Cavemen, geckos, mayhem, Flo, Jake—are we at a theme park here or buying insurance?

The insurance industry sometimes seems like it has a bad case of mascot overload. But you just want to know you’ve got the right coverage and that you’re not overpaying.

So, how do you get there? Well, a lizard may not be your best bet. Better to work with a real professional like an insurance broker.

You wouldn’t be alone if you’ve ever wondered, What is an insurance broker? We’ll break down what they are and how they can help you get covered.

Key Takeaways

- An insurance broker works on your behalf to find you a range of prices and policy options, but they can’t actually sell you a policy. A broker will set you up with a licensed professional for that step.

- An insurance agent has a different job from a broker (although it’s possible for one person to work in both roles). Agents can sell policies from one or more insurers.

- Agents are either captive (meaning they only sell policies from one insurer) or independent (selling from multiple insurers). If you work with an agent, be sure they’re independent because you’ll have way more options for price and coverage.

- Most of our RamseyTrusted insurance pros are both brokers and independent agents.

What Is an Insurance Broker?

An insurance broker is someone who represents you to insurance companies. A broker can work on your behalf to find you everything from health insurance and auto policies to life insurance, homeowners insurance—and more.

When you work with a broker for insurance, their loyalty is to you, not the insurance companies. They’re kind of like personal shoppers. They can’t sell insurance but instead go into the marketplace and look for the best coverage for you. They’ll present you with different options, and once you find what works best, they’ll work with a licensed professional who can sell the policy—usually an insurance agent.

When Should You Use an Insurance Broker?

Are you in the market for car insurance? Finding an insurance broker would be a smart move. Shopping your homeowners policy? That’s a good reason to work with a broker. Then there’s bundling—yet another way a broker can conveniently save you cash. Or maybe you’re just feeling a schedule squeeze and want someone to do the browsing for you. In your case, letting a broker save you time and money makes tons of sense.

Insurance brokers are a great way to access a wide range of policies across multiple types of insurance. They save you the work of hunting down every type of coverage you need and instead present you with the best of the best. What’s not to like about that?

And since you’re the customer, they’re motivated to work hard for you, find you the best policies, and earn your long-term business. They’ll also be able to help you later on during big life changes when you need to update your policy.

Get coverage you can trust.

When a RamseyTrusted pro is in your corner, you have an insurance guide you can trust who will give you confidence in your coverage.

How Insurance Brokers Get Paid

Remember, insurance brokers work for you. Even though brokers can’t sell you the policy (they’ll hand it over to an agent to complete the sale), they do have access to a broader range of options than agents tied to only one or a few insurance companies.

So how do insurance brokers make money? Through commissions and brokers’ fees. For every policy they can pass along to an agent, they receive a commission from the insurance company.

Insurance Broker Commissions

Brokers get a commission from an insurer when they connect you to the company selling you the policy. It’s usually figured as a percentage of the premium you sign up for. Seems simple, right?

Keep in mind that some brokers might try to upsell you on coverage you don’t need. That’s just a word of caution, since there are bad apples in any industry, right?

On the other hand, commissions definitely don’t mean that brokers are just after your money. In fact, commissions make a lot of sense as a way to pay both brokers and agents (more on them below) for their time and industry expertise. Brokers can save you a lot of time and legwork, and that’s worth a commission—especially when you’re working with one who’s looking out for you.

The bottom line here is to verify how your broker’s commissions work before you pay up.

Commissions also come into play in a big way for one of the biggest scams out there, whole life insurance. (We hate it. Big time!) You should never buy whole life anyway (term life all day, baby), but the fact that brokers tend to get a far larger commission on them—sometimes 100% the first year of the policy—should definitely raise flags about whether you’re buying something you need.

Here’s a tip: Brokers will probably be able to share a wider range of insurance options with you than independent agents. But independent agents tend to have more knowledge about the companies they work for than brokers do.

For other kinds of policies like auto or homeowners, the commissions are smaller than with whole life scams. Still, it’s wise to find out from your broker how all their commissions work before buying.

Here’s some good news. Insurers do a couple of things to help protect you from pushy brokers looking to sell unnecessary policies.

- Insurers sometimes require brokers to repay their commissions if customers cancel their policies or stop making payments within a certain time from purchase. That rule helps prevent a commission-hungry broker from talking you into a policy you don’t need, since they know there’s a good chance you’ll just end up canceling.

- Companies also figure commissions into their policy prices, so you’ll pay the same price whether you buy a policy directly from an insurer or through a broker. If you buy it directly, the company just gets to keep the commission.

Insurance Broker Fees

Brokers sometimes charge fees for connecting you with an insurer. They’re pretty cheap though—usually under $100. If so, it’s a percentage commission for the policy you’re buying. But not all brokers charge fees. Most states require brokers to disclose their fees to the buyer, and many also place a cap on how high the fees can be. Be aware that broker fees are most often nonrefundable, even if you cancel your policy.

