Wondering if you need earthquake insurance? You’re not alone.

On the one hand, not all earthquakes cause catastrophic damage. (Earthquakes happen all the time, but they’re so small we don’t even notice them.)

But on the other hand, it only takes one quake, and not even a big one, to cause extensive, permanent damage to your home.

So, does that mean everyone should buy earthquake insurance?

Not necessarily. Let’s walk through all the questions you need to answer before you make a final decision.

What Is Earthquake Insurance?

Earthquake insurance reimburses you for costs related to earthquake damage, including damage to your home and personal property, and for temporary living expenses.

If you want to go deeper, we put together a complete guide to earthquake insurance to give you an in-depth picture of what earthquake insurance is all about.

What Does Earthquake Insurance Cover?

Essentially, earthquake insurance covers damage from an earthquake. A standard earthquake policy includes the following:

- Dwelling coverage: Covers the cost of repairing or rebuilding your house, including attached structures like a garage or patio.

- Personal property coverage: Covers costs of repairing or replacing your personal stuff, including furniture, clothing, appliances and electronics.

- Additional living expenses: If your home is so damaged by an earthquake that you can no longer live in it, earthquake insurance will reimburse you for temporary living expenses (hotel, food) and/or lost rental income while your home is repaired.

Most insurers also offer optional coverages that you can add to your earthquake policy for things like building code upgrades and emergency repairs.

Do I Need Earthquake Insurance?

We can’t make the decision for you. But we can steer you in the right direction so you can make the best choice for your situation.

Home and auto insurance aren’t just about low rates—they’re about the right coverage level. Talk to a trusted pro who can help you get both.

Earthquake insurance is great if your home is seriously damaged, and the damage exceeds your deductible. But it does come with a cost.

The premiums and deductible are usually high, so the difference between what you pay for earthquake insurance and what you get can be a hard pill to swallow.

We get that.

But the purpose of any insurance coverage is to transfer risk you can’t afford from you to the insurance company. So, if you live in an area where you’re at high risk of having your home damaged or destroyed in an earthquake, and you don’t have a lot of cash on hand to cover repairs, earthquake insurance is your best bet.

Even if you don’t think you fall into that category, hear us out. Consider these three things before you make your decision.

How likely is it that an earthquake will happen in your area?

The first thing to think about when you’re considering earthquake insurance is how likely it is that a quake will happen in your area. Earthquakes can happen in all 50 states, but some states are more prone to earthquakes than others.

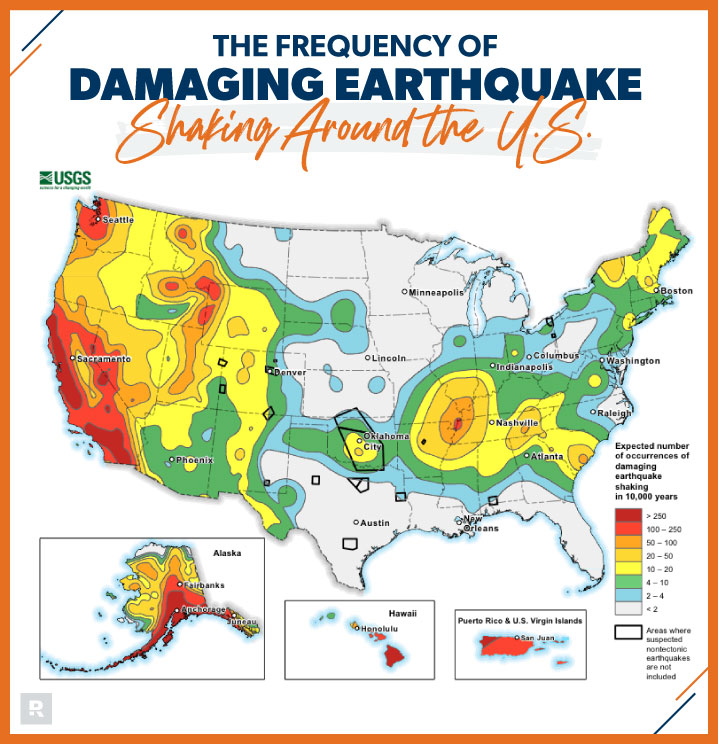

To see how your state compares to others, take a look at the map below that shows how often scientists expect damaging earthquake shaking around the U.S.1

As you can see from the map, residents of the western United States should be on high alert for the risk of an earthquake and the need for insurance. On the flip side, if you live in a low-risk state like Minnesota, it’s safe to say that you don’t need to spend your money on earthquake insurance.

How likely is it that your home will be damaged in an earthquake?

Even if you live in a state where frequent earthquakes don’t occur, the condition of your home and surrounding environmental factors control how your home will do during an earthquake.

The best way to weigh the odds of damage to your home is to think through the same factors that insurance companies use to calculate your premium:

- The age of your home. If your home was built before 1980, chances are it wasn’t constructed using materials that prevent earthquake damage.2 Things like bolted foundations and reinforced shear walls are used to build newer homes, which do better during earthquakes.There’s an easy fix here though. If your home was built before 1980, you can and should have it retrofitted with stronger building materials so that it will hold up better during an earthquake. (This is a great way to save on premiums.)

- The number of stories. Kids love homes with more than one level—going up and down stairs seems to be endlessly entertaining. (Go figure!) But there’s a downside too—taller homes don’t do well in earthquakes, so they’re more expensive to insure.

- Soil type. Dig around in your garden much? If so, you should be able to tell the type of soil your house sits on. If the soil feels compact (like clay) instead of granular (like sand), odds are that your home sits on hard soil. That’s a good thing! Homes built on hard soil do better during earthquakes.

- Raised foundation. Understanding raised foundations can get tricky. Their ability to withstand earthquake activity depends on the building materials used.3 The best way to measure a raised foundation’s strength is to consult an engineer.

- Building materials. Wood-framed homes usually withstand earthquakes better because wood is more elastic than concrete. Not sure what your home is framed with? The easiest way to tell is to remove an outlet cover so you can see what’s behind the electrical box. If you see an open void, it’s probably a wood-framed wall. If the area around the box is completely solid, it’s most likely a concrete wall.

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted® insurance pros are independent and vetted—and they help you fill the gaps in your policies. They make getting insurance (like home, auto and umbrella) one less thing to stress about. Plug in your zip code to connect with an agent who understands the coverage needs in your area.

Would you be able to afford to replace your home after an earthquake without the help of insurance?

Here’s a smart way to answer this crucial question.

Google the average per-square-foot home rebuilding cost for your area and multiply that number by your home’s overall square footage. The number you calculate is the amount of cash you’d need to replace your home.

Most people can’t come up with that kind of money out of pocket even if they emptied their savings account. This is where earthquake insurance comes in. Remember—it only takes one earthquake to permanently damage your home.

Consider this too when you’re tallying your home’s replacement cost. The main form of federal disaster relief is a low-interest loan. And before they even give you a loan, you need to prove that you can pay it back. (Pretty harsh, right? Especially if you’re already frazzled from an earthquake.)

So, is earthquake insurance worth it?

Again, we can’t answer that question for you. The best we can do is boil it down to one question: Can I afford not to have earthquake insurance?

Don’t Wait Until After an Earthquake

Waiting until after an earthquake to buy insurance won’t help you pay for damage that’s already occurred.

Protect your home and your family now. Connect with one of our RamseyTrusted pros. They're independent agents who can answer your questions about earthquake insurance and shop around for the best earthquake coverage at the best price for you.

Connect with a RamseyTrusted pro today!

Interested in learning more about homeowners insurance?

Sign up to receive helpful guidance and tools.