Key Takeaways

- Your tax bill will depend on a lot of things, including how your business is legally structured. C corporations are taxed differently than other business types—and since both the corporation and the shareholders pay taxes, C corporations are taxed twice!

- If your business is not a C corporation, you’ll pay at the personal rate, which means you need to know the tax rates and tax brackets for this year.

- Owning your own business means you have to cover Social Security and Medicare taxes—and make quarterly estimated payments.

- Tax deductions and credits are also different for business owners. You may be able to deduct 20% of your qualified business income.

If you own a small business, I don’t have to fill you in on the perks—you already know! You get to be your own boss, set your own hours, and make your own decisions. Now, that’s what I’m talking about!

Get expert money advice to reach your money goals faster!

My husband and I started a small business back in 2010, and we know from firsthand experience that enjoying the perks is just one side of the story. If you want to be successful and grow your business from the ground up, it takes some serious hustling and grinding. It’s a learning process, for sure! But here we are, more than a decade later, and our small business has turned into one of the leading talent agencies in the cruise industry. The hard work and the hustle have really paid off.

But here’s the deal: Even though our business continues to grow, there’s one part of the hustle that isn’t going anywhere.

Yep, you guessed it—taxes. Small-business taxes, to be exact.

Listen, I get it. Calculating your small-business taxes is the last way you want to spend your weekend, but the IRS says you have to calculate them at least once a quarter so you can file your quarterly taxes. There’s a lot that goes into this, so put your nerd hat on and let’s dig in.

How Is Your Business Legally Structured?

First things first, guys. Before you touch a single spreadsheet, you need to know the legal structure of your business. Whether you run one of those cool small-town coffee shops or a growing online research consulting firm, Uncle Sam will classify your business as one of the following five structures: sole proprietorship, partnership, LLC, C corporation, or S corporation.

For the head-scratchers out there thinking, Well, I don’t know, Jade—I just own a small business, I don’t remember choosing . . . the IRS is probably classifying you as a sole proprietorship. But here’s the rundown just in case:

- Sole Proprietorship: The most common type of small business in the U.S. is sole proprietorship. You don’t have to register it with the state like you do with an LLC or corporation. Nice! Being a sole proprietor is basically the same thing as being an independent contractor—good for low-risk businesses and for anyone wanting to try out a new business idea.

- Partnership: Yep, you guessed it. A partnership is just what it sounds like—a simple business structure for two or more people to own a business together. In a limited partnership (LP), one partner has unlimited liability (and more control over the business) while the other partner(s) have limited liability. In a limited liability partnership (LLP), every owner has limited liability—they’re all protected from debts against the partnership and won’t be responsible for the actions of their partners. And for the record, a partnership is our least favorite business entity . . . it rarely ends well. Dave Ramsey always says, “The only ship that won’t sail is a partnership.” Hey, it’s a dad joke, but there really is truth to it!

- Limited Liability Company (LLC): An LLC can be a good choice for small businesses that carry more risk than your basic sole proprietorship or partnership. It can protect you and your personal assets in case your business gets slapped with a lawsuit or faces bankruptcy. That’s the good news. But members of an LLC are considered self-employed (just like members of sole proprietorships and partnerships). That means they have to pay self-employment tax contributions toward Medicare and Social Security.

- C Corporation: A C corporation is also called a C corp or a corporation, and it’s a legal entity that separates a business from its owner(s) when it comes to legal matters and taxes. Corporations can be a good choice if you have a higher-risk business or plan for your business to eventually “go public” or be sold. Corporations have to pay income taxes on their profits and when dividends are paid to shareholders. Yet again, Uncle Sam is coming in hot when it comes to his cut!

- S Corporation: Sometimes called an S corp, this small-business structure is specially designed to bypass the C corp’s double taxation on profits and dividends. It does that by allowing profits and some losses to be passed through directly to the owners’ personal income without being subject to corporate tax rates. And it’s totally legit.1 This is the business structure my husband and I selected for our small business.

Sheesh, that was a lot of details, but stick with me here, guys.

Knowing the structure of your small business is step number one when it comes to calculating your business taxes because your business structure determines your tax rate. And that’s the next step we’ll tackle.

What’s the Tax Rate for C Corporations?

