How Much Does Long-Term Care Insurance Cost?

14 Min Read | Jan 20, 2025

Key Takeaways

- The cost of long-term care insurance varies a lot. Yearly premiums can start around $900 and climb to about $10,000.1

- Long-term care (LTC) costs are going up, and today’s 65-year-olds have about a 56% chance of needing it—so it’s important to buy long-term care insurance to protect your nest egg.2

- LTC insurance costs are different for men and women. In 2023, the average 60-year-old man paid $1,200 per year for a level benefit policy that covered $165,000 in care. The average 60-year-old woman paid $1,960 for the same coverage.3

- Wait to sign up for long-term care insurance until you’re 60 years old because your chances of needing LTC before then are extremely low.

What if I asked you, “Do you want to get old?” I’m pretty sure the answer would be, “Um, no thank you!” And I get it. But old age is coming whether you want it to or not, and wouldn’t it be so much nicer to know you’re ready?

One of the things you’ll have to start thinking about as you age is how you’ll cover the costs of long-term care. The truth is, long-term care (also called LTC) is expensive and getting more expensive all the time. You need to have a plan to pay for it so you don’t get wrecked financially. That’s where long-term care insurance comes in.

What Is Long-Term Care Insurance?

Long-term care insurance is a policy that covers costs related to nursing home care, assisted living facilities, or caretakers coming to your house. It pays for support for people who can no longer perform everyday activities as they age.

It also covers things like home modifications, medical equipment and care coordination (or care management). So LTC insurance gives folks more options for their care than they’d have paying for it out of pocket. And that often means they can stay in the comfort of their own home longer.

Traditional long-term care insurance policies take effect when you can no longer perform 2 out of 6 activities of daily living on your own, like:

- Bathing

- Dressing

- Toileting

- Transferring (think moving from your bed into a chair)

- Continence (don’t Google it)

- Eating

Since your regular health insurance won’t cover costs for help with these tasks—and Medicare only kicks in for hospitalizations and short-term rehabilitative care—long-term care insurance is a must. Also, Medicaid (the government program for people with low income) only covers a few specific long-term care expenses, and not for very long. No matter how you slice it, these options shouldn’t be your first or only choice.

Where Can You Receive Long-Term Care?

Figuring out where you can get long-term care can be confusing because only certain facilities provide it. For example, nursing homes offer long-term care, while skilled nursing facilities (often housed in the same building as nursing homes) provide rehabilitation but not long-term care.

Here are some of the most common places where you can receive long-term care:

- Nursing home: A residential facility where you receive the highest level of care, including help with daily living activities and medical care

- Your own home: Care at home with caregivers who come to you

- Assisted living facility: A residential facility where you live with other adults who need help with daily activities but not continuous medical care

- Residential care home: A smaller assisted living–type home, often with a caregiver for just three or four residents

- Adult day care center: A facility for daytime-only care

How Much Does Long-Term Care Insurance Cost?

The cost of long-term care insurance varies pretty widely. Yearly premiums can start around $900 and climb to about $10,000.4 The insurance company will look at your age, gender, location, marital status, and current health and family health history. You’ll also pay more if you choose a longer term or a bigger benefit.

And keep in mind that different carriers charge different rates for the same coverage (the number one reason to shop around!). They can also raise your premiums after you buy the policy.

These days, the average 60-year-old man will pay $1,200 per year for a policy that covers $165,000 in care. The average 60-year-old woman will pay $1,960 for the same level of coverage.5

Now ladies, don’t get upset—this isn’t a pink tax. We actually tend to live longer than men! According to federal data, women outlive men by about five years and need an average of 3.2 years of care, compared to only 2.3 years for the average man.6,7 So it makes sense that we pay more.

The good news is that couples often get discounts, usually at least 15%.8 The average 60-year-old couple pays $2,550 a year for a combined policy.9

If you have a pretty standard policy, you’ll probably have a waiting period (also called an elimination period) of 30–90 days before insurance starts paying. This means you should have about three months’ worth of out-of-pocket expenses ready to fill that gap, even with long-term care insurance in place.

Inflation Riders

Inflation riders are marketed as a way to help your LTC benefit keep pace with rising costs over the life of the policy—but I don’t recommend them. Even though an inflation rider will make your benefit rise (usually around 3% per year), it will also inflate your premiums to the point that it’s usually not worth it. The best way to be sure you’re taken care of as you age is to get an LTC policy, skip the inflation riders, and invest that savings in tax-advantaged retirement accounts.

