt, make sure to take care of you and your family. We know—that sounds backward when you can’t pay your bills. But your family comes first! That means you need food in the fridge, lights and running water, a roof over your head, and a way to get to and from work every day.

2. Create a budget.

We know, you might be thinking, What’s the point of a budget when I don’t make enough money to pay bills?

Doing a budget will help you prioritize your spending. When you see all of your income and expenses written down in a budget, you’ll get a fuller picture of what your finances look like. Then, you’ll be able to see what you can cut out and sacrifice as you make a plan for every single dollar you own.

With a zero-based budget (see below) and more bills than paychecks, you might see some red for a little while. But don’t worry. It takes a couple months to get the hang of it. But until then, cut out any extra spending and do everything you can to increase your income. You’ll see it balance out to that beautiful zero in no time.

Here’s exactly how you’ll make your zero-based budget:

List your income.

We’re not just talking about the weekly or biweekly paycheck you get from your employer. We’re talking everything—every penny (yes, penny) you make throughout a given month. Make sure to include it all in your budget!

List your expenses.

Take inventory of all your monthly expenses: mortgage or rent, electricity, heat, groceries, gas, oil changes, dog food, clothing . . . everything. Write down every expense you can think of, including your debts (and don’t forget those subscriptions to services like Amazon Prime, Netflix and Hulu).

Subtract your expenses from your income.

This should equal zero. Why? Because zero means you’ve given every single dollar a job to do. That’s why it’s called a zero-based budget! (And no, it doesn’t mean there are zero dollars in your bank account.) Right now, your budget is probably in the negatives because you’re having trouble covering your bills with your current income. But that’s okay. Take a deep breath. This is where you might want to give up. Don’t!

Instead of thinking, This is exactly why I didn’t want to do a budget in the first place, remember: This is another reason you need a budget. Doing a budget helps you see where you’re overspending. It helps you identify your spending patterns and the why behind them. And ultimately, it helps you get your spending balanced out (one month at a time).

Eventually, we want to see that perfect little goose egg at the top of your zero-based budget. And in order to do that, we’ve got to make some sacrifices.

Find More Margin. Beat Debt Faster.

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

3. Cut any unnecessary spending.

Okay, we just said it’s time to make sacrifices, and this is a great place to start. The first way to making your too-tight budget work month after month is by cutting any unnecessary spending.

If you usually buy your lunch every single day, challenge yourself to do some meal prep and take your lunch. (You’ll be surprised at how quickly eating out at restaurants can add up.) And if you’re the type to swing through the local drive-through for coffee, challenge yourself to make coffee at home instead.

Another thing you can do is pause those subscriptions. If that’s Netflix, head over to the library and see what movies you can check out for free. If that’s your gym membership, hit up those free workouts on YouTube. There are a million ways to save money.

And here’s the cool part: All that money saved goes right back to your budget to help you tackle those bills! But don’t worry, it’s not forever. You won’t be scrimping and sacrificing for the rest of your days—it’s just a season. So, which sacrifices do you want to challenge yourself to make this month?

4. Stop taking out debt.

No more debt. You’ve got to drop the idea that you need to use debt to live your life. Cut up those credit cards. Say no to using buy now, pay later programs to pay for things. Run hard and fast from personal loans, cash advance apps and other kinds of debt that will only keep you living in the past.

Sound a little radical? You may have taken a big gulp right there, and that’s okay. Maybe you were taught debt is a tool to help you get ahead in life. That. Was. A. Lie. That shiny, dumb piece of plastic in your wallet isn’t really a status symbol . . . whether it’s black, gold, yellow or green. The only thing it’ll do is send you further into debt and even more stress. And that might be exactly what you’re feeling right now. If so, it’s time for a change!

Remember, the best thing you can do for yourself and your finances is to stop taking on more debt.

5. Watch out for debt scams.

Turns out, not everyone has your best interest in mind—especially when you’re down on your luck. You might think payday loans and other seemingly well-meaning businesses are there to help you get money when you need it. But sadly, that’s not the case. In fact, it’s the opposite.

