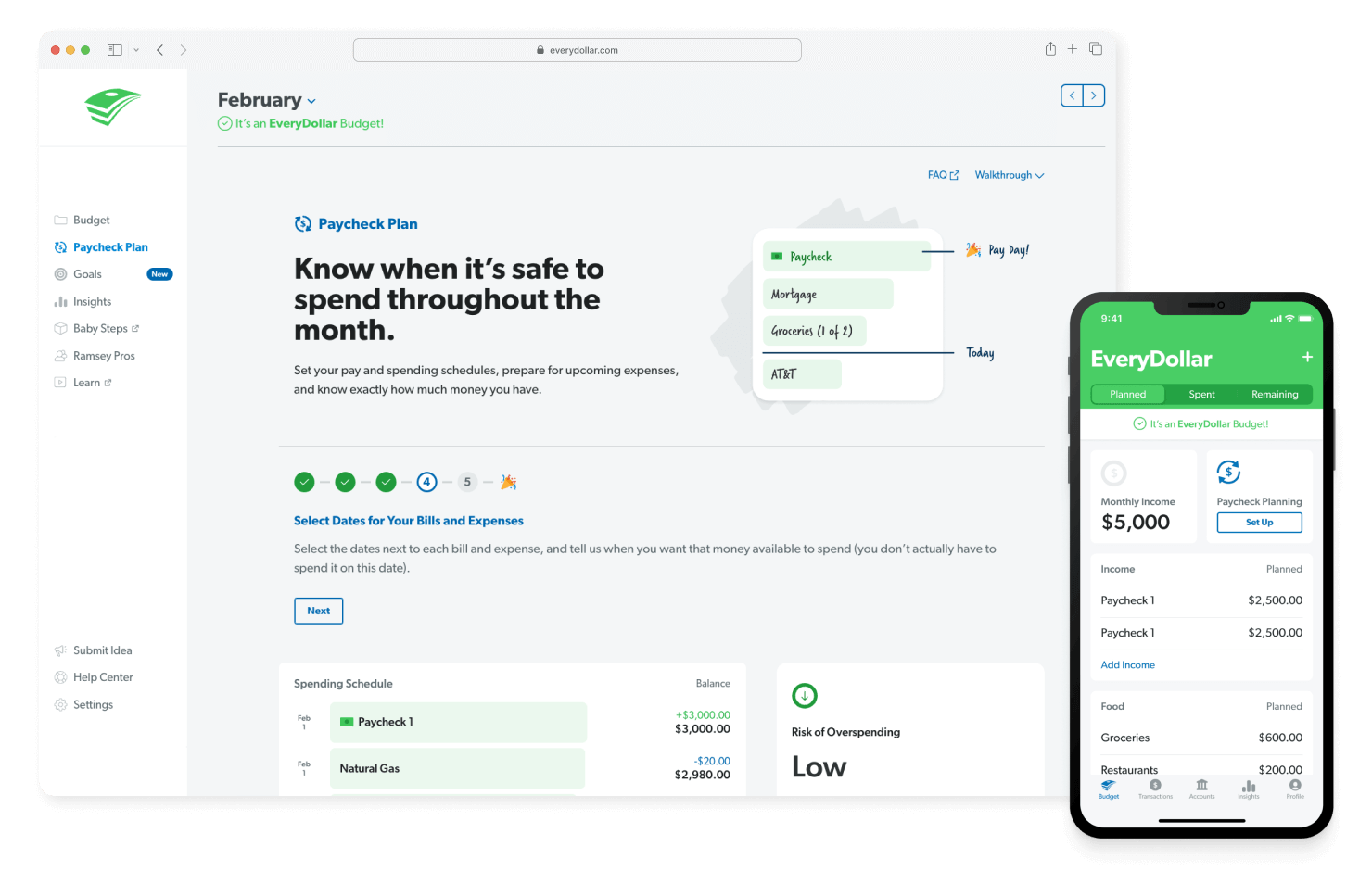

Paycheck Planning

Availability: Premium users

Date of release: October 2022

This might be one of our most requested features. And for good reason—because unless you get paid once a month, you need to plan out your monthly cash flow.

If you get paid at least twice a month, or you have an irregular income (i.e. commission-based, hourly, freelance or contract work), then planning out your monthly expenses all comes down to one thing: timing. When bills and expenses hit, you need to know you have enough cash on hand to cover them. Because there's nothing worse than trying to fill up your gas tank only to realize your bank account is in the red.

Enter paycheck planning—the best way to manage your day-to-day budget, stop overspending, and pace yourself for the month no matter what your pay schedule is. (Sometimes it’s called cash-flow planning, but we’re sticking with paycheck planning.)

