Can you believe it’s already the middle of tax season? Before you know it, Tax Day will be here, and you’ll be scrambling to meet the tax filing deadline. It’s the most wonderful time of the year! Well, not quite.

We can all agree that doing taxes is a pain. But no matter how long you wait, you still have to file them. Tax season will be over soon, so let’s talk about your filing options.

Online tax software has come a long way in the last few years. But if you don’t want to do your taxes yourself—and we don’t blame you if you don’t—you can team up with a tax pro. They can answer your questions and take some of the stress out of filing! But is that the right choice for you or are you better off just filing online yourself? It really comes down to you and your tax situation.

Here are some helpful guidelines to make the choice a little easier.

When It Makes Sense to File Online

When making big financial decisions, we’re all about using a professional. It’s smart to get advice from an expert. But there are also times when filing your taxes with online software is the way to go. Here’s a run-down on the times when it makes sense to use online tax software:

1. You have a simple tax situation.

What do we mean by simple? Let’s look at a few scenarios:

- You only have one or two sources of income (like a full-time job and a weekend side hustle) or a fixed income.

- You have few or no investments outside of your tax-advantaged retirement accounts.

- You haven’t taken money out of your retirement accounts before you’re eligible.

- You plan on taking the standard deduction.

- You plan on making simple itemized deductions.

If these describe your tax situation, filing with online software might be the best choice for you. But before you decide between a tax pro and tax software, let’s talk about your life situation.

2. You had few life changes this year.

If your life this year looks pretty much the same as it did last year or you only had a few life changes this year (changes like buying a new home, getting married, or welcoming a new baby to the family), you can probably handle filing with software.

Get expert money advice to reach your money goals faster!

But if you’ve experienced more major life changes, you should get in touch with a tax pro. We’ll go over some specific examples below.

3. You’re comfortable filing on your own.

If you’re a do-it-yourself kind of guy or gal—someone who is comfortable navigating the software and spending a few extra weekend hours to file online yourself—then tax software is probably for you! Just keep in mind that it’ll be on you to fix any filing errors that might happen in the process.

Here’s something else to think about: You won’t actually pay for using the software until you’re ready to file. So if you try it and get stuck, you can always reach out to a tax pro for some guidance!

We also have some resources, like one of our Tax Prep Checklists or our Beginner’s Guide to Taxes, that can help you knock out your taxes and move on with your year.

But just because tax software can handle your tax situation and the life changes you’ve experienced this year, it doesn’t mean you have to file online. Let’s talk about when it makes more sense to work with a tax pro.

When It Makes Sense to Use a Tax Pro

Sometimes your taxes can be a bit more complicated than income from a full-time job and taking the standard deduction. You should strongly consider using a tax pro if:

1. You have a complex tax situation.

If your tax situation involves a lot more tax forms or paperwork than just a W-2 and a couple of 1099 forms, then it might be time to call a tax pro! Here are a few situations that could complicate your tax situation and require a tax professional for help:

- You have a lot of taxable investments outside of your retirement accounts.

- You made a big Roth conversion.

- You own a rental property.

- You owe taxes in multiple states.

In those cases, it’s worth spending a few hundred dollars to let a qualified tax expert answer your questions and file your return for you. It may cost more than using online software to file, but working with a tax advisor could save you money in the end. After all, they are experts on all things taxes, including all the deductions and credits you could qualify for!

2. You had major life changes this year.

Like we said before, online tax software can handle a few specific life changes (getting married, buying a new home, and having a baby), but tax pros can help you navigate through any major life change. We recommend using a tax expert if you retired, received an inheritance, or went through some other major life event that will significantly change your tax situation.

3. You’re not confident about filing your taxes.

Whether it’s your first time filing taxes or you’re just not familiar or comfortable with online tax software, there’s no shame in skipping the software! Tax season is stressful enough, so let a tax pro handle the heavy lifting and give you confidence that your return is being filed correctly.

4. You want to save time.

We know you’re busy with work and family, and using tax software to file your taxes can take a few hours of your time. If you’ve got better things to do on your Saturday than taxes, bring all your paperwork to a tax pro and let them file for you instead!

5. You own a business.

If you have to file a separate business tax return or you’re a sole business owner who reports income (or loss) from your business on your personal tax return, this makes your taxes more complex. A tax pro can file for you—and take the headache out of payroll and bookkeeping.

You may have other reasons for considering a tax pro. Maybe you’re still wrapping your head around how inflation has affected your tax bracket and tax rate. Or maybe you could file your taxes on your own, but you just don’t want the hassle. Do what works for you! Sometimes it just makes sense to get the advice of a professional. It is their day job, after all.

File Your Taxes With Confidence

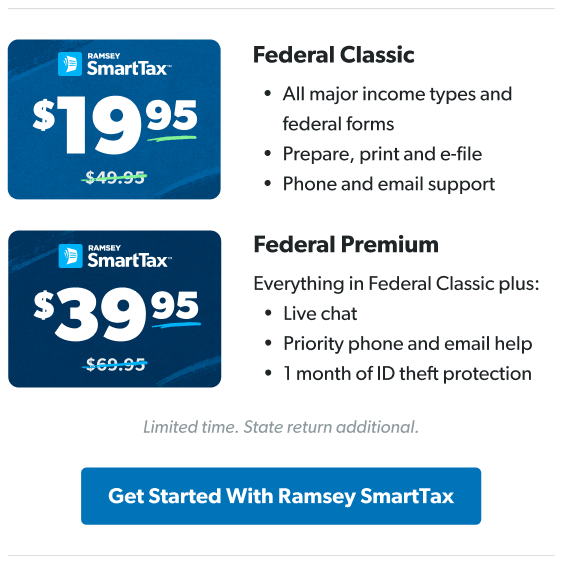

If you’re confident about your tax forms and financial situation, check out Ramsey SmartTax. Our online tax service is easy-to-use and will walk you through the entire tax filing process step by step. You'll get the most out of your tax software and with no hidden fees or upcharges, you’ll always know exactly what you’re paying to file with no nasty surprises along the way.

If you’ve decided your situation is complicated enough to require some outside help, good news! You can connect with a RamseyTrusted® tax pro and take the first step to getting your questions answered and your taxes done. These pros are vetted and coached by our team, so you can sleep easy at night knowing your taxes are being taken care of by the best of the best.

Find your RamseyTrusted tax pro today!

Still not sure whether to work with a tax pro or use an online tax software to file your return? No worries! Our Tax Services site is full of resources that can help you narrow down which option is right for you.