Key Takeaways

- You don’t need a six-figure income or inheritance to get rich—most millionaires built their wealth by earning and managing money well.

- Make monthly budgets and follow the Baby Steps to save money, pay off debt, and build lasting wealth.

- Start investing 15% of your household income in retirement accounts like a 401(k) and Roth IRA.

- Don’t fall for trendy get-rich-quick schemes—consistent investing is what actually builds real wealth.

If you want to know how to get rich, first believe it’s possible. Yes, for you. Even if you aren’t in a high-paying job. Even if you aren’t a trust fund baby. Even if you never win the lottery.

Really! The top three jobs held by the 10,000 millionaires surveyed in the National Study of Millionaires were engineer, accountant and teacher—and one-third never had a six-figure household income! Plus, 79% got zero inheritance. They just earned and managed their money really, really, really well.

Want to learn how you can do that too? Follow these eight tips!

1. Make monthly budgets.

Maybe you think budgets are for broke people. Nope. That National Study of Millionaires shows that 93% of millionaires stick to the budgets they create.

Budgeting is a key step in building wealth because it’s how you plan out every dollar you’ll give, save and spend every month. It’s you putting every dollar to work! That’s how you can get rich even without a six-figure income—by being super intentional with the money you’ve got.

Rich. People. Budget. So start budgeting—every dollar, every month.

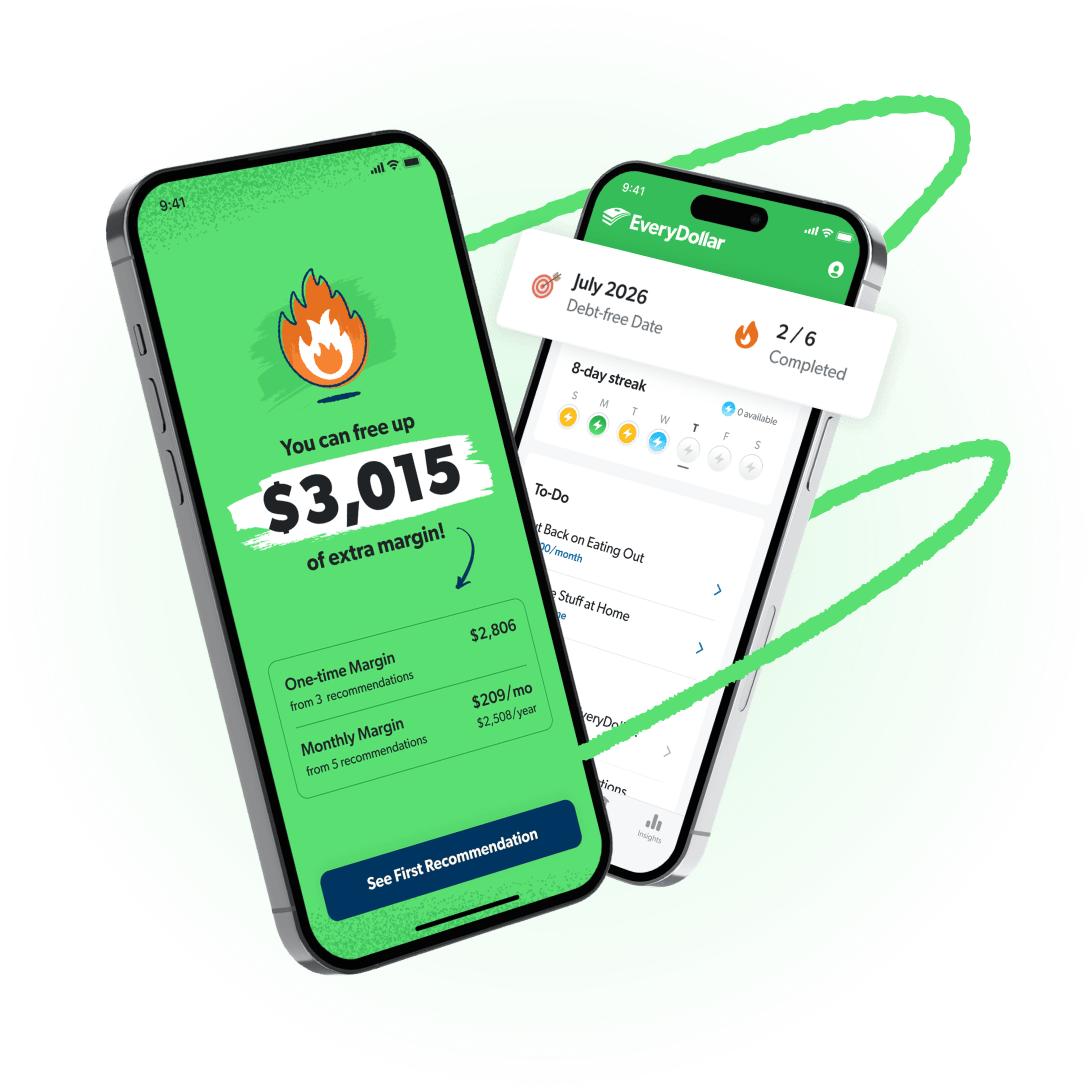

Free Up Margin. Make Real Progress.

