A budget is a plan for your money: every single dollar that’s coming in (income) and going out (expenses). When you learn how to budget—and make one every month—you give your money purpose. You. Take. Control.

List your income.

List your expenses.

Subtract expenses from income.

Track your expenses (all month long).

Make a new budget (before the month begins).

Join Our Free Workshop

New to budgeting? You’re not alone. In Budgeting 101, we’ll show you how to budget with EveryDollar so you can do it with confidence.

During the live workshop, you’ll:

- Learn to set up a budget in EveryDollar

- Get to know EveryDollar’s features

- Find support and encouragement from our team

5 Steps to Make a Budget With EveryDollar

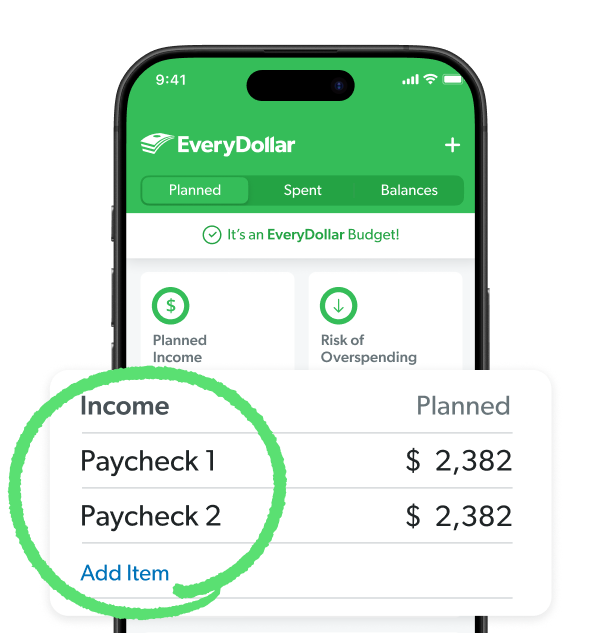

1. List your income.

In the app’s Income group, plug in how much you’re expecting this month from paychecks (and any side hustles). Got irregular income? Use the average income from your lowest-earning month.

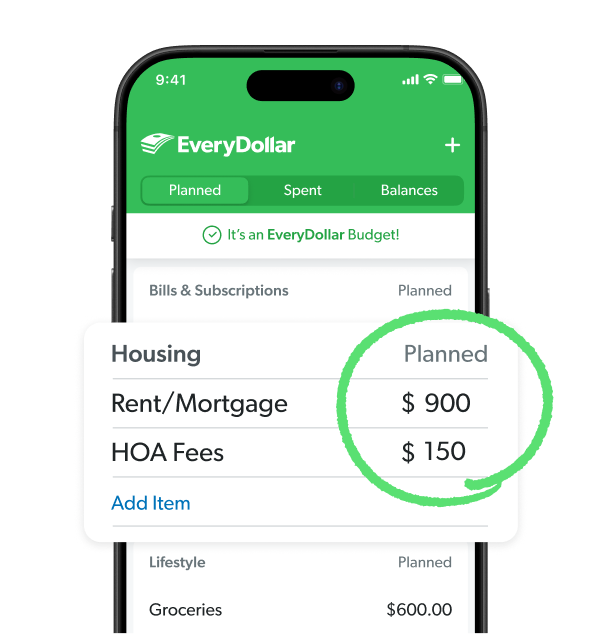

2. List your expenses.

It’s time to tell your money where to go! Plan how much you’ll give, save and spend this month, starting with your Four Walls: food, utilities, shelter and transportation. Don’t stress about making it perfect—just give it your best!

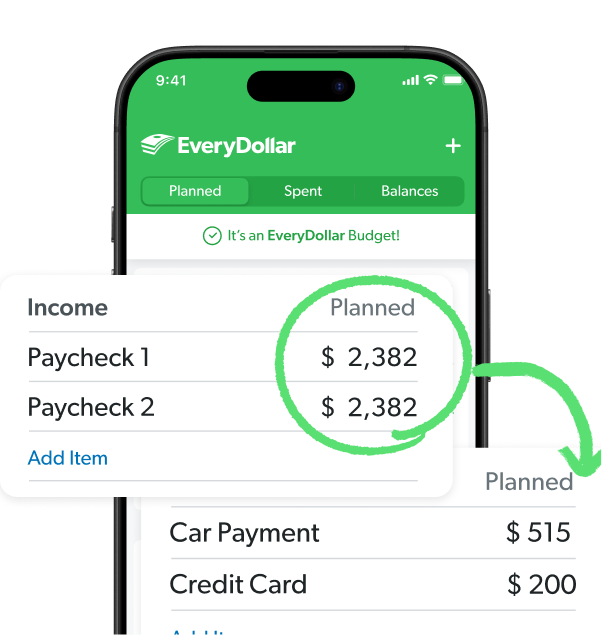

3. Subtract expenses from your income.

Your income minus expenses should equal $0. That means you’ve got a zero-based budget—and every dollar has a job! Nice. Got money left over? Put it toward debt or savings. Over budget? See where you can cut back until you hit zero.

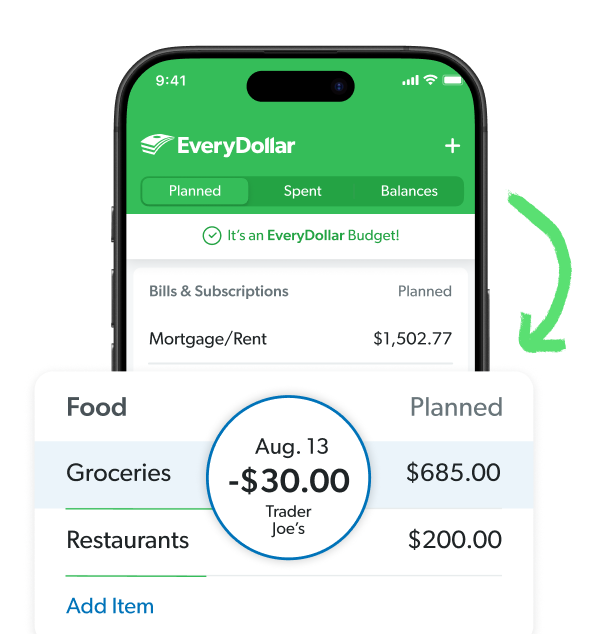

4. Track your expenses all month long.

You know what’ll help you stay on top of your new budget? Tracking. Your. Transactions. EveryDollar makes it so easy for you to keep tabs on your money—even when you’re on the go.

5. Make a new budget before the month begins.

Most months, your budget will look about the same—but each month brings surprises. (Utility bills hit different in the blazing heat of summer.) Making a new budget each month means you’re on top of it.