C corporations are taxed twice. Yep, you read that right. Twice. Once at the corporate level and then again at their shareholders’ personal rates (if they take a dividend).2

For example, let’s say you own a company called Money Makeover Inc. Suppose your company killed it this year and brought in $200,000 in profit. That’s what’s up. And after business expenses and deductions, you’re left with $175,000 of taxable income.

First, Money Makeover Inc. has to pay taxes at the corporate level, which is a flat rate of 21%. Remember: No matter how much profit Money Makeover Inc. makes, it will always pay a flat 21% for income taxes. In my example, that would be:

$175,000 x 21% = $36,750

So, Money Makeover Inc. pays $36,750 in income taxes for the corporation. Now, let’s say you’re one of only two shareholders for Money Makeover Inc., and you get a dividend of $25,000. Sweet!

Well, this is where things get a little complicated, so listen up.

If you owned the stock longer than 60 days, it’s called a qualified dividend and the IRS will tax it on a sliding scale. That means the higher your dividend, the more you’ll pay in taxes. For 2025, if you file as single and your qualified dividend is $48,350 or lower (like in our example above), you wouldn’t pay taxes.3

But the moment your dividend goes above $49,450, you start to pay the tax. The rate maxes at 20% for earnings over $600,050.5

Let’s say you haven’t owned the stock longer than 60 days. Now, it’s called an unqualified dividend. You’ll pay taxes on unqualified dividends by using your personal tax rate, which you’ll find in your tax bracket.6,7

Geez, why does Uncle Sam have to make things so complicated?

What’s the Tax Rate if You’re Not a C Corp?

If your business is a sole proprietorship, partnership, LLC, or S corporation, calculating income taxes is a lot easier than for C corporations. Whatever profit you make will be taxed only once at your personal tax rate. Let’s take a look at the 2025 tax year brackets and rates before we dive into an example:

|

Tax Rate |

Single |

Married Filing Jointly |

Married Filing Separately |

Head of Household |

|

10% |

$0–11,925 |

$0–23,850 |

$0–11,925 |

$0–17,000 |

|

12% |

$11,925–48,475 |

$23,850–96,950 |

$11,925–48,475 |

$17,000–64,850 |

|

22% |

$48,475–103,350 |

$96,950–206,700 |

$48,475–103,350 |

$64,850–103,350 |

|

24% |

$103,350–197,300 |

$206,700–394,600 |

$103,350–197,300 |

$103,350–197,300 |

|

32% |

$197,300–250,525 |

$394,600–501,050 |

$197,300–250,525 |

$197,300–250,500 |

|

35% |

$250,525–626,350 |

$501,050–751,600 |

$250,525–375,800 |

$250,500–626,350 |

|

37% |

Over $626,350 |

Over $751,600 |

Over $375,800 |

Over $626,3508 |

So, again, let’s say you own a company called Money Makeover. Let’s also say your company makes $75,000 in profit. And after business expenses, deductions, and employment taxes (I’ll get to those next), you’re left with $50,000 in taxable income.

Now, if this is your only income and you’re filing single, then based on the 2025 tax brackets, you would pay $5,915 in taxes. Here’s how that breaks down:

- Your first $11,925 is taxed at 10%. That’s $1,193.

- Your next $36,550 ($48,475 - $11,925) is taxed at 12%. That’s $4,386.

- Your last $1,525 ($50,000 - $48,475) is taxed at 22%. That’s $336.

- So $1,193 + $4,386 + $336 = $5,915.

How Do You Calculate Employment Taxes for Small Businesses?

Get ready for the smoke because we haven’t even touched on employment taxes yet. So far, calculating small-business taxes hasn’t been super difficult. (If you’ve been on the struggle bus, don’t sweat it. Talking through all this with a tax pro can help you get on the right track.)

Here’s the deal: When you pay income (whether to an employee or yourself), you also have to pay employment taxes, also called FICA taxes. FICA stands for the Federal Insurance Contributions Act, and it requires employers to withhold a percentage of an employee’s wages to help fund Social Security and Medicare. As the employer, you pay half of each tax, and your employee pays the other half.

Yep, you read that right. As a small-business owner, you feel the burn of taxes in a unique way because you pay them on both sides—you are both the employer and the employee. But trust me, it’s far better to accept paying employment taxes rather than try to run from it and get burned for owing back taxes. I just talked to someone who owed $90,000 in back taxes for their small business. Now that is painful!