The EveryDollar budget app helps you find hidden margin and put it to work so you can stack savings, crush debt, and build wealth that lasts.

2. Increase your income.

It honestly makes sense: If you want to have more money, then make more money. Work to increase your income.

Now, notice this isn’t our very first tip. And that’s for a very important reason. If you increase your income but don’t budget, it’s way too easy for that extra money to get spent accidentally. Or for you to make mindless bougie purchases that might make you look rich, but won’t help you get rich.

When you increase your income, remember to put that money to work too by building your wealth.

3. Cut your expenses.

Another tip: Lower what you spend on essentials and cut out some extras completely.

We’re talking about meal planning to save on groceries, taking quicker (not fewer, please) showers to save on utilities, and cutting out a few of those TV streaming services to save on subscriptions.

Cutting costs helps you make the most of your income and gets you closer to your goal of being rich.

4. Ditch your debt.

Speaking of income—did you know that’s your best wealth-building tool? Yep. But if you’re spending this month’s income to pay for the past (aka you’ve got debt), you aren’t taking full advantage of that tool. You can’t get ahead if you’re literally spending in the past.

Ditch the debt. Reclaim your entire paycheck so you can start covering today’s expenses and saving serious cash for the future.

5. Save an emergency fund.

While you’re working all these ways to get rich, you need a buffer between you and those life happens moments. You need to know that a setback (even one as painful and huge as job loss) won’t mean financial disaster—or even derail your wealth-building plans.

Make sure you’ve got a fully funded emergency fund in place stacked with enough money to cover 3–6 months of expenses. Then you can breathe deeply and feel true financial security while you’re growing that wealth.

6. Follow the Baby Steps.

A few of these tips are part the Baby Steps—the proven plan for saving money, paying off debt, and building wealth. In other words, it’s the plan for how to get rich (in a way that lasts).

Here are all 7 Baby Steps:

Baby Step 1: Save $1,000 for your starter emergency fund.

Baby Step 2: Pay off all debt (except the house) using the debt snowball.

Baby Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Baby Step 4: Invest 15% of your household income in retirement.

Baby Step 5: Save for your children’s college fund.

Baby Step 6: Pay off your home early.

Baby Step 7: Build wealth and give.

Listen, when you work through those Baby Steps, they work. The focus you’re able to give each goal helps you feel like you’re making progress. Because you literally are!

Here's A Tip

Learn how to walk those Baby Steps and build wealth faster than ever with Financial Peace University.

7. Start investing.

When you’re on Baby Step 4, it’s time to get the investment party bumping—yep, start investing 15% of your gross household income.

First, if you’ve got an employer’s 401(k) option, invest up to the employer match. Then open up a Roth IRA and max out your contributions there. If you hit the max and still haven’t reached 15% of your income, head back on over to your 401(k) and contribute the rest there!

By the way, if your employer offers a Roth 401(k) and you like the investment options, you could just invest your whole 15% there.

That was a quick flyover, but this will put you on the path to getting rich.

8. Don’t fall for trendy scams.

Plenty of finfluencers (you know, those financial influencers flooding your social media feeds) love to tell you how one new trend or another will help you get rich quick.

But listen, when you’re talking about building legit wealth that’ll last—slow and steady wins the race. Think back to the fable of the tortoise and the hare. Those trends are hares. They get distracted. They lose interest. They don’t win wealth. Put your money on the tortoise. Slow and steady wins the race every time.

Remember that National Study of Millionaires? Those wealthy people said the number one contributing factor to their high net worth wasn’t a flash-in-the-pan trend. It was long-term, consistent investing in retirement plans (like the tip we just walked through).

That’s right: Most millionaires used their 401(k) and IRA to build their wealth. Those fantastic tortoises.

When it comes to ways to get rich, go with tried-and-true methods. That way your wealth actually lasts.

Get Intentional With Your Money to Get Rich

One of the common themes through all those tips? Being truly intentional with your money. That’s the secret for how to get rich—but it doesn’t have to be a secret. Go tell everyone! (Or at least all the people you like.)

And that financial intentionality starts, ends, and has everything in between to do with budgeting. Remember, rich people budget. You want to be rich. So budget!

That doesn’t mean one weekly or monthly peek into your online bank account. That doesn’t mean writing down what you think you’ll spend and then never checking in.

That does mean creating a monthly budget to plan where all your money will go. It also means tracking your spending. Every. Single. Dollar.

Ramsey’s EveryDollar budget app helps you find that hidden money fast and gives you step-by-step guidance to use it with purpose. Whether you want to knock out debt, stack up savings, or fund some fun, start EveryDollar for free and make it happen.