Key Takeaways

- A college fund is a tax-favored savings plan for college costs.

- Types of college funds include ESAs, 529 plans, UTMAs and UGMAs.

- Your student can also help save for college by choosing the right school, applying for scholarships, living at home, and working while in school.

How much student loan debt do you think the average college student racks up by the time they cross the graduation stage? Seriously, take a guess. $10,000? $20,000? You’d be what’s known as wrong.

Get expert money advice to reach your money goals faster!

The average college student graduates with a whopping $38,290 of student loan debt.1 Yikes. And that’s just the average!

And when you multiply that amount by millions of college grads in America, you get an overall student loan debt of $1.6 trillion.2 Yeah, that’s trillion with a T. Not a misprint. At this rate, college graduates will be lucky to pay off their student loans before their kids start college.

But thankfully, there’s a much better way to pay for your kids’ education—with a college fund. And if you take the time to plan now, you can save enough for your child to graduate from college debt-free!

How Much Should You Save for College?

When Should You Start Saving for College?

How to Start a College Fund and Types of College Funds

10 Simple College Savings Tips for Students

How Much Should You Save for College?

The first step to starting a college fund is knowing how much you need to save. If your kid is a junior in high school, for example, you’ll need to save more money (and faster) than if you start saving when your kid is in first grade. Or you can really get a head start by saving for your child’s college the moment they’re born (which is exactly what my wife and I did).

It also helps if you have an idea of where your child will go to school—like an in-state community college or an Ivy League university (which, unless your toddler is doing advanced calculus, you probably won’t know until your kid is a junior or a senior).

Just keep in mind that while there’s typically a huge cost difference between a public school and a private school, it doesn’t necessarily mean the quality of the education is that different. So do what makes the most sense for your student and your budget.

