Adoption is one of the most beautiful and rewarding acts. But it honestly comes with unique challenges. Growing your family in this way can be an emotional and financial roller coaster. The good news is, it’s completely worth it. And with some planning ahead, you can make the whole ride way smoother.

So let’s get you prepped. For everyone wondering “how much does it cost to adopt a child?” and even “how can I afford adoption?” we’ve broken down the numbers and set up some practical steps to help you make your adoption dreams a reality.

How Much Is Adoption?

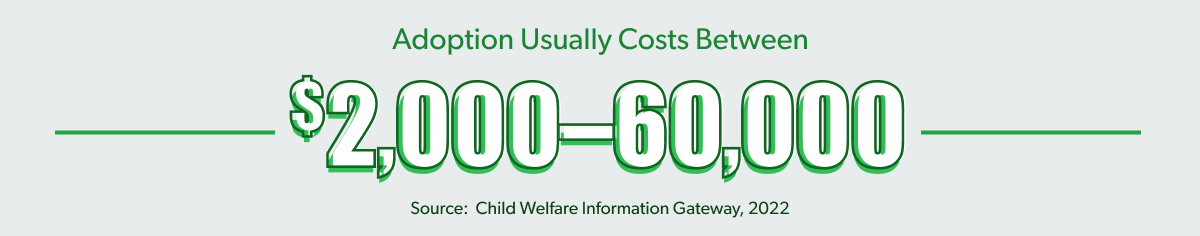

Adoption costs $2,000–60,000, though some adoptions can end up costing you nothing!1

Yes, that’s quite a range. The adoption cost depends on the child’s age, birthplace, the type of adoption . . . and so much more.

Let’s start with the four adoption types.

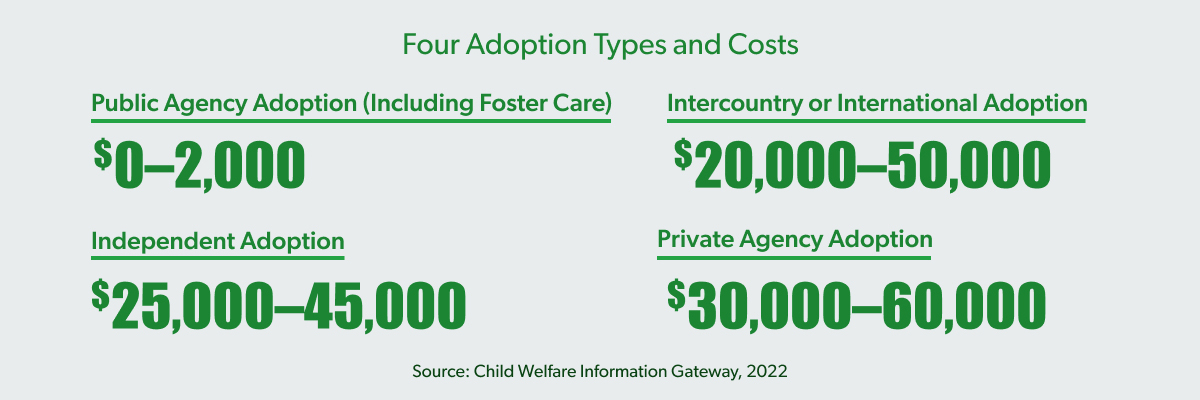

4 Adoption Types and Costs

- Public Agency Adoption (Including Foster Care): $0–2,000

If you work directly with a public agency, they sometimes cover all the work and expenses of the adoption. Also, reimbursement options are offered to help you recover part of the adoption costs—which the federal government has currently capped at $2,000.2

- Private Agency Adoption: $30,000–60,0003

This is a popular way to adopt a baby domestically (aka in the USA) using a licensed adoption agency. It’s a pricy method, but you have a high level of guidance and are involved in a lot of the decision making throughout the process.

- Independent Adoption: $25,000–45,0004

With an independent adoption, you don’t have the private agency’s fees—or their continual support through the process. You have to do more of the work on your own. But not all of it (thank goodness) because you’ll be paired with an attorney who specializes in adoption.

- Intercountry or International Adoption: $20,000–50,0005

International adoption costs depend a ton on what country you’re working with. You might be working with private agencies, orphanages, nonprofits, attorneys—or a combination of these! Plus, there’s travel and often there are translation fees.

Get expert money advice to reach your money goals faster!

Whether you finalize your adoption overseas or back home, you’ll have extra paperwork (and a cost here) involved in getting your child an American citizenship versus adopting directly from the USA.

