Key Takeaways

- The Bible has hundreds of verses about money, covering how to manage it, give generously, avoid debt, build wealth and guard against the love of money.

- Scripture calls believers to give generously and consistently, trust God as their provider, and keep their hearts free from the love of money.

- God’s Word warns that debt, greed and get-rich-quick thinking lead to trouble—while steady hard work and faithfulness lead to lasting blessing.

What does the Bible say about money? A lot. In fact, there are hundreds of verses in the Bible that talk about money alone. (The book of Proverbs is basically a finance course in itself!)

Here are 50 of the most popular scriptures on money that cover everything from building wealth and managing money to avoiding debt and giving generously.

50 Bible Verses About Money

Bible Verses About Managing Money

Bible Verses About Giving

Bible Verses About Debt

Bible Verses About Building Wealth

Bible Verses About the Love of Money

Bible Verses About Managing Money

When it comes to managing money God’s ways, the Bible says we should be honest, provide for our family, and plan ahead.

Luke 14:28–30 (NIV): “Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it? For if you lay the foundation and are not able to finish it, everyone who sees it will ridicule you, saying, ‘This person began to build and wasn’t able to finish.’”

Proverbs 27:23–24 (NIV): “Be sure you know the condition of your flocks, give careful attention to your herds; for riches do not endure forever, and a crown is not secure for all generations.”

Proverbs 21:20 (NIV84): “In the house of the wise are stores of choice food and oil, but a foolish man devours all he has.”

Proverbs 13:16 (TLB): “A wise man thinks ahead; a fool doesn’t and even brags about it!”

Luke 16:10–11 (NIV): “Whoever can be trusted with very little can also be trusted with much, and whoever is dishonest with very little will also be dishonest with much. So if you have not been trustworthy in handling worldly wealth, who will trust you with true riches?”

Matthew 25:20–21 (NIV): “The man who had received five bags of gold brought the other five. ‘Master,’ he said, ‘you entrusted me with five bags of gold. See, I have gained five more.’ His master replied, ‘Well done, good and faithful servant! You have been faithful with a few things; I will put you in charge of many things. Come and share your master’s happiness!’”

Proverbs 11:1 (NIV): “The LORD detests dishonest scales, but accurate weights find favor with him.”

James 5:4 (NIV): “Look! The wages you failed to pay the workers who mowed your fields are crying out against you. The cries of the harvesters have reached the ears of the Lord Almighty.”

1 Timothy 5:8 (NIV): “Anyone who does not provide for their relatives, and especially for their own household, has denied the faith and is worse than an unbeliever.”

Ecclesiastes 11:2 (NIV): “Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land.”

Proverbs 13:22 (NKJV): “A good man leaves an inheritance to his children’s children . . .”