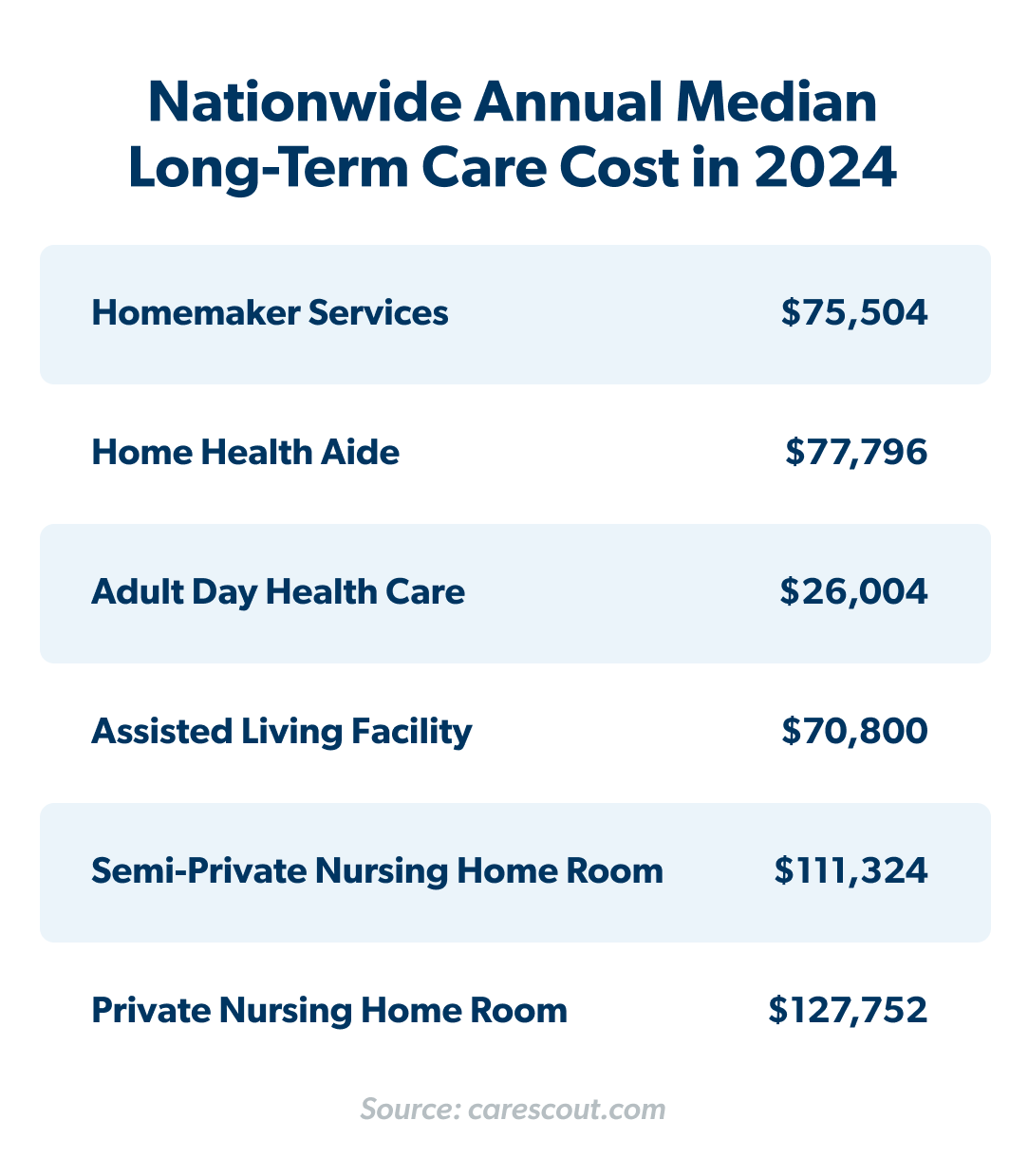

Long-Term Care Costs Without Insurance

If you don’t have long-term care insurance in place, get ready to pay a lot of money for long-term care. It’s expensive! Let’s look at the numbers.

The median cost for a semiprivate nursing home stay in the United States in 2024 was $9,277 for just one month. And that number rises to $10,646 for a private room.10 Remember, that’s per month!

As we age, the possibility of needing long-term care only grows. Over half (56%) of Americans who turn 65 today will wind up needing it.11 Take a look at a few scenarios and estimates of long-term care costs if care begins at age 65.

|

Length of Care |

Approximate Lifetime LTC Cost |

|

|

Less than 1 year |

Under $100,000 |

|

|

1–2 years |

$100,000–200,000 |

|

|

2–5 years |

$200,000–500,000 |

|

|

5 years or more |

$500,000 or more12 |

These are huge numbers, guys! But don’t worry—later in the article, I’ll share the best ways to prepare for them and the types of products to avoid.

