EveryDollar is the budgeting app that helps you find more margin and put it to work to beat debt and build wealth.

- Plan your money with easy zero-based budgeting

- Track your spending and expenses quickly

- Manage your money better with the budgeting app made for real life

*Based on average new users. Your results may vary.

If a few extra bucks of breathing room feels good, imagine having thousands! Find margin you didn’t know you had and make real progress on your goals, real fast.

Over $2 billion of margin found!

That's just in 2025 alone! And we're just getting started.

Join millions of EveryDollar budgeters transforming their finances!

EveryDollar is more than a budgeting app.

It’s the only app that gives you a plan to get better with money—every single day.

You work too hard to feel this broke . . .

-

Missing out on thousands of dollars in margin

-

Feeling stuck, just doing “okay,” never getting ahead

-

Watching your debt and stress pile up

Hundreds of dollars of extra margin every month

Hundreds of dollars of extra margin every month

Way more confidence with your money

Way more confidence with your money

A plan to make the most of every dollar, every day

A plan to make the most of every dollar, every day

Frequently Asked Questions

-

What features should I look for in a budgeting app?

-

Look for a budget app that makes it easy to:

- Plan your spending

- Track transactions

- See at a glance what’s left to spend

- Set goals (saving, debt payoff, plan for retirement, etc.)

- Stay on top of bills and expenses

- Share the budget if you manage money with a partner

- Stay motivated and on track

-

Is EveryDollar free?

-

Yes! EveryDollar has a free version you can use as long as you want. If you want to experience the all-access version, EveryDollar premium, you can start with a 14-day free trial (new users only).

-

What’s included in EveryDollar premium?

-

EveryDollar premium includes all the free features, plus time- and money-saving upgrades like:

