It’s no secret that cell phone bills are out-of-this-world expensive. J.D. Power reports the average monthly bill will set you back $157.1 After your monthly housing, grocery and utility costs, it might just be the next priciest thing in your entire budget.

But are there actual ways you can have a lower cell phone bill? We’re surrounded by a million different cellular providers and too many plans to count. It can be overwhelming when you try to look over all the options to save money on your bill. But guess what—it is possible to save money!

If you’re tired of paying a small fortune every month just to make calls, try these 12 tips to have a lower cell phone bill.

1. Use Wi-Fi when you can.

Try to stay on a Wi-Fi connection whenever it’s available—especially at home or work. And if you don’t have Wi-Fi access when you’re on the go, be smart about it! Don’t download or stream any movies, podcasts or music unless you’re on Wi-Fi.

Get expert money advice to reach your money goals faster!

Those fees for using too much data can add up quickly, and some providers charge you as much as $15 the instant you go over. Make sure you stay within your monthly limit by only using cellular data (4G/LTE) when you need it. Some carriers will send you a warning when you’re getting close to your limit. Sign up for those alerts!

2. Limit your background data use.

Even if you don’t use the internet when you’re out and about, your apps might still be using it in the background. Sneaky, we know.

Go into your settings and look over the Cellular Data Usage and Background App Refresh of each app and turn off the ones you don’t really use. Making this quick flip means you’ll know they aren’t running in the background and draining your data (and your battery) while you’re minding your own business.

Need to bring up your Starbucks app while you’re waiting in line? No big deal. You can turn on cellular data for a specific app anytime you want.

3. Cut the insurance.

Let’s say you pay about $11 a month for phone insurance. That adds up to an extra $132 a year you’re shelling out just in case something happens to your phone. Instead, set aside a few extra dollars a month so you can pay for a replacement phone if you ever need one.

If you still feel like you really “need” insurance for your cell phone, stop and ask yourself this question: Have I bought a phone I can’t actually afford? If you don’t have the cash on hand to replace your phone if something happens to it, your phone is too expensive for your budget.