Payday lenders are the worst. They reel you in with the promise of fast cash and then keep you stuck in the cycle of debt. How? With impossibly large interest rates. You’ll end up using your next paycheck just to pay the payday lender back. You can never get ahead this way. Never.

And while we’re on the topic . . . don’t get sucked into debt consolidation or credit card balance transfers either. Those folks are just as bad! They promise you margin and less stress with some fancy footwork (moving debt from one place to the other), but it never pays off in the long run.

Believe us, these kinds of debt scams aren’t worth it. Keep your paycheck and continue following these steps to get rid of your debt and start winning with money.

6. Plan ways to increase your income.

Now that you’ve cut out the extras, it’s time to increase your income. If you’re in between jobs, that’s okay. You don’t have to find your forever job to make ends meet. All you need is hard work and the willingness to do whatever it takes to keep the money coming in.

Maybe that means you get a second or third job, start a side hustle making cupcakes, or sell that fancy wedding china you’ve never taken out of the box.

Don’t worry—there are plenty of things you can do to increase your income and make ends meet:

-

Sell your brand-new vehicle for a cheap-but-reliable used car instead.

-

Have the biggest yard sale ever.

-

Get a second job.

-

Get a roommate and charge rent.

-

And no matter if it’s $5 or $500, any extra money you make should go toward catching up on your bills.

You always have options!

7. Contact your lenders.

One of the hardest parts of being in the red is worrying about how to pay the bills. And if you’ve got notice after notice piling up on your kitchen table, it might be time to give those lenders a call.

Don’t let pride get in the way of communicating with your lenders. Often, they’ll understand and try to work with you. Ask about a payment plan and let them know what you’re able to pay (more on this in a second).

If you’re dealing with debt collectors who are harassing you day and night, it’s time to put a stop to it. We’re not saying you shouldn’t pay your bills (because you should), but we don’t believe you need to be bullied into it. Learn more about dealing with debt collectors. And while you’re at it, read up on how the Fair Debt Collection Practices Act protects you from unfair collection practices to make sure they’re not breaking the law.