- Automatic transactions with Bank Connect

- Personalized recommendations to help you free up more money every month

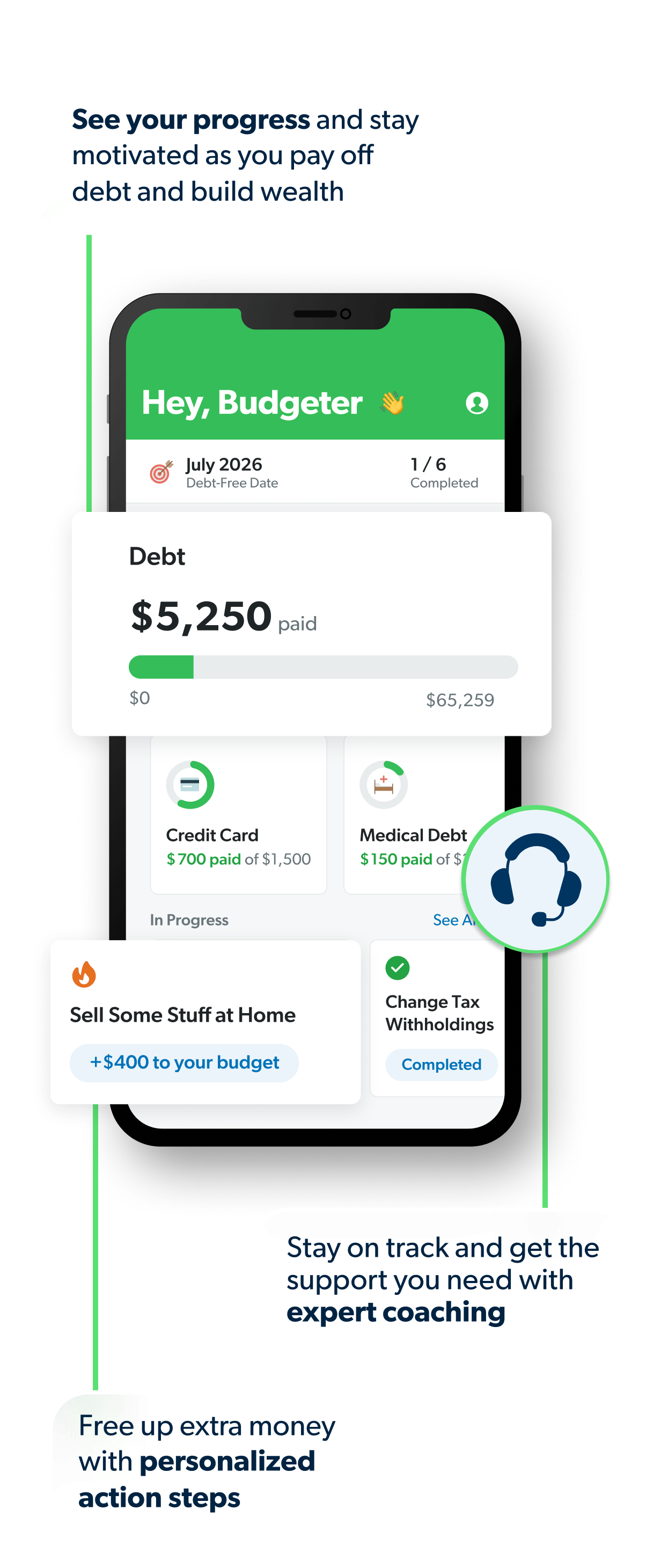

- Debt payoff tracker to stay motivated and on track

- Expert coaching (1:1 and group) for support and accountability

- Free live trainings every week to help you build budgeting skills and feel confident using EveryDollar

-

How does EveryDollar help you find more margin/save money?