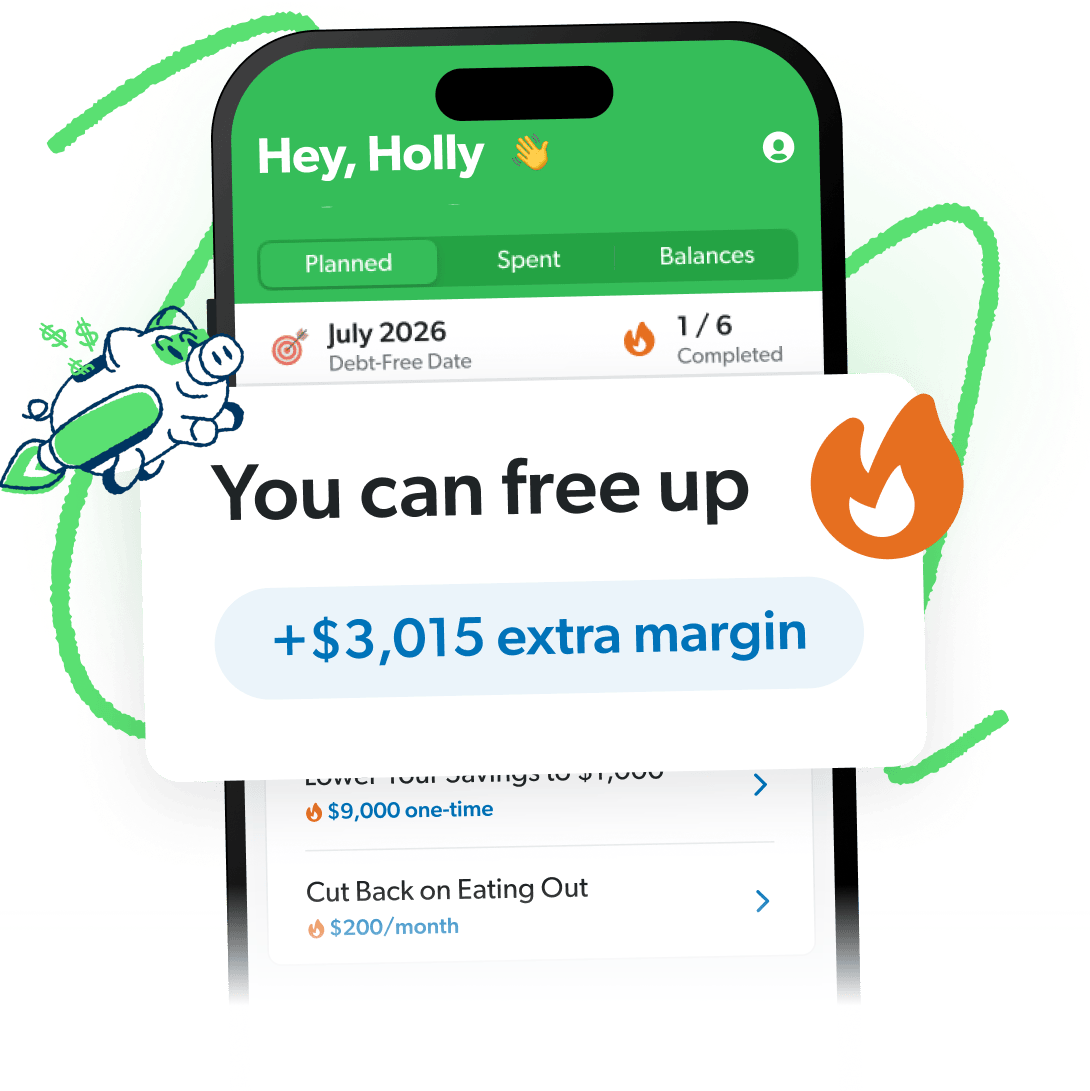

Put More Breathing Room in Your Budget

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

4. Sign up for automated payments or paperless billing.

Here’s one way to lower your cell phone bill with very little effort. This probably won’t save you a huge amount of money. But if you could save $5 a month just for going paperless or having your bill automatically taken out of your account, why wouldn’t you?

5. Take advantage of your employee discount.

Another thing to find out is if your work offers team members a general corporate discount. It’s also worth a shot to see if they reimburse you for using your phone for work (email, calls, etc.). And if you’re using your phone for a home business or side hustle, you might be able to write off some of your cost when tax time rolls around.

6. Buy no-contract phones.

Cell phone companies know how to make money—lots and lots of money. One way they do that is through contracts. To buy a phone through them, you’ll usually have to sign a two-year or even three-year contract to use their network. And then they’ll hit you with a ridiculous cancellation charge if you try to switch carriers.

So, what do you do instead? Buy no-contract, gently used phones. These phones are labeled “unlocked” (meaning you can use them with any carrier) and can take a SIM card. Ask around and look online for older phone models to purchase at a discounted price.

No, you won’t get the hottest or newest smartphone this way, but you can get a really good smartphone without locking yourself into one expensive company for years to come. Which leads us to the next tip here . . .

7. Keep your phone longer.

Want a lower cell phone bill? This is one of the easiest ways to do it! Hang on to that phone as long as you can! Does your “old” phone make calls just fine? Great. Keep it a little longer. Don’t get tempted by the latest and greatest shiny cell phone on the market. A phone is a phone.

8. Don’t do a payment plan for your phone.

This is one of the simplest ways to get a lower cell phone bill. Steer clear of rolling the cost of a brand-new phone into your wireless bill. You’d just be making payments on a new phone (yeah, that counts as debt) all while it hikes up your phone bill even more. No thanks!

Let’s say you want to buy a new iPhone. We all know that sucker isn’t cheap. And your cellular provider is offering it to you for a low monthly payment of $30 a month—for two years. That means your entire phone bill will be $30 higher than it needs to be for two years! Wouldn’t you rather have an extra 30 bucks to put toward your money goals?

And what happens if you lose the phone or it breaks? You’re going to need a new phone. But you’ll still have to pay off the remaining balance left over from the old phone. Well, gee, that stinks.

Believe us, paying for your phone outright will save you a ton of money in the long run.

9. Cut out the stuff you don’t use.

Take a look at your monthly bill. This might seem like common sense, but you’d be surprised by how many people don’t look at the breakdown of their cell phone bill. Don’t continue to pay for things you never use, like too many minutes, unlimited data, emergency roadside assistance, 411 and “enhanced voicemail” (whatever that means).

Decide if you really need everything you’re paying for. If the answer is no, it could be time to switch your plan. If you don’t talk on your phone a lot, you might be able to downgrade to a plan with fewer minutes. And if you never even come close to reaching your data limit, find a plan that includes less.

Some carriers even offer prepaid plans or let you pay for only what you use. See if either of those options could reduce your costs. Look into all the possibilities out there!

10. Ask for a better price.

When you’re in the market for a new phone, don’t just assume you have to pay the sticker price. Go to the store and talk with a salesperson to see if you can get the activation or upgrade fee waived (aka canceled so you don’t have to pay for it!). If you’ve been a customer for a long time, be sure to bring that up to see if you can score a loyalty discount.

And if you find a great offer from a competitor, ask your current provider if they can match it. Use whatever bargaining chip you have, including fees—or lack of fees—from competitors. It never hurts to ask for a better deal. Competition with other carriers is stiff, so they might just agree! But if they won’t negotiate, move on to our next point.

11. Switch carriers.

So, you’ve tried everything else. We saved the best (and most drastic) for last: It’s time to switch your service provider! Shop around to see who can give you what you need for the price that fits your budget. You’ll probably discover a better deal at one of the smaller, lesser-known carriers. Most of them have some link to the “big guys” and use their cellular towers for your phone signal anyway. So chances are, you’re still going to get pretty great coverage—but at a fraction of the cost.

Just make sure you do your research. Ask around. Read reviews. And don’t sign up with a lousy carrier.

12. Add up the long-term costs.

If you’re shopping carriers and aren’t sure who to pick, this is one surefire way to see it all in black and white. Add up the cost of the phone itself plus the cost of the service for the whole year. That puts the total amount in your face instead of just the easy-to-chew, month-to-month payments. Be sure to do this before you actually take the plunge and switch.

A Lower Cell Phone Bill Is What Your Budget Needs

Your budget is all about the numbers. If you have a lower cell phone bill and it becomes a smaller part of your budget, you’ll have more money on hand to hit your goals each month—whether that’s throwing more at your debt or saving up for your future.

Keep track of your cell phone bill and other monthly expenses with our budgeting app, EveryDollar.

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.