I get it—long-term care isn’t an easy subject to deal with. No one wants to think about themselves or their loved ones being unable to live on their own.

But hear me out: Even though long-term care is an uncomfortable topic, it’s a super important one. That’s because some kind of long-term care—like living in a nursing home, assisted living facility, or needing in-home care—is likely in your future, so you need to think about how you’re going to pay for it.

My guess is you probably already have some questions, like, Is long-term care insurance really necessary? and How do you know if you actually need it? You might also be wondering whether Medicare will cover the costs of long-term care.

So, let’s look at who needs long-term care insurance and how much you can expect to pay for it. That way, you can put together a solid plan for your future.

What Is Long-Term Care Insurance?

Long-term care insurance covers the cost for a nursing home, assisted living facility, or in-home care when you get older and start dealing with health issues. Long-term care is defined as any care that is longer than three months.

Long-term care is an important decision. Connect with a trusted pro to make sure you have the right coverage.

Long-term care insurance also covers things like adult day care services, home modifications, and care coordination (or management). For many people, it allows them to protect their retirement savings while also living in their home longer. It’s also one of the eight types of insurance you need.

Who Needs Long-Term Care Insurance?

If you’re currently healthy, you might be wondering, Do I need long-term care insurance? Yes! You aren’t required by any laws to purchase long-term care insurance, but you still need a policy because odds are you’ll end up needing long-term care—and it’s not cheap.

The numbers say 7 out of 10 Americans over 65 will need long-term care, and an estimated 20% of Americans will need it for longer than five years.1 And the typical cost of just one month in a nursing home in the United States is $8,910!2

That’s insane, you guys. Unless you’ve built enough wealth to be self-insured and pay for that cost yourself, long-term care insurance is the best way to make sure you don’t end up running out of money toward the end of your life. Regular health insurance won’t cover those costs, but long-term care insurance will.

Now, you might be wondering whether there are any government programs that can help. Well, for starters, Medicare will not cover long-term care costs. And while Medicaid—the government program designed for people who truly don’t have any money—will cover some long-term care expenses, it should never be your first choice because you’ll have to spend all your assets before you receive help.

So, if you wouldn’t feel comfortable writing a check for $9,000 every month for a few years, you’ll want long-term care insurance.