8. Give your creditors their fair share.

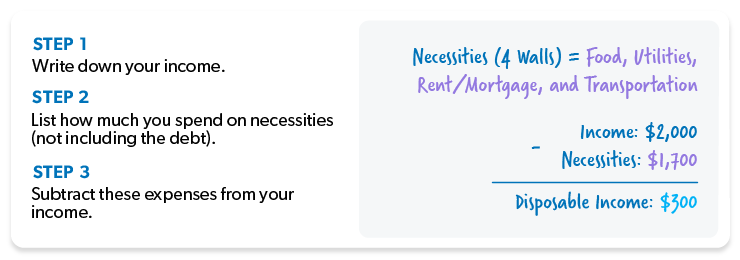

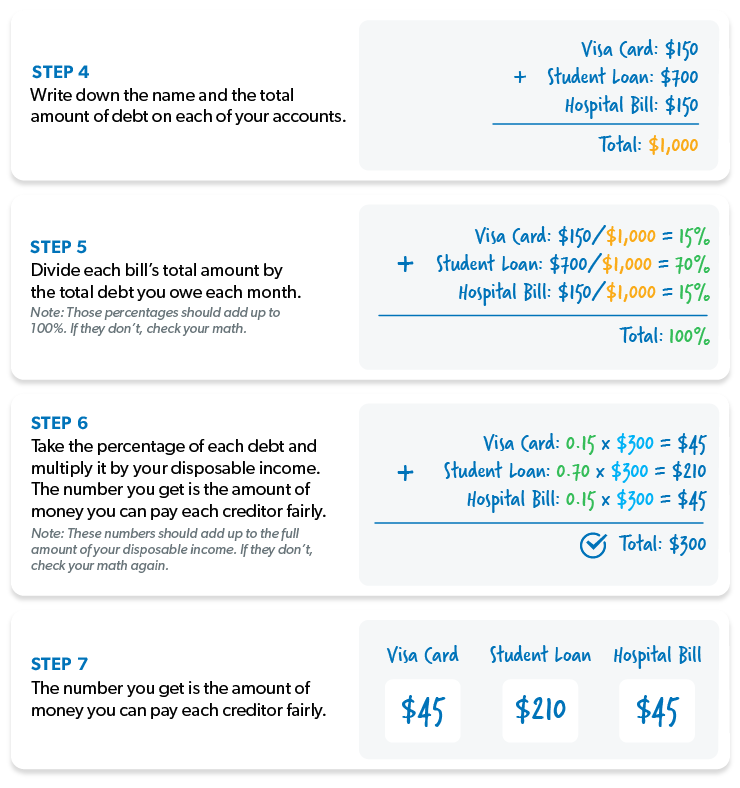

Okay, if you’ve done all those steps above, and you’re still struggling and can’t pay your bills, there’s still hope. You just need a plan. And when it comes to dealing with creditors, we like to use what’s called pro rata . . . or fair share. This means you’ll give each of your creditors their fair share of the money you have left after you’ve paid for the essentials (like the Four Walls). Here’s an example of how it works:

In this case, you have $300 left over to pay your creditors. This is your disposable income.

Once you know how much money you can spend on debt payments, you need to figure out pro rata. This part is a little more complicated, but stay with us. Here’s how you calculate it:

Remember, the pro rata plan is only a short-term solution. It just gives you enough breathing room to make changes for the better.

And here’s the thing: You won’t get out of debt this way. However, making monthly payments to each creditor goes a long way in the long run, even if you’re in collections.

9. Send payments with a letter.

Now that you’ve decided who to pay (and how much to pay them), it’s time to send your payments. Make copies of your math, including your income, expenses, disposable income and the calculations you made to give every creditor their fair share. Don’t forget to include this letter (also called a hardship letter) with every bill every single month.

Those creditors won’t like getting less than the minimum payment, but if you keep sending checks every month, they’ll probably keep cashing them.

This doesn’t mean they’ll stop calling and trying to bully you into giving them more money, but don’t let that steer you off course. You don’t want to get so rattled that you agree to something that will shoot you and your family in the foot when it’s time to buy groceries.

And never ever give a creditor access to your bank account for automatic withdrawal every month. They’ll clean you out—even if they say they won’t.

10. Get on a plan to get out of debt.

Debt is a thief. Not only does it steal from your future, but it also steals from your peace in the present. When you’re having a hard time making ends meet month after month, it wears on you. But listen: It doesn’t always have to be this way! You don’t always have to be in debt. You don’t always have to scrimp and sacrifice and eat nothing but beans and rice.

You can change your life! You get to be the hero of your own story . . . starting with learning how to get out of debt. And if you want to hear how someone else went from rock bottom to changing the trajectory of their future, watch Lesson 1 of Financial Peace University. (Spoiler: That someone is Dave Ramsey.)

So, get your footing back, get your bills up to date, and then give debt the kick in the pants it needs to get out—and stay out—of your life. How? By changing your behavior. We’re guessing by now you’re sick and tired of living paycheck to paycheck.

That’s where the debt snowball comes in handy:

Step 1: List your debts from smallest to largest, regardless of interest rate. Pay minimum payments on everything but the little one.

Step 2: Attack the smallest debt with a vengeance. Once that debt is gone, take that payment (and any extra money you can squeeze out of the budget) and apply it to the second-smallest debt while continuing to make minimum payments on the rest.

Step 3: Once that debt is gone, take its payment, and apply it to the next-smallest debt. The more you pay off, the more your freed-up money grows and gets thrown onto the next debt—like a snowball rolling downhill.

Repeat this method as you plow your way through debt. Pretty soon, you’ll be debt-free and ready to start living the life debt stole from you.

Remember: You don’t ever want to go there again, so do whatever it takes to say hasta la vista to debt—for good! While that may sound like a fairy tale right now, it could be your happily-ever-after story sooner than you think . . . especially if you’ve got the right inspiration and a plan to help you get there. Financial Peace University is that plan! In fact, nearly 10 million people have gone through the course and learned how to dump debt, save for emergencies, and prepare for their future. You can be one of them. Sign up today.