Key Takeaways

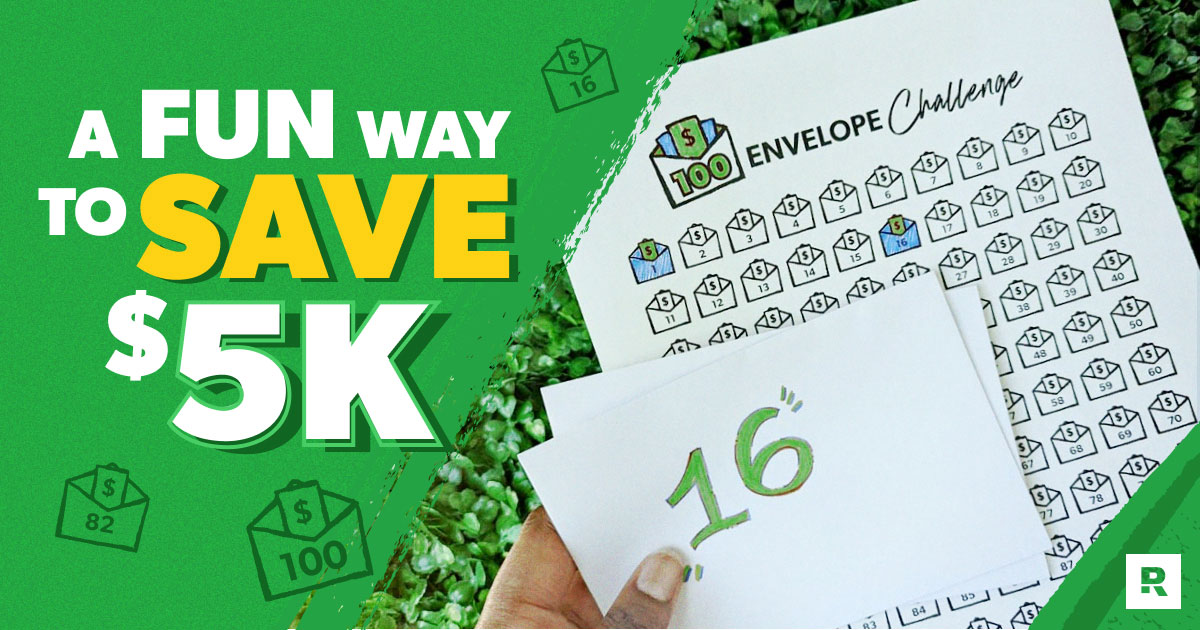

- The 100 Envelope Challenge is a fun way to intentionally save money.

- To do the 100 Envelope Challenge, label individual envelopes 1 to 100. Pick an envelope each day, and whatever number is on the envelope is the amount of cash you put in it.

- After 100 days, you’ll have saved $5,050!

Raise your hand if you’d love an extra $5,000 right now. Yep, us too!

Just think about what you could do with that money: pay down some debt, build up your savings, pay cash for your next vacation.

Well, good news! There’s a money trend called the 100 Envelope Challenge—and it’ll help you save $5,000 in just 100 days. Are you up for the challenge?

What Is the 100 Envelope Challenge?

The 100 Envelope Challenge is a money-saving challenge where you put a certain amount of cash into 100 envelopes over 100 days to save about $5,000 total.

Basically, the 100 Envelope Challenge is a simple, low-tech way to gamify your savings!

How Does the 100 Envelope Challenge Work?

Here’s how the 100 Envelope Savings Challenge works: You label 100 individual envelopes with the numbers 1 to 100. Each day, you pick an envelope, and whatever number is on the envelope is the amount of cash you put in it.

For example: On Day 1, you put $1 in the envelope labeled “1,” and on Day 55, you put $55 in the envelope labeled “55.”

After 100 days, the math works out to $5,050 saved! (You can double-check us if you want—or just drive to the dollar store for envelopes right now to get started.)

Free Up Margin. Make Real Progress.

The EveryDollar budget app helps you find hidden margin and put it to work so you can stack savings, crush debt, and build wealth that lasts.

How to Do the 100 Envelope Challenge

1. Gather your supplies.

To do this 100-day envelope challenge, you’ll need:

- A stack of 100 envelopes

- A marker

- Physical cash

- A competitive spirit

- A healthy dose of willpower

2. Label 100 envelopes from 1 to 100.

This step can be as simple or creative as you want. If you’re doing this with the family, pull out some art supplies and get the kids in on decorating the envelopes.