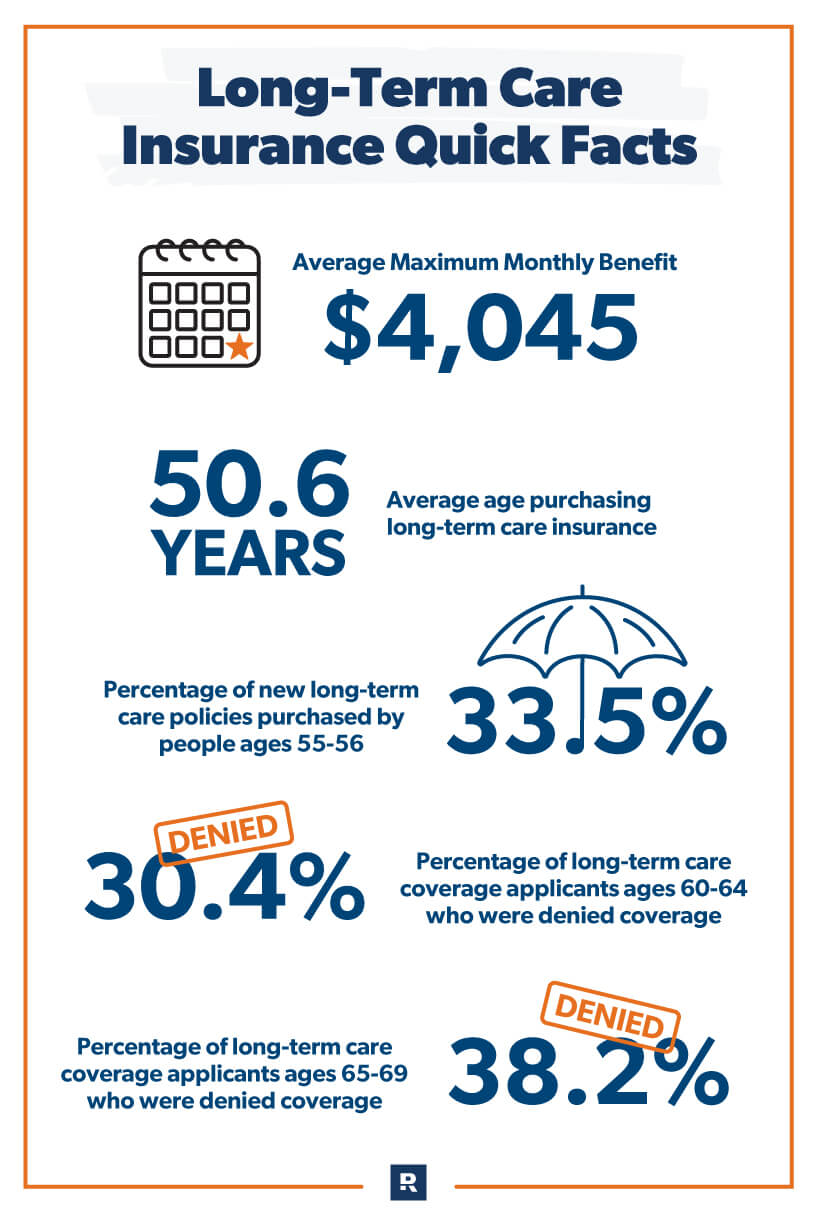

Milliman Long Term Care Insurance Survey3

Is Long-Term Care Insurance Worth Buying?

Yes, long-term care insurance is definitely worth it. Even though it can be expensive, most policies work out to be a bargain in the long run, considering what you get in return. The reality is, most Americans simply will not be able to afford the super high costs of long-term care. Or they’ll have to dip into their savings or retirement funds to pay for it, which is a terrible plan!

Long-term care insurance also allows you to live in your home longer because it pays for things like in-home care and home modifications (like adding a wheelchair ramp).

Another benefit is that your family and friends won’t be burdened with every aspect of your care. You can spend more quality time with them without relying on your grown kids or friends to come over every day to help.

With long-term care insurance, you’ll enter your golden years with a plan, and your quality of life will be better than if you were constantly trying to cut costs. Your long-term care insurance premiums may seem expensive now, but they’ll be worth it later when you start getting those long-term care bills in the mail.

How Much Does Long-Term Care Insurance Cost?

Depending on factors like your age, gender, health and family health history, the cost of long-term care insurance can be affordable. For others, it can be more expensive. The cost also varies depending on where you live and what kind of policy you pick.

The average 60-year-old man will pay $1,200 per year for a policy that covers $165,000 in care. The average 60-year-old woman will pay $1,960 for the same coverage.4 (Because women tend to outlive men, insurance companies require them to fork over more money to make up for the added risk.) The average 60-year-old couple will pay $2,550 a year for a combined policy.5 The couples discount ranges from 15–30%, depending on where you live.6

It’s also important to know that long-term care insurers can increase your rates after you sign up, so don’t be surprised if your rates climb. But here’s a silver lining: Long-term care insurance premiums are tax-deductible up to certain limits, so you could save some money there.

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted insurance pros are pre-vetted—which just means we’ve filtered out all the duds. And they make getting long-term care insurance one less thing to stress about. Plug in your zip code to connect with an agent and get started.

When Should I Get Long-Term Care Insurance?

I recommend getting long-term care insurance when you turn 60. Think of it as a birthday present! (Okay, that doesn’t have to be the only present you get, but it’s an important one.)

About 92% of long-term care claims are filed by people older than age 70, with most new claims starting after age 80.7 That’s why it doesn’t make sense to purchase a long-term care insurance policy any earlier than age 60. You don’t want to dish out money for an extra decade when you don’t need to.

But keep in mind that insurance isn’t one-size-fits-all. You need to do what’s right for you and your family. If you or your spouse has a family history of illness at a young age, or either of you are currently dealing with big health issues, you might need to get long-term care insurance earlier. The peace of mind you’ll have is worth more than any cash you’ll save on premiums. But don’t do it because you’re afraid of what might happen. If it’s not likely to happen, wait until you’re 60.

You may have heard you’ll pay less and lock in a lower premium if you buy your policy at age 50, but don’t forget that insurers can change your premium after you buy your policy.

Will Your Health Affect Your Ability to Buy a Policy or Claim Benefits Later On?

While buying a long-term care policy is almost always a great idea, not everyone qualifies to buy it. Unfortunately, certain health issues make insuring some people too expensive for carriers.