How Do You Calculate Social Security Taxes?

For the 2025 tax year, all employees must pay Social Security taxes on income up to $176,100 (income above $176,100 is not subject to those taxes).9 It’s super easy to calculate this tax. Just take 12.4% of your employee’s income and set aside 6.2% for taxes. Your employee will then pay the other 6.2%. (Or, if we’re talking about you as the owner, you’ll set aside 12.4% of your income to cover this.)

How Do You Calculate Medicare?

Everyone pays Medicare tax. To calculate this amount, take out 2.9% of your employee’s wages and set aside half, which is 1.45%.10 Again, your employee will pay the other half. (And in your case as the owner, you’ll need 2.9% to cover your own Medicare tax.)

How Do You Calculate Estimated Taxes?

Now, here’s where things get real trippy for small businesses. Unlike personal filers, who file their taxes once a year, small-business owners have to pay estimated taxes once every quarter. Yes, that’s four times a year.

Estimated taxes, or quarterly taxes, are based on what you expect your taxable income to be throughout the year. And let’s be real—that can be tough, especially if you’re just starting your small business. But once you’ve got an income estimate to work with, it’s really not so bad. Here’s a quick step-by-step process to help you figure out these quarterly headaches (sorry, taxes).

1. Estimate your taxable income this year.

2. Calculate how much you’ll owe in income and self-employment taxes.

3. Divide your estimated total tax into quarterly payments.

4. Send an estimated quarterly tax payment to the IRS.

How Do Tax Deductions and Credits Play Into This?

Tax deductions and tax credits are the biggest breaks you’ll get from Uncle Sam. Deductions reduce your taxable income, while tax credits reduce the actual amount you owe to the IRS.

The biggest tax deduction for sole proprietors, partnerships, LLCs, and S corporations is a 20% deduction on qualified income.11 Yeah—20%. That means if your taxable income is $100,000, you may be able to deduct $20,000.

Check out this list of common deductions to find out which ones apply to your small business, or talk to your tax pro. Hey—if the IRS is offering ways to keep some of your money in your own pockets and out of theirs, do your research and take advantage of it!

Want to Never Do Small-Business Taxes Again?

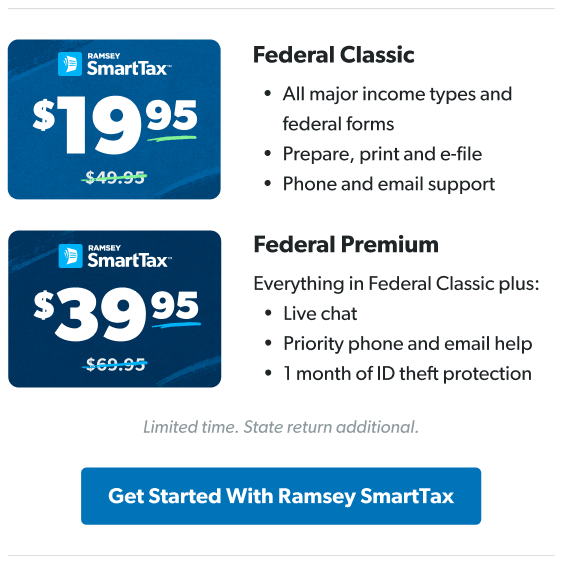

Look, guys—I get it. You have a company to run (and look at that—now you know exactly which kind of company). If you’re sick and tired of balancing spreadsheets, filling out quarterly forms, and filing annual returns by yourself, level up and hire a tax pro. An experienced tax pro will not only save you time, but can also save you money, since it’s their job to know more about taxes than you.

Worried about finding a competent, trustworthy professional? Don’t sweat it. Our RamseyTrusted tax pros can work alongside you and answer any questions you have about your small-business taxes.

Next Steps

- Want to learn more about what the IRS expects from entrepreneurs? Check out this handy guide to small-business taxes.

- It might be time to hire a Certified Public Accountant (CPA) to help you keep track of your business finances. We can show you how to find the right one for your business needs.

- RamseyTrusted small-business tax pros can take tax work off your plate so you can focus on growing your business.