3. Store the envelopes.

Find a box or drawer to safely store your envelopes. Remember, these envelopes may be empty now, but pretty soon, they’ll have cash in them—so make sure you’ve got enough room for all 100 full envelopes.

4. Pick one envelope each day to fill with cash.

Here’s where the fun (and saving) begins! Each day, you pick an envelope to fill with cash. You can choose to go in numerical order or grab envelopes at random.

Here's A Tip

To make the challenge get easier throughout the months, start backward (with 100!).

5. Make a plan for your saved money.

An extra $5,050 is great! But let’s be honest: It can disappear real fast if you don’t have a plan for it. So, before you start spending, you need to decide where that money will go.

While you should definitely celebrate your hard work, this is your chance to make progress toward your money goals. So, what’s most important for you right now? Maybe you need to pay off credit card debt, build your emergency fund, or continue saving for an upcoming expense.

It’s up to you how you want to spend your cash. But it’s best to have a plan beforehand. Otherwise, if you’re not careful, your 100 days of savings could disappear in just one day.

Tips to Complete the 100 Envelope Savings Challenge

We’re not going to lie—this 100-day savings challenge can be hard work. You’ve got to be intentional with your saving and practice lots of self-control during those 100 days. So, here are some practical and motivational tips to help you actually stick with it.

Create a budget.

First off, you need to make a budget. Because the best way to make sure you’ve got enough cash to save for this challenge is to tell your money where to go during the month. The EveryDollar budgeting app is an easy way to get started!

Increase your income.

Next up, find ways to increase your income. You could get a side hustle, sell some stuff, work overtime—or a combo of all three. Yes, it’s extra work, but it’s only for 100 days. You can do this!

Cut your spending.

A big way to have more money to win the 100-day money challenge is to cut some of your spending. Again, it’s just for 100 days! (Although, there’s no rule that says you can’t fill more than one envelope a day. Just saying.)

Can you stop eating out for a couple months? Why not skip the fancy lattes, pack a brown-bag lunch, or pause some subscriptions? Who knows—you might realize you can live without some things because you prefer to have that extra cash in your budget every single month.

Use a 100 Envelope Challenge chart.

Don’t underestimate the power of making your goals visual! Use our 100 Envelope Challenge chart to track your savings progress and keep yourself motivated. Print it out, hang it up somewhere you’ll see it every day, and color in each number as you go. This could even be a way for the whole family to participate in the fun!

Create accountability (and competition).

A challenge is easier when you have an accountability partner to check in with. If you’ve got a spouse or kids, you should all be working on this together!

And since the 100 Envelope Challenge is all about making a game out of saving money, making it a competition against some friends could be the extra motivation you need to cross the finish line. See who can get there quicker, or go in like a team and plan a group reward for when you all make it through.

100 Envelope Challenge Pros and Cons

Pros

- You save $5,050! (Obvious pro, right?)

- You prove to yourself you can set a goal and reach it.

- It makes saving money more fun!

- You learn how to budget and take control of your money.

- Your family learns how to work toward a common goal together.

- Cutting back on spending can make you feel more content.

Cons

- 100 days can feel like a long time to keep saving. Personally, we think you can do it.

- You may not have enough to save $5,050. If you’re tight on money, use the tips we gave to help you boost your cash flow. And even if you want to extend the challenge for more than 100 days, you’re still saving money!

- It requires you to have easy access to physical cash. If you’re not comfortable having large amounts of cash on hand, you could do a digital version of the challenge. Just pick an amount of money to transfer into your savings once a week and color in that number of envelopes on your 100 Envelope Challenge chart.

Save Money Every Month With EveryDollar

The 100 Envelope Challenge is a great way to save money in a short amount of time. But the fun doesn’t have to stop there! You can start saving (and keep saving) every single month with a budget.

When you budget, you know exactly how much you have to spend and save. Because you’re the one telling your money where to go. No more guessing or mental math. You’ve got a plan.

Ramsey’s EveryDollar budget app helps you find that hidden money fast and gives you step-by-step guidance to use it with purpose. Whether you want to knock out debt, stack up savings, or fund some fun, start EveryDollar for free and make it happen.