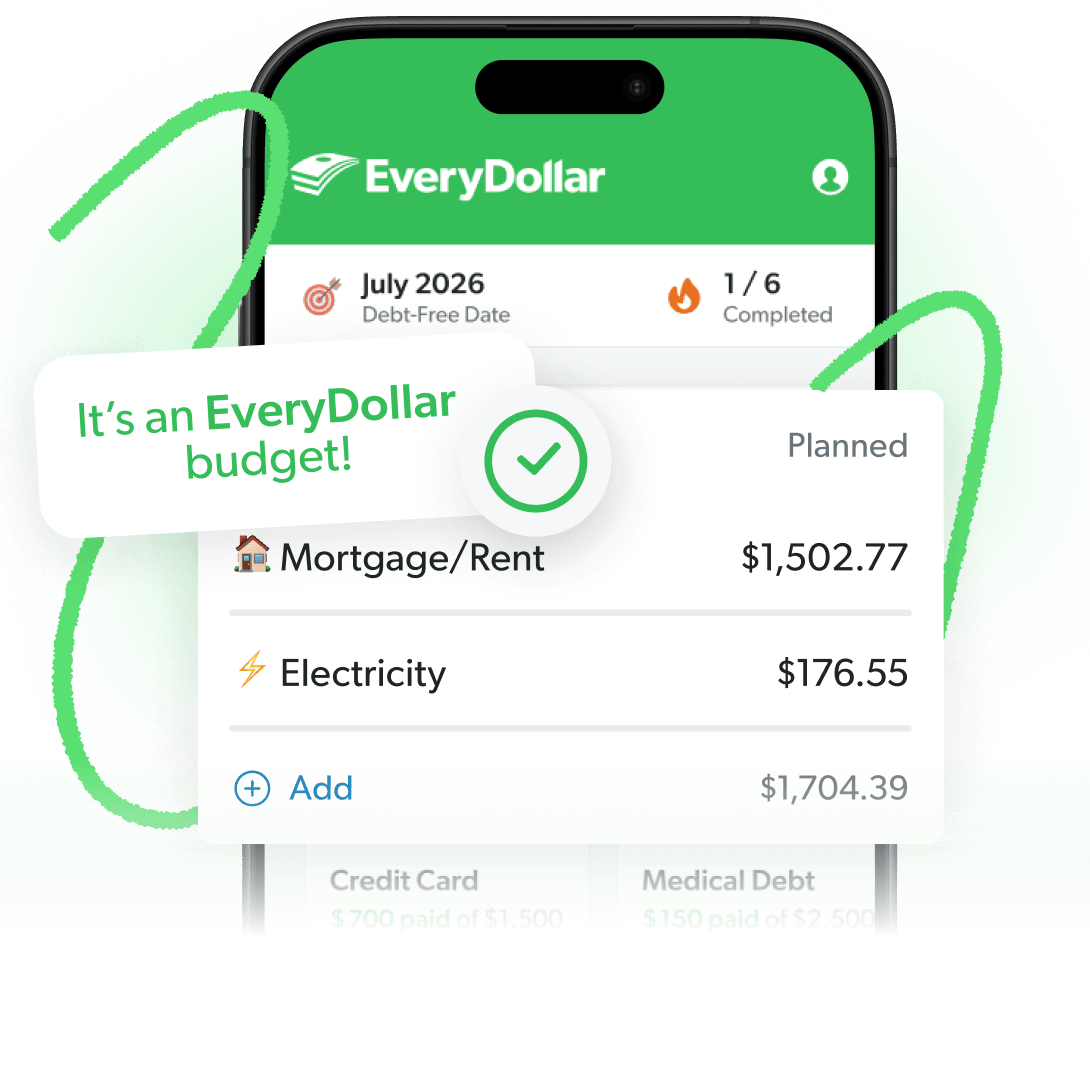

Here's A Tip

The best way to make a plan for your money and spend intentionally is with a monthly budget. Start budgeting for free with EveryDollar today!

Bible Verses About Giving

There are many commands throughout the Bible to tithe regularly and give generously to others.

Proverbs 3:9 (NIV): “Honor the LORD with your wealth, with the firstfruits of all your crops.”

Leviticus 27:30 (TLB): “A tenth of the produce of the land, whether grain or fruit, is the Lord’s, and is holy.”

Nehemiah 10:35 (NIV): “We also assume responsibility for bringing to the house of the LORD each year the firstfruits of our crops and of every fruit tree.”

Malachi 3:10 (NIV): “Bring the whole tithe into the storehouse, that there may be food in my house. Test me in this,” says the LORD Almighty, “and see if I will not throw open the floodgates of heaven and pour out so much blessing that there will not be room enough to store it.”

Luke 12:33 (NIV): “Sell your possessions and give to the poor. Provide purses for yourselves that will not wear out, a treasure in heaven that will never fail, where no thief comes near and no moth destroys.”

Mark 12:43–44 (NIV): “Calling his disciples to him, Jesus said, ‘Truly I tell you, this poor widow has put more into the treasury than all the others. They all gave out of their wealth; but she, out of her poverty, put in everything—all she had to live on.’”

Deuteronomy 15:7 (NIV): “If anyone is poor among your fellow Israelites in any of the towns of the land the LORD your God is giving you, do not be hardhearted or tightfisted toward them.”

Proverbs 11:24 (NIV): “One person gives freely, yet gains even more; another withholds unduly, but comes to poverty.”

Acts 20:35 (NIV): “In everything I did, I showed you that by this kind of hard work we must help the weak, remembering the words the Lord Jesus himself said: ‘It is more blessed to give than to receive.’”

Matthew 6:2–4 (NIV): “So when you give to the needy, do not announce it with trumpets, as the hypocrites do in the synagogues and on the streets, to be honored by others. Truly I tell you, they have received their reward in full. But when you give to the needy, do not let your left hand know what your right hand is doing, so that your giving may be in secret. Then your Father, who sees what is done in secret, will reward you.”

2 Corinthians 9:6–8 (NIV): “Remember this: Whoever sows sparingly will also reap sparingly, and whoever sows generously will also reap generously. Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.”

Bible Verses About Debt

The Bible is clear we should stay away from debt and pay what we owe.

Proverbs 22:7 (NIV): “The rich rule over the poor, and the borrower is slave to the lender.”

Proverbs 22:26–27 (NIV): “Do not be one who shakes hands in pledge or puts up security for debts; if you lack the means to pay, your very bed will be snatched from under you.”

Proverbs 17:18 (NIV): “One who has no sense shakes hands in pledge and puts up security for a neighbor.”

Romans 13:7–8 (NIV): “Give to everyone what you owe them: If you owe taxes, pay taxes; if revenue, then revenue; if respect, then respect; if honor, then honor. Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.”

Deuteronomy 28:12 (NIV): “The LORD will open the heavens, the storehouse of his bounty, to send rain on your land in season and to bless all the work of your hands. You will lend to many nations but will borrow from none.”