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted insurance pros are pre-vetted—which just means we’ve filtered out all the duds. And they make getting long-term care insurance one less thing to stress about. Plug in your zip code to connect with an agent and get started.

Keep in mind, these costs are rising year over year even faster than inflation. For example, the annual cost for an assisted living community rose 10% from 2023 to 2024. And a private room in a nursing home for just one month? That went up about a thousand bucks during that same period.14

If you don’t have a solid plan, these costs could burn up your savings pretty quick—unless your net worth is high enough that you’re able to self-insure.

Factors That Affect the Cost of Long-Term Care Insurance

As you can see, the cost of long-term care can get out of hand quickly—especially without insurance. So, how do those factors play into what you pay for LTC insurance? And how do you keep your costs down? Well, some of it’s within your control and some of it’s not. Here are the main factors that affect the cost of LTC insurance:

- Your age: The older you are, the more likely you’ll need LTC—so you’re riskier to insure.

- Your gender: LTC insurance costs more for women than men.

- Your marital status: Couples are more likely to care for each other rather than paying for LTC—so if you’re married, you’ll often pay less. Also, couples buying an LTC policy together can usually get a discounted rate.

- How much coverage you buy: The more you buy, the more you pay.

- Your health: If you’re in poor health, you’re riskier to insure.

- The benefit period you choose: If you want a longer benefit period, your premiums will be higher.

- Whether you buy inflation protection or not: Purchasing inflation protection will drive your price up.

- How long your elimination period is: Your elimination period is the number of days you pay out of pocket for care before your insurance kicks in. It’s like a time deductible—and the bigger your deductible, the lower your premium!

- The type of policy: Different policies have different features—and different prices.

- The insurance company you choose: The price for LTC insurance can vary wildly from carrier to carrier.

- Where you live: The cost for LTC changes from state to state.

- Whether you qualify for a tax break: Premiums can be tax-deductible—we’ll talk about this more later.

With that many different factors, you’ll hopefully find a few ways to save money!

What’s the Cost of Long-Term Care Insurance by Age?

Let’s take a look at the annual premiums for LTC insurance by age and beneficiary:

Long-Term Care Insurance by Age for a $165,000 Policy Benefit

|

Beneficiary |

Annual Premium |

|

55 years old |

|

|

Male |

$900 |

|

Female |

$1,500 |

|

Couple |

$2,080 |

|

60 years old |

|

|

Male |

$1,200 |

|

Female |

$1,960 |

|

Couple |

$2,550 |

|

65 years old |

|

|

Male |

$1,700 |

|

Female |

$2,700 |

|

Couple |

$3,75015 |

As you can see, premiums go up with age, so you want to figure out the right time to buy! Speaking of which . . .

When Should You Sign Up for a Long-Term Care Insurance Policy?

You may be wondering, What’s the best age to buy LTC insurance? I don’t think I’m going to need long-term care for a while, and I don’t want to pay premiums for something I don’t need. That’s a good point.

Then there’s the other thought: Isn’t it usually cheaper to buy this kind of insurance when you’re younger? Well, you’re right about that too.

You don’t want to buy LTC insurance too early—or you’ll end up paying more in premiums than you really need to. And you don’t want to wait so long that premiums are crazy high, or run the risk of being denied coverage. So there has to be a happy medium, right?

Here's A Tip

I recommend buying yourself an LTC insurance policy when you turn 60. Nothing says “Happy birthday!” like an LTC insurance policy, am I right? But seriously, your chances of needing LTC before age 60 are pretty slim. That’s why I recommend you buy it as soon as you turn 60.

Do Other Types of Insurance Plans Offer LTC Coverage?

There aren’t really any other ways to get long-term care coverage outside of buying LTC insurance—unless you count hybrid policies. (But fair warning: They stink!) Hybrid policies combine life insurance with long-term care coverage. They allow you to use your death benefit (the money your beneficiaries would receive when you die) while you’re still alive to pay for long-term care. If you don’t end up needing care, your heirs get the full payout.

Sounds good, right? Well, keep reading.

Are Hybrid Long-Term Care Policies Cheaper?

Hybrid policies typically cost thousands of dollars more than traditional ones because, on top of long-term care insurance, you’re also paying for life insurance you might not even need. And while hybrid policy premiums are usually fixed, most are not tax-deductible.

With hybrid policies, the insurance carrier invests your money for you, like they do with whole life insurance. The problem is, they’re choosing poor investment options and charging crazy-high fees, which means your returns will probably barely keep up with inflation. If you factor in the lost earnings compared to other investing options, hybrids might be the most expensive long-term care insurance option.

