Everything you need to make a will with confidence—so you can protect what matters most.

Key Takeaways

- Find out what belongs in your will—physical, financial, and digital assets.

- Learn who should fill each role, from executors to guardians and more.

- Walk away with a clear plan to protect your legacy.

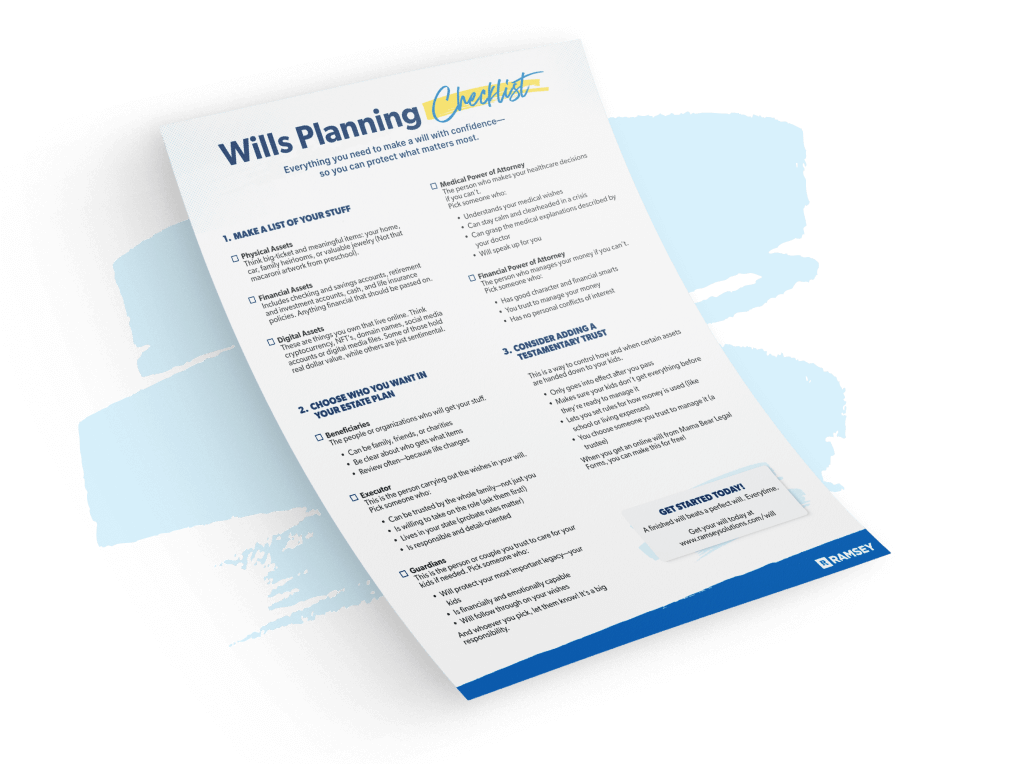

Want a Printable Copy?

Like to mark things off on paper?

Download our printable Wills Planning Checklist!

Make a List of Your Stuff

Physical Assets

Think big-ticket and meaningful items: your home, car, family heirlooms, or valuable jewelry. (Not that macaroni artwork from preschool.)

Financial Assets

Includes checking and savings accounts, retirement and investment accounts, cash, and life insurance policies: anything financial that should be passed on.

Digital Assets

These are things you own that live online. Think cryptocurrency, NFTs, domain names, social media accounts, or digital media files. Some of those hold real dollar value, while others are just sentimental.

Will an online will work for you?

Find out if an online will works for you in less than 5 minutes.

Choose Who You Want in Your Estate Plan

Beneficiaries

The people or organizations who will get your stuff.

- Can be family, friends, or charities

- Be clear about who gets what items

- Review often—because life changes

Executor

This is the person carrying out the wishes in your will.

Pick someone who:

- Can be trusted by the whole family—not just you

- Is willing to take on the role (ask them first!)

- Lives in your state (probate rules matter)

- Is responsible and detail-oriented

Guardian

This is the person or couple you trust to care for your kids if needed.

Pick someone who:

- Will protect your most important legacy—your kids

- Is financially and emotionally capable

- Will follow through on your wishes

And whoever you pick, make sure they’re willing! It’s a big responsibility.

Medical Power of Attorney

The person who makes your healthcare decisions if you can’t.

Pick someone who:

- Understands your medical wishes

- Can stay calm and clearheaded in a crisis

- Can grasp the medical explanations described by your doctor

- Will speak up for you

Financial Power of Attorney

The person who manages your money if you can’t.

Pick someone who:

- Has good character and financial smarts

- You trust to manage your money

- Has no personal conflicts of interest

Consider Adding a Testamentary Trust

This is a way to control how and when certain assets are handed down to your kids.

- Only goes into effect after you pass

- Makes sure your kids don’t get everything before they’re ready to manage it

- Lets you set rules for how money is used (like school or living expenses)

- You choose someone you trust to manage it (a trustee)

When you get an online will from Mama Bear Legal Forms, you can make this for free!

Ready to Make It Happen?

Don’t let perfection stop you from protecting your legacy. Create your will with Mama Bear Legal Forms today.

-

Last Will & Testament: Married Couples

$249

- Two Last Wills and Testaments

- Two Medical Powers of Attorney

- Two Financial Powers of Attorney

-

Last Will & Testament: Individual

$159

- Last Will and Testament

- Medical Power of Attorney

- Financial Power of Attorney

Mama Bear's promise: If our product doesn't meet your expectations, we'll refund your money (no hard feelings.)

What Counts as an Heirloom?

An heirloom is any valuable or sentimental family item you want passed down to the next generation.

What's an NFT?

An NFT (non-fungible token) is a digital certificate of ownership of a specific digital item or collectible—like online art or music—that can be bought and sold online.