What’s the Difference? Insurance Broker vs. Insurance Agent

An insurance agent helps customers find and buy insurance policies too. Remember when we told you brokers can’t actually sell you an insurance policy? That’s the main difference between agents and brokers: Agents are licensed to sell policies from one or more insurers.

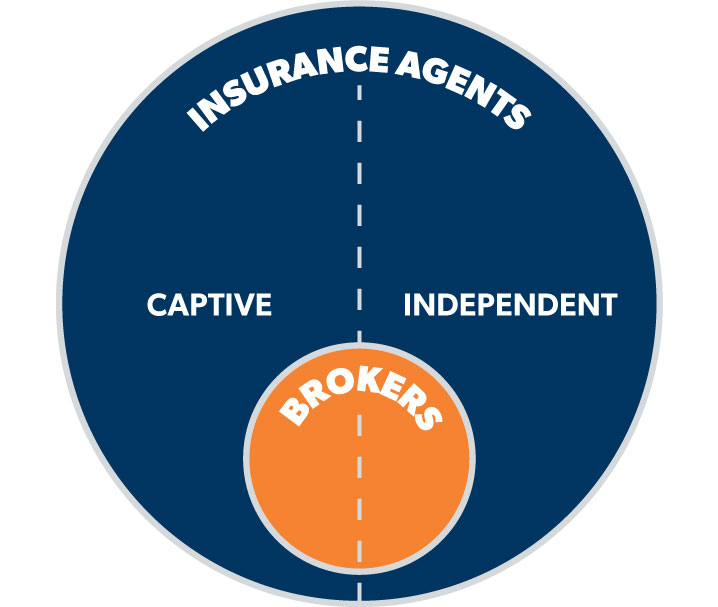

There are two kinds: captive insurance agents and independent insurance agents. Let’s see what makes them different from each other.

Captive Insurance Agent

It’s kind of a weird name, but a captive insurance agent is an insurance agent who only sells policies from one insurer. They’re locked in—captive—to working with one company. They usually work on salary plus commission, so the more policies they sell, the more money they make. One downside to working with a captive agent is you might not get the best policy for you if the company they work with doesn’t offer it.

Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies. This means a wider variety of options for you. They work on commission only and aren’t an employee of any of the companies they work with.

Here are just a few benefits of using independent insurance agents:

- They offer a wider selection of policies from multiple insurers (but be aware that some of the bigger companies don’t work with independent agents).

- They have an in-depth knowledge about those plans and policies and can help you avoid some of the insurance gimmicks that are out there.

- They won’t steer you toward just one insurance company.

- They are licensed professionals.

Most of our RamseyTrusted insurance pros are brokers and independent agents. But all of our RamseyTrusted pros are qualified to find the best coverage at the best price for you and your family.

“We worked with a RamseyTrusted pro and are very happy,” Patricia M. said in the Ramsey Baby Steps Facebook Community. “When it came time to renew our homeowners and auto insurance, he saved us hundreds of dollars.”

What Should You Look for in an Insurance Broker?

If you love the idea of letting a personal shopper save you time and money on insurance, a broker could be an awesome option. Here are the qualities we recommend you look for in a thoroughbred broker for insurance:

- They help people win with their money and life goals.

- They push themselves to keep learning the industry and improving their customer service.

- They’re reliable and have their clients’ best interests in mind.

- They’ve got multiple years of industry experience as brokers.

How Do I Get an Insurance Broker?

Now you know what an insurance broker does, and even how they compare with an insurance agent. But how can you put that knowledge to work for yourself? Well that depends on your own current needs and coverage levels. We put together a list of easy and practical steps you can take right away to keep yourself moving toward the best coverage.

Next Steps

- Take our quick Coverage Checkup to see if you have all the right insurance.

- Read more about the eight types of insurance everyone needs.

- If you’re in the market for any type of insurance—or you’re just wondering if you can get a better deal—our RamseyTrusted pros include both insurance brokers and independent insurance agents. They’re also RamseyTrusted, meaning we’ve personally vetted them and know they’ll take great care of you.

Frequently Asked Questions

-

What Is an Insurance Agent?

-

An insurance agent helps customers find and buy insurance policies. Unlike insurance brokers, who don’t actually sell insurance policies, agents sell policies from one or more insurers. There are two kinds: captive insurance agents and independent insurance agents.

-

Is It Better to Get Insurance Through a Broker?

-

Getting insurance through a broker isn’t necessarily better than working with an independent agent. But working with a broker could be your best bet if you are crunched for time and want to get several options for your insurance needs. A great thing about a broker is that you can be sure they’re not working on behalf of the insurers. Their whole business model is based on helping you find the best and most affordable options for coverage.