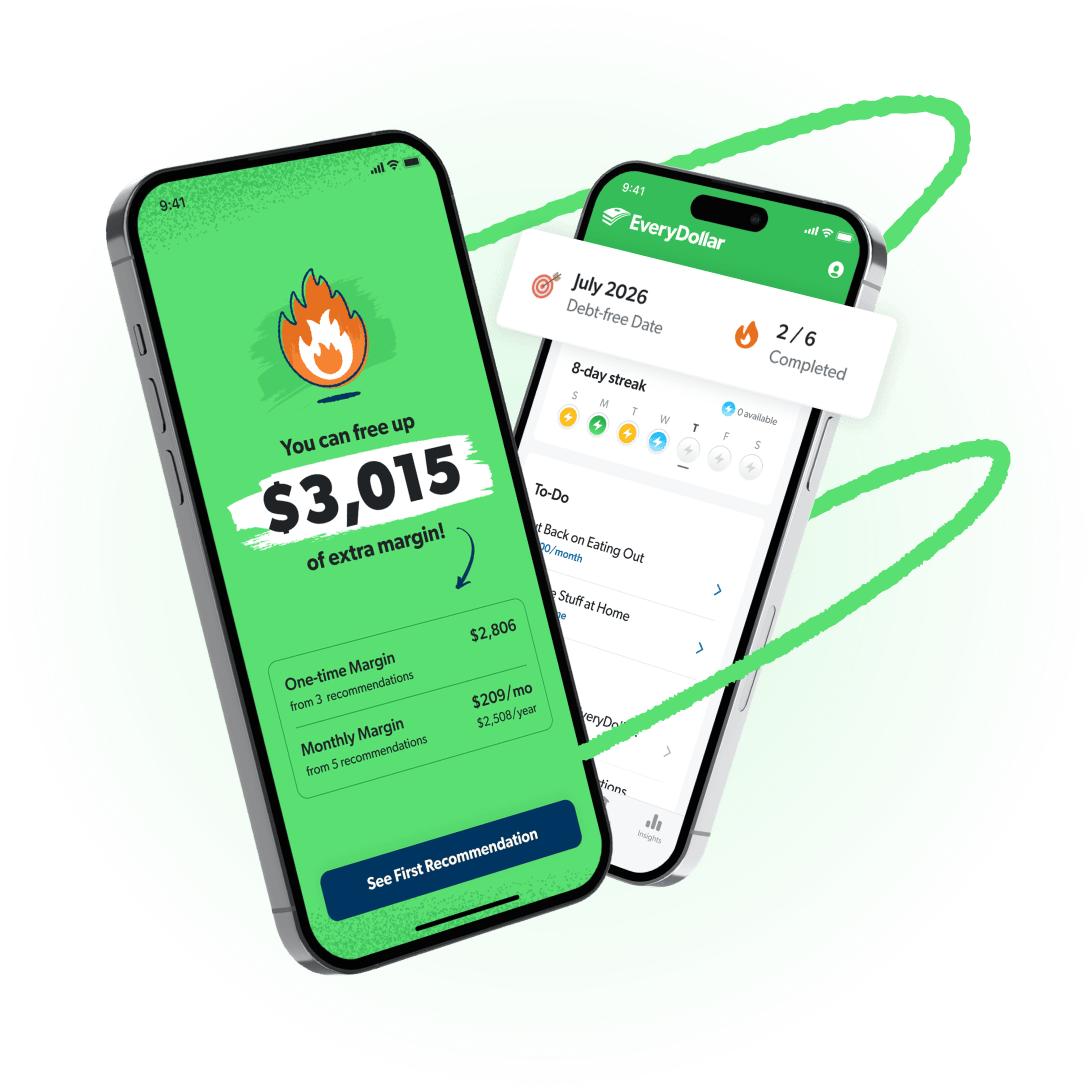

Free Up Margin. Make Real Progress.

The EveryDollar budget app helps you find hidden margin and put it to work so you can stack savings, crush debt, and build wealth that lasts.

For an estimate of how much to start saving, here are the average costs of attendance for the 2023–2024 school year:3

- Public, Two-Year College: $19,860

- Public, Four-Year, In-State College: $28,840

- Public, Four-Year, Out-of-State College: $46,730

- Private, Four-Year College: $60,420

The cost of attendance includes tuition and fees, housing and food, books and supplies, transportation and other personal expenses for full-time undergraduate students. Also, these numbers don’t take inflation into account. So, 18 years from now, the rates will likely be much higher.

When Should You Start Saving for College?

As soon as possible!

Now, if you’re on a tight timeline, give yourself some grace here. People often assume parents are responsible for paying for their kids’ college, but that’s not always possible. And the reality is, your kids can help pay for college by earning grants and scholarships or by working a part-time job (more on that later).

So, for any parents out there: Before you jump into saving for college for your kids, you need to set up your future for success. And no, it isn’t selfish—it’s smart. This is one of those “put your mask on before assisting others” situations. Just follow the 7 Baby Steps:

Baby Step 1: Save $1,000 for your starter emergency fund.

Baby Step 2: Pay off all debt (except the house) using the debt snowball.

Baby Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Baby Step 4: Invest 15% of your household income in retirement.

Baby Step 5: Save for your children’s college fund.

Baby Step 6: Pay off your home early.

Baby Step 7: Build wealth and give.

Now, depending on where you are financially, Baby Step 5 may feel like a ways away. But it’s important to do things in the right order. Because your child may or may not go to college (or graduate), but there’s a 100% chance you’ll have to retire one day—so trust the steps.

How to Start a College Fund and Types of College Funds

Once you’ve gotten your own finances in order and have an idea of what it’ll cost for your child to go to college, it’s time to start saving for college using a tax-favored plan.

Setting up a college fund is simple—you just need to know which fund is the right choice for you and your savings goals. You can also work with an investing professional to help you pick a savings plan and walk you through your investment options.

Education Savings Account (ESA) or Education IRA

An Education Savings Account (ESA) works a lot like a Roth IRA, except it’s for education expenses. It allows you to invest up to $2,000 (after tax) per year, per child. Plus, it grows tax-free! So, if you start saving $2,000 a year when your child is born, by the time they turn 18, you’d have invested $36,000.