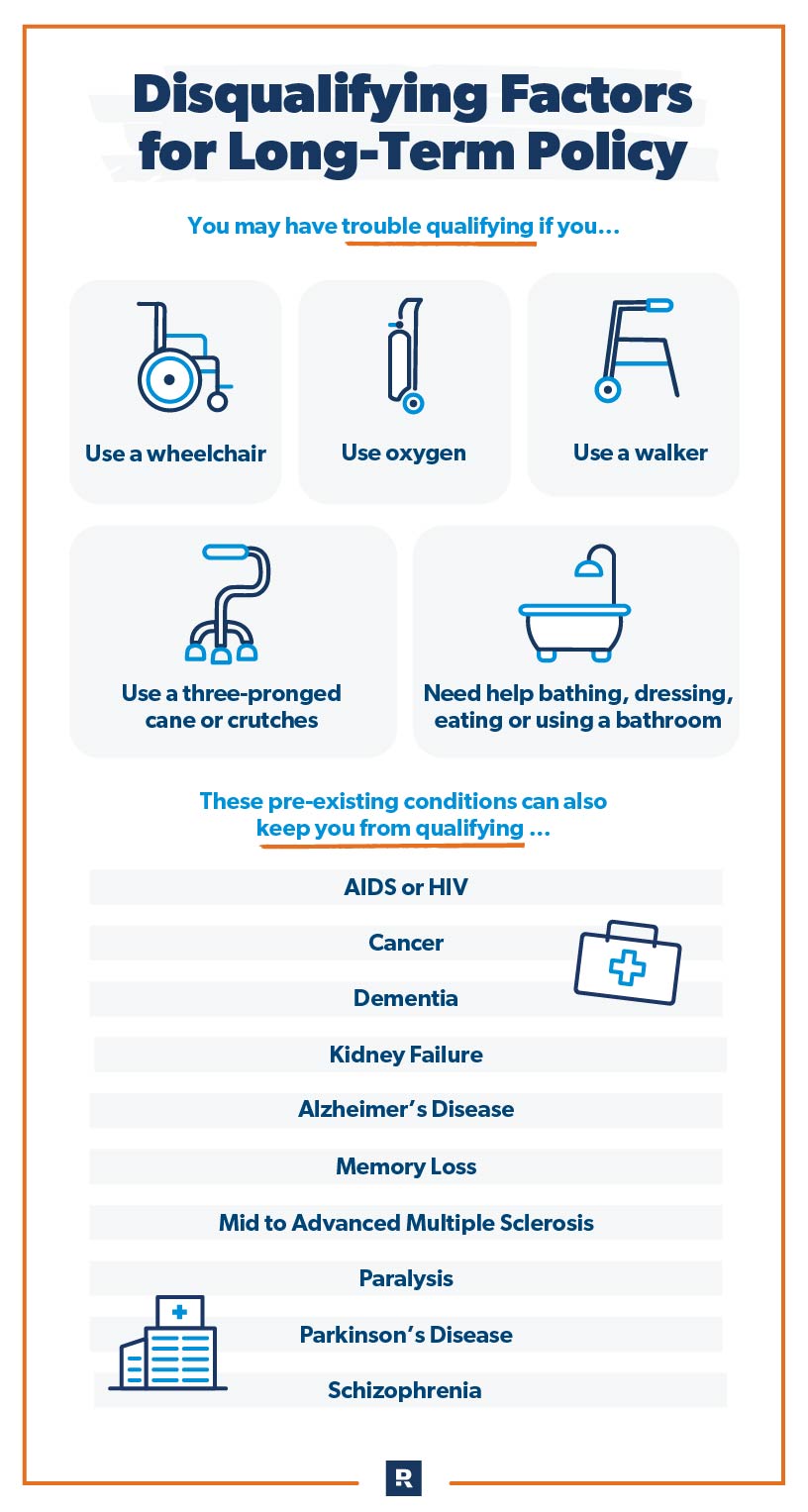

You’ll have trouble qualifying if you already:

- Use a three-pronged cane or crutches

- Use oxygen

- Use a walker

- Use a wheelchair

- Need help bathing, dressing, eating or using the bathroom

What if You Have a Preexisting Condition?

A preexisting condition can also keep you from being able to get a long-term care policy. Here is a list of major health conditions that disqualify people:

- AIDS or HIV

- Alzheimer’s disease

- Cancer

- Dementia

- Kidney failure

- Memory loss

- Mid to advanced multiple sclerosis

- Paralysis

- Parkinson’s disease

- Schizophrenia

Are You Protected With the Right Insurance?

Take the Coverage Checkup to get a personalized action plan that breaks down what to keep, add or nix so you can take control of your insurance with confidence.

The Best Way to Get Long-Term Care Insurance

The best long-term care insurance policy is the one that fits your budget and covers your future needs.

Make sure the policy you choose will pay you enough to keep your retirement savings intact. If you’re on a tight budget, you can try lowering your premium by choosing a longer elimination period (the time you have to wait between when you start receiving long-term care and when your insurance begins paying the bills)—but only if you can afford to pay for three months of care out-of-pocket.

The best way to make sure you get the right policy, though, is to talk with an independent insurance agent. They’ll answer all your questions, shop around with several different long-term care companies, and get you quotes that can save you thousands of dollars and loads of unnecessary worries.

Next Steps

- Find out if you qualify for long-term care insurance. Some health issues and preexisting conditions could keep you from being able to sign up for a policy.

- Connect with a RamseyTrusted independent insurance agent. They’ll shop around several different long-term care companies and get you quotes that can save you thousands of dollars and loads of unnecessary worries.

- Take the Coverage Checkup below to find out what insurance coverage you should add, tweak or drop based on your individual needs.