One caveat I’ll mention, though: If your health prevents you from qualifying for a traditional long-term care insurance policy, you might look into buying a hybrid plan as a last resort. Even a hybrid plan is better than no plan at all.

If you qualify for a traditional policy, though, just buy long-term care insurance and life insurance separately. (And speaking of life insurance, check out my friend George’s take on why term life is your best option to protect your income and your family’s future.)

Tax Benefits of Long-Term Care Insurance

So, all we’ve seen so far is how expensive long-term care insurance is. But let me tell you, there is a silver lining! LTC insurance premiums are tax-deductible up to a certain limit. And you might even be able to pay your premiums out of a pretax Health Savings Account (HSA).

How do you get these tax savings?

If you itemize your deductions, the federal government and some states allow you to count some or all of your premiums as tax-deductible medical expenses. But they must add up to a certain percentage of your income. And not all long-term care insurance plans qualify for these tax breaks.

Here's A Tip

Talk to an insurance pro before you buy to make sure you get one that qualifies.

Here’s a handy breakdown from the IRS showing the maximum amount of your premiums you can deduct based on your age.

|

Age at End of Tax Year |

Maximum Premium Amount You Can Deduct |

|

40 or younger |

$480 |

|

41–50 years old |

$900 |

|

51–60 years old |

$1,800 |

|

61–70 years old |

$4,810 |

|

71 years or older |

$6,02016 |

How to Calculate Your Long-Term Care Insurance Cost

There are a few different factors to think about when you’re figuring out how much long-term care insurance you need.

How much do you have saved for retirement? If you have $10 million in retirement savings, you don’t need to worry about LTC insurance because you can pay out of pocket. If you don’t have that much, consider this: Would you feel comfortable cutting a check for $100,000–500,000? Because that’s about how much you’ll need to pay for long-term care.

The second thing to consider is what kind of care you think you’ll need. There are a few options when it comes to long-term care. These include:

- A private room in a nursing home (most expensive)

- A semiprivate room in a nursing home (cheaper)

- In-home care (you get to stay in the comfort of your home!)

- An adult day care center (you go here for the day)

- An assisted living facility (people help you, but not as intensive as a nursing home)

- A residential care home (much smaller than an assisted living center)

Once you figure out what kind of care to plan for, you can calculate a rough cost. On average, people need about three years of care. The next step is to multiply that number by the inflation rate on long-term care, which is 3–5%.

Let’s look at an example. Chris is about to turn 60 and is looking into LTC insurance. He’s a widower with no kids, so he’s basing his costs on a semiprivate room in a nursing home.

A semiprivate room at $111,325 (2024 price) for three years will cost $333,975.17 But Chris won’t need this room until he’s probably 80. So, calculating inflation at 4% over 20 years means your adjusted cost would wind up being $742,286. Yikes!

Okay, that was a lot of math, but with this number in hand, Chris can get in touch with an insurance pro and look for a three-year policy with a benefit worth roughly $750,000.

Should You Get Long-Term Care Insurance?

Maybe you’re still thinking, Uh no, I’ll just keep my head right here in this hole and everything will be fine! And it might be—for a while. But remember what I said before: 65-year-olds today have about a 56% chance of needing long-term care. And around 22% will need it for longer than five years.18 But only about 7 million Americans—roughly 2%—have some form of long-term care insurance.19

That’s crazy! All those folks who don’t have LTC insurance better hope they have some really awesome kids or relatives. (Actually, those come in handy with or without insurance—but they’re also no excuse to skip this coverage!)

And I just want to point out: The fact that you’re even reading this article means you want to be prepared. You’re already ahead of the curve—so way to go!

Having a long-term care insurance policy will take away a ton of worry about your future. It’ll also ease the burden on your loved ones. And you’ll have peace of mind knowing you won’t go broke dipping into that nest egg you’ve worked so hard for.

The last thing you want to do is pay for expensive care out of pocket—directly out of your savings and retirement funds. And while you could sock away a bunch of money in something like a pretax Health Savings Account (HSA), that probably isn’t the best idea since you’ll still be using up your hard-earned savings.

Long-term care insurance is a must!

How to Get Long-Term Care Insurance

So, now that you’ve learned about the costs of long-term care and long-term care insurance, maybe you’re ready to start shopping rates or see if you qualify.

While you could do this on your own, we recommend working with an independent RamseyTrusted insurance agent. They’ll shop for you so you can save time and have peace of mind knowing you’re getting the right coverage at the best price.

Next Steps

- If the cost of LTC insurance has you hesitating, read up on why it’s worth it.

- Still not sure you need it? Learn more about who does.

- Get in touch with a RamseyTrusted insurance pro who can walk you through your options and get you the best deal on an LTC insurance policy.