Here’s how it works in EveryDollar. If you're using the web app, click on Paycheck Planning in the left-hand navigation. If you're in the mobile app, click on the Paycheck Planning tile. You’ll see all the numbers you’ve planned for your income and expenses for the month so far.

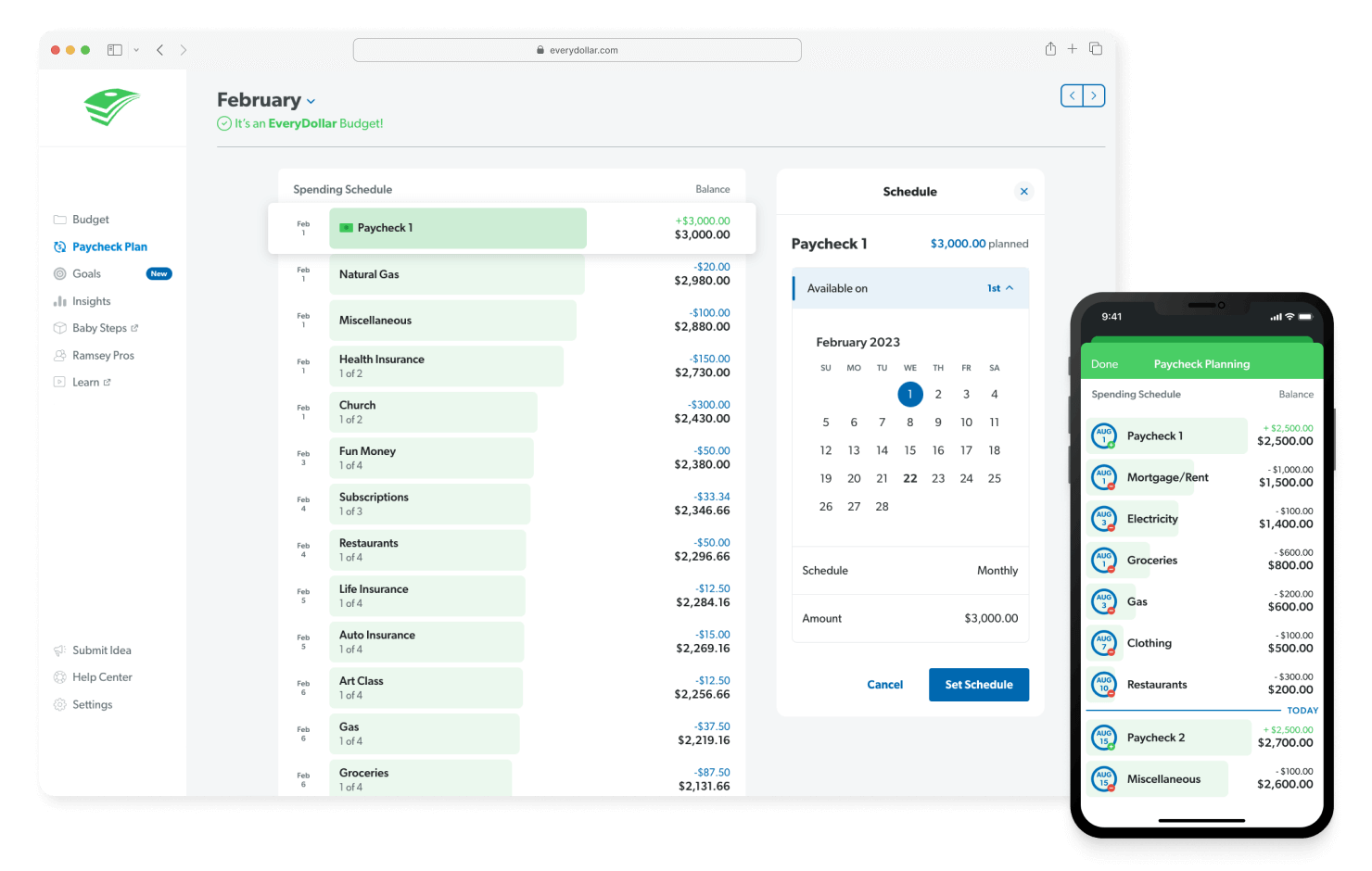

First, click on your paychecks and set the date they arrive. This will tell you when your money is coming in. If you’ve got an irregular income (hourly, commission, or freelance), then check out this article to make sure you’re planning each paycheck accurately.

Now you’re ready for the fun part: planning out your expenses. Start with the bills that hit once a month (like your utilities, cell phone and rent). Set the date they’re due, and they’ll automatically be put in order in your cash-flow plan.