It’s hard to say exactly what the rate of growth is with an ESA because it varies based on the investments in the account. But if you invest in good growth stock mutual funds and get an average return of 10–12%, that $36,000 could grow to around $112,000 by the time your child is ready to go off to college. Congrats, you more than tripled your investment, and now Junior doesn’t have to worry about paying for tuition!

I like the ESA because it’s likely a much higher rate of return than you’d get in a regular savings account—and you won’t have to pay taxes when you withdraw the money to pay for education expenses. An ESA isn’t just for college tuition either. It can be used for K-12 private school tuition, vocational school or things like textbooks, school supplies or tutoring. And if your child doesn’t end up needing the money, you can transfer it to a sibling so they can use it for their school expenses.

Why I Like It:

- There’s a variety of investment options.

- Your money grows tax-free.

- There’s a higher rate of return than a regular savings account.

Why I Don’t Like It:

- Contributions are limited to $2,000 per year.

- You must be within the income limit to qualify.

- The amount must be used by the beneficiary by age 30.

Here's A Tip

Use our College Savings Calculator to see how much you’ll need to save for college.

529 Plan

If you want to save more than $2,000 a year for your children’s college education, or if you don’t meet the income limits for an ESA, a 529 plan could be a better option. But be careful—some 529 plans are no good. Look for a savings plan that allows you to choose which funds you invest in. These are usually called “flexible” plans.

I wouldn’t use a prepaid 529 plan that freezes your tuition savings rate or automatically changes your investments based on the age of your child. Stay away from so-called “fixed” or “life phase” plans too. You want to stay in control of the mutual funds at all times.

Like the ESA, the 529 can be used for other education expenses, like K-12 tuition, vocational school or required college textbooks. Some 529 plans also give you the option to move the funds from one family member to another, which is helpful if the child you’ve been saving money for decides not to go to college—but some 529 plans don’t allow this.

Why I Like It:

- Contribution rates are higher (this varies by state, but generally you can contribute up to $300,000).

- Most of the time, there aren’t any income limits or restrictions based on age.

- Your money grows tax-free.

Why I Don’t Like It:

- Restrictions may apply if you choose to transfer the funds to another child.

- If one person contributes more than $18,000 to the 529 in 2024 that money is subject to a gift tax.4

UTMA or UGMA

If you’ve already done an ESA and a 529, or if you don’t qualify for an ESA, then (and only then) should you look into a Uniform Transfer to Minors Act (UTMA) or a Uniform Gift to Minors Act (UGMA). These plans are different from ESAs and 529 plans because they’re not just for saving for college.

The account is in the child’s name but controlled by a parent or guardian until the child reaches either age 18 or 21 (this age varies by state, but it’s generally age 18 for UGMA and age 21 for UTMA). Once the child reaches the set age, they’ll be able to control the account to use any way they choose. So, you’re basically opening up a mutual fund in your child’s name.

There are no limits to the amount of gift money you contribute to these funds, but anything above $18,000 per year (or $36,000 for a married couple) will have a federal gift tax.

While you can use a UTMA or UGMA to save for college and invest in your child’s future with reduced taxes, your kid ultimately gets to choose how the money is spent. And I don’t know about you, but when I was 18, I would’ve bought a vintage guitar and way too many plaid western snap-button shirts (if you haven’t been through that phase, it’s coming for you).

Why I Like It:

- Funds can be used for more than just college expenses.

- There are tax advantages for the contributor.

Why I Don’t Like It:

- Once the beneficiary is of legal age, they can use the money however they want (aka they could pay for a sports car instead of college).

- The beneficiary can’t be changed once selected.

10 Simple College Savings Tips for Students

Many of us want our kids to pursue a college degree. But college is a privilege—not a requirement. And to be honest, college isn’t worth it for everyone.

But if your child does decide to go to college, remember that it’s not necessarily your responsibility to pay for it. It’s totally okay (and even empowering) for your child to take some ownership in their education. Even if they’re a full-time student, they can still start saving money themselves and establish healthy money habits they’ll carry into the future.

