If you’ve got student loans hanging over your head, you know just how hard it can be to pay them off—especially if you’ve got an interest rate higher than the Empire State Building slowing down your progress.

But one way you can accelerate your debt payoff—and save yourself a ton of money in interest—is by refinancing. (Yep, it’s the only kind of “financing” we’re cool with.) And chances are you’ve wondered at least once, Should I refinance my student loans?

We’re here to answer all your questions around student loan refinancing and help you decide if it’s right for you—so you can get rid of your student loans once and for all!

How Does Student Loan Refinancing Work?

Student loan refinancing is when you take your private loans—or a combination of federal and private loans—and turn them into a new loan. But keep in mind, refinancing can only be done through a private lender.

Pay off debt fast and save more money with Financial Peace University.

Here’s how it works: The private lender pays off your current loan balances and becomes your new lender. At that point, you’ll have a new loan with a new interest rate and new repayment terms. The goal here is to get a better interest rate or to combine multiple loans into one payment.

But what if you only have federal student loans? With student loan relief ending sometime in 2023, we know you might be looking for a way to soften the blow of payments starting back up again.

While you can’t refinance your federal student loans through the government, you can do so through a private lender (and yes, that includes Parent PLUS Loans). But you’re not guaranteed to get a lower interest rate on your federal loans when you refinance. Plus, you’ll lose access to federal relief programs and other rights that protect federal borrowers.

So, if you’re struggling to keep up with multiple federal student loan payments, you’re better off looking into student loan consolidation instead (which we’ll get into next).

Consolidation vs. Refinancing

Consolidation and refinancing are kind of like the Jonas brothers—they’re related, but different. The goal with consolidation is to roll multiple loans into one loan. The goal with refinancing is to get a new interest rate (though you can also consolidate your loans through a refinance).

Whether or not you should consolidate depends on what kind of student loans you have. Federal loans can be consolidated for free through the government with what’s called a Direct Consolidation Loan, while private loans (or a mix of private and federal) have to be consolidated by refinancing with a private lender. But student loan consolidation isn't the right choice for everyone—even if you’ve got multiple federal loans.

When You Should (and Shouldn’t) Refinance Your Student Loans

My student loan interest rate is too high. My variable interest rate is making it hard for me to budget. At this rate, it’s going to take me forever to pay off my student loans.

Sound familiar? If so, refinancing might be a good option for you. But there are a few boxes you need to check off first to be sure.

You should only refinance your student loans if:

- It’s 100% free to refinance. Application or origination fees could cancel out any savings you might get in the end.

- You can get a lower interest rate. The whole point of refinancing is to get a lower interest rate. Lenders may try to tempt you with a lower monthly payment instead. But if your interest rate is the same or higher, you’ll only end up paying more in the long run (not cool!).

- You can keep a fixed rate or trade your variable rate for a fixed rate. The last thing you want to do is give your lender the option to jack your monthly payment way up without notice!

- You don’t have to sign up for a longer repayment period. Anything that pushes your debt-free date further into the future is an absolute no-go. And if the new loan shortens the term of repayment, that’s even better!

- You don’t need a cosigner. Cosigning for a loan is always a bad idea—for both the person seeking a loan and the person cosigning. Why? Because it mixes money into relationships. That’s usually a toxic mess. Imagine getting your Uncle Ralph to cosign for your refinance, then hearing him bring it up at every family gathering until it’s paid. That could get really ugly.

- You haven’t recently declared bankruptcy. Most lenders aren’t as willing to offer a refinance after bankruptcy. If that’s you, you’re probably hurting in more ways than a refinance can solve. You may want to start by talking to a financial coach who can help you navigate your specific situation and get you back on your feet.

- It will actually motivate you to pay off your student loans faster. Just because you get a lower interest rate and a shorter term, don’t let it be an excuse to slow down. This isn’t a set-it-and-forget-it sort of thing. Even if you refinance, the goal is to pay off your student loans ASAP.

Do You Qualify for Student Loan Refinance?