But listen, don’t let any of that discourage you! And if your heart is pulled toward an adoption process that seems more difficult or more expensive, don’t let those challenges hold you back.

Think of these facts as your friend. The more you know, the better you can walk the adoption journey.

Why Is Adoption So Expensive?

We know these numbers can feel overwhelming. Adoption can be quite expensive. But that’s because so much is involved in the adoption process, and most parts of that process cost money.

Professionals including doctors, counselors, lawyers, social workers and other government officials are involved—working for both the biological and adoptive parents.

The best thing you can do is gather up all the info on all the adoption costs connected to the type of adoption you’re prepping for. Speaking of which . . .

Adoption Costs Broken Down

Every kind of adoption has its own unique costs. But here’s a list of some common ones to help you see why the overall cost to adopt can seem so high.

- Adoption Profile Book: $90–5006

- Advertising and Networking for Matching: $1,000–2,0007

- Application Fee: varies (Tennessee specific is $0–1,000)8

- Birth Mother Medical Expenses: varies (the average cost to have a baby is $2,854 with insurance and $18,865 without insurance)9

- Court Document Preparation: $500–2,00010

- Home Study: $1,000–3,00011

- Legal Representation: $2,500–12,00012

- Pre- and Post-Adoption Counseling for Birth Parents: $450–2,00013

- Travel: varies (usually higher for international adoptions)

If you decide to go with an agency, specifically ask if they charge a flat rate and ask for a detailed list of every single thing that rate covers. Sometimes everything in that list (and more) will be covered by a clearly-defined, upfront cost. Sometimes there are added adoption costs you'll have to prep for. Just be ready to ask a lot of questions so you don’t have a lot of unexpected expenses.

Ways to Pay for Adoption Costs

Tax Credit

The government offers a tax credit for qualified adoption expenses up to $16,810 per child.14 Plus, you can exclude any adoption-assistance income from your employer from your taxes. Make sure you fill out all the correct paperwork so you get your max benefits. (This is a time when hiring a tax pro is well worth it.)

Employer Adoption Assistance

Did you know paid adoption leave is a thing? And the popularity of this workplace benefit is growing. About 34% of employers offer it now.15

According a survey by the Dave Thomas Foundation for Adoption, employers reimbursed workers who adopted in 2023 nearly $15,000 per adoption.16 So find out if your employer offers any kind of assistance!

Adoption Subsidies

If you adopt a child who has special needs or you use the foster-to-adopt route, you may qualify for monthly financial assistance, medical assistance for the child (through Medicaid), and even a reimbursement for your initial adoption costs.

Military Adoption Benefits

Active duty military families can get up to $2,000 of adoption costs reimbursed, plus adoption leave and health care benefits before the adoption is final.17

Grants

From Show Hope to the Tim Tebow Foundation, the list of grants you can apply for to help cover some of your adoption costs is long one. And plenty of these companies go above and beyond, offering a community and emotional support throughout and even after your adoption process.

Fundraising

Raising funds to make extra money so you can cover adoption costs is pretty common. Here are some ideas:

- Host a garage sale (with donations from friends, family and others in your community).

- Serve up a delicious meal for a ticketed potluck.

- Connect with adoption fundraising companies like Both Hands and Just Love Coffee to plan projects or sell products.

- See if any local restaurants will do a spirit night, donating a portion of the profits to your adoption costs.

- Organize a 5k, golf tournament, bowl-a-thon or trivia night.

And listen: Plenty of generous people will find joy in helping you on the financial side of your adoption journey. Let them buy those tickets, that coffee, or that meal so they can bless you.

Saving

Find ways to save up extra money to cover your adoption costs. That means working to increase your income and cutting back on spending. Pick up a side hustle or drop some extra fluff in the budget—for now.

Get the whole family on board. You can even set up savings challenges and get competitive about it. No matter who wins, you all win!

Don’t Forget This Key to Covering Adoption Costs

Here’s a super important callout as you work to fund your adoption: You’re about to have money coming in that has a very special purpose—paying for those adoption costs! You need to keep up with all the income from your fundraising, donating and side hustling. That means saving and organizing all the paperwork you might get from any of these money-earning methods.

It also means you need to budget. Because a budget is a plan for your money—a way for you to tell every dollar where to go. And right now you’ve got extra dollars that are going toward your adoption goals. Download EveryDollar (it’s free!) and make a budget. This will help you manage your normal income and expenses plus everything else.

And, through it all, always remember your why: bringing a child into their forever home.

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)