-

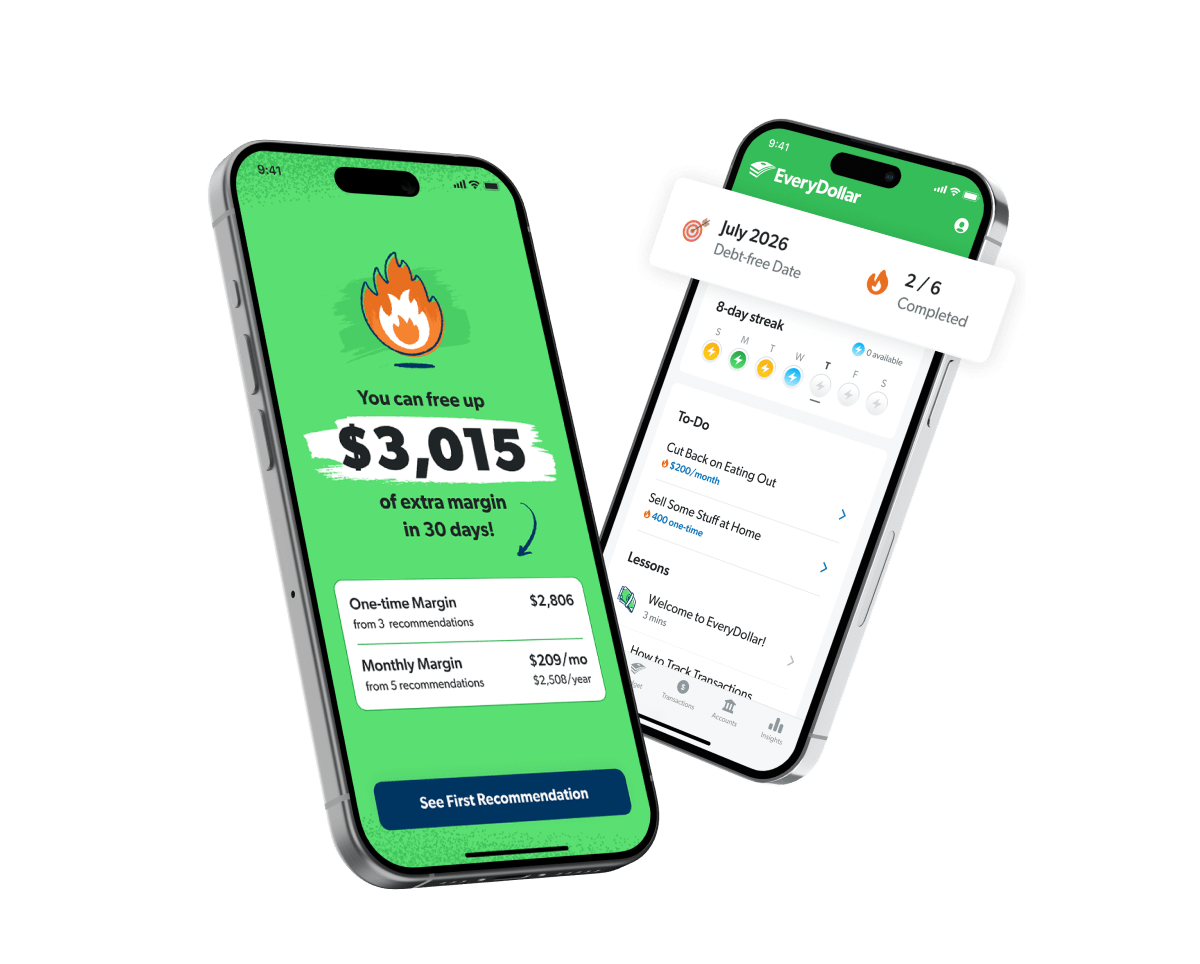

EveryDollar’s personalized recommendations consider your spending habits and lifestyle to help you free up more money in your budget. You may have thousands in margin hiding in plain sight. EveryDollar helps you find it and guides you step-by-step on how to put it toward what matters most.

-

Does EveryDollar connect to my bank / import transactions?

-

Yes! With EveryDollar premium, Bank Connect pulls your transactions into your budget for you.

-

Is EveryDollar good for couples/shared budgets?

-

Yes! The Household feature lets couples manage one budget together, even if you each sign in with separate emails.

-

What is zero-based budgeting and how does EveryDollar use it?

-

Zero-based budgeting means you plan where every dollar will go before you spend it, so your income minus expenses equals zero. EveryDollar makes it simple by helping you build your plan with custom categories before the month begins, then showing you what’s left in each category as you go.

-

Can EveryDollar help with debt payoff planning?

-

Yes. EveryDollar helps you work the Debt Snowball method of paying off your debts from smallest to largest. You focus on the smallest debt first to get quick wins, stay motivated, and keep making progress. EveryDollar tracks your progress and, if you’re a little off, recommends a new payment amount and where to find the margin to cover it.

-

How do I cancel Premium?

-

You can cancel EveryDollar premium anytime. Canceling won’t delete your account. You’ll still have access to the free version.

Follow these steps to cancel your subscription:If you are billed directly by EveryDollar

- Sign in to account.ramseysolutions.com/subscriptions

- Click on Manage Subscription on the applicable product

- Toggle Auto-Renew OFF.

Third-Party Billing

If you subscribed to EveryDollar premium through Apple/iTunes or Google Play, you’ll need to cancel directly with that provider. EveryDollar is not able to cancel or issue refunds for third-party purchases. -

Is my data secure with EveryDollar?

-

Yes. We take your privacy and security seriously. To connect your bank to your budget, EveryDollar partners with highly trusted third-party providers Mastercard Connect and Plaid. They follow strict security protocols, and your data is protected with multiple layers of security and encryption, including secure data transmission, identity verification, and fraud prevention tools.

*“Find $3,015 in 15 minutes” refers to the average amount of potential budget margin opportunities identified based on new EveryDollar users’ responses during the initial onboarding questionnaire (approximately 15 minutes).

Based on historical user data, new users identify $3,015 or more in a combination of one-time margin and ongoing monthly margin during onboarding.

Actual savings require users to take action on the personalized recommendations surfaced in the app, resulting in customers realizing $3,015 or more in available margin within their first 30 days and $20,150 within their first year.

Individual results will vary and are not guaranteed.