Why You Should Be Offering Financial Education for Your Employees

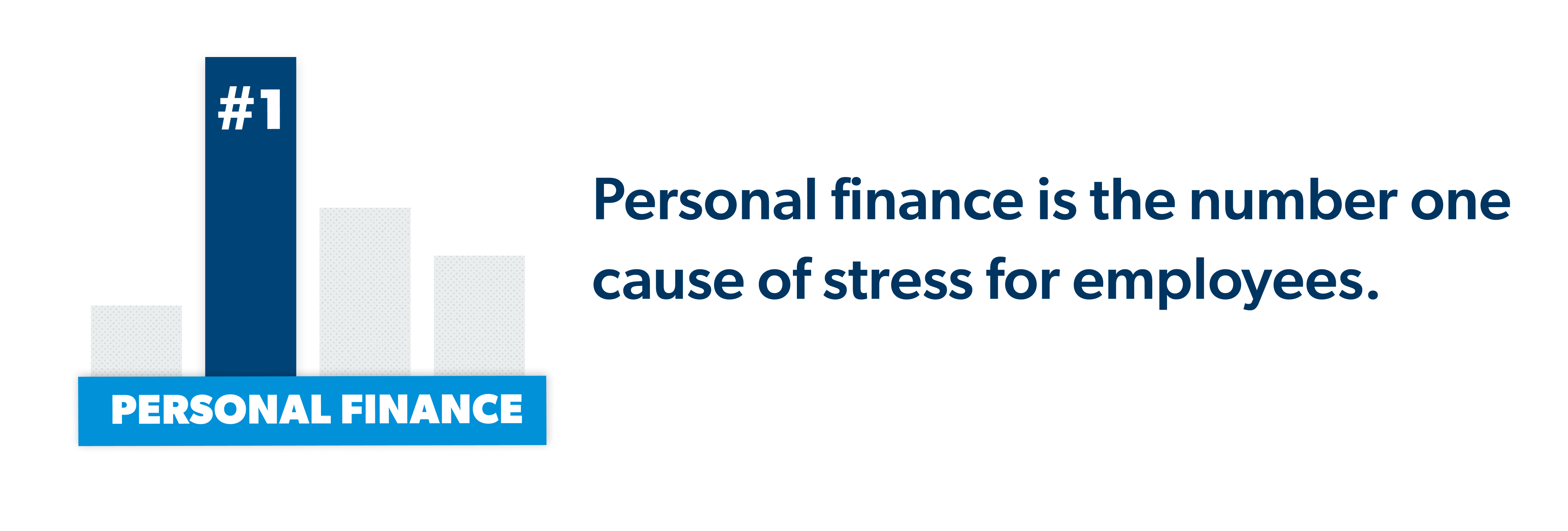

Personal finance is 80% behavior and only 20% head knowledge. Employee financial education is any program or benefit that teaches employees about money management. The best solution requires more than a new budgeting app or a new book—it requires change through new behaviors and habits.