Here are some college savings tips to help your student pay their way through school:

1. Apply for scholarships.

Scholarships are free money for college that your child doesn’t have to pay back! If Jimmy or Suzie excels in athletics, academics or extracurricular activities, they should use those abilities to their advantage and try to get rewarded for it. Encourage your child to apply for any scholarship they’re eligible for. In fact, make it almost a part-time job where they’re applying for several scholarships every single week. And don’t ignore the small scholarship awards—they add up fast!

2. Apply for aid.

Everyone who wants to go to college should fill out the Free Application for Federal Student Aid (FAFSA). It’s a form schools use to figure out how much money they can offer the student. The FAFSA allows you to get federal grants, work-study programs, state aid and school aid—all versions of free money! But beware: The FAFSA also shows how much student loans you can borrow, which is a terrible idea. So, when the award letter arrives, read the fine print to make sure it’s a scholarship or grant—not a student loan.

3. Take AP classes.

Advanced Placement (AP) classes give high school students the opportunity to earn college credits while they’re still in high school. Now, whether or not you receive college credit depends on your AP test scores and the college you’re heading to. Also, you usually have to pay a small fee for the class, but it’s way less than the cost of a college class. Hallelujah! Tell your child to talk to their academic counselor to see what AP classes are available. You can also look into dual enrollment courses offered through local community colleges.

4. Get a job.

Whether they take on a full-time gig during the summer (like mowing lawns, walking dogs, or lifeguarding at the local Y) or a part-time job during the school year, your child will be able to save money for college and gain work experience to put on their resumé. And trust me, there are some things that you can only learn by working at the Apple Store (mostly how to quickly close out of apps with Command + Tab + Q) .

5. Open a savings account.

Your student will need a safe place to keep all their earnings from their part-time jobs. Most banks offer a student checking account that includes a debit card and a savings account. Plus, there’s usually no monthly maintenance fees or minimum balance requirements. If your child is under 18, you’ll need to be the joint account holder, but this is a great way to get them used to saving, spending and budgeting.

6. Save money instead of spending it.

Encourage your child to immediately put a portion of the money they get into their savings account, so they aren’t tempted to spend it. You can also agree to match their savings dollar for dollar to get them to save even more.

7. Never use student loans.

You’ve got to take student loans completely off the table. They may seem like a quick fix, but they’re actually a nightmare that sends college graduates out into the world anchored in debt. If your child can’t pay cash when tuition is due, then they need to decide what has to change. Should they transfer schools? Take a semester off to work and save more money? It may not be ideal—but student loan debt is worse.

8. Choose a cheaper school.

I know Ivy League might be the dream, but going to an in-state school can offer the same degree programs at a huge fraction of the cost. Plus, if your kid stays local, that cuts down on moving costs, out-of-state tuition, and travel expenses to visit family and friends.

9. Let them live at home.

Having your child live at home and commute as a college student can save thousands of dollars a year on room and board expenses. Plus, your child can ditch the campus meal plan and save money by cooking at home or joining family dinners instead. I did that for my first year of college and I have no regrets (mostly because Mama Kamel’s cooking is chef’s kiss). And don’t worry, your kid can still join clubs and be a part of campus life as a commuter!

10. Look for tuition reimbursement at work.

Some companies offer tuition reimbursement for their college student employees. If your child is applying for part-time jobs, help them filter their job search to include companies that offer a tuition reimbursement benefit. Any little bit helps, plus they’ll get professional experience to add to their resumé.

It’s Time to Get Serious About Saving for College

It’s never too early to start thinking about a college savings plan. Whether your child is a teenager or toddler, the best time to start a college fund is now (after you’ve paid off debt, saved an emergency fund, and started investing 15% of your income in retirement accounts, of course).

And the best way to save for college—or any other goal—is with a budget.

The EveryDollar budget app can help you free up thousands in margin—money you didn’t even know you had—and give you a custom plan to put it to work on crushing debt, stacking savings, and building wealth that actually lasts.

Download EveryDollar for free today and finally make the progress you’ve wanted all along.