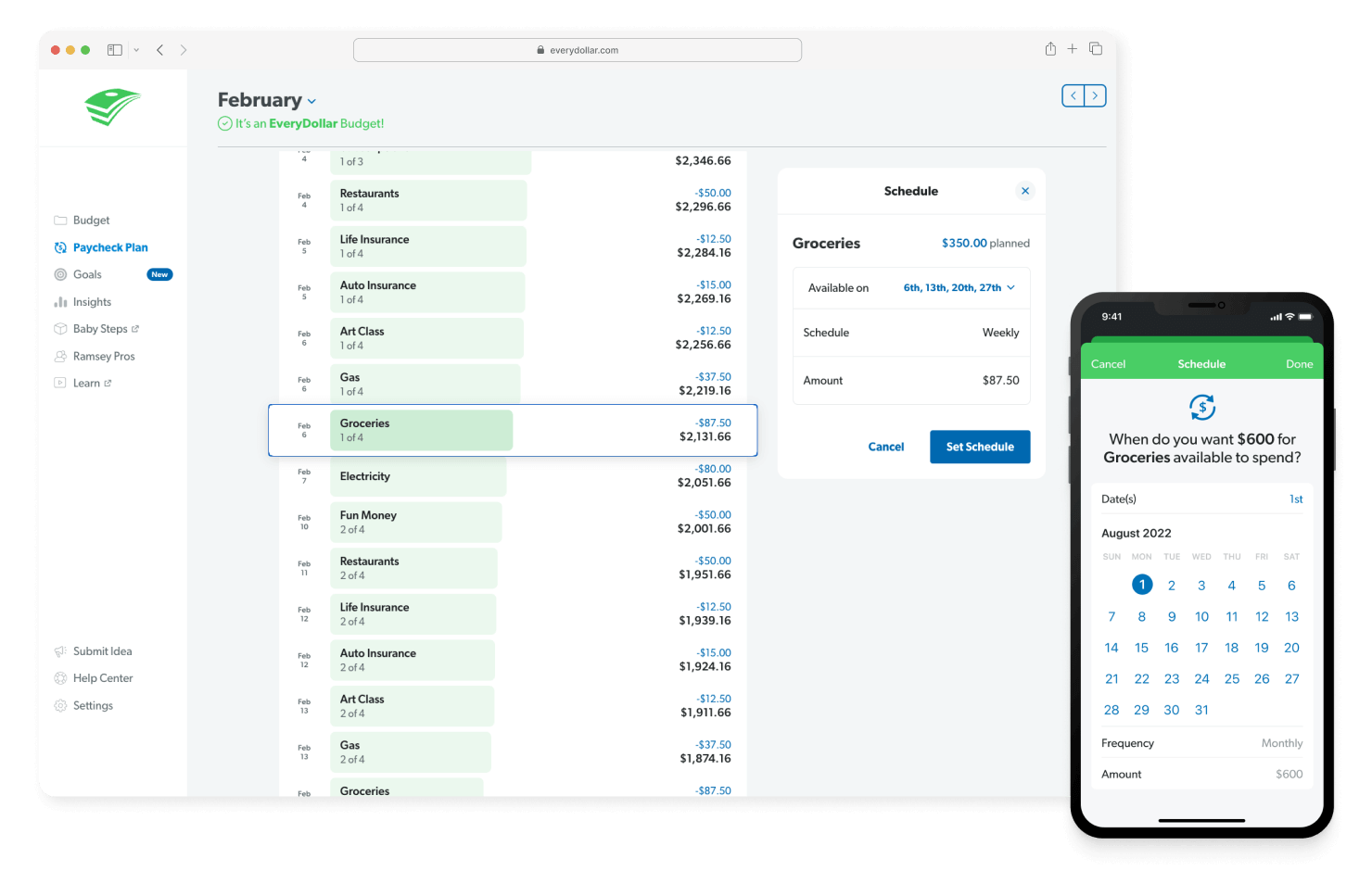

Next, spread out your bigger monthly expenses (like groceries) into weekly expenses. Select the days you typically shop, and EveryDollar will automatically divide the amount evenly for you. You don't have to spend on those exact days, but get as close as you can to a weekly rhythm for planning purposes.

Finally, plan out those expenses that occur multiple times a month, but not necessarily weekly. For example, if you fill up your car with gas every 10 days, select those dates in the calendar. You can also do this for an expense that occurs more than four times per month. And if you’re not sure the exact dates, just take a guess and adjust them later.

Once you have all the dates set, check out your new paycheck plan! See if you need to make some adjustments so you're not at risk of overspending (those red numbers will jump out at you), and have the ultimate confidence you’ll be covered for the month.

And, you can check and adjust your paycheck plan at any time on the EveryDollar mobile app.