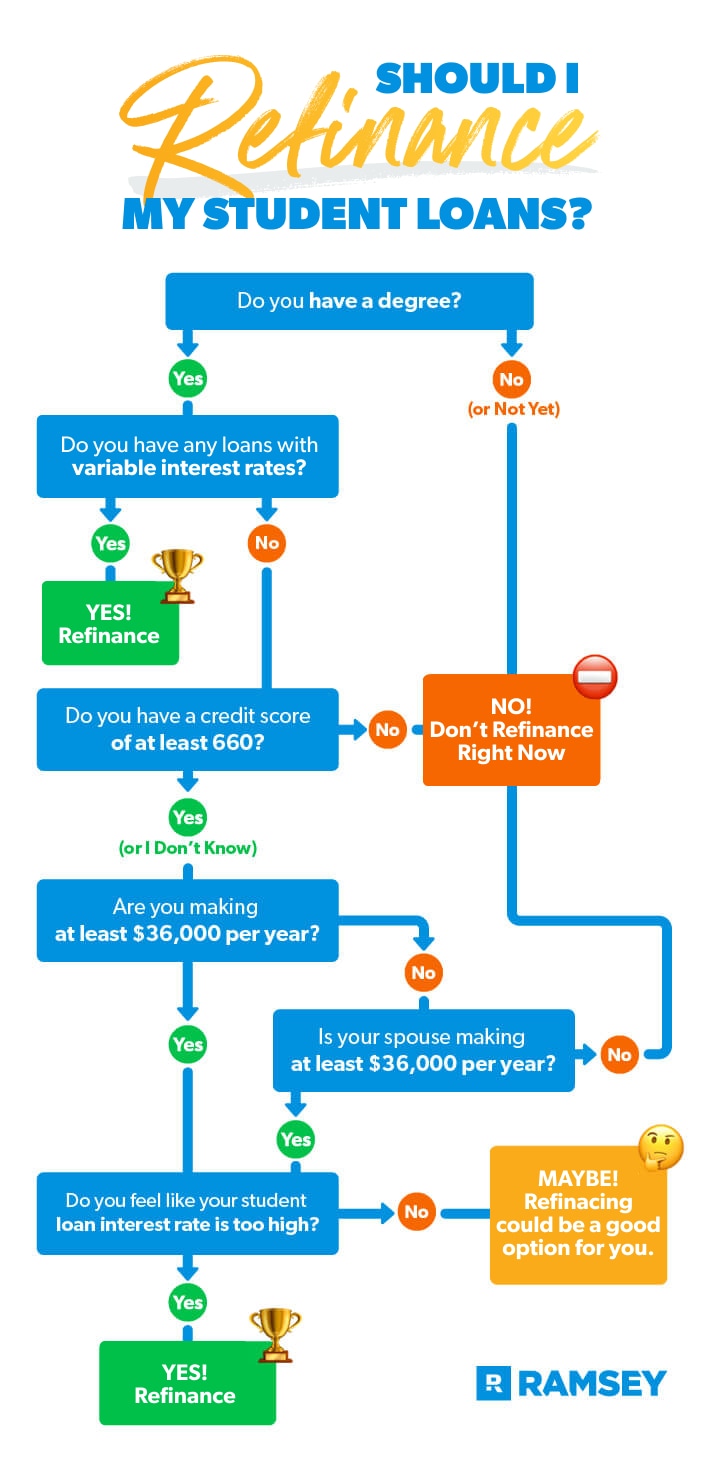

So, we’ve talked about whether or not you should refinance your student loans. But do you even qualify? There are four things lenders look at to determine if you’re eligible for a refinance:

- A credit score of 660 or more (no, we haven’t started liking FICO, but if you have loans, you have a score—and 660 is the minimum to refinance)

- An annual income of at least $36,000

- A degree

- A low debt-to-income ratio

If all those are true, refinancing your student loans might be a good choice. But even if you don’t qualify for a refinance, you can still knock out your student loans faster than you think—no matter your balance or interest rate!

How Much Could Refinancing Your Student Loans Save You?

So, let’s do the math and see if refinancing is actually worth it. Imagine you have a $25,000 student loan with a variable interest rate that’s currently sitting at 7%. You’d probably like to get rid of it, but so far you haven’t exactly been attacking the debt—which means you’re only making the minimum monthly payment of $225. At that rate, it’s going take you 15 years to pay it off. That’s nearly four presidential elections away (and that’s if your interest rate doesn’t go up)!

A refinance on the right terms could get things moving much faster in the right direction. Let’s see what would happen if you found a lender who could refinance (with no fees) to a fixed rate of 5% on a 10-year timetable. Take a look at the difference:

|

|

Original Student Loan |

Refinanced Student Loan |

|

Starting Balance |

$25,000 |

$25,000 |

|

Interest Rate |

7% (variable) |

5% (fixed) |

|

Monthly Payment |

$225 |

$265 |

|

Term |

At least 15 years |

10 years |

|

Total Cost |

At least $40,231 ($15,231 in interest) |

$31,902 ($6,902 in interest) |

Wow! By paying an extra $40 a month, you’re knocking the loan out five years earlier and saving nearly $9,000 in interest over that period. And guess what? Nothing’s stopping you from throwing more than the minimum at your debt after you refinance. In fact, that new interest rate and the closer payoff date will probably motivate you to attack your debt even faster. Refinancing can feel like going from dial-up to Wi-Fi!

Should You Refinance Your Student Loans?

Even if you checked all the boxes we listed earlier, whether or not you should refinance your student loans really comes down to your specific situation.

There are a lot of student loan relief options out there, but most only slow you down and keep you trapped in debt way longer than you need to be. And while there may be times when you’re not able to make the debt payoff progress you want, your goal should be to get rid of your student loans as fast as you can. Because the sooner you can get rid of them, the sooner you can stop stressing about them!

Refinancing your student loans can give you the push you need to pay off your debt. It can replace a variable rate and all of the worry it causes with a fixed rate and some peace of mind. It could also lower your interest rate, allowing you to save a lot of money as you pay your loan down. Or it could shorten the timetable for the life of the loan, moving your payoff date way up.

But refinancing is only one piece of the puzzle. You still need a proven plan like the debt snowball to attack your debt. (Oh, and a good budget. That’s key!)