Exodus 22:25 (NIV): “If you lend money to one of my people among you who is needy, do not treat it like a business deal; charge no interest.”

Bible Verses About Building Wealth

While we are called to work hard and build wealth, the Bible warns against trying to get rich quick.

Proverbs 14:23 (NIV): “All hard work brings a profit, but mere talk leads only to poverty.”

Proverbs 13:11 (ESV): “Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.”

Proverbs 28:20 (NKJV): “A faithful man will abound with blessings, but he who hastens to be rich will not go unpunished.”

Proverbs 20:21 (NIV): “An inheritance claimed too soon will not be blessed at the end.”

Proverbs 21:5 (NIV): “The plans of the diligent lead to profit as surely as haste leads to poverty.”

Psalm 37:16 (NIV): “Better the little that the righteous have than the wealth of many wicked.”

Ephesians 4:28 (NIV): “Anyone who has been stealing must steal no longer, but must work, doing something useful with their own hands, that they may have something to share with those in need.”

Deuteronomy 8:17–18 (NIV): “You may say to yourself, ‘My power and the strength of my hands have produced this wealth for me.’ But remember the LORD your God, for it is he who gives you the ability to produce wealth, and so confirms his covenant, which he swore to your ancestors, as it is today.”

Proverbs 10:22 (NIV): “The blessing of the Lord brings wealth, without painful toil for it.”

Ecclesiastes 5:19 (NIV): “Moreover, when God gives someone wealth and possessions, and the ability to enjoy them, to accept their lot and be happy in their toil—this is a gift of God.”

Bible Verses About the Love of Money

The Bible reminds us to watch out for greed, practice contentment, and put our trust in God rather than money or earthly possessions.

Matthew 6:24 (NIV): “No one can serve two masters. Either you will hate the one and love the other, or you will be devoted to the one and despise the other. You cannot serve both God and money.”

Hebrews 13:5 (NIV): “Keep your lives free from the love of money and be content with what you have, because God has said, ‘Never will I leave you; never will I forsake you.’”

Philippians 4:12 (ESV): “I know how to be brought low, and I know how to abound. In any and every circumstance, I have learned the secret of facing plenty and hunger, abundance and need.”

Matthew 6:20–21 (NIV): “‘But store up for yourselves treasures in heaven, where moths and vermin do not destroy, and where thieves do not break in and steal. For where your treasure is, there your heart will be also.’”

Luke 12:15 (NIV): “Then he said to them, ‘Watch out! Be on your guard against all kinds of greed; life does not consist in an abundance of possessions.’”

Proverbs 15:27 (NIV): “The greedy bring ruin to their households, but the one who hates bribes will live.”

Mark 10:21–23 (NIV): “Jesus looked at him and loved him. ‘One thing you lack,’ he said. ‘Go, sell everything you have and give to the poor, and you will have treasure in heaven. Then come, follow me.’ At this the man’s face fell. He went away sad, because he had great wealth. Jesus looked around and said to his disciples, ‘How hard it is for the rich to enter the kingdom of God!’”

Proverbs 11:28 (NIV): “Those who trust in their riches will fall, but the righteous will thrive like a green leaf.”

Ecclesiastes 5:10 (NIV): “Whoever loves money never has enough; whoever loves wealth is never satisfied with their income. This too is meaningless.”

1 Timothy 6:10 (NIV): “For the love of money is a root of all kinds of evil. Some people, eager for money, have wandered from the faith and pierced themselves with many griefs.”

1 Timothy 6:17–19 (NIV): “Command those who are rich in this present world not to be arrogant nor to put their hope in wealth, which is so uncertain, but to put their hope in God, who richly provides us with everything for our enjoyment. Command them to do good, to be rich in good deeds, and to be generous and willing to share. In this way they will lay up treasure for themselves as a firm foundation for the coming age, so that they may take hold of the life that is truly life.”

Jeremiah 9:23–24 (NIV): “This is what the LORD says: ‘Let not the wise boast of their wisdom or the strong boast of their strength or the rich boast of their riches, but let the one who boasts boast about this: that they have the understanding to know me, that I am the LORD, who exercises kindness, justice and righteousness on earth, for in these I delight,’ declares the LORD.”

Help Others Manage Their Money God’s Ways

As you can see, the Bible has plenty for us to learn about how we should manage our finances. And if you want practical guidance on how to live out these verses in your daily life, Financial Peace University (FPU) will show you how!

FPU is a biblically based, nine-week class that teaches people how to pay off debt, save more money, and give generously. It’s helped nearly 10 million people change their lives for good—and we need your help sharing FPU with your community!

Bring FPU to your church and help others learn how to manage their money God’s ways. Just think what can happen when people are debt-free and using their resources to better serve others!

Find Margin You Didn’t Know You Had With EveryDollar

The EveryDollar budgeting app helps you find extra money every month so you can beat debt, build wealth, and make progress. Every. Day.